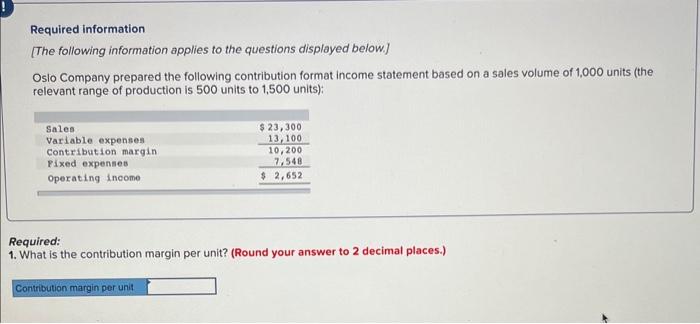

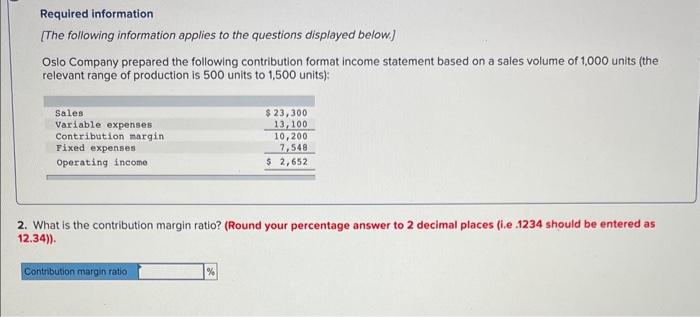

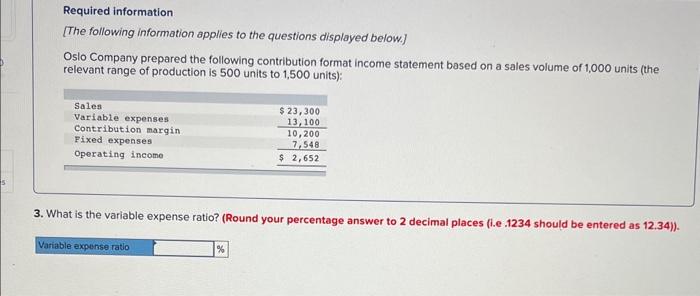

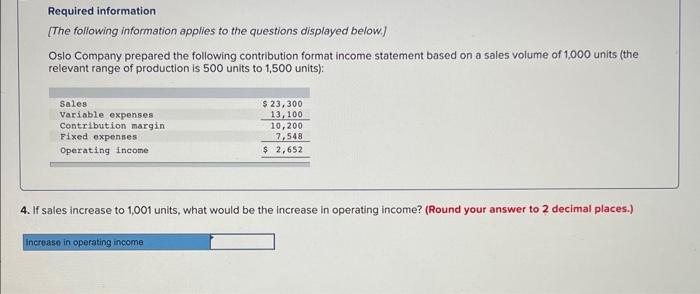

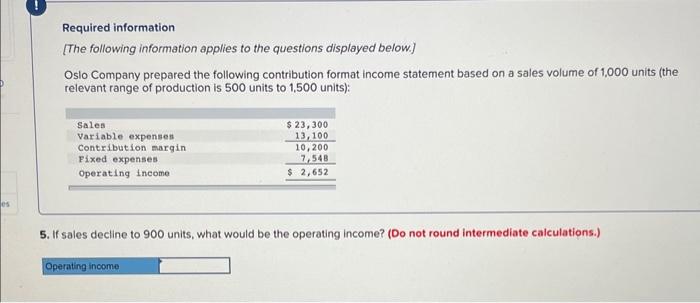

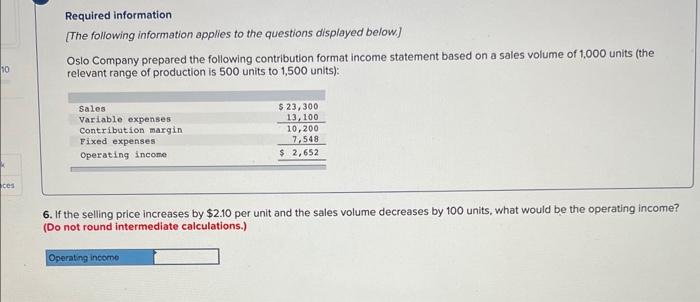

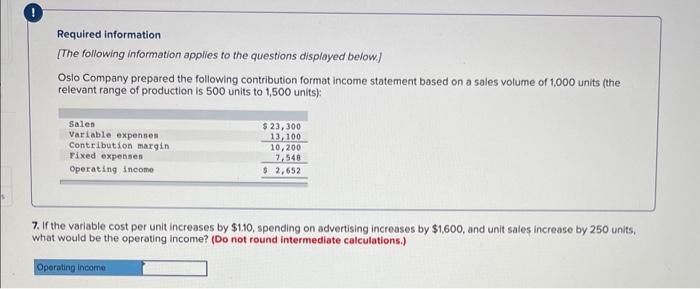

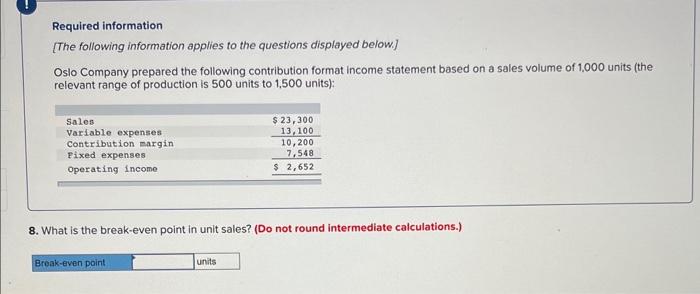

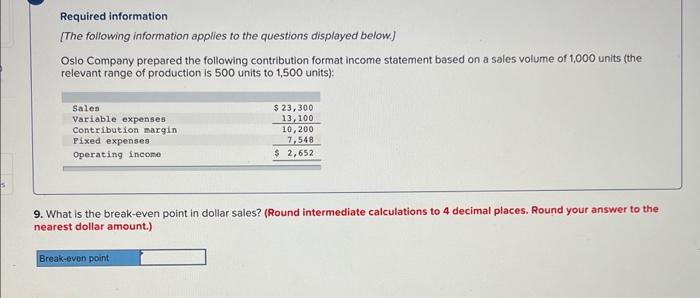

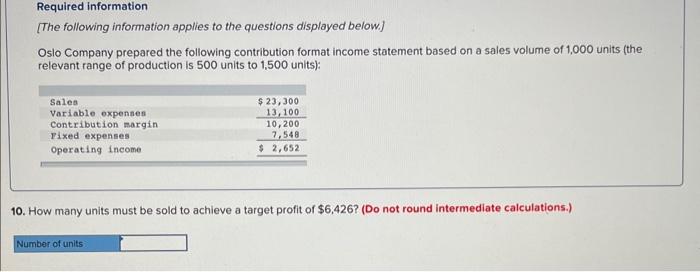

Required information [The following information applies to the questions displayed below.] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Required: 1. What is the contribution margin per unit? (Round your answer to 2 decimal places.) Required information [The following information applies to the questions displayed belowi] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): 2. What is the contribution margin ratio? (Round your percentage answer to 2 decimal places (i.e . 1234 should be entered as 12.34)). Required information [The following information applies to the questions displayed below.] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): What is the variable expense ratio? (Round your percentage answer to 2 decimal places (i.e .1234 should be entered as 12.34 )). Required information [The following information applies to the questions displayed below.] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): If sales increase to 1,001 units, what would be the increase in operating income? (Round your answer to 2 decimal places.) Required information [The following information applies to the questions displayed below] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): 5. If sales decline to 900 units, what would be the operating income? (Do not round intermediate calculations.) Required information [The following information applies to the questions displayed below.] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): 5. If the selling price increases by $2.10 per unit and the sales volume decreases by 100 units, what would be the operating income? Do not round intermediate calculations.) Required information [The following information applies to the questions displayed below.] Osio Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): 7. If the variable cost per unit increases by $1.10, spending on advertising increases by $1,600, and unit sales increase by 250 units, What would be the operating income? (Do not round intermediate calculations.) Required information [The following information applies to the questions displayed below.] Osio Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): 8. What is the break-even point in unit sales? (Do not round intermediate calculations.) Required information [The following information applies to the questions displayed below.] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): What is the break-even point in dollar sales? (Round intermediate calculations to 4 decimal places. Round your answer to the earest dollar amount.) Required information [The following information applies to the questions displayed below.] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): 10. How many units must be sold to achieve a target profit of $6,426 ? (Do not round intermediate calculations.)