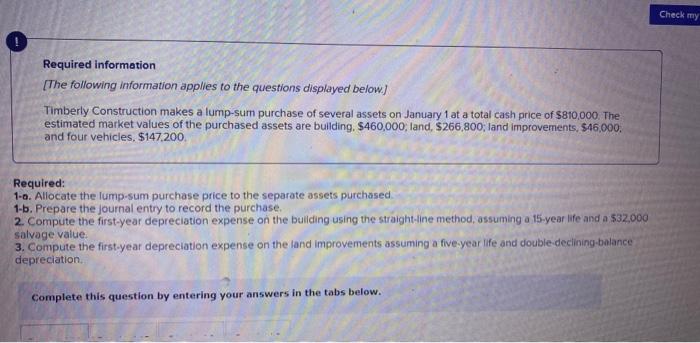

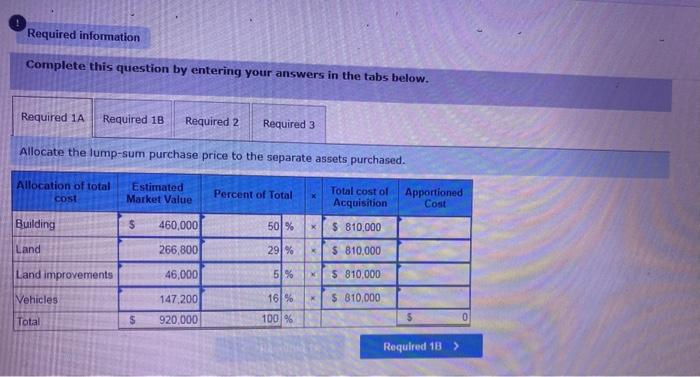

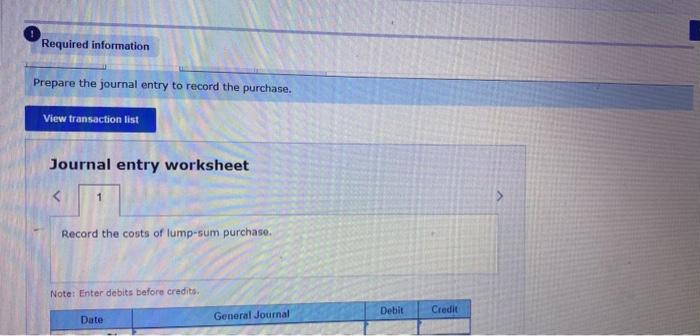

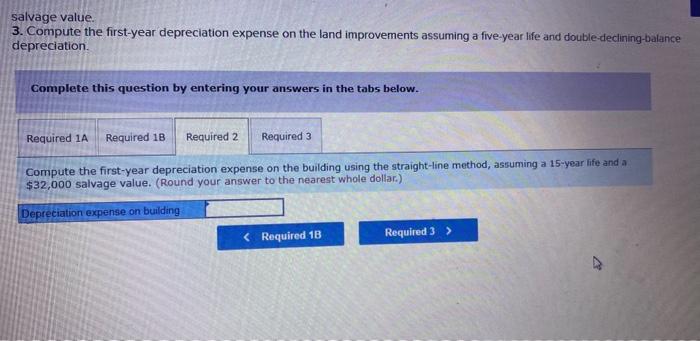

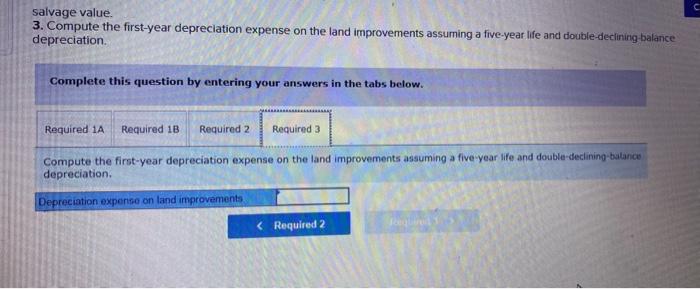

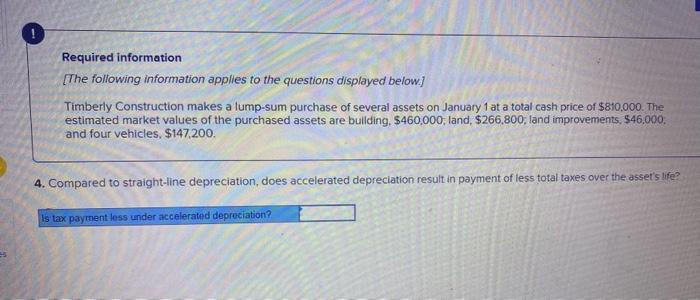

Required information [The following information applies to the questions displayed below] Timberly Construction makes a lump-sum purchase of several assets on January 1 at a total cash price of $810,000. The estimated market values of the purchased assets are building, $460,000; land, $266,800; land improvements, $46,000. and four vehicles, $147,200 Required: 1-0. Allocate the lump-sum purchase price to the separate assets purchased 1-b. Prepare the journal entry to record the purchase. 2. Compute the first-year depreciation expense on the buliding using the straight-line method, assuming a 15 -year life and a $32,000 salvage value. 3. Compute the first-year depreciation expense on the land improvements assuming a five.year life and double decining-balance depreciation. Complete this question by entering your answers in the tabs below. Complete this question by entering your answers in the tabs below. Allocate the lump-sum purchase price to the separate assets purchased. Prepare the journal entry to record the purchase. salvage value. 3. Compute the first-year depreciation expense on the land improvements assuming a five-year life and double-decining-balance depreciation. Complete this question by entering your answers in the tabs below. Compute the first-year depreciation expense on the building using the straight-line method, assuming a 15 -year life and a $32,000 salvage value. (Round your answer to the nearest whole dollar.) salvage value. 3. Compute the first-year depreciation expense on the land improvements assuming a five-year life and double-declining-balance depreciation. Complete this question by entering your answers in the tabs below. Compute the first-year depreciation expense on the land improvements assuming a five-year life and double-declining-butance depreciation. Required information [The following information applies to the questions displayed below.] Timberly Construction makes a lump-sum purchase of several assets on January 1 at a total cash price of $810,000. The estimated market values of the purchased assets are bulding, $460,000; land, $266,800; land improvements, $46.000. and four vehicles, $147,200. 4. Compared to straight-line depreciation, does accelerated depreciation result in payment of less total taxes over the asset's life