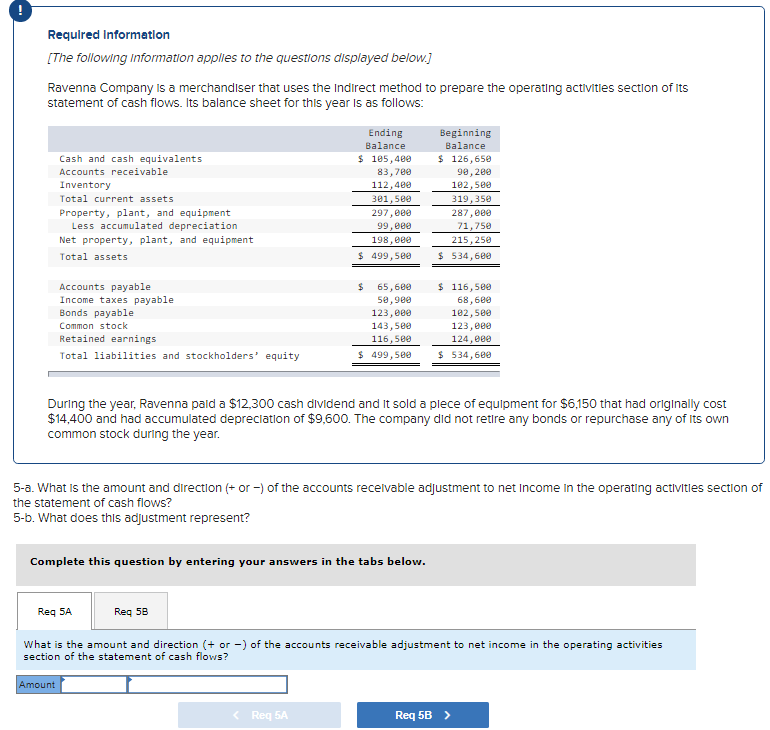

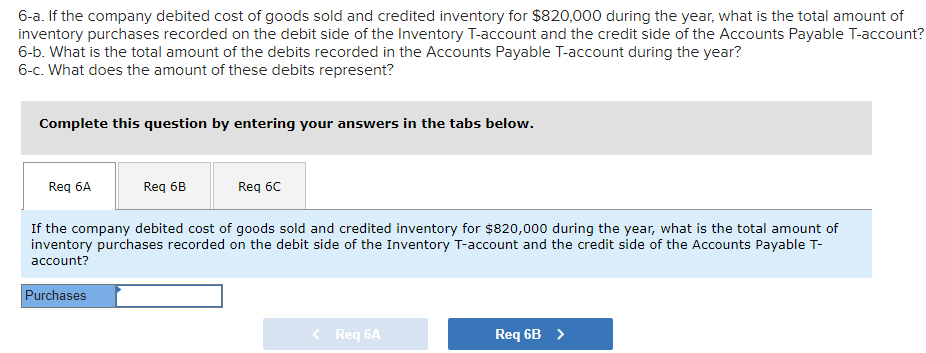

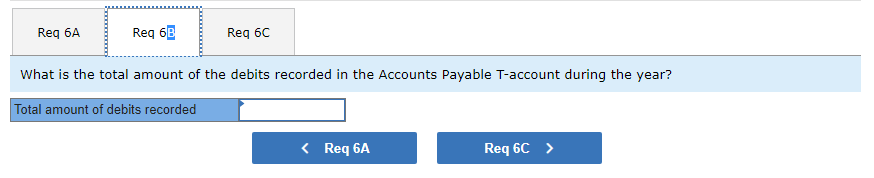

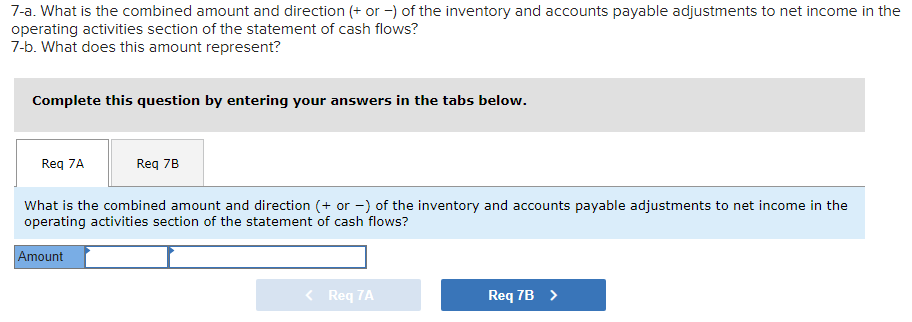

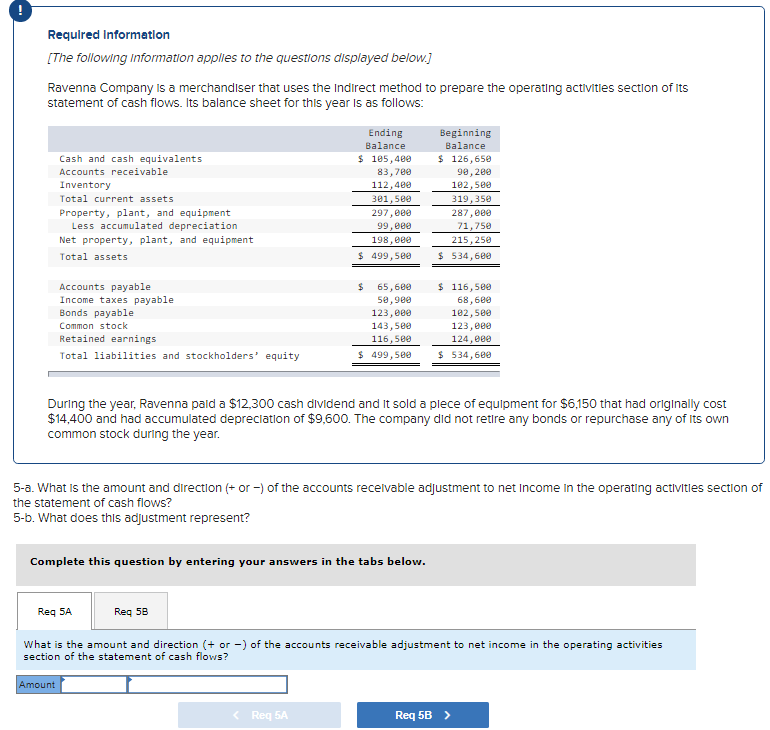

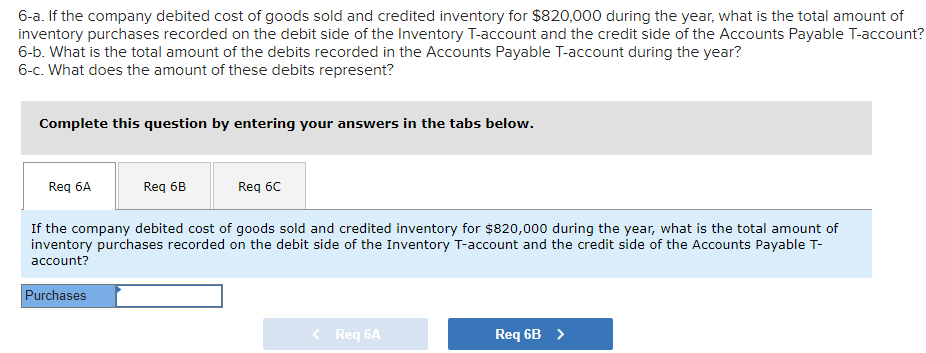

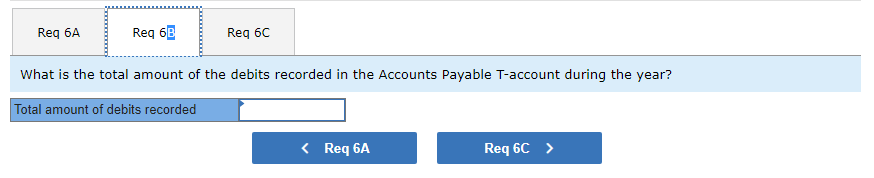

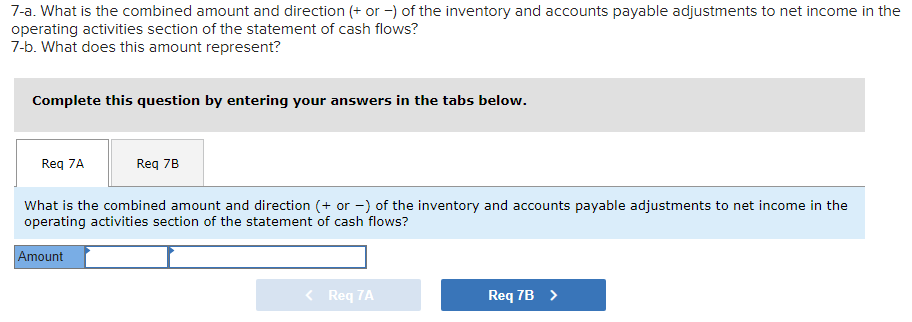

Required Information [The following information applies to the questions displayed below.) Ravenna Company is a merchandiser that uses the Indirect method to prepare the operating activities section of its statement of cash flows. Its balance sheet for this year is as follows: Cash and cash equivalents Accounts receivable Inventory Total current assets Property, plant, and equipment Less accumulated depreciation Net property, plant, and equipment Total assets Ending Balance $ 105,400 83,780 112,480 301,580 297,080 99, eee 198,00 $ 499, 5ee Beginning Balance $ 126,650 98,280 102,580 319,350 287,080 71,750 215,250 $ 534,680 Accounts payable Income taxes payable Bonds payable Common stock Retained earnings Total liabilities and stockholders' equity $ 65,689 50,900 123, eee 143,589 116,500 $ 499, 580 $ 116,500 68,680 182, see 123,280 124,280 $ 534,689 During the year, Ravenna pald a $12,300 cash dividend and it sold a plece of equipment for $6,150 that had originally cost $14,400 and had accumulated depreciation of $9,600. The company did not retire any bonds or repurchase any of its own common stock during the year. 5-a. What is the amount and direction (+ or -) of the accounts receivable adjustment to net Income in the operating activities section of the statement of cash flows? 5-6. What does this adjustment represent? Complete this question by entering your answers in the tabs below. Req 5A Reg 58 What is the amount and direction (+ or -) of the accounts receivable adjustment to net income in the operating activities section of the statement of cash flows? Amount Reg 5A Req 5B > Required Information [The following information applies to the questions displayed below.) Ravenna Company is a merchandiser that uses the Indirect method to prepare the operating activities section of its statement of cash flows. Its balance sheet for this year is as follows: Cash and cash equivalents Accounts receivable Inventory Total current assets Property, plant, and equipment Less accumulated depreciation Net property, plant, and equipment Total assets Ending Balance $ 105,400 83,780 112,480 301,580 297,080 99, eee 198,00 $ 499, 5ee Beginning Balance $ 126,650 98,280 102,580 319,350 287,080 71,750 215,250 $ 534,680 Accounts payable Income taxes payable Bonds payable Common stock Retained earnings Total liabilities and stockholders' equity $ 65,689 50,900 123, eee 143,589 116,500 $ 499, 580 $ 116,500 68,680 182, see 123,280 124,280 $ 534,689 During the year, Ravenna pald a $12,300 cash dividend and it sold a plece of equipment for $6,150 that had originally cost $14,400 and had accumulated depreciation of $9,600. The company did not retire any bonds or repurchase any of its own common stock during the year. 5-a. What is the amount and direction (+ or -) of the accounts receivable adjustment to net Income in the operating activities section of the statement of cash flows? 5-6. What does this adjustment represent? Complete this question by entering your answers in the tabs below. Req 5A Reg 58 What is the amount and direction (+ or -) of the accounts receivable adjustment to net income in the operating activities section of the statement of cash flows? Amount Reg 5A Req 5B >