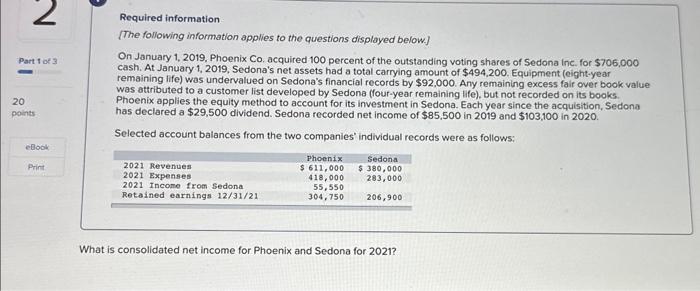

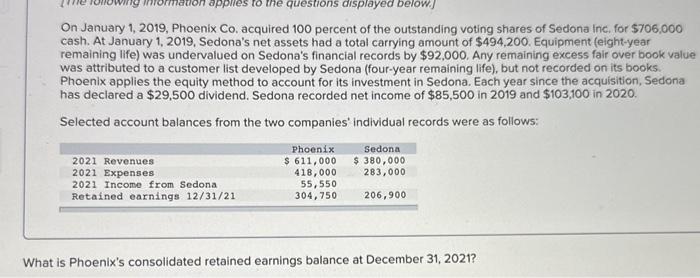

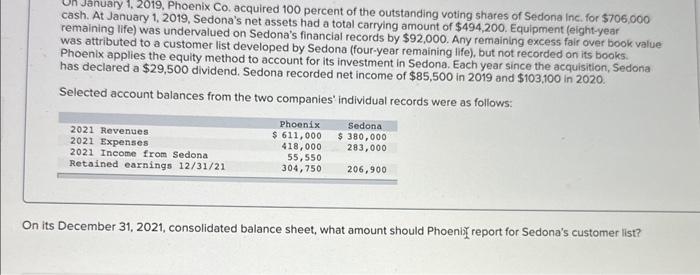

Required information [The following information applies to the questions displayed below] On January 1, 2019, Phoenix Co, acquired 100 percent of the outstanding voting shares of Sedona inc. for $706,000 cash. At January 1, 2019, Sedona's net assets had a total carrying amount of $494,200. Equipment (eight-year remaining life) was undervalued on Sedona's financial records by $92,000. Any remaining excess fair over book value was attributed to a customer list developed by Sedona (four-year remaining life). but not recorded on its books. Phoenix applies the equity method to account for its investment in Sedona. Each year since the acquisition, Sedona has declared a $29,500 dividend. Sedona recorded net income of $85,500 in 2019 and $103,100 in 2020. Selected account balances from the two companies' individual records were as follows: What is consolidated net income for Phoenix and Sedona for 2021? On January 1, 2019, Phoenix Co, acquired 100 percent of the outstanding voting shares of Sedona Inc, for $706,000 cash. At January 1, 2019, Sedona's net assets had a total carrying amount of $494,200. Equipment (eight-year remaining life) was undervalued on Sedona's financial records by $92,000. Any remaining excess fair over book value was attributed to a customer list developed by Sedona (four-year remaining life), but not recorded on its books. Phoenix applies the equity method to account for its investment in Sedona. Each year since the acquisition, Sedona has declared a $29,500 dividend. Sedona recorded net income of $85,500 in 2019 and $103,100 in 2020. Selected account balances from the two companies' individual records were as follows: What is Phoenix's consolidated retained earnings balance at December 31,2021? Cash. At January 1, 2019, Phoenix Co, acquired 100 percent of the outstanding voting shares of Sedona Inc. for $706,000 Cash. At January 1, 2019, Sedona's net assets had a total carrying amount of $494,200. Equipment (eight-year remaining life) was undervalued on Sedona's financial records by $92,000. Any remaining excess faig over book value) was attributed to a customer list developed by Sedona (four-year remaining life), but not recorded on its books. Phoenix applies the equity method to account for its investment in Sedona. Each year since the acquisition, Sedona has declared a $29,500 dividend. Sedona recorded net income of $85,500 in 2019 and $103,100 in 2020 . Selected account balances from the two companies' individual records were as follows: On its December 31, 2021, consolidated balance sheet, what amount should Phoenirg report for Sedona's customer list