Answered step by step

Verified Expert Solution

Question

1 Approved Answer

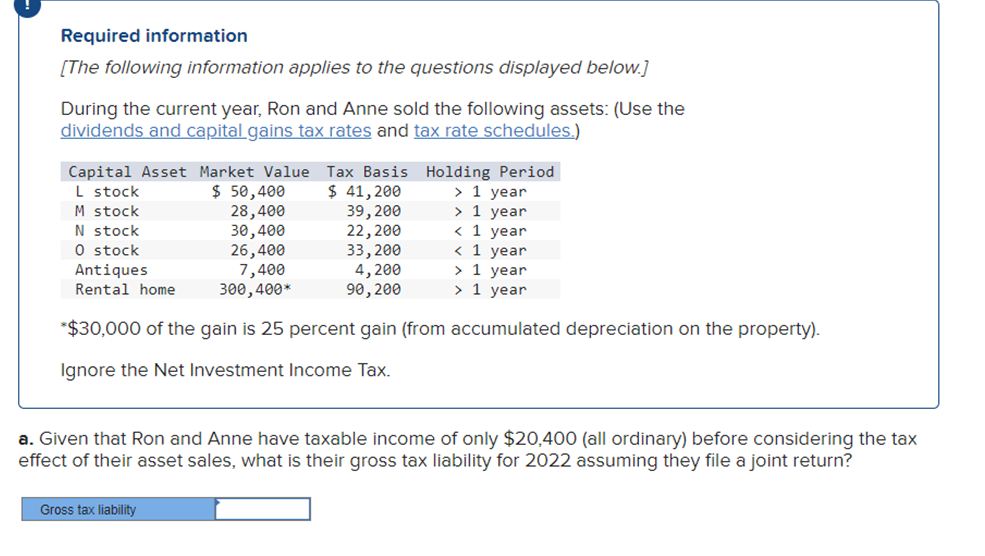

Required information [The following information applies to the questions displayed below.] During the current year, Ron and Anne sold the following assets: (Use the dividends

Required information [The following information applies to the questions displayed below.] During the current year, Ron and Anne sold the following assets: (Use the dividends and capital gains tax rates and tax rate schedules.) * $0,000 of the gain is 25 percent gain (from accumulated depreciation on the property). Ignore the Net Investment Income Tax. a. Given that Ron and Anne have taxable income of only $20,400 (all ordinary) before considering the tax effect of their asset sales, what is their gross tax liability for 2022 assuming they file a joint return? Required information [The following information applies to the questions displayed below.] During the current year, Ron and Anne sold the following assets: (Use the dividends and capital gains tax rates and tax rate schedules.) * $0,000 of the gain is 25 percent gain (from accumulated depreciation on the property). Ignore the Net Investment Income Tax. a. Given that Ron and Anne have taxable income of only $20,400 (all ordinary) before considering the tax effect of their asset sales, what is their gross tax liability for 2022 assuming they file a joint return

Required information [The following information applies to the questions displayed below.] During the current year, Ron and Anne sold the following assets: (Use the dividends and capital gains tax rates and tax rate schedules.) * $0,000 of the gain is 25 percent gain (from accumulated depreciation on the property). Ignore the Net Investment Income Tax. a. Given that Ron and Anne have taxable income of only $20,400 (all ordinary) before considering the tax effect of their asset sales, what is their gross tax liability for 2022 assuming they file a joint return? Required information [The following information applies to the questions displayed below.] During the current year, Ron and Anne sold the following assets: (Use the dividends and capital gains tax rates and tax rate schedules.) * $0,000 of the gain is 25 percent gain (from accumulated depreciation on the property). Ignore the Net Investment Income Tax. a. Given that Ron and Anne have taxable income of only $20,400 (all ordinary) before considering the tax effect of their asset sales, what is their gross tax liability for 2022 assuming they file a joint return Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started