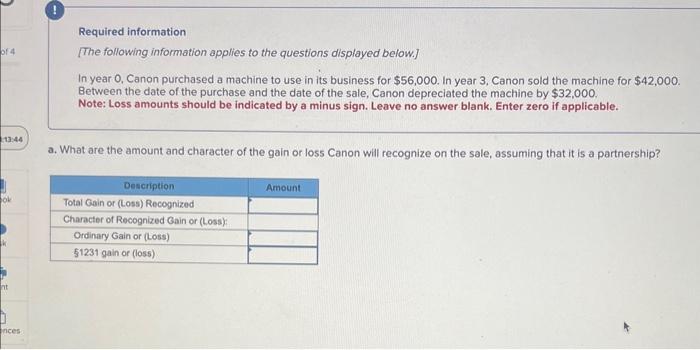

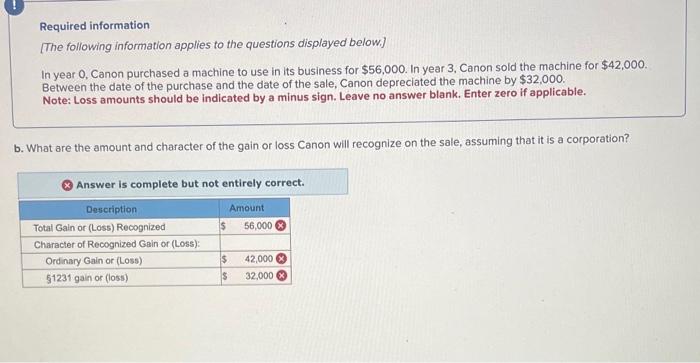

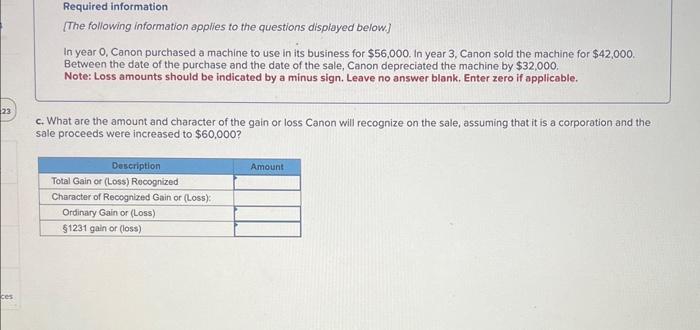

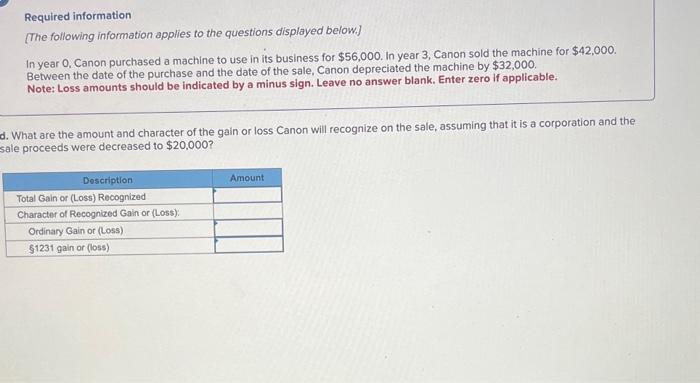

Required information [The following information applies to the questions displayed below.] In year 0 , Canon purchased a machine to use in its business for $56,000. In year 3, Canon sold the machine for $42,000. Between the date of the purchase and the date of the sale, Canon depreciated the machine by $32,000. Note: Loss amounts should be indicated by a minus sign. Leave no answer blank. Enter zero if applicable. What are the amount and character of the gain or loss Canon will recognize on the sale, assuming that it is a partnership? Required information [The following information applies to the questions displayed below.] In year 0 , Canon purchased a machine to use in its business for $56,000. In year 3, Canon sold the machine for $42,000. Between the date of the purchase and the date of the sale, Canon depreciated the machine by $32,000. Note: Loss amounts should be indicated by a minus sign. Leave no answer blank. Enter zero if applicable. b. What are the amount and character of the gain or loss Canon will recognize on the sale, assuming that it is a corporation? Answer is complete but not entirely correct. Required information [The following information applies to the questions displayed below] In year 0, Canon purchased a machine to use in its business for $56,000, In year 3 , Canon sold the machine for $42,000. Between the date of the purchase and the date of the sale, Canon depreciated the machine by $32,000. Note: Loss amounts should be indicated by a minus sign. Leave no answer blank. Enter zero if applicable. c. What are the amount and character of the gain or loss Canon will recognize on the sale, assuming that it is a corporation and the sale proceeds were increased to $60,000 ? Required information [The following information applies to the questions displayed below.] In year 0 , Canon purchased a machine to use in its business for $56,000. In year 3, Canon sold the machine for $42,000. Between the date of the purchase and the date of the sale, Canon depreciated the machine by $32,000. Note: Loss amounts should be indicated by a minus sign. Leave no answer blank. Enter zero if applicable. What are the amount and character of the gain or loss Canon will recognize on the sale, assuming that it is a corporation and the ale proceeds were decreased to $20,000