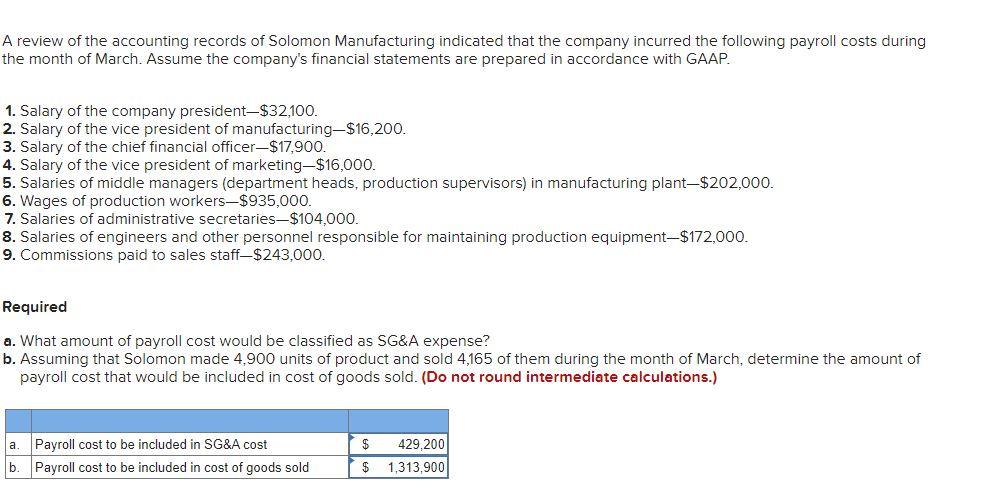

Required information [The following information applies to the questions displayed below.] Munoz Company began operations on January 1 , year 1 , by issuing common stock for $35,000 cash. During year 1 , Munoz received $63,600 cash from revenue and incurred costs that required $49,600 of cash payments. Prepare a GAAP-based income statement and balance sheet for Munoz Company for year 1, for the below scenario: c. Munoz is a manufacturing company. The $49,600 was paid to purchase the following items: (1) Paid $3,700 cash to purchase materials that were used to make products during the year. (2) Paid $1,880 cash for wages of factory workers who made products during the year. (3) Paid $23,720 cash for salaries of sales and administrative employees. (4) Paid $20,300 cash to purchase manufacturing equipment. The equipment was used solely to make products. It had a four-year life and a $2,300 salvage value. The company uses straight-line depreciation. (5) During year 1, Lang started and completed 2,100 units of product. The revenue was earned when Lang sold 1,700 units of product to its customers. A review of the accounting records of Solomon Manufacturing indicated that the company incurred the following payroll costs during the month of March. Assume the company's financial statements are prepared in accordance with GAAP. 1. Salary of the company president- $32,100. 2. Salary of the vice president of manufacturing $16,200. 3. Salary of the chief financial officer $17,900. 4. Salary of the vice president of marketing $16,000. 5. Salaries of middle managers (department heads, production supervisors) in manufacturing plant $202,000. 6. Wages of production workers $935,000. 7. Salaries of administrative secretaries $104,000. 8. Salaries of engineers and other personnel responsible for maintaining production equipment $172,000. 9. Commissions paid to sales staff- $243,000. Required a. What amount of payroll cost would be classified as SG\&A expense? b. Assuming that Solomon made 4,900 units of product and sold 4,165 of them during the month of March, determine the amount of payroll cost that would be included in cost of goods sold. (Do not round intermediate calculations.)