Answered step by step

Verified Expert Solution

Question

1 Approved Answer

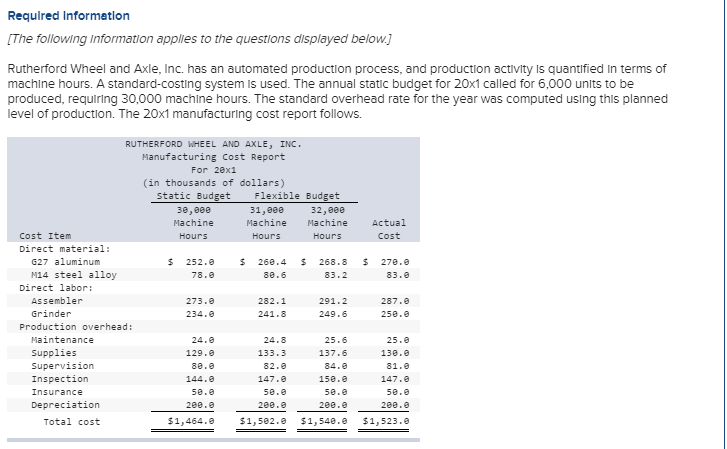

Required Information [The following information applies to the questions displayed below.] Rutherford Wheel and Axle, Inc. has an automated production process, and production activity Is

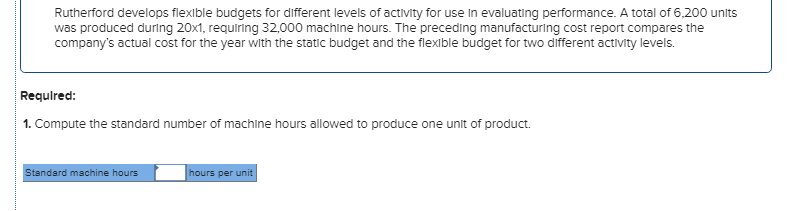

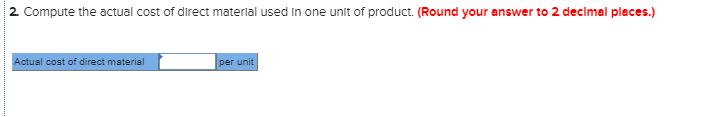

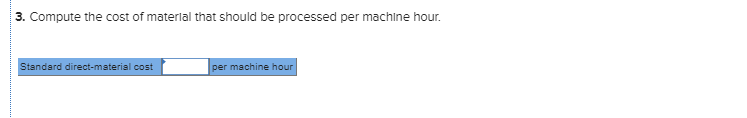

Required Information [The following information applies to the questions displayed below.] Rutherford Wheel and Axle, Inc. has an automated production process, and production activity Is quantified In terms of machine hours. A standard-costing system is used. The annual static budget for 20x1 called for 6,000 units to be produced, requiring 30,000 machlne hours. The standard overhead rate for the year was computed using this planned level of production. The 20x1 manufacturing cost report follows. RUTHERFORD WHEEL AND AXLE, INC Manufacturing Cost Report For 20x1 (in thousands of dollars) Static Budget Flexible Budget 32,eee 30,eee Machine 31,0ee Machine Machine Actual Cost Item Cost Hours Hours Hours Direct material: G27 aluminum 270.e 252.8 260.4 268.8 M14 steel alloy 78.8 80.6 83.2 83.e Direct labor: Assembler 273.e 282.1 291.2 287. Grinder 234.e 241.8 249.6 250.0 Production overhead: Maintenance 24.e 24.8 25.6 25.e Supplies 130.e 129.e 133.3 137.6 Supervision Inspection 81.0 80.e 82.e 84.0 147.0 144.e 147.8 150.e Insurance 50.e 50.e 50.e 50.e Depreciation 200.e 200.0 200.0 200.0 Total cost $1,464.e $1,502.e $1,540.e $1,523.e Rutherford develops flexible budgets for different levels of activity for use in evaluating performance. A total of 6,200 unlts was produced during 20x1, requiring 32,000 machine hours. The preceding manufacturing cost report compares the company's actual cost for the year with the static budget and the flexible budget for two different activity levels. Required: 1. Compute the standard number of machine hours allowed to produce one unit of product Standard machine hours hours per unit 2. Compute the actual cost of direct materlal used In one unit of product. (Round your answer to 2 decimal places.) Actual cost of direct material per unit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started