Answered step by step

Verified Expert Solution

Question

1 Approved Answer

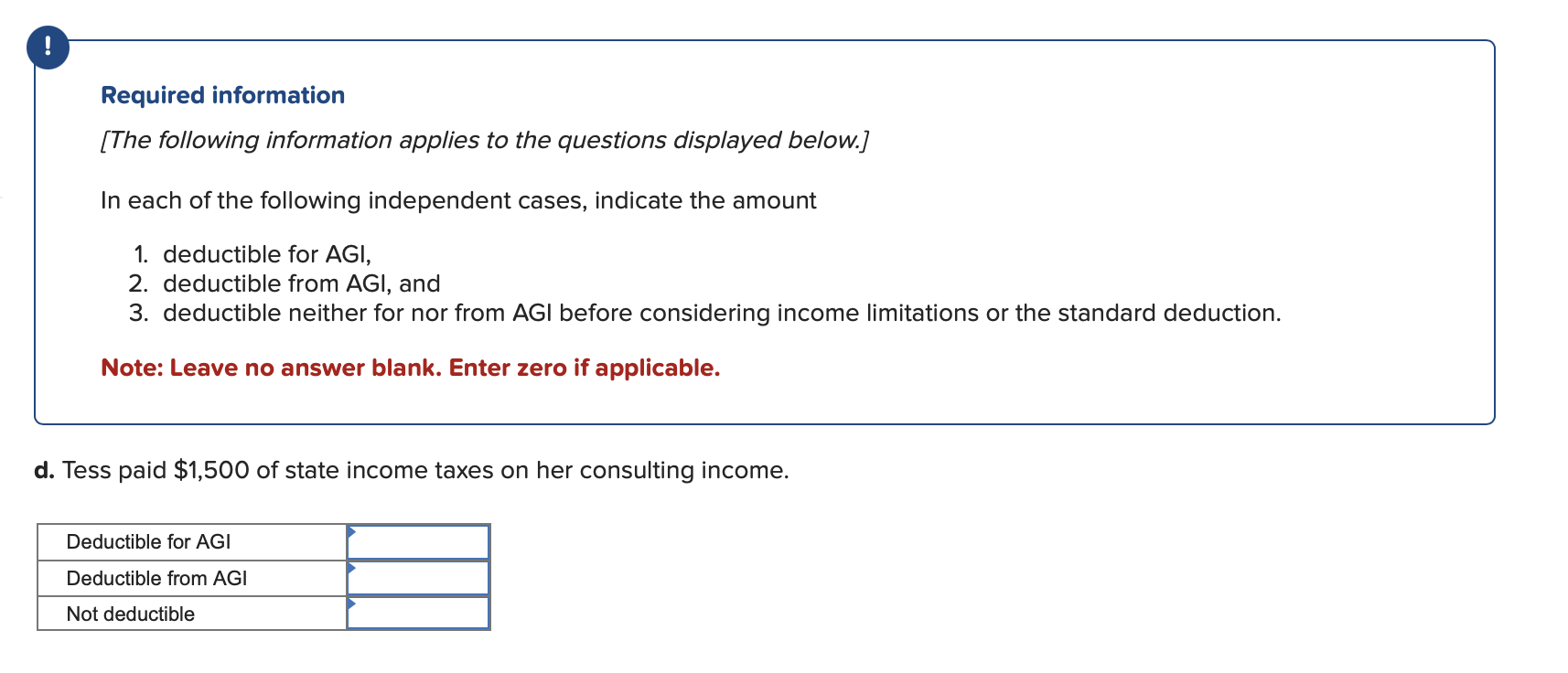

Required information [The following information applies to the questions displayed below.] In each of the following independent cases, indicate the amount 1. deductible for AGI,

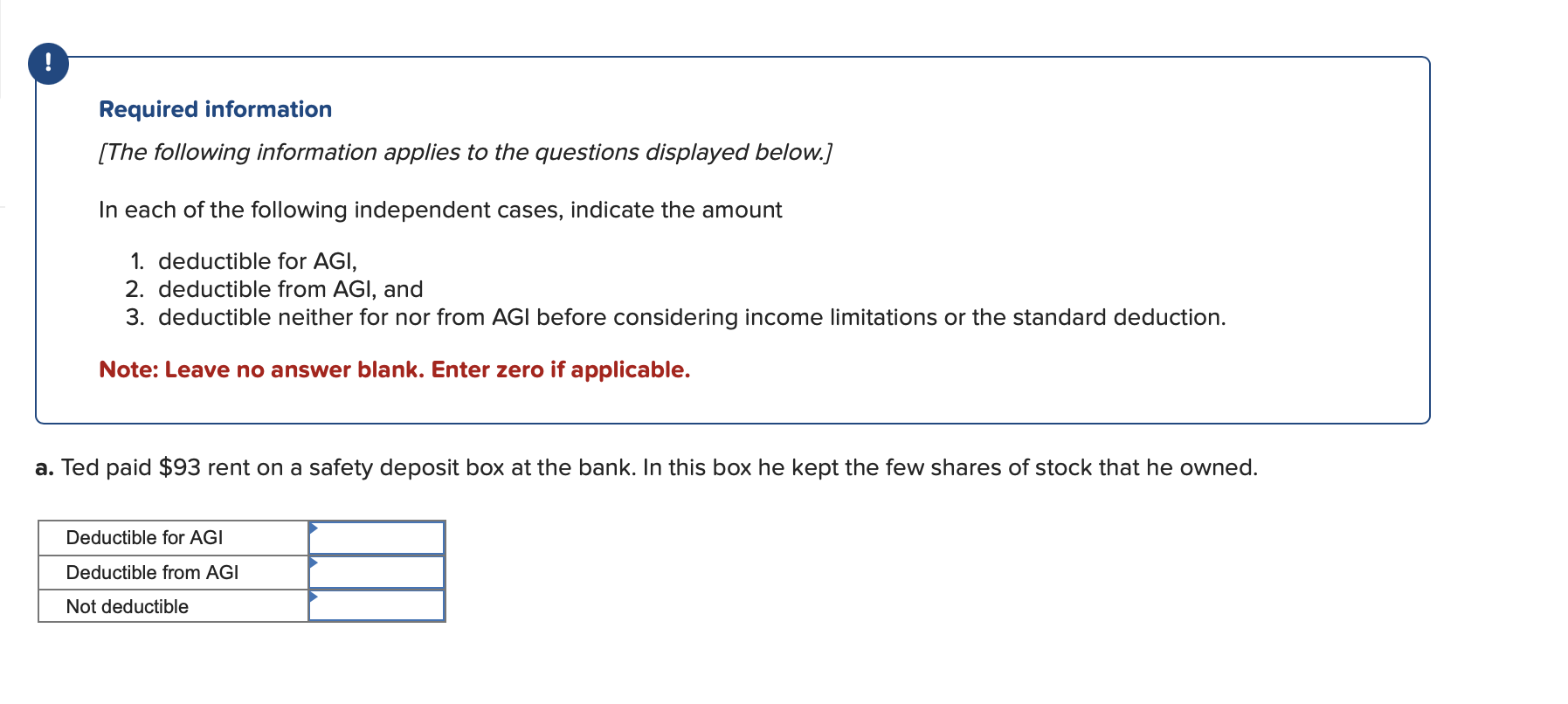

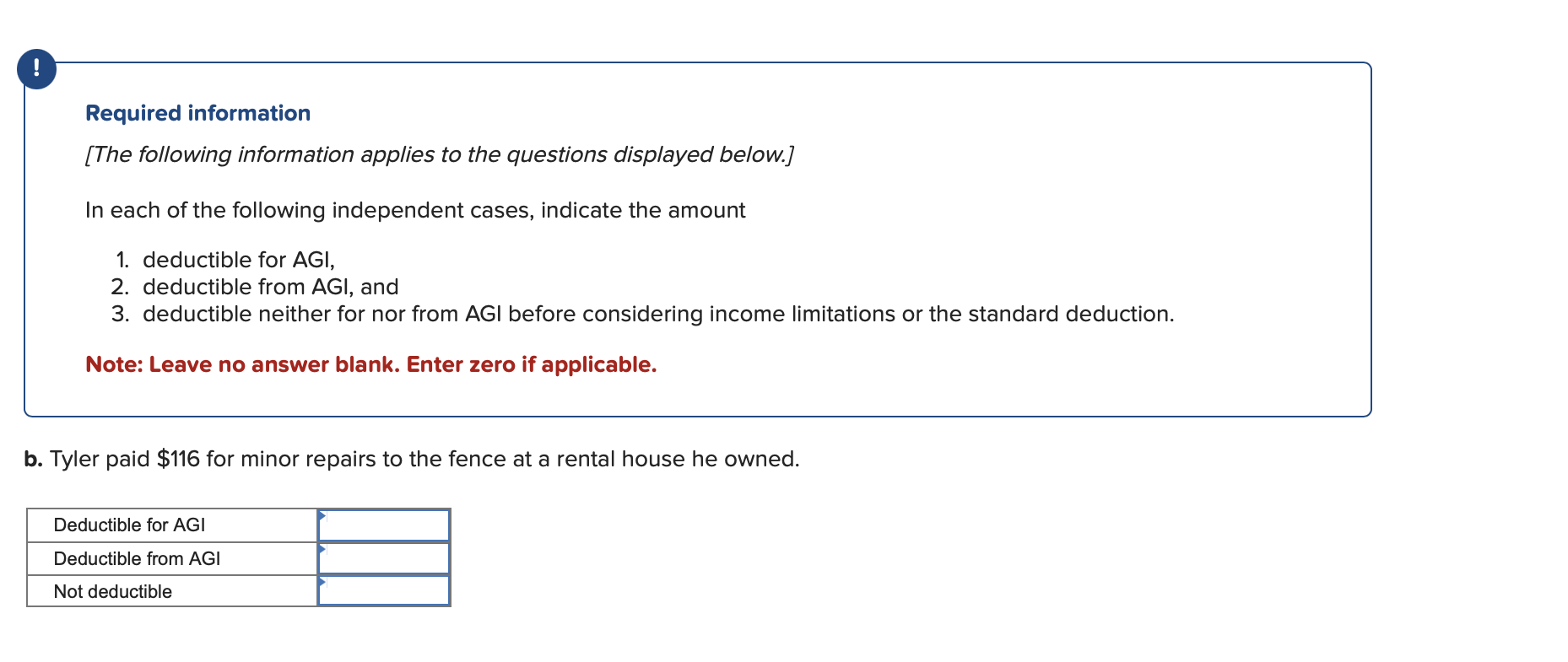

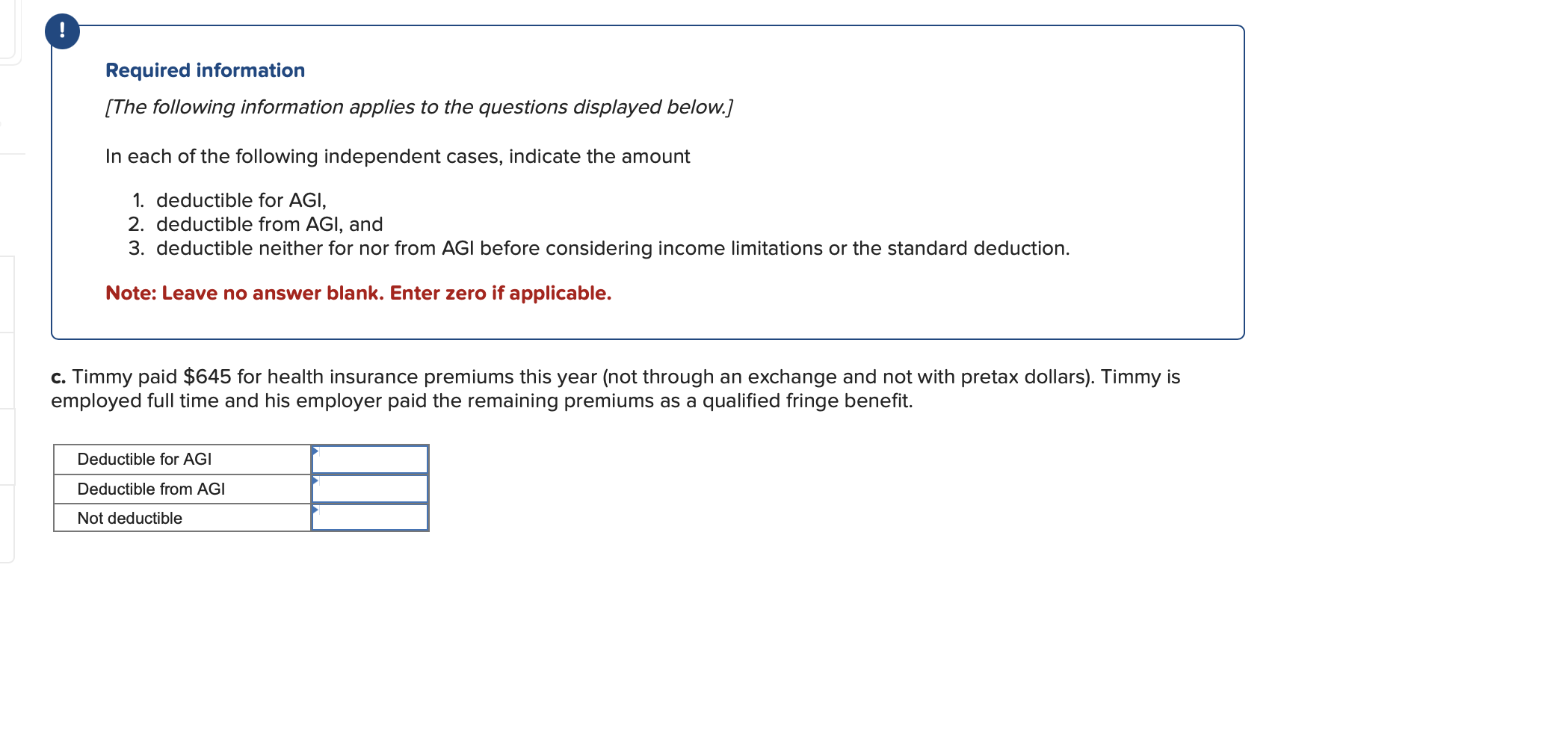

Required information [The following information applies to the questions displayed below.] In each of the following independent cases, indicate the amount 1. deductible for AGI, 2. deductible from AGI, and 3. deductible neither for nor from AGI before considering income limitations or the standard deduction. Note: Leave no answer blank. Enter zero if applicable. c. Timmy paid $645 for health insurance premiums this year (not through an exchange and not with pretax dollars). Timmy is employed full time and his employer paid the remaining premiums as a qualified fringe benefit. Required information [The following information applies to the questions displayed below.] In each of the following independent cases, indicate the amount 1. deductible for AGI, 2. deductible from AGI, and 3. deductible neither for nor from AGI before considering income limitations or the standard deduction. Note: Leave no answer blank. Enter zero if applicable. a. Ted paid $93 rent on a safety deposit box at the bank. In this box he kept the few shares of stock that he owned. Required information [The following information applies to the questions displayed below.] In each of the following independent cases, indicate the amount 1. deductible for AGI, 2. deductible from AGI, and 3. deductible neither for nor from AGI before considering income limitations or the standard deduction. Note: Leave no answer blank. Enter zero if applicable. b. Tyler paid $116 for minor repairs to the fence at a rental house he owned. Required information [The following information applies to the questions displayed below.] In each of the following independent cases, indicate the amount 1. deductible for AGI, 2. deductible from AGI, and 3. deductible neither for nor from AGI before considering income limitations or the standard deduction. Note: Leave no answer blank. Enter zero if applicable. d. Tess paid $1,500 of state income taxes on her consulting income

Required information [The following information applies to the questions displayed below.] In each of the following independent cases, indicate the amount 1. deductible for AGI, 2. deductible from AGI, and 3. deductible neither for nor from AGI before considering income limitations or the standard deduction. Note: Leave no answer blank. Enter zero if applicable. c. Timmy paid $645 for health insurance premiums this year (not through an exchange and not with pretax dollars). Timmy is employed full time and his employer paid the remaining premiums as a qualified fringe benefit. Required information [The following information applies to the questions displayed below.] In each of the following independent cases, indicate the amount 1. deductible for AGI, 2. deductible from AGI, and 3. deductible neither for nor from AGI before considering income limitations or the standard deduction. Note: Leave no answer blank. Enter zero if applicable. a. Ted paid $93 rent on a safety deposit box at the bank. In this box he kept the few shares of stock that he owned. Required information [The following information applies to the questions displayed below.] In each of the following independent cases, indicate the amount 1. deductible for AGI, 2. deductible from AGI, and 3. deductible neither for nor from AGI before considering income limitations or the standard deduction. Note: Leave no answer blank. Enter zero if applicable. b. Tyler paid $116 for minor repairs to the fence at a rental house he owned. Required information [The following information applies to the questions displayed below.] In each of the following independent cases, indicate the amount 1. deductible for AGI, 2. deductible from AGI, and 3. deductible neither for nor from AGI before considering income limitations or the standard deduction. Note: Leave no answer blank. Enter zero if applicable. d. Tess paid $1,500 of state income taxes on her consulting income Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started