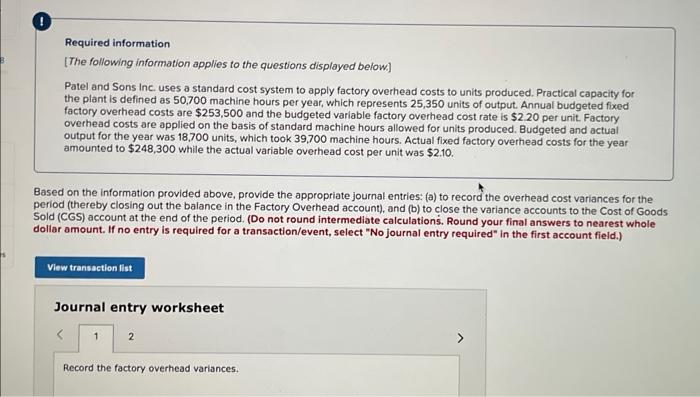

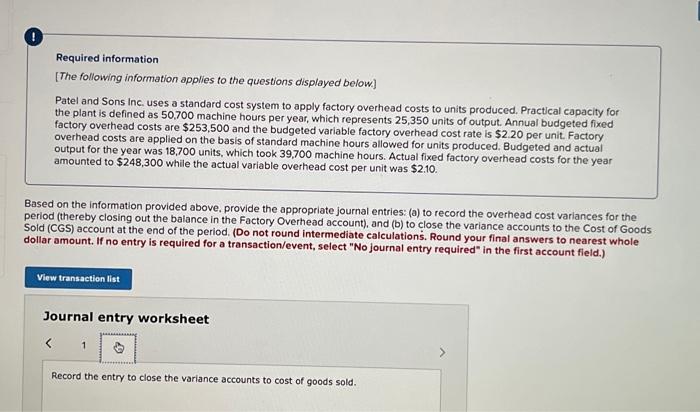

Required information [The following information applies to the questions displayed below.] Patel and Sons Inc. uses a standard cost system to apply factory overhead costs to units produced. Practical capacity for the plant is defined as 50,700 machine hours per year, which represents 25,350 units of output. Annual budgeted fixed factory overhead costs are $253,500 and the budgeted variable factory overhead cost rate is $2.20 per unit. Factory overhead costs are applied on the basis of standard machine hours allowed for units produced. Budgeted and actual output for the year was 18,700 units, which took 39,700 machine hours. Actual fixed factory overhead costs for the year amounted to $248,300 while the actual variable overhead cost per unit was $2.10. Based on the information provided above, provide the appropriate journal entries: (a) to record the overhead cost variances for the period (thereby closing out the balance in the Factory Overhead account), and (b) to close the variance accounts to the Cost of Goods Sold (CGS) account at the end of the period. (Do not round intermediate calculations. Round your final answers to nearest whole dollar amount. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet 2 Record the factory overhead variances. Required information [The following information applies to the questions displayed below.] Patel and Sons inc. uses a standard cost system to apply factory overhead costs to units produced. Practical capacity for the plant is defined as 50,700 machine hours per year, which represents 25,350 units of output. Annual budgeted fixed factory overhead costs are $253,500 and the budgeted variable factory overhead cost rate is $2.20 per unit. Factory overhead costs are applied on the basis of standard machine hours allowed for units produced. Budgeted and actual output for the year was 18,700 units, which took 39,700 machine hours. Actual fixed factory overhead costs for the year amounted to $248,300 while the actual variable overhead cost per unit was $2.10. Based on the information provided above, provide the appropriate journal entries: (a) to record the overhead cost variances for the eriod (thereby closing out the balance in the Factory Overhead account), and (b) to close the variance accounts to the Cost of Goods fold (CGS) account at the end of the period. (Do not round intermediate calculations. Round your final answers to nearest whole follar amount. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the entry to close the variance accounts to cost of goods sold