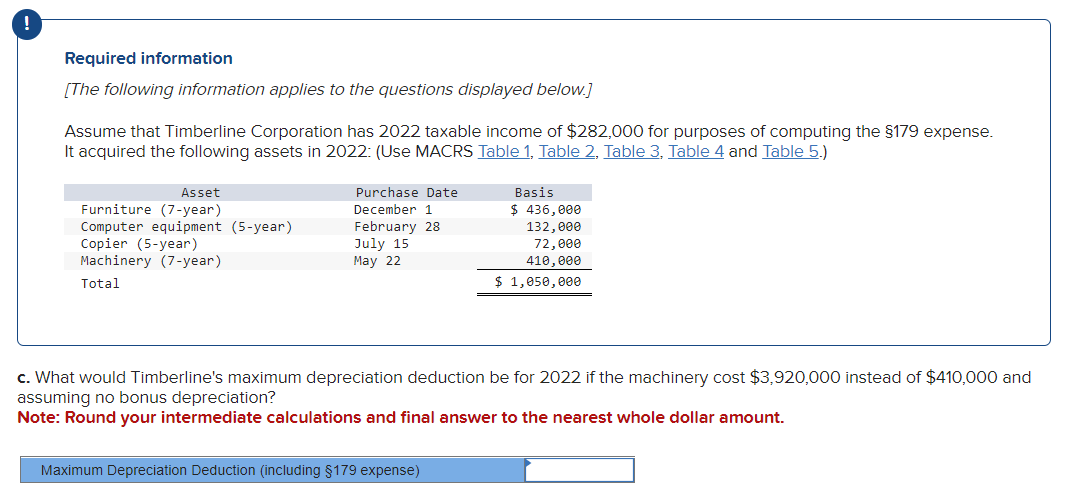

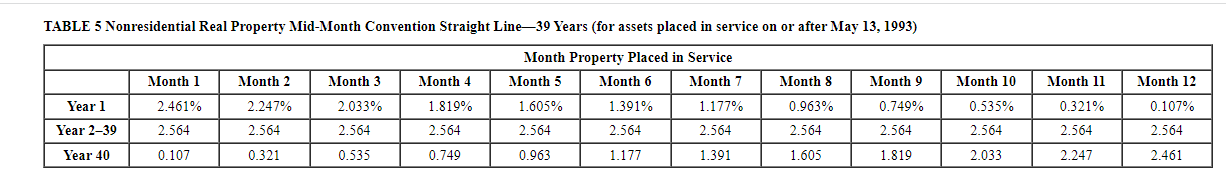

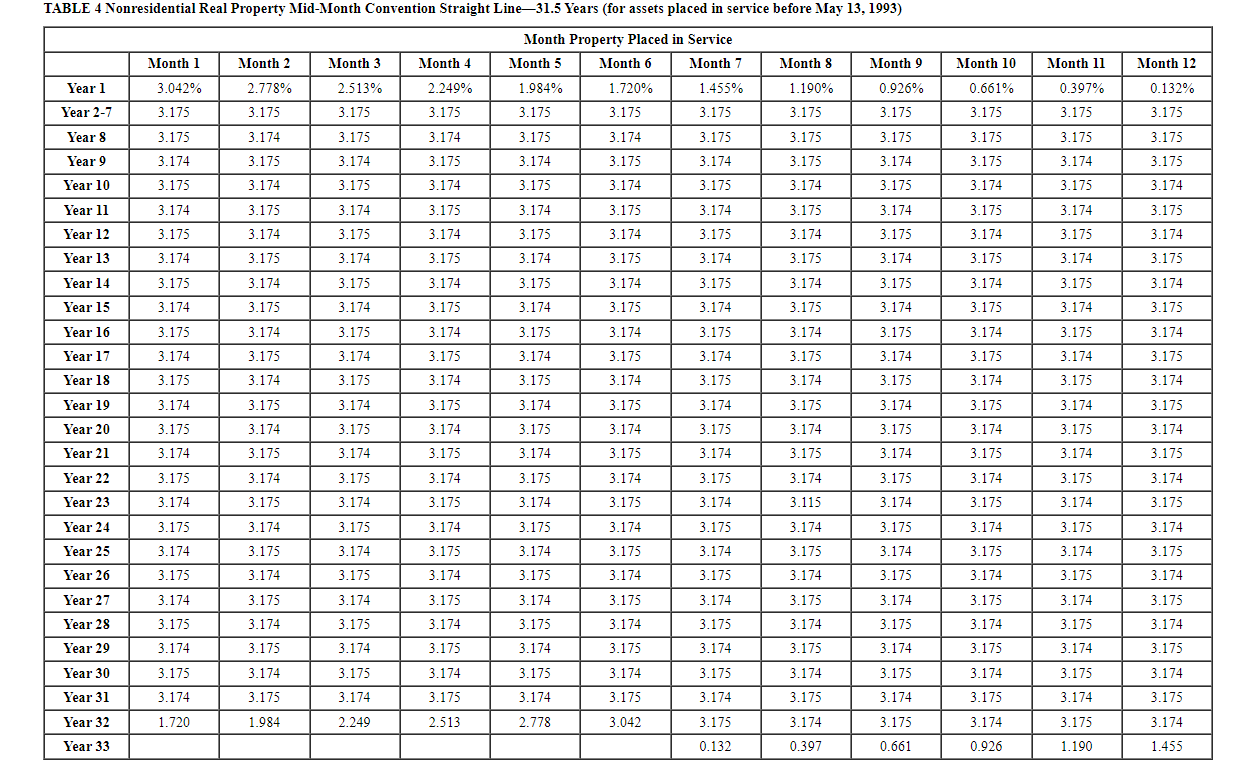

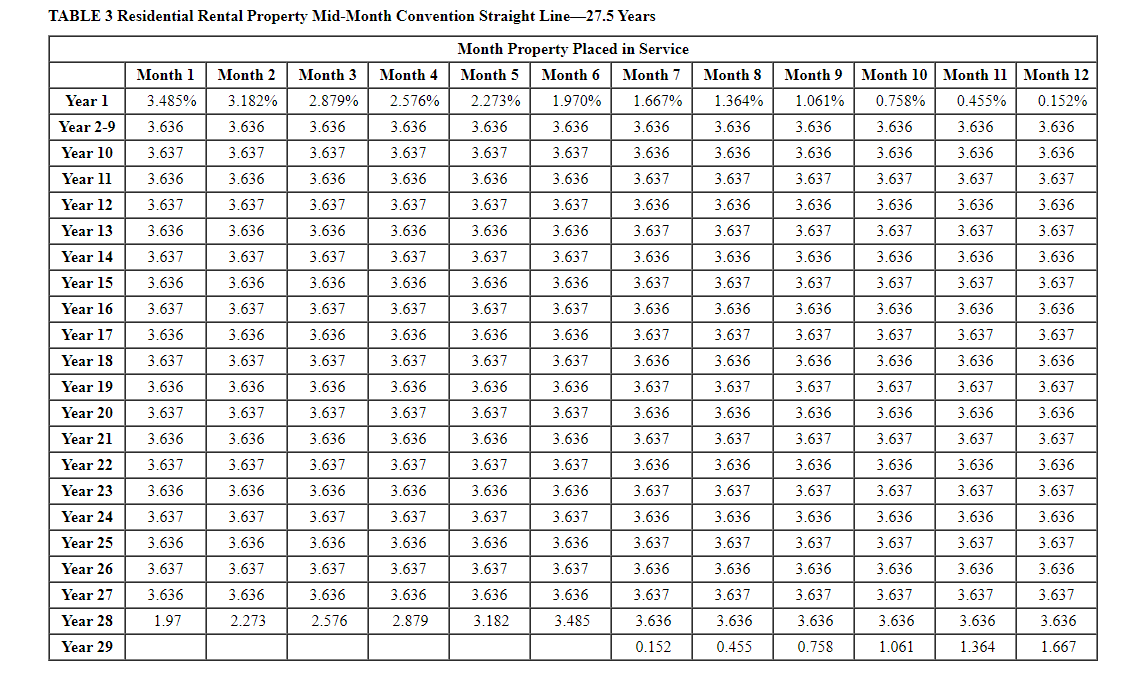

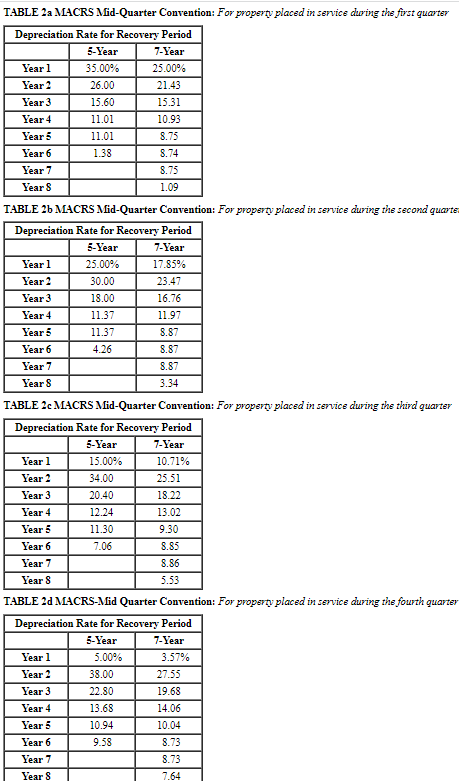

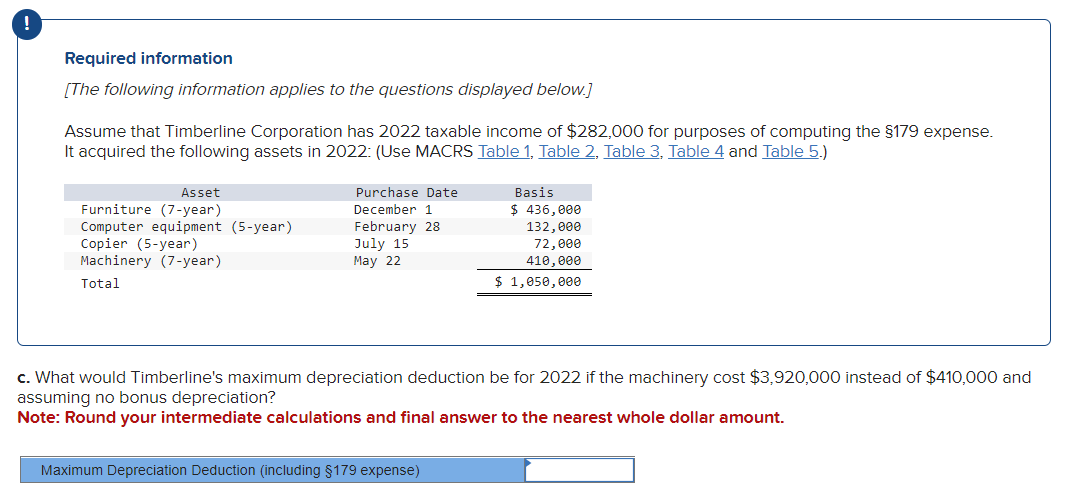

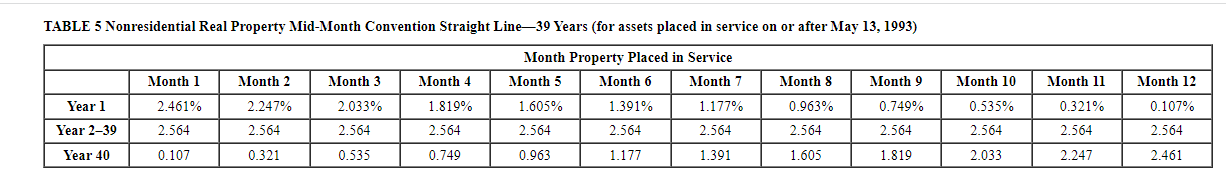

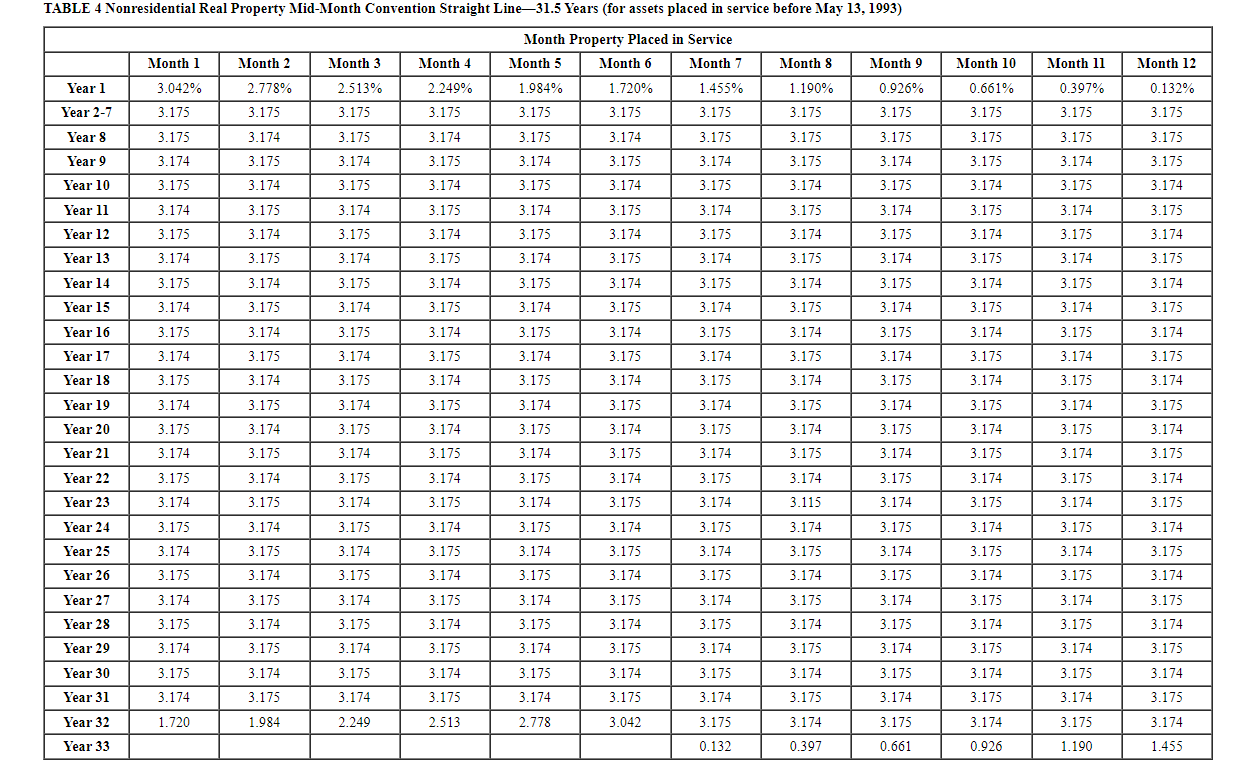

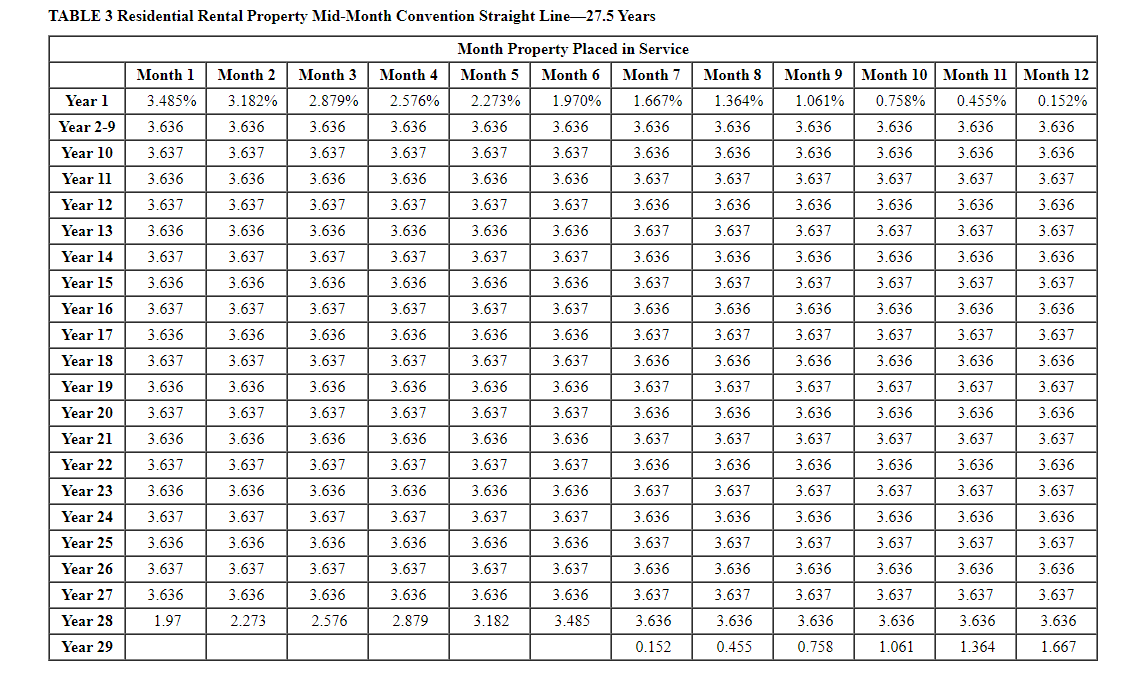

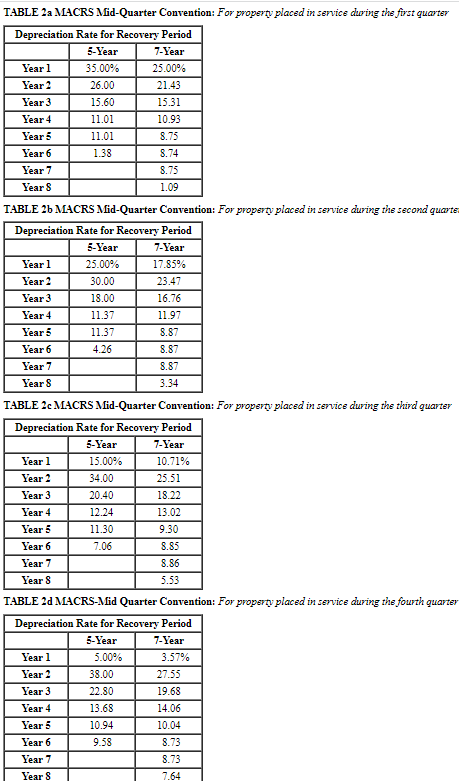

Required information [The following information applies to the questions displayed below.] Assume that Timberline Corporation has 2022 taxable income of $282,000 for purposes of computing the $179 expense. It acquired the following assets in 2022: (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) What would Timberline's maximum depreciation deduction be for 2022 if the machinery cost $3,920,000 instead of $410,000 and ssuming no bonus depreciation? ote: Round your intermediate calculations and final answer to the nearest whole dollar amount. TABLE 5 Nonresidential Real Property Mid-Month Convention Straight Line-39 Years (for assets placed in service on or after May 13, 1993) TABLE 4 Nonresidential Real Property Mid-Month Convention Straight Line-31.5 Years (for assets placed in service before May 13,1993 ) TABLE 3 Residential Rental Property Mid-Month Convention Straight Line-27.5 Years TABLE 2 a MACS Mid-Quarter Convention: For property placed in service dering the first quarter TABLE 2b MACRS Mid-Quarter Convention: For property placed in service during the second quarte TABLE 2c MACRS Mid-Quarter Convention: For property placed in service during the third quarter TABLE 2d MACRS-Mid Quarter Convention: For property placed in service during the fourth quartel Required information [The following information applies to the questions displayed below.] Assume that Timberline Corporation has 2022 taxable income of $282,000 for purposes of computing the $179 expense. It acquired the following assets in 2022: (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) What would Timberline's maximum depreciation deduction be for 2022 if the machinery cost $3,920,000 instead of $410,000 and ssuming no bonus depreciation? ote: Round your intermediate calculations and final answer to the nearest whole dollar amount. TABLE 5 Nonresidential Real Property Mid-Month Convention Straight Line-39 Years (for assets placed in service on or after May 13, 1993) TABLE 4 Nonresidential Real Property Mid-Month Convention Straight Line-31.5 Years (for assets placed in service before May 13,1993 ) TABLE 3 Residential Rental Property Mid-Month Convention Straight Line-27.5 Years TABLE 2 a MACS Mid-Quarter Convention: For property placed in service dering the first quarter TABLE 2b MACRS Mid-Quarter Convention: For property placed in service during the second quarte TABLE 2c MACRS Mid-Quarter Convention: For property placed in service during the third quarter TABLE 2d MACRS-Mid Quarter Convention: For property placed in service during the fourth quartel