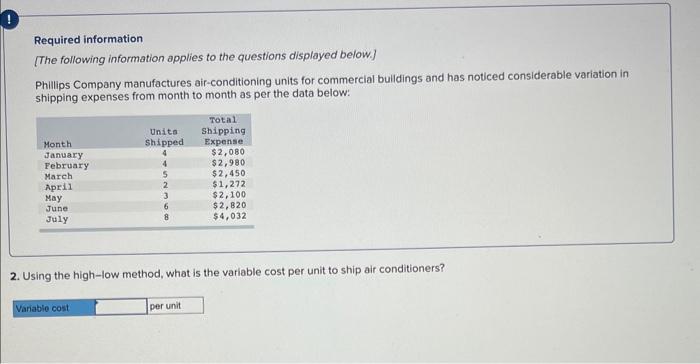

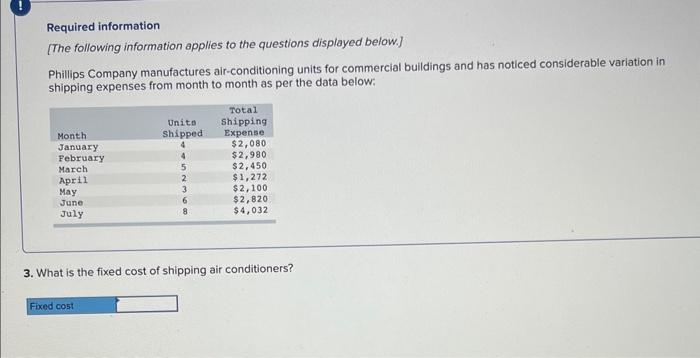

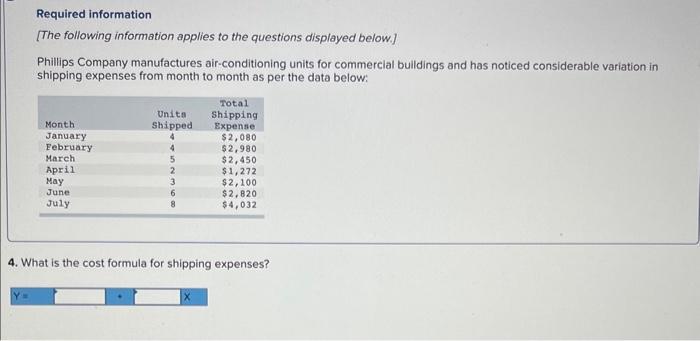

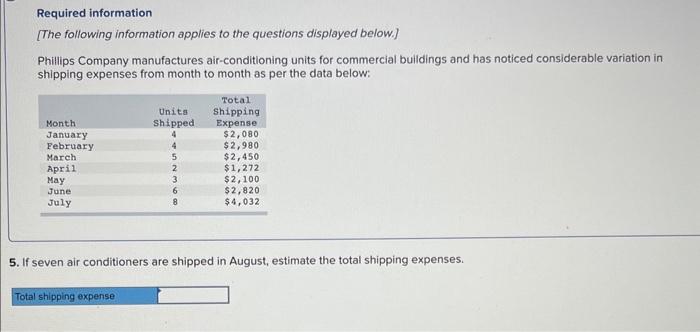

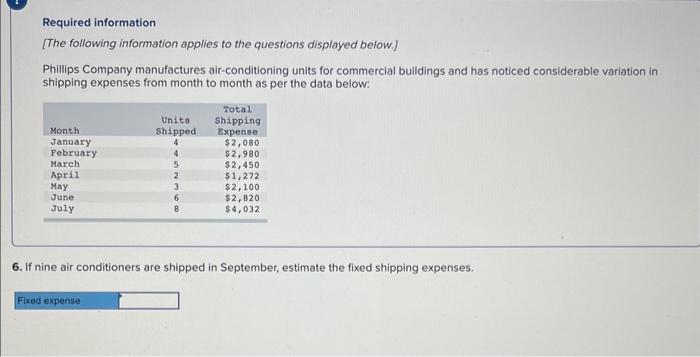

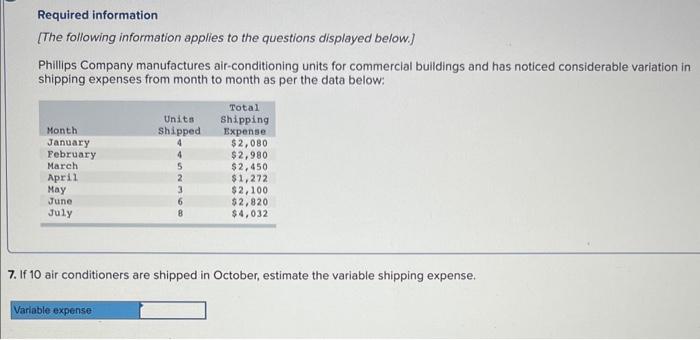

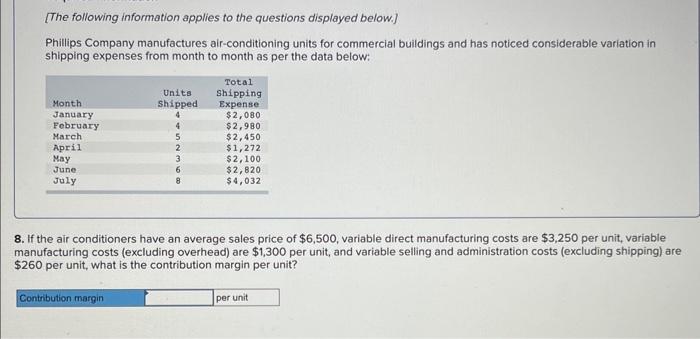

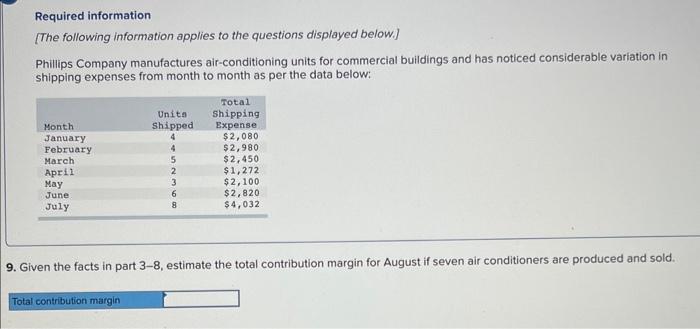

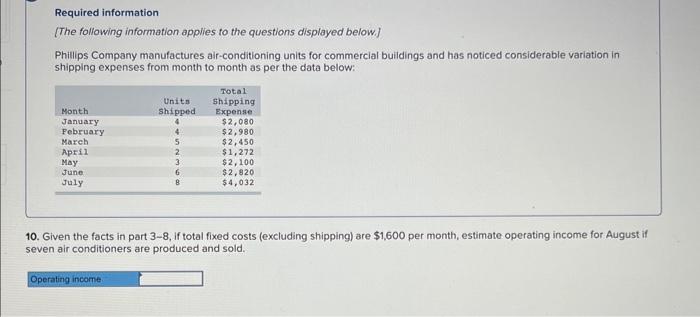

Required information [The following information applies to the questions displayed below.] Phillips Company manufactures air-conditioning units for commercial bulidings and has noticed considerable variation in shipping expenses from month to month as per the data below: 2. Using the high-low method, what is the variable cost per unit to ship air conditioners? Required information [The following information applies to the questions displayed below.] Phillips Company manufactures air-conditioning units for commercial buildings and has noticed considerable variation in shipping expenses from month to month as per the data below: 3. What is the fixed cost of shipping air conditioners? Required information [The following information applies to the questions displayed below.] Phillips Company manufactures air-conditioning units for commercial bulidings and has noticed considerable variation in shipping expenses from month to month as per the data below: 4. What is the cost formula for shipping expenses? Required information [The following information applies to the questions displayed below.] Phillips Company manufactures air-conditioning units for commercial buildings and has noticed considerable variation in shipping expenses from month to month as per the data below: 5. If seven air conditioners are shipped in August, estimate the total shipping expenses. Required information [The following information applies to the questions displayed below.] Phillips Company manufactures air-conditioning units for commercial bulidings and has noticed considerable variation in shipping expenses from month to month as per the data below: 6. If nine air conditioners are shipped in September, estimate the fixed shipping expenses. Required information [The following information applies to the questions displayed below.] Phillips Company manufactures air-conditioning units for commerclal bulidings and has noticed considerable variation in shipping expenses from month to month as per the data below: 7. If 10 air conditioners are shipped in October, estimate the variable shipping expense. [The following information applies to the questions displayed below.] Phillips Company manufactures air-conditioning units for commercial buildings and has noticed considerable variation in shipping expenses from month to month as per the data below: 8. If the air conditioners have an average sales price of $6,500, variable direct manufacturing costs are $3,250 per unit, variable manufacturing costs (excluding overhead) are $1,300 per unit, and variable selling and administration costs (excluding shipping) are $260 per unit, what is the contribution margin per unit? Required information [The following information applies to the questions displayed below.] Phillips Company manufactures air-conditioning units for commercial buildings and has noticed considerable variation in shipping expenses from month to month as per the data below: Given the facts in part 3-8, estimate the total contribution margin for August if seven air conditioners are produced and sold. Required information [The following information applies to the questions displayed below.] Phillips Company manufactures air-conditioning units for commercial buildings and has noticed considerable variation in shipping expenses from month to month as per the data below: 0. Given the facts in part 3-8, if total fixed costs (excluding shipping) are $1,600 per month, estimate operating income for August if even air conditioners are produced and sold