Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required information [The following information applies to the questions displayed below.] On January 1, 2022, Drennen, Incorporated, issued $5.1 million face amount of 11-year, 14%

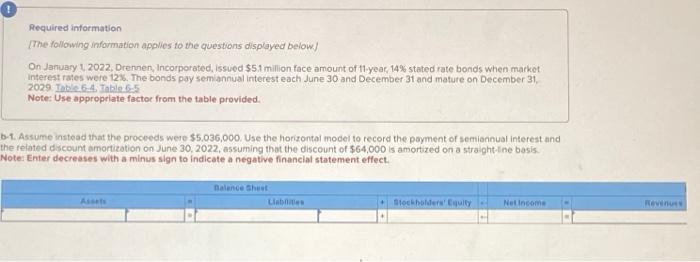

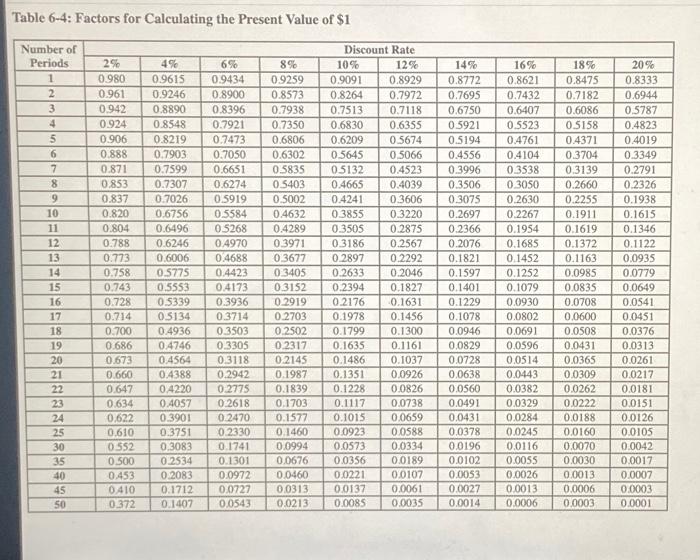

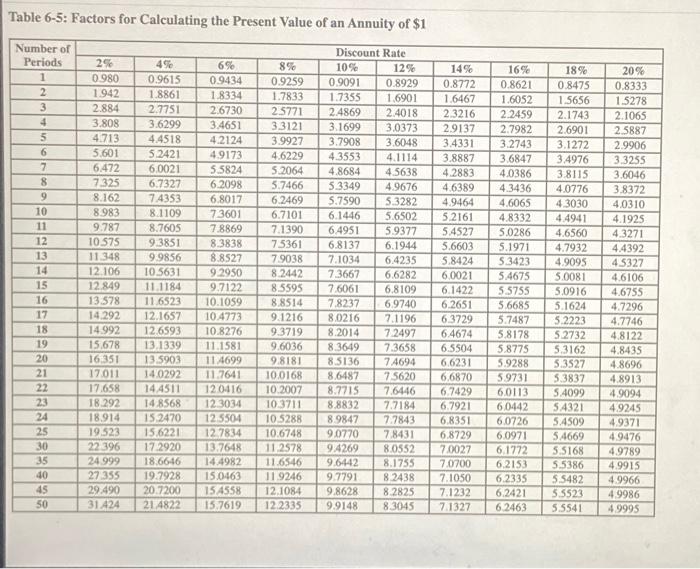

Required information [The following information applies to the questions displayed below.] On January 1, 2022, Drennen, Incorporated, issued $5.1 million face amount of 11-year, 14% stated rate bonds when market interest rates were 12%. The bonds pay semiannual interest each June 30 and December 31 and mature on December 31, 2029. Table 6-4, Table 6-5 Note: Use appropriate factor from the table provided. b-1. Assume instead that the proceeds were $5,036,000. Use the horizontal model to record the payment of semiannual interest and the related discount amortization on June 30, 2022, assuming that the discount of $64,000 is amortized on a straight-line basis. Note: Enter decreases with a minus sign to indicate a negative financial statement effect. Assets Balance Sheet Liabilities Stockholders' Equity Net Income Revenues

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started