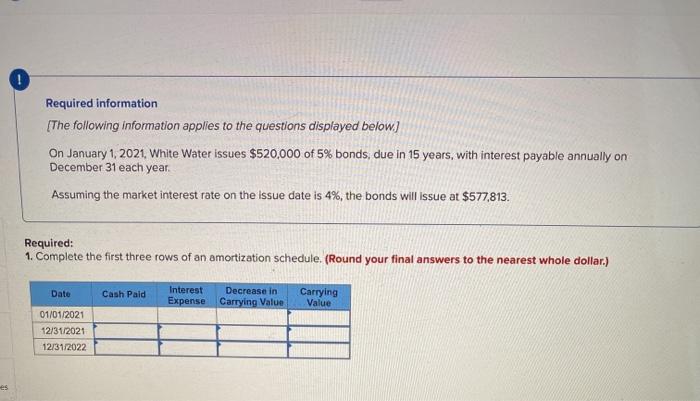

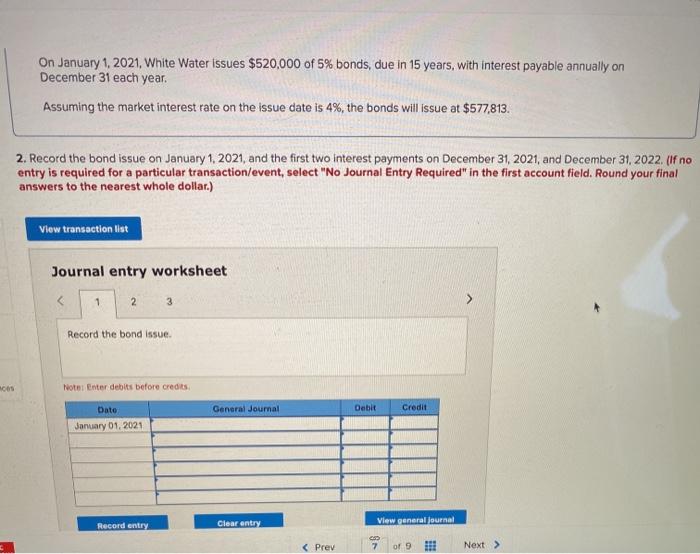

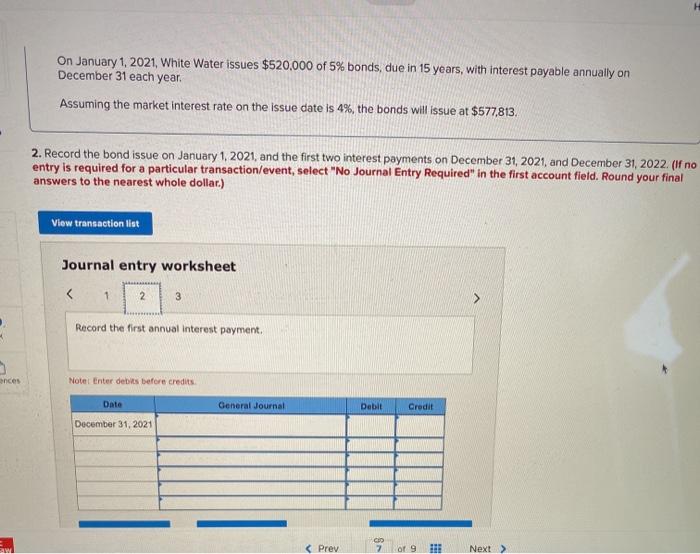

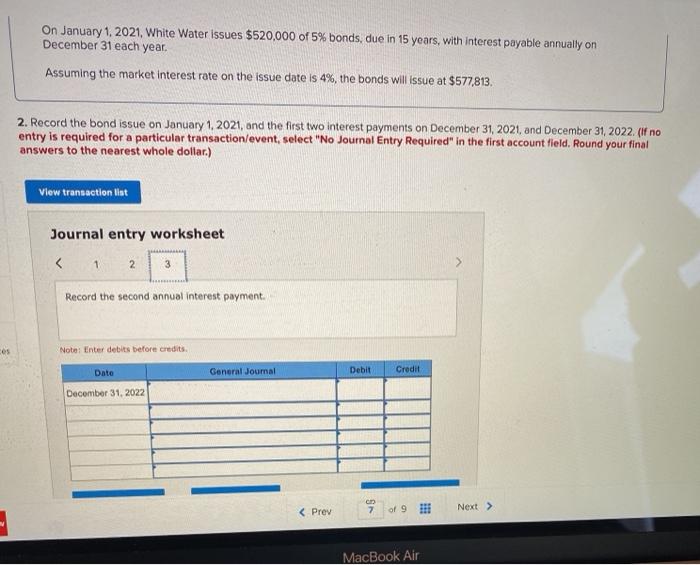

Required information (The following information applies to the questions displayed below) On January 1, 2021. White Water issues $520,000 of 5% bonds, due in 15 years, with interest payable annually on December 31 each year. Assuming the market interest rate on the issue date is 4%, the bonds will issue at $577,813. Required: 1. Complete the first three rows of an amortization schedule. (Round your final answers to the nearest whole dollar.) Date Cash Paid Interest Decrease in Expense Carrying Value Carrying Value 01/01/2021 12/31/2021 12/31/2022 On January 1, 2021, White Water issues $520,000 of 5% bonds, due in 15 years, with interest payable annually on December 31 each year. Assuming the market interest rate on the issue date is 4%, the bonds will issue at $577,813. 2. Record the bond issue on January 1, 2021, and the first two interest payments on December 31, 2021, and December 31, 2022. (if no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Round your final answers to the nearest whole dollar.) View transaction list Journal entry worksheet 1 2 3 Record the bond issue Note: Enter debits before credits General Journal Debit Credit Date January 01, 2021 Record entry Clear entry View general Journal On January 1, 2021, White Water issues $520,000 of 5% bonds, due in 15 years, with interest payable annually on December 31 each year. Assuming the market interest rate on the issue date is 4%, the bonds will issue at $577,813. 2. Record the bond issue on January 1, 2021, and the first two interest payments on December 31, 2021, and December 31, 2022. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Round your final answers to the nearest whole dollar.) View transaction list Journal entry worksheet On January 1, 2021, White Water issues $520,000 of 5% bonds, due in 15 years, with interest payable annually on December 31 each year. Assuming the market interest rate on the issue date is 4%, the bonds will issue at $577,813. 2. Record the bond issue on January 1, 2021, and the first two interest payments on December 31, 2021, and December 31, 2022. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Round your final answers to the nearest whole dollar.) View transaction list Journal entry worksheet 1 2 3 > Record the second annual interest payment Note: Enter debits before credits Date General Journal Debit Credit December 31, 2022 7 MacBook Air