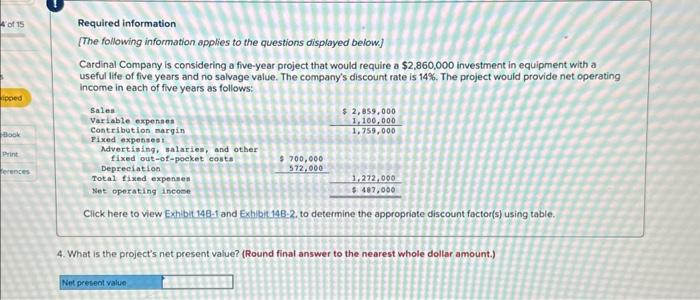

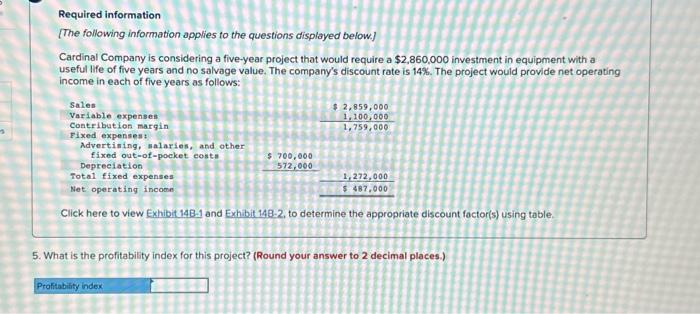

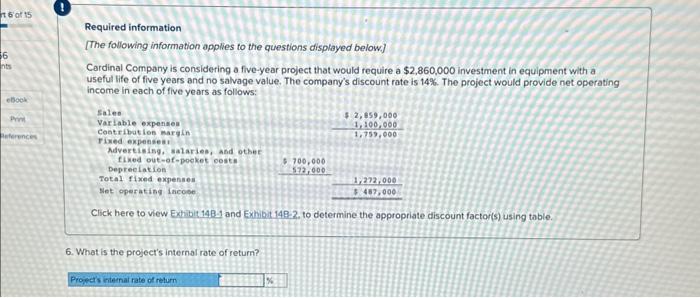

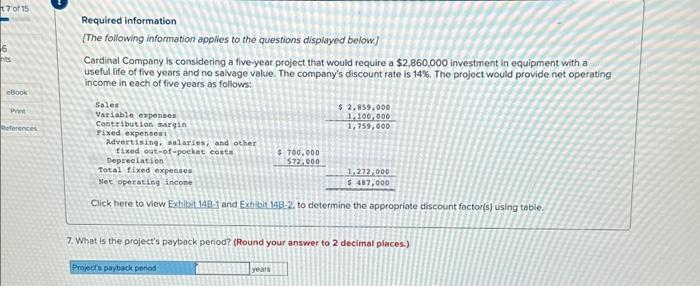

Required information [The following information applies to the questions displayed below] Cardinal Company is considering a five-year project that would require a $2,860,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 14%. The project would provide net operating income in each of five years as follows: Click here to view Exhibit 148-1 and Exhibit 148-2, to determine the appropriate discount factor(s) using table. 4. What is the project's net present value? (Round final answer to the nearest whole doltar amount.) Required information [The following information applies to the questions displayed below.] Cardinal Company is considering a five-year project that would require a $2,860,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 14%. The project would provide net operating income in each of five years as follows: Click here to view Exhibit 148-1 and Exhibit 148-2, to determine the appropriate discount foctor(s) using table. 5. What is the profitability index for this project? (Round your answer to 2 decimal places.) Required information [The following information applies to the questions displayed below] Cardinal Company is considering a five-year project that would require a $2,860,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 14%. The project would provide net operating income in each of five years as follows: Click here to view Exhibit 148-1 and Exhibit 148-2, to determine the appropriate discount factor(s) using table. 6. What is the project's internal rate of return? Required information [The following information applies to the questions displayed below) Cardinal Company is considering a five-year project that would require a $2,860,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 14%. The project would provide net operating income in each of five years as follows: Click here to Vlew Exhibit 148-1 and Exbbit 148-2, to determine the appropriate discount factor(s) using table. 7. What is the project's paybock period? (Round your answer to 2 decimal places.)