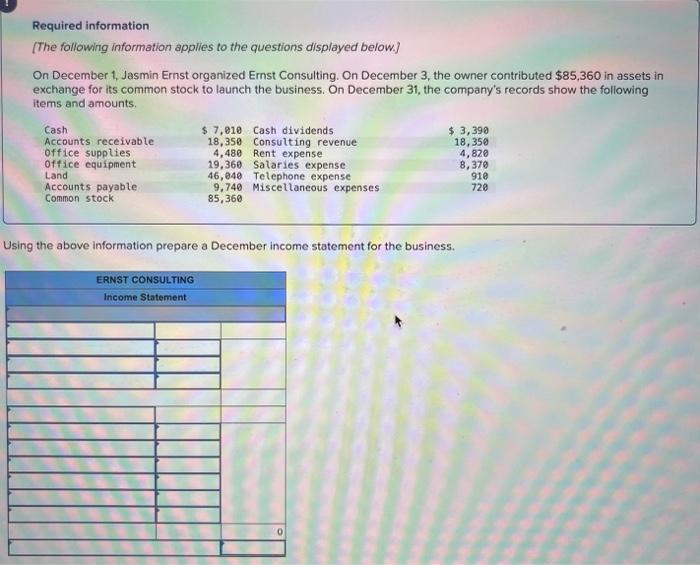

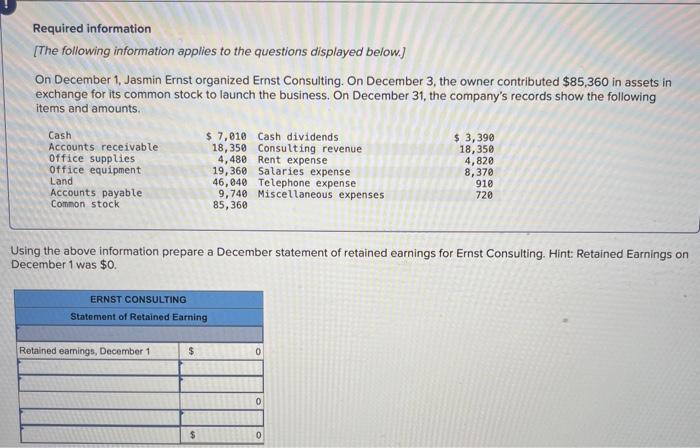

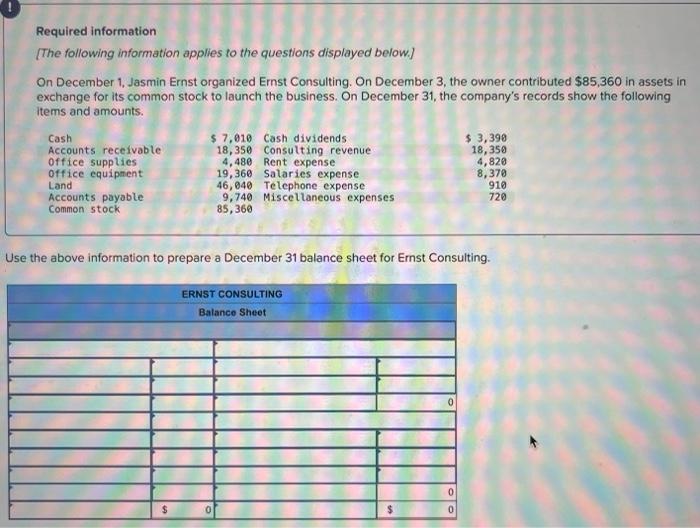

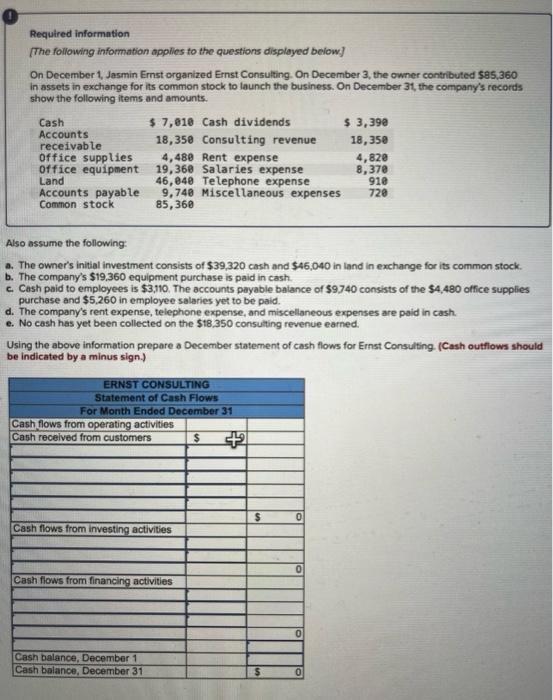

Required information [The following information applies to the questions displayed below.] On December 1, Jasmin Ernst organized Ernst Consulting. On December 3, the owner contributed $85,360 in assets in exchange for its common stock to launch the business. On December 31, the company's records show the following items and amounts. Using the above information prepare a December income statement for the business. Required information [The following information applies to the questions displayed below.] On December 1, Jasmin Ernst organized Ernst Consulting. On December 3, the owner contributed $85,360 in assets in exchange for its common stock to launch the business. On December 31 , the company's records show the following items and amounts. Jsing the above information prepare a December statement of retained earnings for Ernst Consulting. Hint: Retained Earnings on December 1 was $0. Required information [The following information applies to the questions displayed below.] On December 1, Jasmin Ernst organized Ernst Consulting. On December 3, the owner contributed $85,360 in assets in exchange for its common stock to launch the business. On December 31 , the company's records show the following Items and amounts. Use the above information to prepare a December 31 balance sheet for Ernst Consulting. Required information [The following information applies to the questions displeyed below] On December 1, Jasmin Ernst organized Ernst Consulting. On December 3, the owner contributed $85.360 in assets in exchange for its common stock to launch the business. On December 31 , the company's records show the following items and amounts. Also assume the following: a. The owner's initial investment consists of $39,320 cash and $46,040 in land in exchange for its common stock. b. The company's $19,360 equipment purchase is paid in cash. c. Cash paid to employees is $3,110. The accounts payable baiance of $9740 consists of the $4,480 office supplies purchase and $5,260 in employee salaries yet to be paid. d. The company's rent expense, telephone expense, and miscellaneous expenses are paid in cash. e. No cash has yet been collected on the $18.350 consulting revenue earned. Using the above information prepare a December statement of cash flows for Ernst Consulting. (Cash outflows should be indicated by a minus sign.)