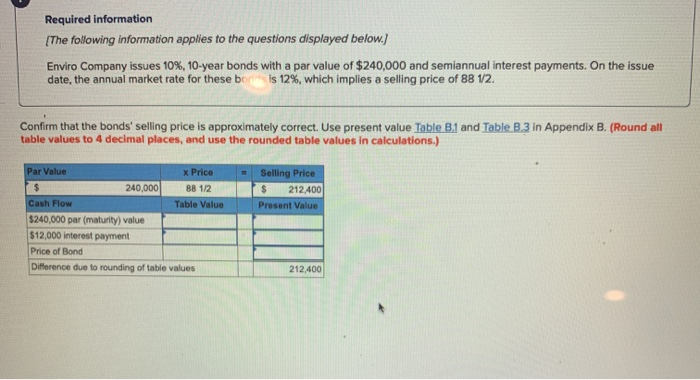

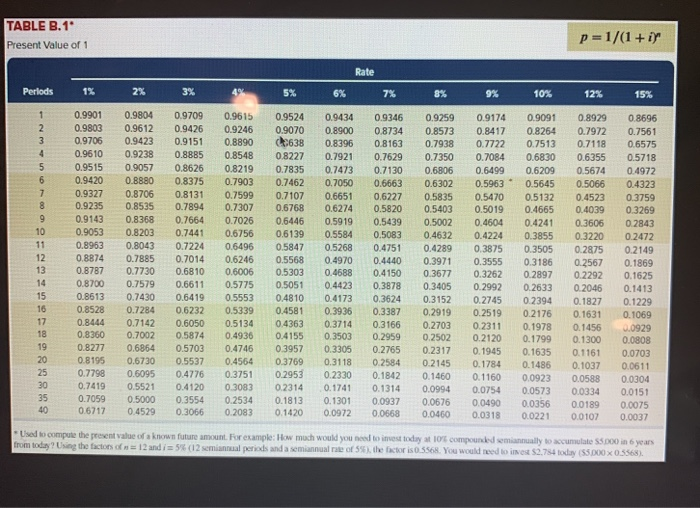

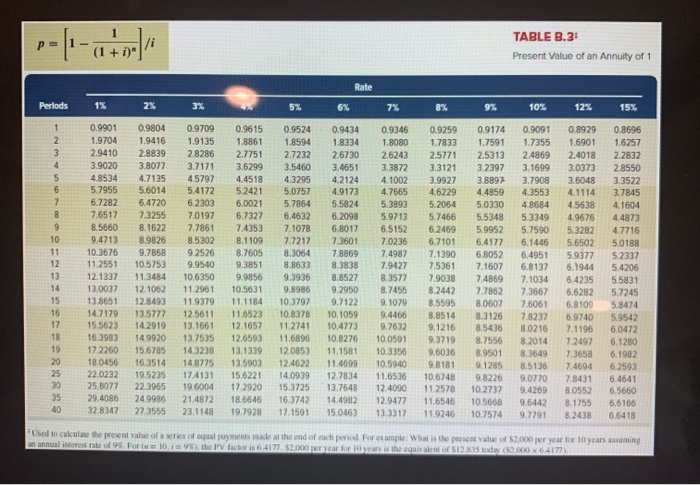

Required information [The following information applies to the questions displayed below] Enviro Company issues 10% , 10- year bonds with a par value of $240,000 and semiannual interest payments. On the issue date, the annual market rate for these bons is 12%, which implies a selling price of 88 1/2. Confirm that the bonds' selling price is approximately correct. Use present value Table B1 and Table B.3 in Appendix B. (Round all table values to 4 decimal places, and use the rounded table values in calculations.) Par Value x Price Selling Price 240,000 88 1/2 212.400 Cash Flow Table Value Present Value $240,000 par (maturity) value $12,000 interest payment Price of Bond Difference due to rounding of table values 212,400 TABLE B.1 p= 1/(1+i Present Value of 1 Rate Perlods 1% 2% 3% 5% 6% 7% 8% 9% 10% 12% 15% 0.9901 0.9804 0.9709 0.9615 0.9524 0.9434 0.9346 0.9259 0.9174 0.9091 0.8929 0.8696 2 0.9803 0.9612 0.9426 0.9246 0.9070 0.8900 0.8396 0.8734 0.8573 0.8417 0.8264 0.7972 0.7561 0.9706 0.9423 0.8890 638 0.9151 0.8163 0.7938 0.7722 0.7513 0.7118 0.6575 0.9610 0.9238 0.8885 0.8548 0.8227 0.7921 0.7629 0.7350 0.7084 0.6830 0.6355 0.5718 0.9515 0.8626 0.9057 0.8219 0.7835 0.7473 0.7130 0.6806 0.6499 0.6209 0.5674 0.4972 6 0.9420 0.8880 0.8375 0.7903 0.7462 0.7050 0.5963 0.6663 0.5066 0.4323 0.6302 0.5645 7 0.9327 0.9235 0.8706 0.8535 0.8131 0.7599 0.7307 0.7107 0.6651 0.6274 0.6227 0.5835 0.5403 0.5470 0.5019 0.5132 0.4523 0.3759 0.3269 8 0.7894 0.6768 0.5820 0.4665 0.4039 0.9143 0.8368 0.7664 0.7026 0.6446 0.5919 0.5439 0.5002 0.4604 0.4241 0.3606 0.2843 10 0.9053 0.8203 0.7441 0.6756 0.6139 0.5584 0.5083 0.4632 0.4224 0.3855 0.3220 02472 11 0.8963 0.8043 0.7224 0.6496 0.5847 0.5268 0.4751 0.4289 0.3875 0.3505 0.2875 0.2149 12 0.8874 0.7885 0.7730 0.7014 0.6810 06246 0.5568 0.5303 0.4970 0.4440 0.3971 0.3555 0.3186 0.2567 0.1869 13 0.8787 0.6006 0.4688 0.4150 0.3677 0.3262 0.2992 0.2897 0.2292 0.1625 14 0.8700 0.7579 0.6611 0.5775 0.5051 0.4423 0.3878 0.3405 0.2633 0.2046 0.1413 15 0.8613 0.7430 0.6419 0.5553 0.4810 0.4173 0.3624 0.3152 0.2745 0.2394 0.1827 0.1229 16 0.8528 0.7284 0.6232 0.5339 0.4581 0.3936 0.3387 0.2919 0.2519 0.2176 0.1631 0.1069 17 0.8444 0.7142 0.6050 0.5134 0.4363 0.4155 0.3957 0.3714 0.3503 0.3166 0.2959 0.2765 0.2703 0.2502 0.2311 0.2120 0.1978 0.1799 0.1456 0.0929 0.0808 18 0.8360 0.7002 0.5874 0.4936 0.1300 19 0.8277 0.6864 0.5703 0.4746 0.3305 0.2317 0.1945 0.1635 0.1486 0.1161 0.1037 0.0703 20 0.8195 0.6730 0.5537 0.4564 0.3769 0.2953 0.3118 0.2584 0.2145 0.1784 0.0611 25 0.7798 0.6095 0.4776 0.3751 0.2330 0.1842 0.1314 0.1460 0.1160 0.0923 0.0588 0.0304 30 0.7419 0.5521 0.4120 0.3083 0.2314 0.1741 0.0994 0.0754 0.0573 0.0356 0.0334 0.0151 35 0.7059 0.5000 0.3554 0.3066 0.2534 0.2083 0.1813 0.1301 0.0972 00937 0.0668 0.0676 0.0460 0.0490 0.0318 00189 0.0075 0.0037 40 0.6717 0.4529 0.1420 0.0221 0.0107 Used to compute the present value of a known future from today? Using the factors ofn 12 and i 5% (12 semiannual periods and a semiannual rate of 5%), the factor is 0.5568. You would need to inea $2.784 today (55,000x 0.5568). For examp you need to inest today at 10E compounded semiannually to accumulate S5,000 in 6 years TABLE B.3 /i (1 +i) P ' Present Value of an Annuity of 1 Rate Perlods 1% 2% 3% 5% 10% 6% 7% 9% 12% 15% 1 0.9901 0.9804 0.9709 0.9615 0.9524 0.9434 0.9346 0.9259 0.9174 0.9091 0.8929 0.8696 1.9704 1.9416 1.9135 1.8861 1.8594 1.7355 1.6901 1.8334 1.8080 1.7833 1.7591 1.6257 3 2.9410 2.8839 2.8286 2.7751 2.7232 2.6730 3.4651 2.6243 2.5771 2.5313 2.4869 3.1699 2.4018 2.2832 4 3.9020 3.8077 3.7171 3.6299 3.5460 3.3872 3.3121 3.2397 3.0373 2.8550 4.8534 5.7955 4.7135 4.5797 4.4518 4.3295 4.2124 4.1002 3.9927 4,6229 3.8897 3.7908 3.6048 3.3522 3.7845 4.1604 6 5.6014 5.4172 5.2421 5.0757 4.9173 4.7665 4.4859 4.3553 4.1114 6.7282 6.4720 7.3255 6.2303 6.0021 5.7864 5.5824 6.2098 5.3893 5.2064 5.0330 4.8684 4.5638 7.6517 7.0197 6.7327 7.4353 6.4632 5.7466 6.2469 6.7101 7.1390 5.9713 5.5348 5.3349 4.9676 4.4873 4.7716 9 8.5660 8.1622 7.7861 7.1078 6.8017 6.5152 5.9952 5.7590 5.3282 10 9.4713 10.3676 11.2551 12.1337 8.9826 8.5302 8.1109 7.7217 8.3064 8.8633 9.3936 9.8986 7.3601 7.0236 6.4177 6.1446 5.6502 5.9377 6.1944 5.0188 11 9.7868 9.2526 8.7605 7.8869 7.4987 6.8052 7.1607 6.4951 6.8137 7.1034 7.3667 5.2337 12 10.5753 9.9540 9.3851 8.3838 7,9427 7.5361 7.9038 8.2442 5.4206 13 11.3484 10.6350 9.9856 8.8527 8.3577 7.4869 7.7862 8.0607 6.4235 6.6282 6.8109 5.5831 14 13.0037 13.8651 12.1062 11.2961 10.5631 9.2950 8.7455 5.7245 15 11.1184 12.8493 11.9379 10.3797 10.8378 11.2741 11.6896 9.7122 9.1079 8.5595 7.6061 7.8237 8.0216 5.8474 5.9542 6.0472 16 14.7179 13.5777 14.2919 12.5611 11.6523 10,1059 9.4466 9.7632 8.3126 8.5436 8.7556 8.8514 6.9740 7.1196 7.2497 17 15.5623 10.4773 13.1661 12.1657 9.1216 18 19 16.3983 14.9920 15.6785 13.7535 12.6593 10.8276 10.0591 9.3719 8.2014 6.1280 6.1982 17.2260 18.0456 22.0232 25.8077 29.4086 14.3238 13.1339 13.5903 12.0853 11,1581 10.3356 9.6036 8.9501 9.1285 8.3649 7.3658 20 16.3514 14.8775 12.4622 11.4699 10.5940 9.8181 8.5136 7.4694 6.2593 6.4641 25 19.5235 22.3965 17.4131 15.6221 14.0939 12.7834 11.6536 10.6748 9.8226 9.0770 7.8431 8.0552 30 19.6004 21.4872 17.2920 18.6646 15.3725 13.7648 14.4982 15.0463 12.4090 11.2578 11.6546 11.9246 10.2737 9.4269 6.5660 35 24.9986 27.3555 16.3742 12.9477 10.5668 10.7574 9.6442 8.1755 6.6166 40 32.8347 23.1148 19.7928 17.1591 13.3317 9.7791 8.2438 6.6418 FUsed to calculate the present value of a series of oqual payments made at the end of an annual inlerest rate of 9%. For in 10. i9%), the PV factor is 6.4177, $2.000 per year for 10 years is the equiv aleni of S12.835 today (52.000 x 64177) hat is the peosent value of $2.000 per year for 10 years assuming example