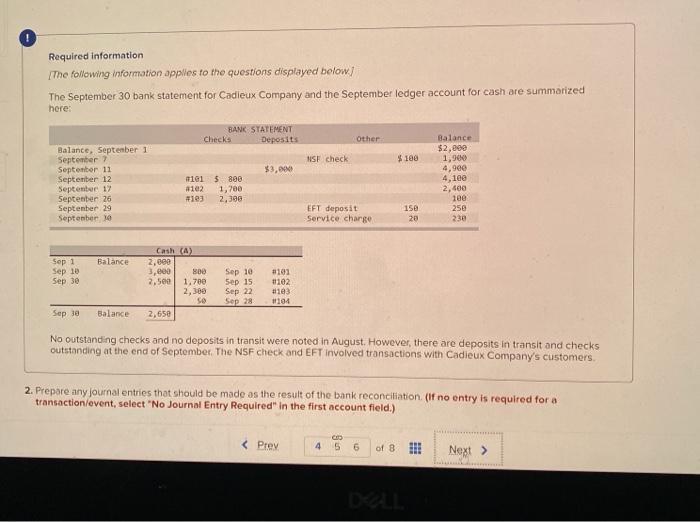

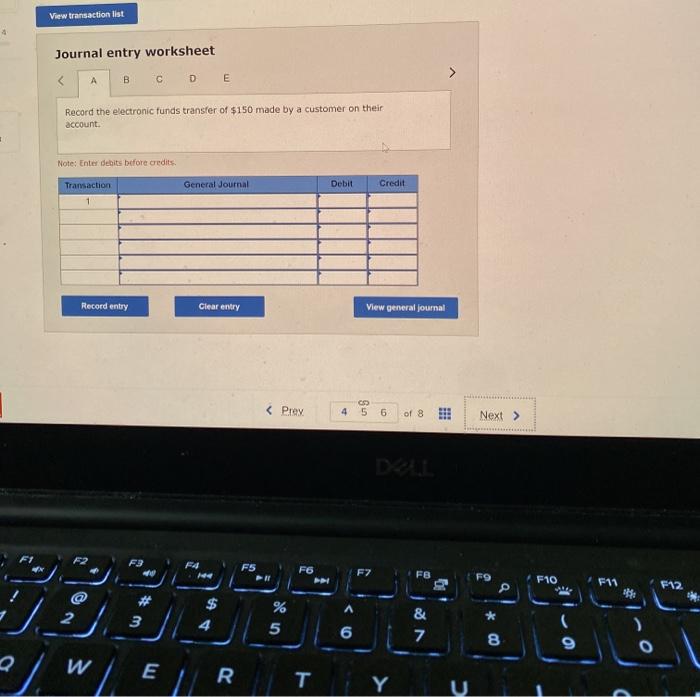

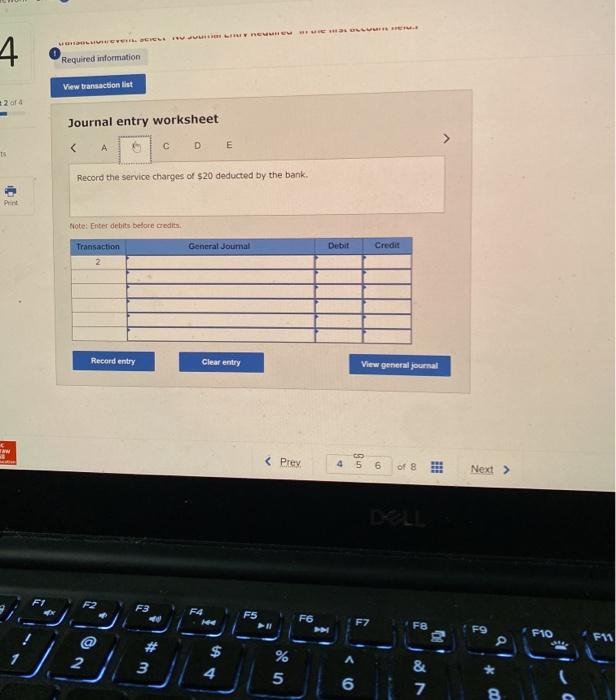

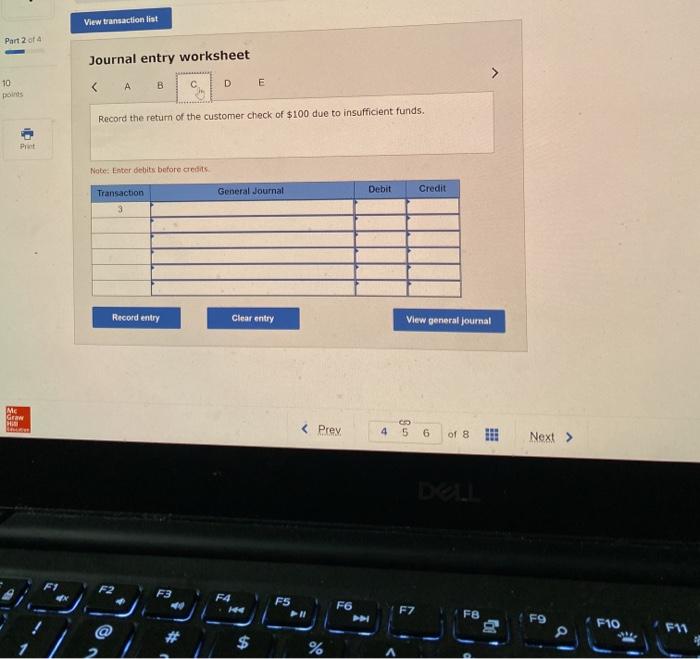

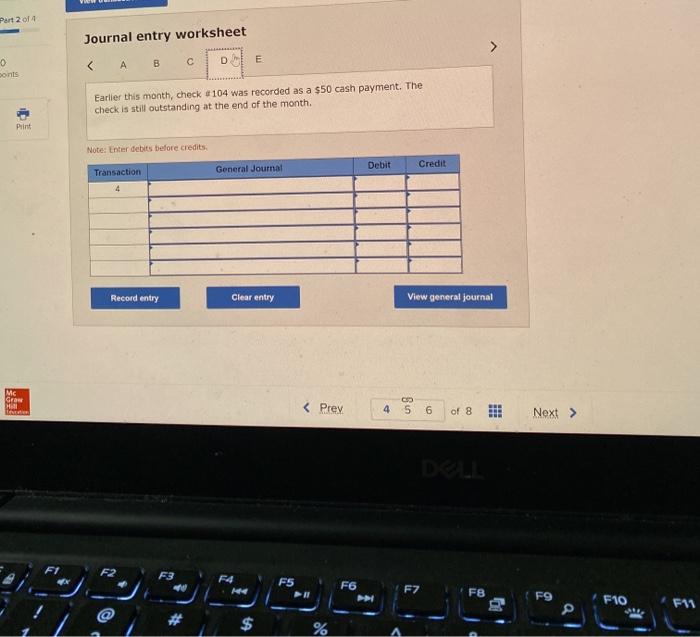

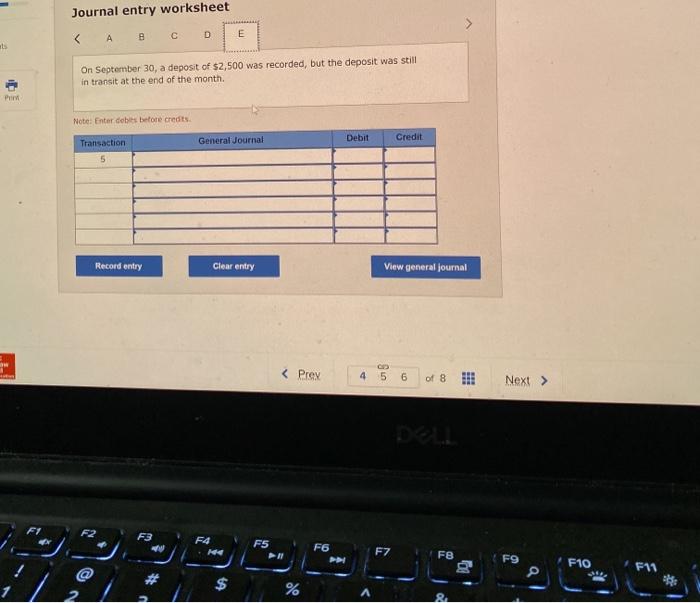

Required information The following information applies to the questions displayed below The September 30 bank statement for Cadieux Company and the September ledger account for cash are summarized here: BANK STATEMENT Checks Deposits Other NSF check $ 108 $3,00 Balance, September 1 September September 11 September 12 September 17 September 26 September 29 September 10 161 5890 102 1,700 #103 2.306 Balance $2,000 1.900 4,900 4,100 2,400 10e 250 230 15e EFT deposit Service charge 20 Balance Sep 1 Sep 10 Sep 30 Cash (A) 2,800 3,000 800 2.500 1,700 2,308 Sep 10 Sep 15 Sep 22 Sep 28 8101 #102 #103 Sep 30 Balance 2,650 No outstanding checks and no deposits in transit were noted in August. However, there are deposits in transit and checks outstanding at the end of September. The NSF check and EFT involved transactions with Cadieux Company's customers. 2. Prepare any Journal entries that should be made as the result of the bank reconciliation (If no entry is required for a transaction/event, select "No Journal Entry Required in the first account field.) View transaction list Journal entry worksheet B C D E Record the electronic funds transfer of $150 made by a customer on their account. Note: Enter debits before credits Transaction General Journal Debit Credit Record entry Clear entry View general journal F3 F4 FS F6 F7 FB FO # F10 F11 a F42. A. #3 A 2 $ 4 % 5 * & 7 6 8 2 W E R. T Y SU LE THE ELE 4 Required information View transaction list 2014 Journal entry worksheet A D E 15 Record the service charges of $20 deducted by the bank. Print Note: Enter debits before credits General Journal Debit Credit Transaction 2 Record entry Clear entry View general journal TAM FI F3 FA F5 F6 F7 FB F9 F10 a F11 2 # 3 $ 4 A % 5 6 & 7 * a View transaction list Part 2 of 4 Journal entry worksheet 10 F3 F4 FS F6 ll F7 FB F9 @ F10 $ % Part 2 of 4 Journal entry worksheet B C D E 0 onts Earlier this month, check # 104 was recorded as a $50 cash payment. The check is still outstanding at the end of the month. Paint Note: Enter debits before credits Debit Credit Transaction General Journal 4 Record entry Clear entry View general journal MC Grow FI F3 F4 F5 F6 PN F7 FB F9 F10 F41 Q @ $ % Journal entry worksheet C D E On September 30, a deposit of $2,500 was recorded, but the deposit was still in transit at the end of the month. Note: Enter debes before credits Debit General Journal Transaction Credit 5 Record entry Clear entry View general Journal FY F3 F4 A F5 F6 PO F7 FB F9 g F10 F11 $ %