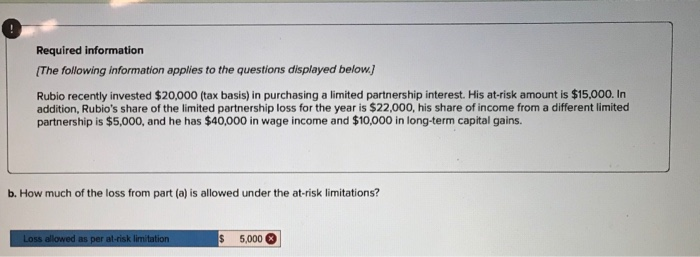

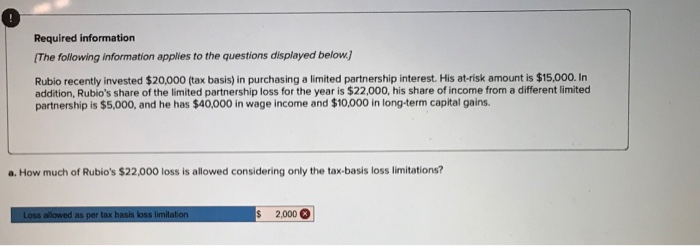

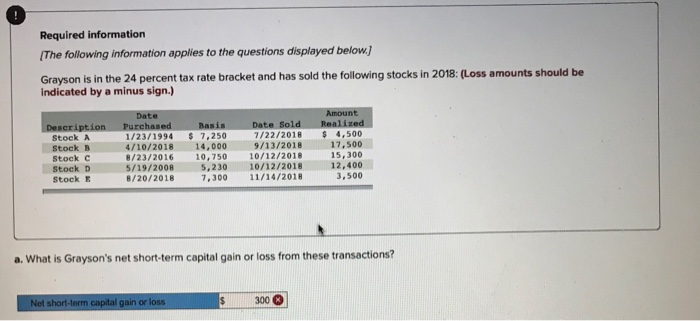

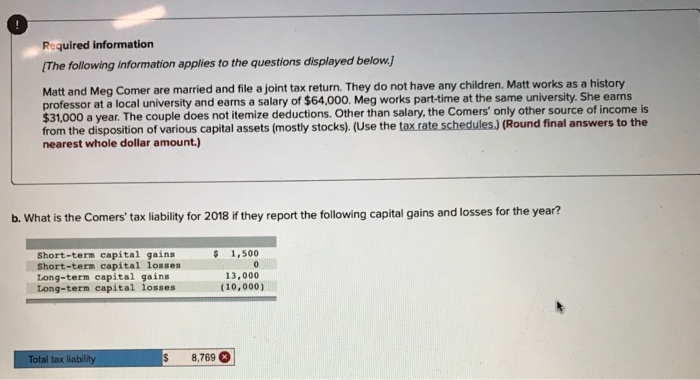

Required information The following information applies to the questions displayed below. Rubio recently invested $20,000 (tax basis) in purchasing a limited partnership interest. His at-risk amount is $15,000. In addition, Rubio's share of the limited partnership loss for the year is $22,000, his share of income from a different limited partnership is $5,000, and he has $40,000 in wage income and $10,000 in long-term capital gains. b. How much of the loss from part (a) is allowed under the at-risk limitations? 5,000 Required information The following information applies to the questions displayed below Rubio recently invested $20,000 (tax basis) in purchasing a limited partnership interest. His at-risk amount is $15,000. In addition, Rubio's share of the limited partnership loss for the year is $22,000, his share of income from a different limited partnership is $5,000, and he has $40,000 in wage income and $10,000 in long-term capital gains a. How much of Rubio's $22,000 loss is allowed considering only the tax-basis loss limitations? 2,000 Required information (The following information applies to the questions displayed below] Grayson is in the 24 percent tax rate bracket and has sold the following stocks in 2018: (Loss amounts should be indicated by a minus sign. Purchas te So /22/2018 4,500 17,500 15,300 5/19/2008 5,230 10/12/2018 12,400 3,500 1/23/1994 $ 7,250 Stock A Stock B Stock C Stock D stock E 4/10/2018 14,000 9/13/2018 8/23/2016 10,750 10/12/2018 8/20/2018 7,300 11/14/2018 a. What is Grayson's net short-term capital gain or loss from these transactions? 300 Required information (The following information applies to the questions displayed below] Matt and Meg Comer are married and file a joint tax return. They do not have any children. Matt works as a history professor at a local university and earns a salary of $64,000. Meg works part-time at the same $31,000 a year. The couple does not itemize deductions. Other than salary, the Comers' only other source of income is from the disposition of various capital assets (mostly stocks). (Use the tax rate schedules.) (Round final answers to the nearest whole dollar amount. university. She eams b. What is the Comers' tax liability for 2018 if they report the following capital gains and losses for the year? $ 1,500 Short-term capital gains Short-tern capital losses tong-term capital gains tong-term capital losses 13,000 (10,000) Total tax liability 8,769