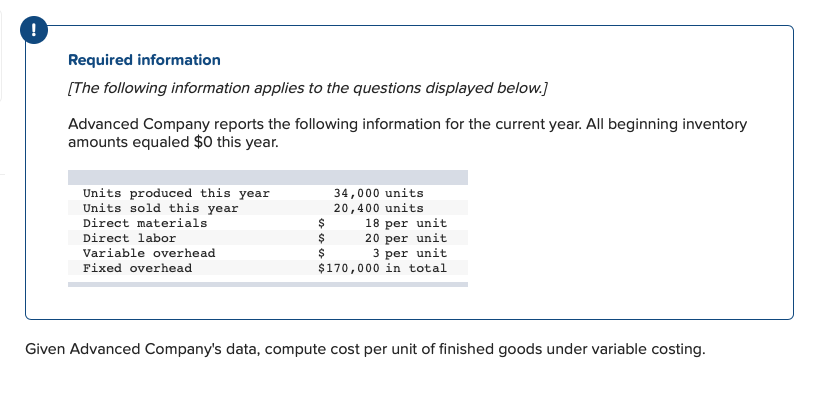

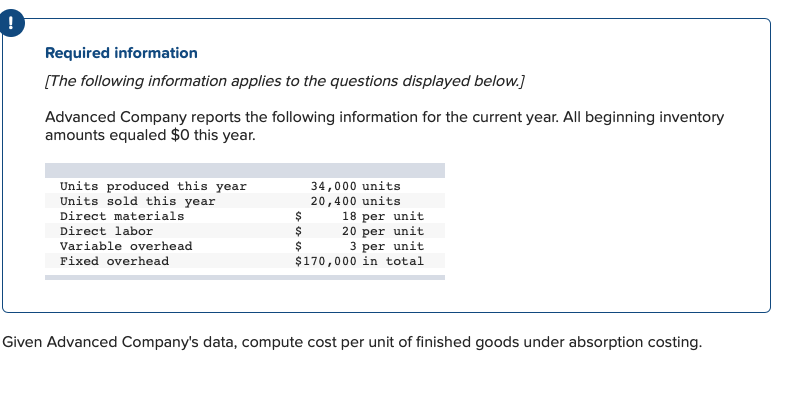

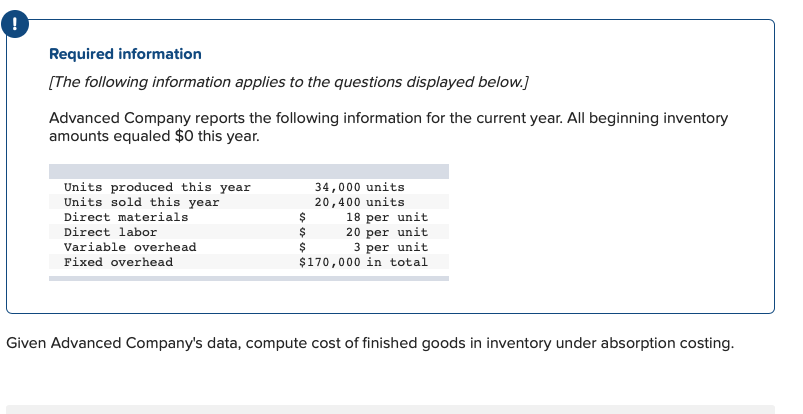

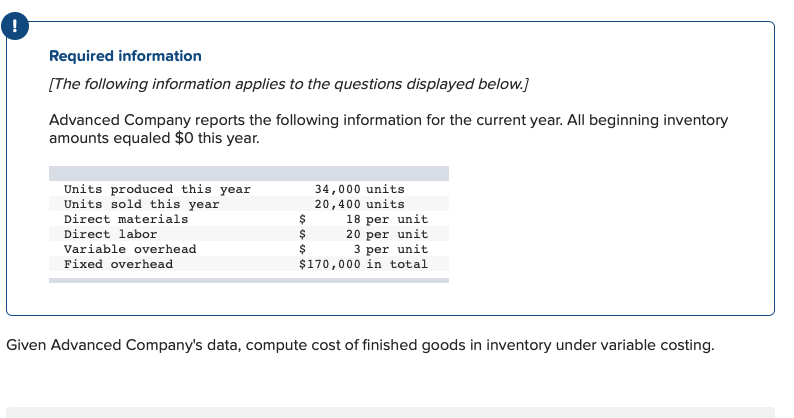

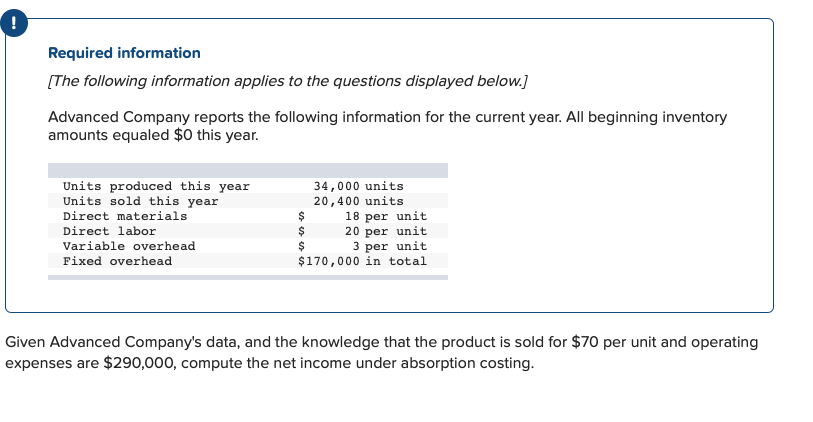

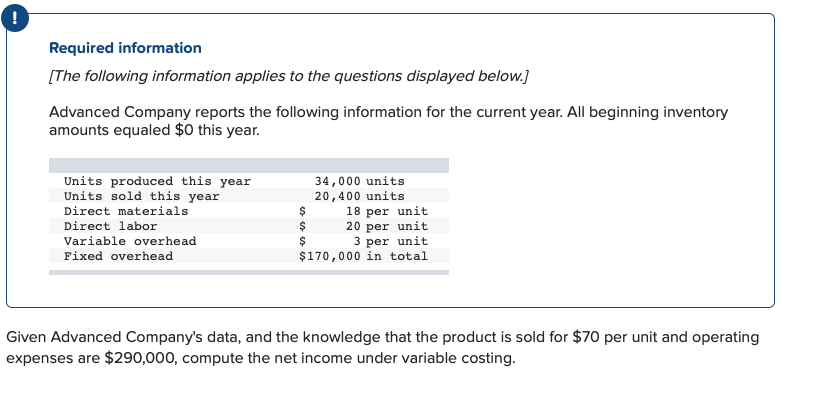

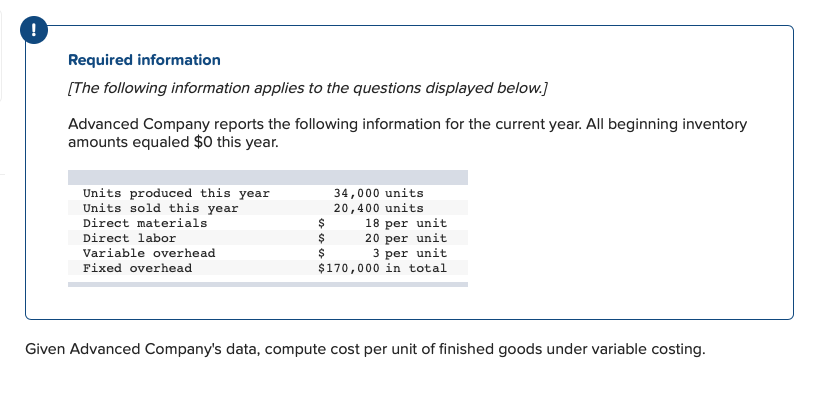

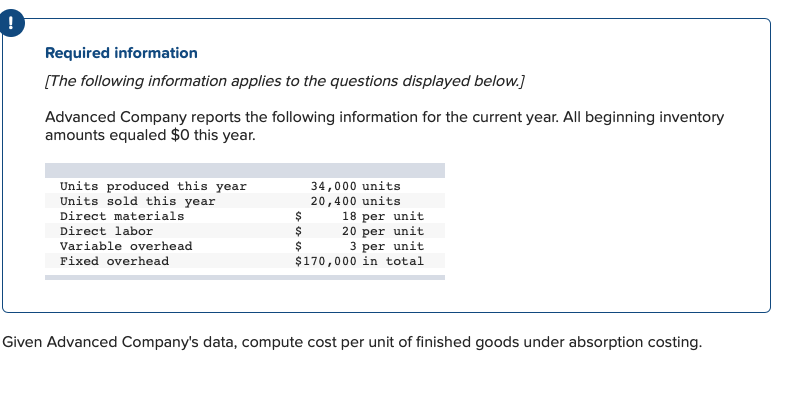

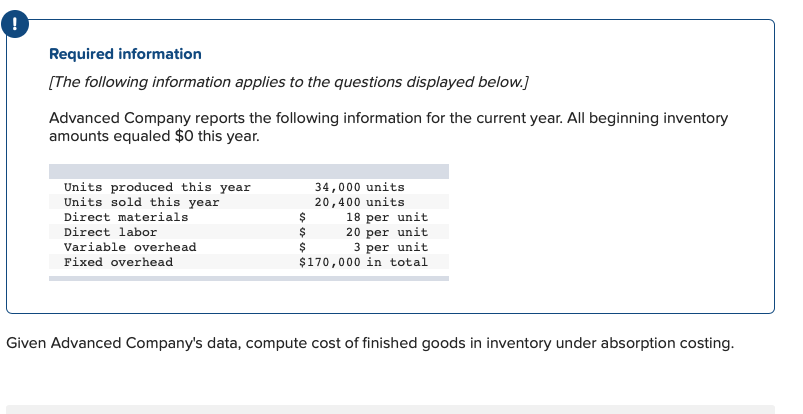

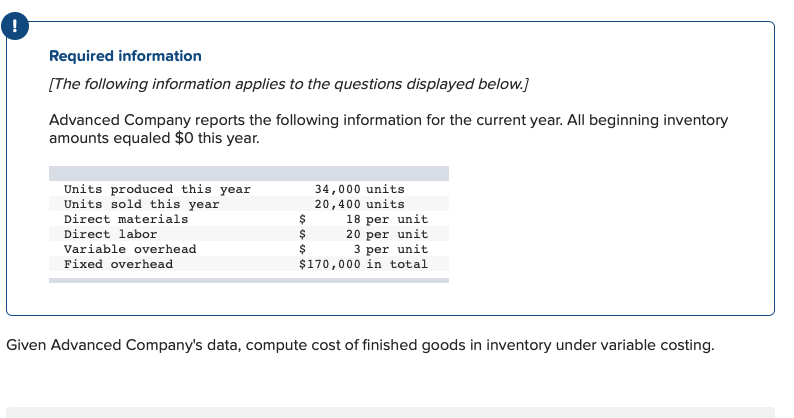

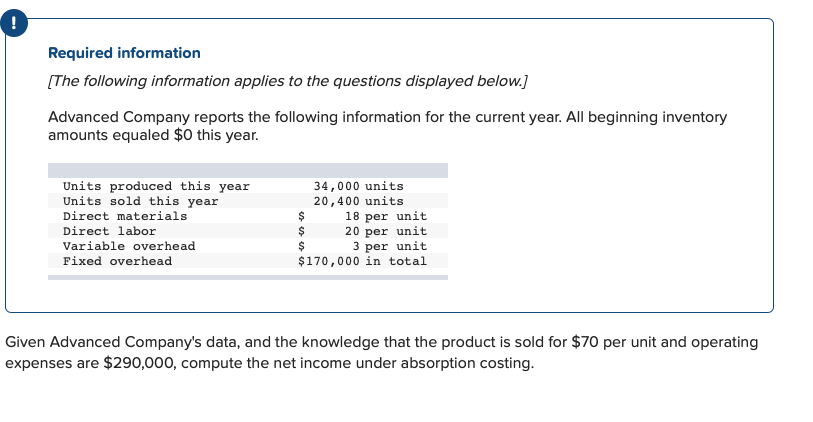

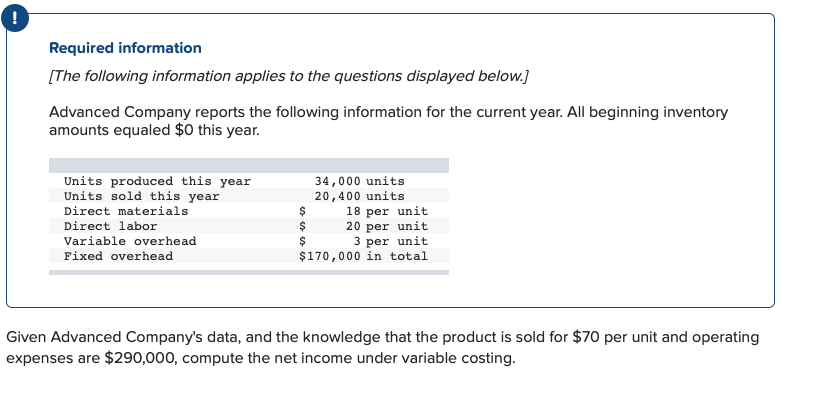

Required information [The following information applies to the questions displayed below.) Advanced Company reports the following information for the current year. All beginning inventory amounts equaled $0 this year. Units produced this year Units sold this year Direct materials Direct labor Variable overhead Fixed overhead 34,000 units 20,400 units 18 per unit 20 per unit 3 per unit $170,000 in total Given Advanced Company's data, compute cost per unit of finished goods under variable costing. o $38.00 o $43.00 o $39.88 o $41.00 o $46.00 Required information [The following information applies to the questions displayed below.) Advanced Company reports the following information for the current year. All beginning inventory amounts equaled $0 this year. Units produced this year Units sold this year Direct materials Direct labor Variable overhead Fixed overhead 34,000 units 20, 400 units $ 18 per unit $ 20 per unit $ 3 per unit $170,000 in total Given Advanced Company's data, compute cost per unit of finished goods under absorption costing. $38.00 $38.00 $5133 $51.33 $43.00 $41.00 $46.00 Required information (The following information applies to the questions displayed below.] Advanced Company reports the following information for the current year. All beginning inventory amounts equaled $0 this year. Units produced this year Units sold this year Direct materials Direct labor Variable overhead Fixed overhead 34,000 units 20,400 units $ 18 per unit 20 per unit 3 per unit $170,000 in total Given Advanced Company's data, compute cost of finished goods in inventory under variable costing. o $625,600 o $1,564,000 o $938,400 o $557,600 o $836,400 Required information [The following information applies to the questions displayed below.) Advanced Company reports the following information for the current year. All beginning inventory amounts equaled $0 this year. Units produced this year Units sold this year Direct materials Direct labor Variable overhead Fixed overhead 34,000 units 20, 400 units $ 18 per unit 20 per unit 3 per unit $170,000 in total Given Advanced Company's data, and the knowledge that the product is sold for $70 per unit and operating expenses are $290,000, compute the net income under absorption costing. $68,000 $131,600 $195,160 $199,600 $301,600 Required information [The following information applies to the questions displayed below.] Advanced Company reports the following information for the current year. All beginning inventory amounts equaled $0 this year. Units produced this year Units sold this year Direct materials Direct labor Variable overhead Fixed overhead 34,000 units 20, 400 units $ 18 per unit $ 20 per unit $ 3 per unit $170,000 in total Given Advanced Company's data, and the knowledge that the product is sold for $70 per unit and operating expenses are $290,000, compute the net income under variable costing. $68,000 0 $131,600 $195,160 $199,600 $296,800