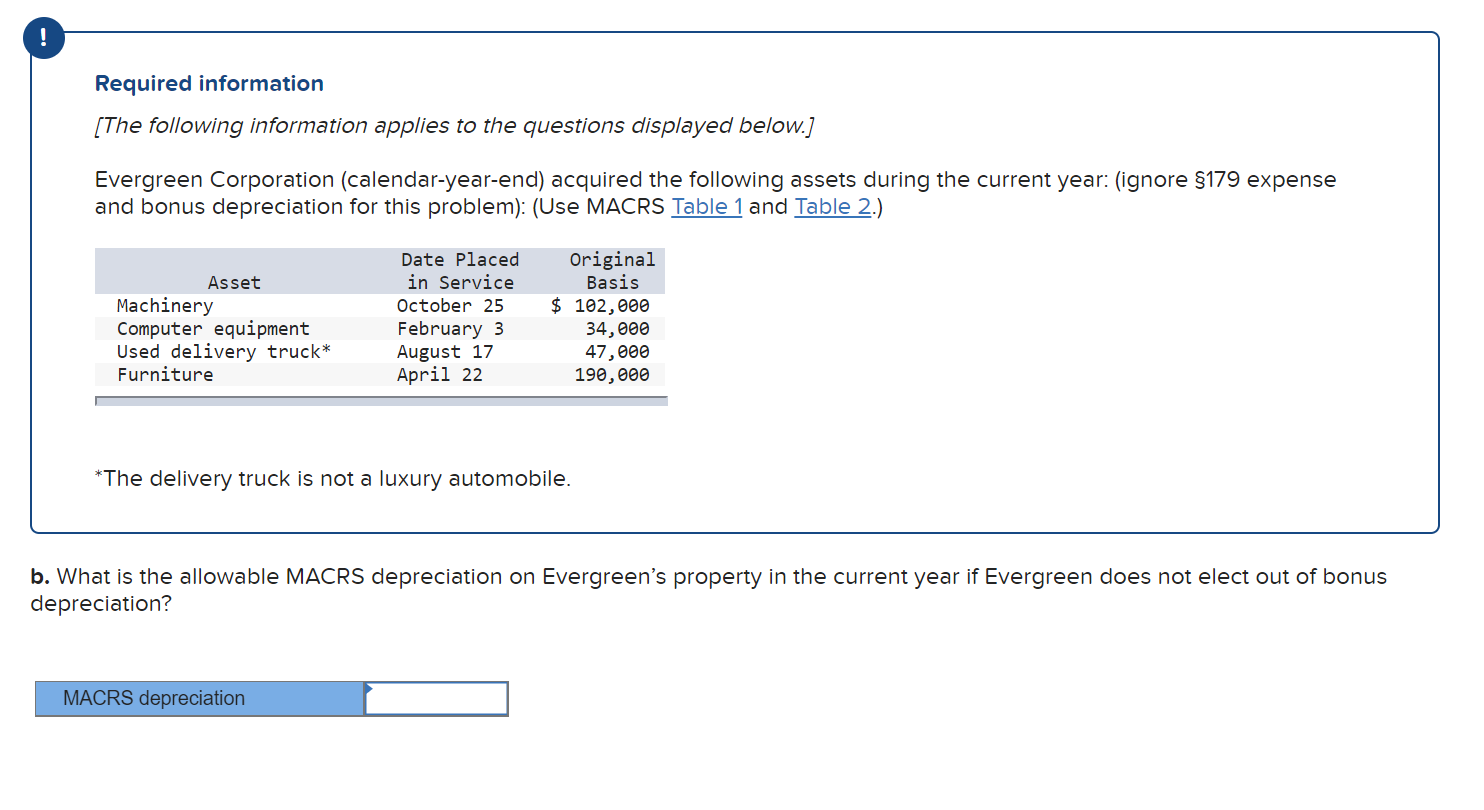

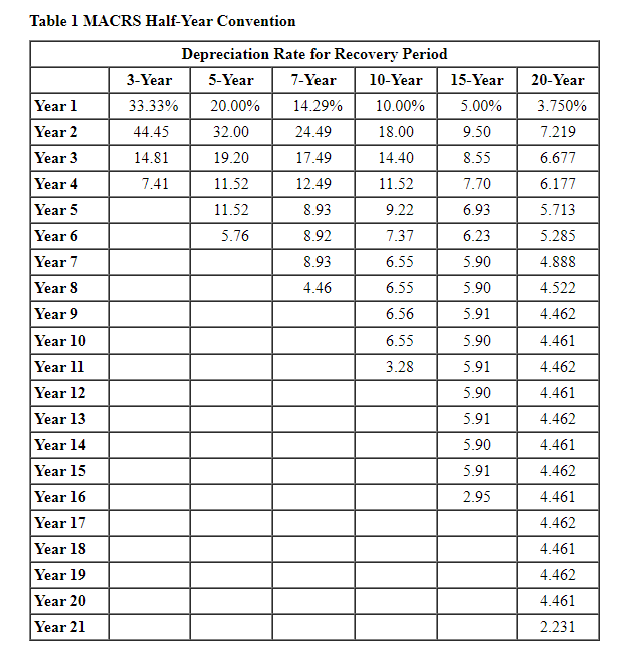

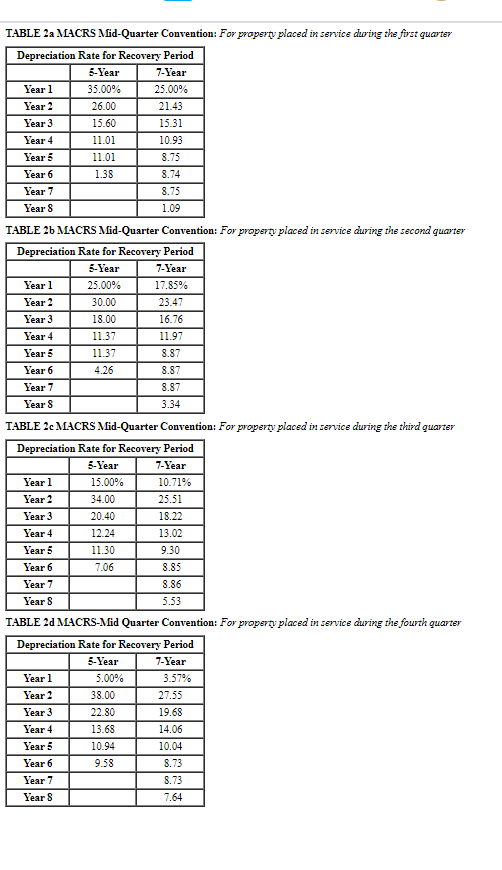

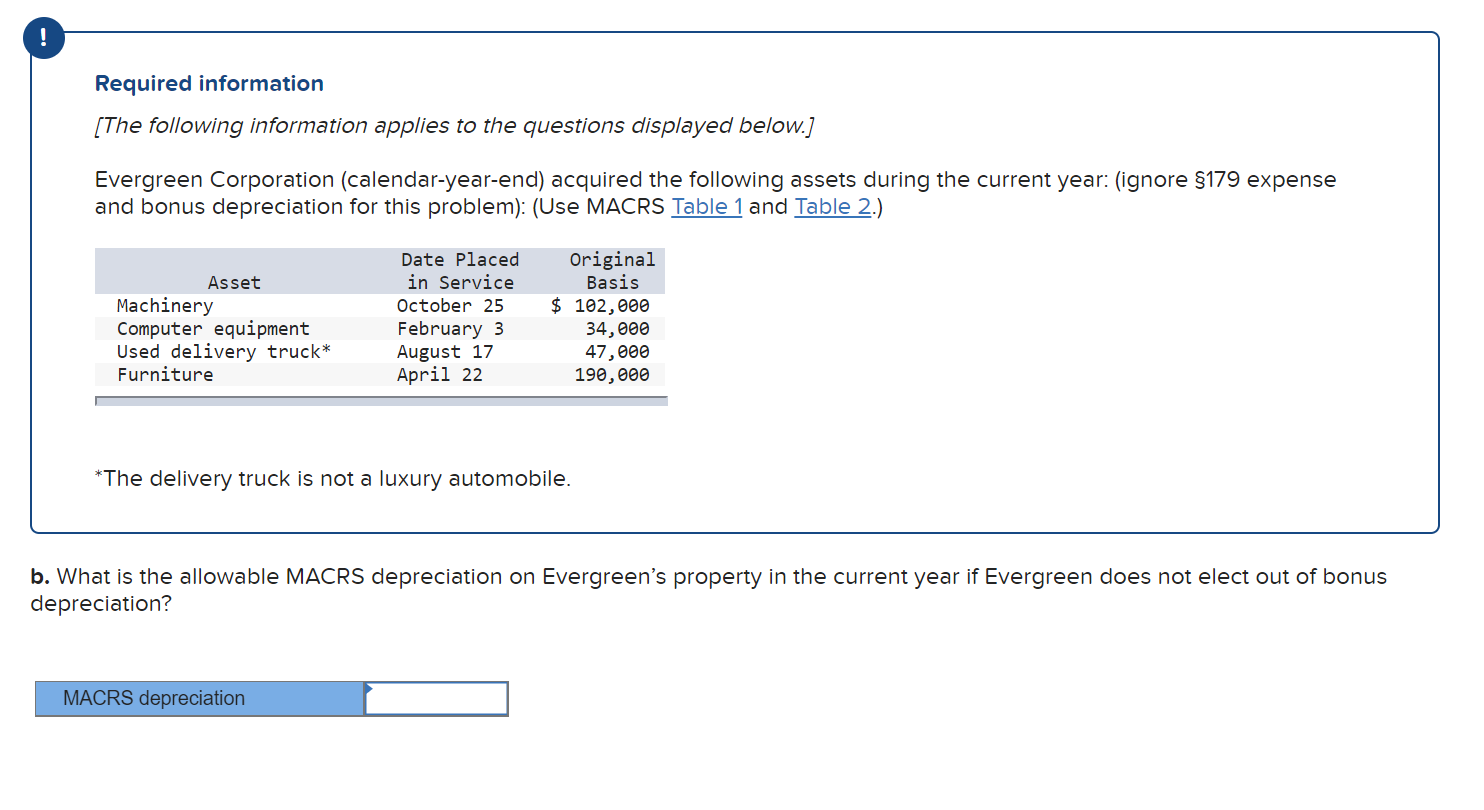

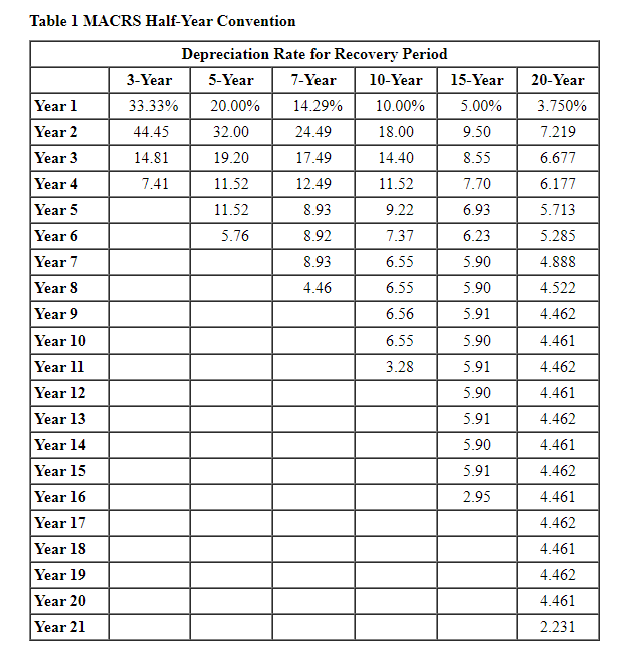

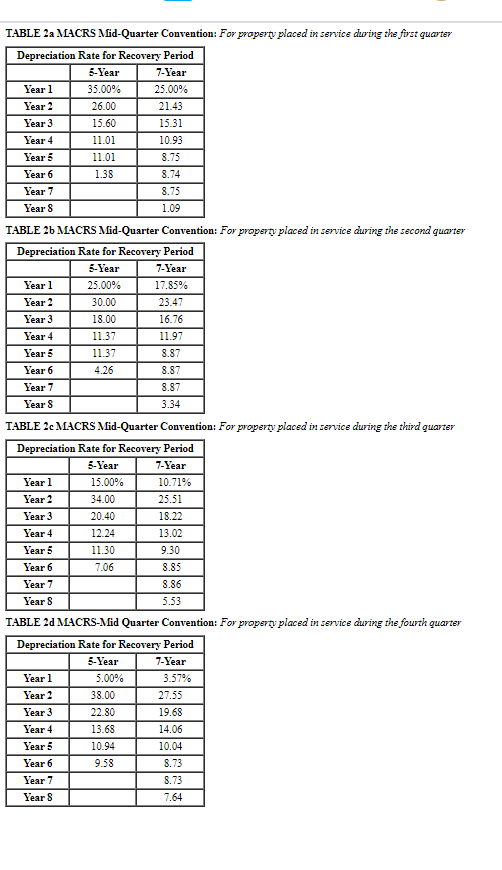

Required information [The following information applies to the questions displayed below.] Evergreen Corporation (calendar-year-end) acquired the following assets during the current year: (ignore $179 expense and bonus depreciation for this problem): (Use MACRS Table 1 and Table 2.) Asset Machinery Computer equipment Used delivery truck* Furniture Date Placed in Service October 25 February 3 August 17 April 22 Original Basis $ 102,000 34,000 47,000 190,000 *The delivery truck is not a luxury automobile. b. What is the allowable MACRS depreciation on Evergreens property in the current year if Evergreen does not elect out of bonus depreciation? MACRS depreciation Table 1 MACRS Half-Year Convention 20-Year 3.750% 7.219 Year 1 Year 2 Year 3 Year 4 Depreciation Rate for Recovery Period 3-Year 5-Year 7-Year 10-Year 15-Year 33.33% 20.00% 14.29% 10.00% 5.00% 44.45 32.00 24.49 18.00 9.50 14.81 19.20 17.49 14.40 8.55 7.41 11.52 12.49 11.52 7.70 11.52 8.93 9.22 6.93 5.76 8.92 7.37 6.23 8.93 6.55 5.90 6.677 6.177 5.713 Year 5 Year 6 Year 7 5.285 4.888 4.46 6.55 5.90 4.522 Year 8 Year 9 6.56 5.91 4.462 6.55 5.90 4.461 3.28 4.462 5.91 5.90 5.91 4.461 4.462 5.90 5.91 Year 10 Year 11 Year 12 Year 13 Year 14 Year 15 Year 16 Year 17 Year 18 Year 19 Year 20 Year 21 4.461 4.462 4.461 2.95 4.462 4.461 4.462 4.461 2.231 TABLE 2a MACRS Mid-Quarter Convention: For property placed in service during the first quarter Depreciation Rate for Recovery Period 6-Year 7-Year Year 1 35.00% 25.00% Year 2 26.00 21.43 Year 3 15.60 15.31 Year 4 11.01 10.93 Year 5 11.01 8.75 Year 6 1.38 8.74 Year 7 8.75 Year 8 1.09 TABLE 26 MACRS Mid-Quarter Convention: For property placed in service during the second quarter Depreciation Rate for Recovery Period 6-Year 7-Year Year 1 25.00% 17.85% Year 2 30.00 23.47 Year 3 18.00 16.76 Year 4 11.37 11.97 Year 5 11.37 8.87 Year 6 4.26 8.87 Year 7 8.87 Year 8 3.34 TABLE 2 MACRS Mid-Quarter Convention: For property placed in service during the third quarter Depreciation Rate for Recovery Period 5-Year 7-Year Year 1 15.00% 10.71% Year 2 34.00 25.51 Year 3 20.40 18.22 Year 4 12 24 13.02 Year 5 11.30 9.30 Year 6 7.06 8.85 Year 7 8.86 Year 8 5.53 TABLE 20 MACRS-Mid Quarter Convention: For property placed in service during the fourth quarter Depreciation Rate for Recovery Period 5-Year 7-Year Year 1 5.00% 3.57% Year 2 38.00 27.55 Year 3 22.80 19.68 Year 4 13.68 14.06 Year 5 10.94 10.04 Year 6 9.58 8.73 Year 7 8.73 Year 8 7.64