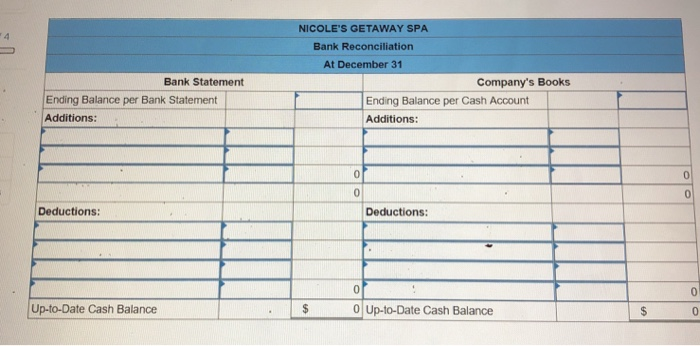

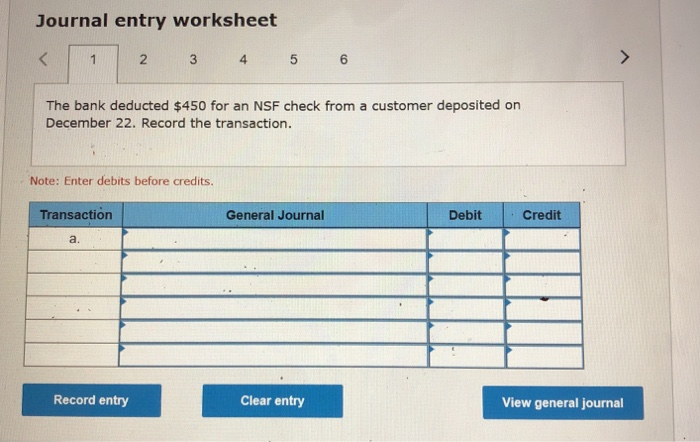

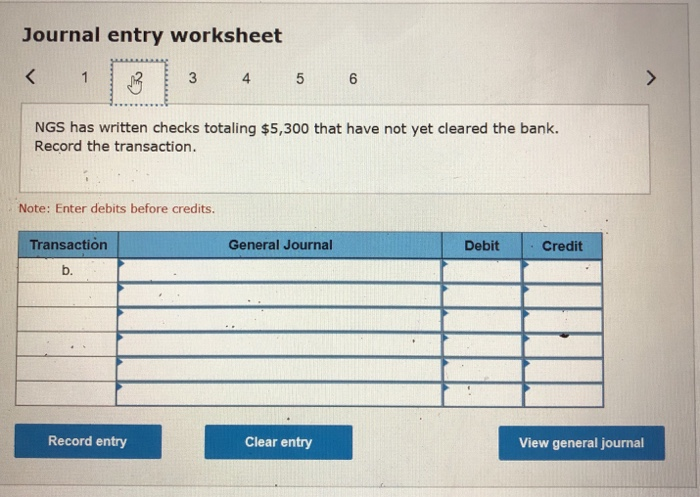

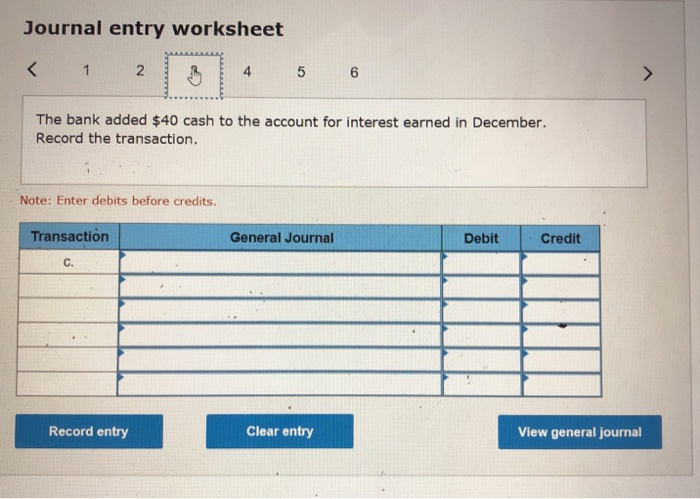

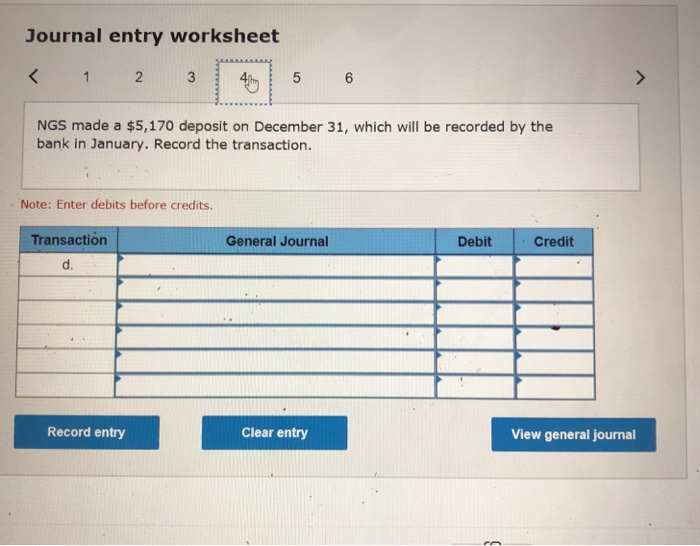

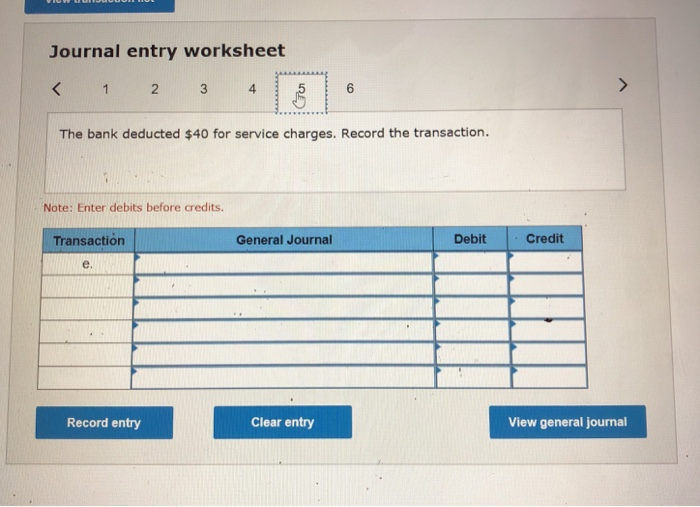

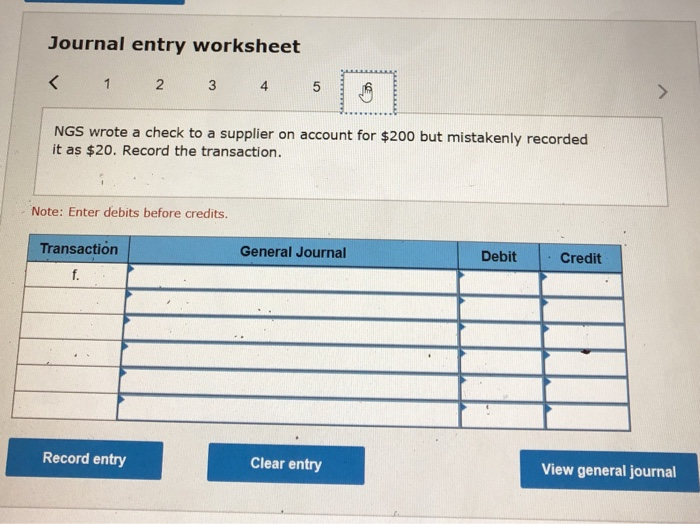

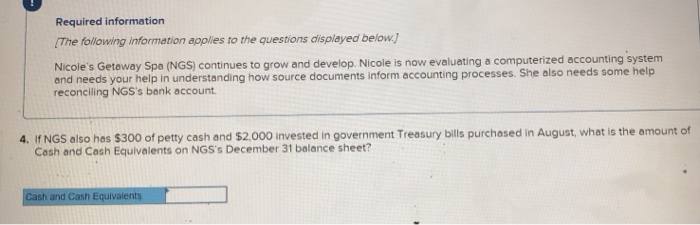

Required information The following information applies to the questions displayed below Nicole's Getaway Spa (NGS) continues to grow and develop. Nicole is now evaluating a computerized accounting system and needs your help in understanding how source documents inform accounting processes. She also needs some help reconciling NGS's bank account. Nicole has asked you to prepare a bank reconciliation for NGS. According to her records, NGS's cash balance is $7.800 at December 31, but the bank reports a balance of $7,300 a. The bank deducted $450 for an NSF check from a customer deposited on December 22 b. NGS has written checks totaling $5,300 that have not yet cleared the bank. c. The bank added $40 cash to the account for interest earned in December d. NGS made a $5,170 deposit on December 31, which will be recorded by the bank in January. e. The bank deducted $40 for service charges f. NGS wrote a check to a supplier on account for $200 but mistakenly recorded it as $20 NICOLE'S GETAWAY SPA Bank Reconciliation At December 31 Bank Statement Company's Books Ending Balance per Bank Statement Additions: Ending Balance per Cash Account Additions: 0 0. 0 Deductions: Deductions: 0 Up-to-Date Cash Balance 0 Up-to-Date Cash Balance Journal entry worksheet 2 4 The bank deducted $450 for an NSF check from a customer deposited on December 22. Record the transaction. Note: Enter debits before credits. Transaction General Journal Debit Credit a. Record entry Clear entry View general journal Journal entry worksheet 4 NGS has written checks totaling $5,300 that have not yet cleared the bank Record the transaction. Note: Enter debits before credits. Transaction General Journal Debit Credit b. Record entry Clear entry View general journal Journal entry worksheet 2 4 6 The bank added $40 cash to the account for interest earned in December. Record the transaction. Note: Enter debits before credits. Transaction General Journal Debit Credit C. Record entry Clear entry View general journal Journal entry worksheet NGS made a $5,170 deposit on December 31, which will be recorded by the bank in January. Record the transaction. Note: Enter debits before credits. Transaction General Journal Debit Credit d. Record entry Clear entry View general journal Journal entry worksheet 2 3 4 6 The bank deducted $40 for service charges. Record the transaction. Note: Enter debits before credits. Transaction General Journal Debit Credt e. Record entry Clear entry View general journal Journal entry worksheet 2 3 4 NGS wrote a check to a supplier on account for $200 but mistakenly recorded it as $20. Record the transaction. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journal Required information The following information applies to the questions displayed below Nicole's Geteway Spa (NGS) continues to grow and develop. Nicole is now evaluating a computerized accounting system and needs your help in understanding how source documents inform accounting processes. She also needs some help reconciling NGS's bank account. 4. I NGS also hes h and $2 000 invested in government Tresury bills purchased in August, what is the amount of Cash and Cash Equivalents on NGS's December 31 balance sheet? sh and