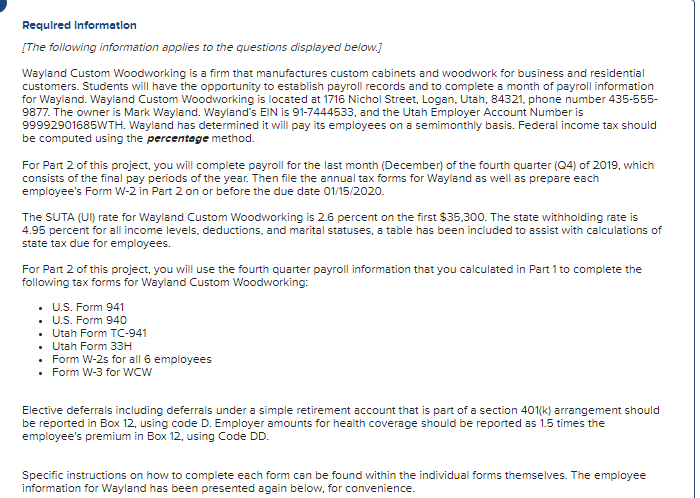

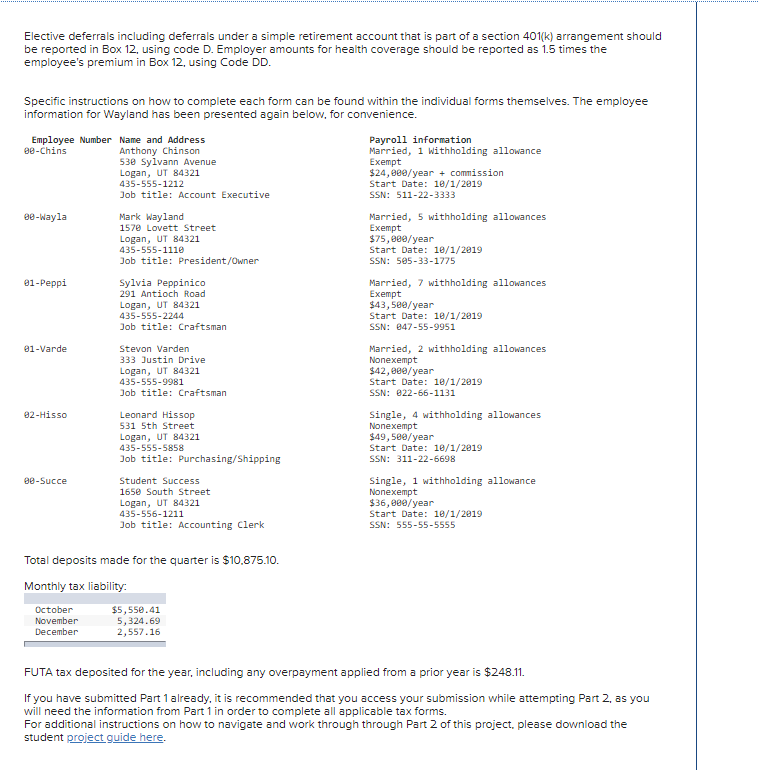

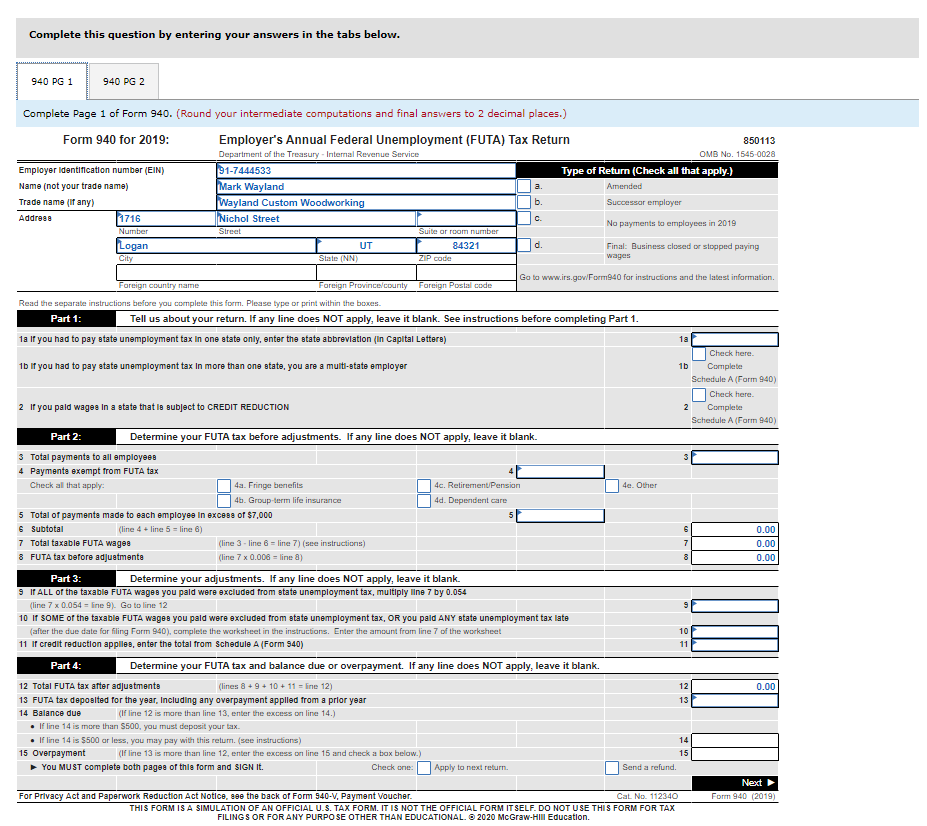

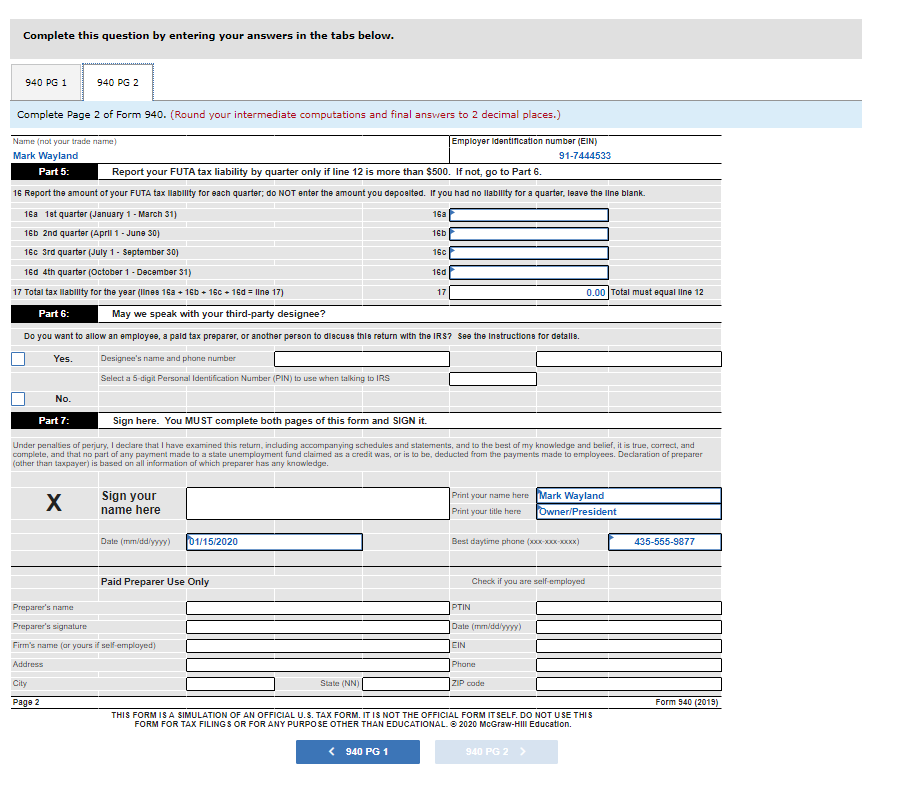

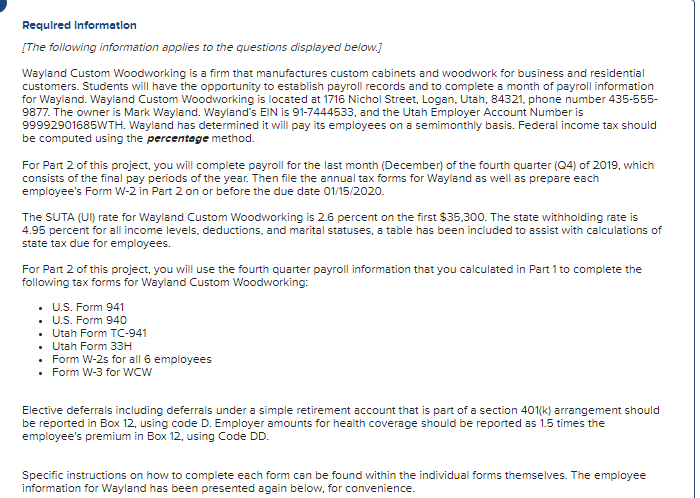

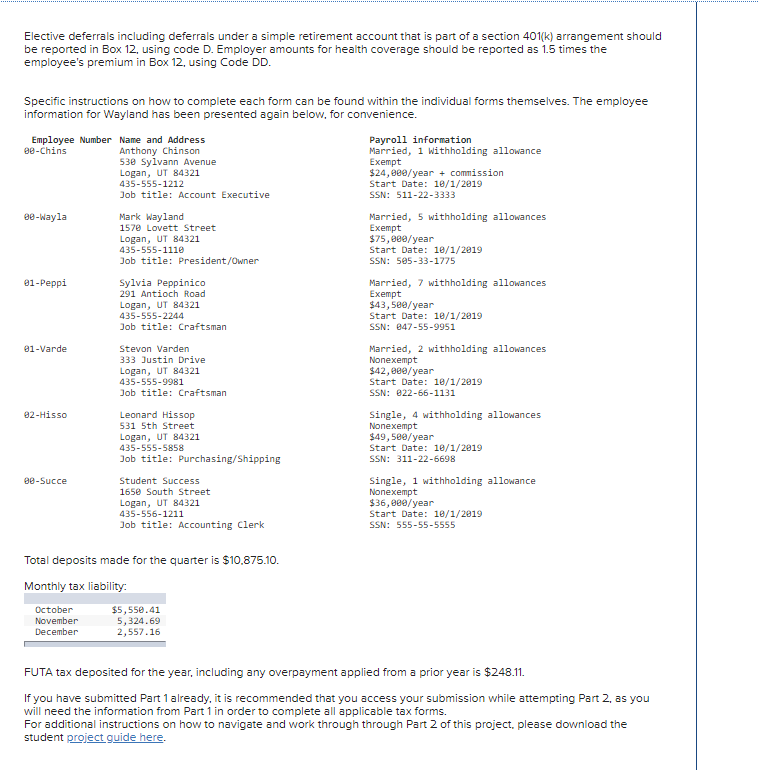

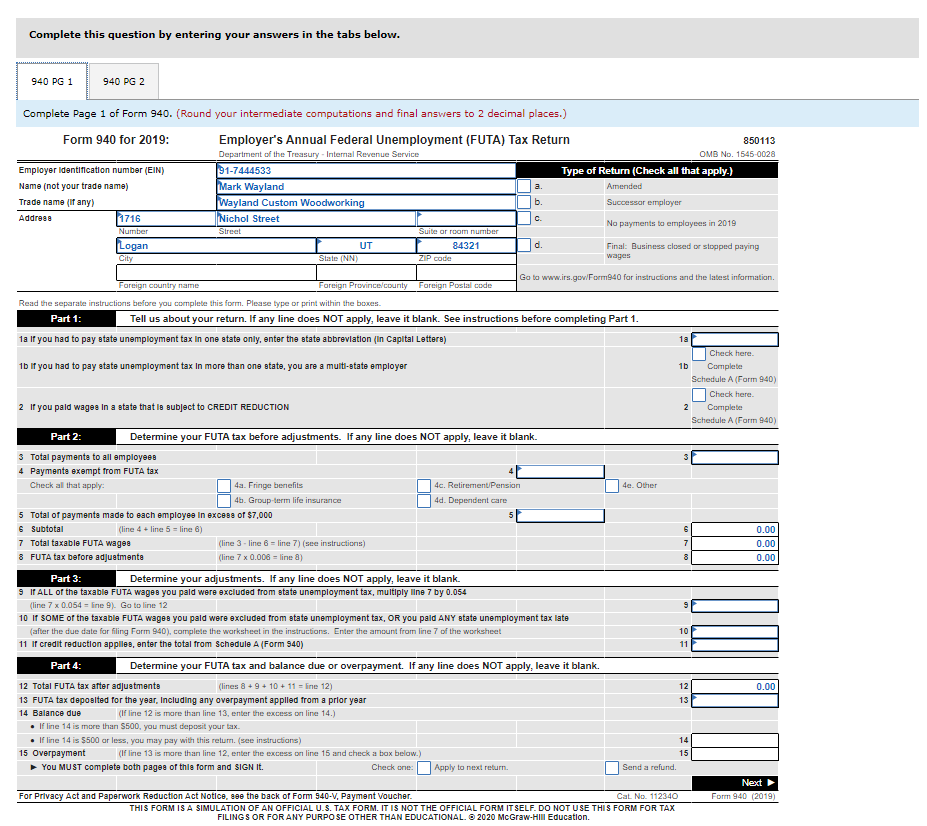

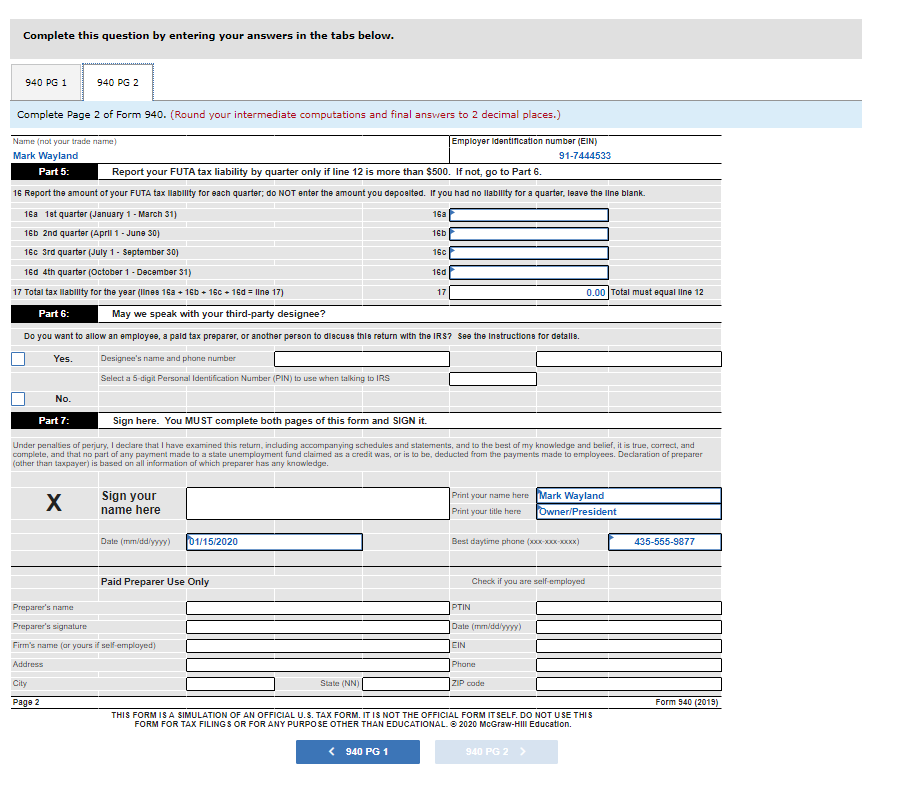

Required Information [The following information applies to the questions displayed below.) Wayland Custom Woodworking is a firm that manufactures custom cabinets and woodwork for business and residential customers. Students will have the opportunity to establish payroll records and to complete a month of payroll information for Wayland. Wayland Custom Woodworking is located at 1716 Nichol Street, Logan. Utah, 84321. phone number 435-555- 9877. The owner is Mark Wayland. Wayland's EIN is 91-7444533, and the Utah Employer Account Number is 99992901685WTH. Wayland has determined it will pay its employees on a semimonthly basis. Federal income tax should be computed using the percentage method. For Part 2 of this project, you will complete payroll for the last month (December) of the fourth quarter (Q4) of 2019, which consists of the final pay periods of the year. Then file the annual tax forms for Wayland as well as prepare each employee's Form W-2 in Part 2 on or before the due date 01/15/2020. The SUTA (UI) rate for Wayland Custom Woodworking is 2.6 percent on the first $35.300. The state withholding rate is 4.95 percent for all income levels, deductions, and marital statuses, a table has been included to assist with calculations of state tax due for employees. For Part 2 of this project, you will use the fourth quarter payroll information that you calculated in Part 1 to complete the following tax forms for Wayland Custom Woodworking: U.S. Form 941 U.S. Form 940 Utah Form TC-941 Utah Form 33H Form W-2s for all 6 employees Form W-3 for WCW Elective deferrals including deferrals under a simple retirement account that is part of a section 401(k) arrangement should be reported in Box 12, using code D. Employer amounts for health coverage should be reported as 1.5 times the employee's premium in Box 12, using Code DD. Specific instructions on how to complete each form can be found within the individual forms themselves. The employee information for Wayland has been presented again below, for convenience. Elective deferrals including deferrals under a simple retirement account that is part of a section 401(k) arrangement should be reported in Box 12, using code D. Employer amounts for health coverage should be reported as 1.5 times the employee's premium in Box 12, using Code DD. Specific instructions on how to complete each form can be found within the individual forms themselves. The employee information for Wayland has been presented again below, for convenience. Employee Number Name and Address Payroll information ee-Chins Anthony Chinson Married, 1 Withholding allowance 530 Sylvann Avenue Exempt Logan, UT 84321 $24,880/year + commission 435-555-1212 Start Date: 10/1/2019 Job title: Account Executive SSN: 511-22-3333 ee-Wayla Mark Wayland 1570 Lovett Street Logan, UT 84321 435-555-1110 Job title: President/Owner Married, 5 withholding allowances Exempt $75, eee/year Start Date: 10/1/2019 SSN: 505-33-1775 Married, 7 withholding allowances Exempt $43,500/year Start Date: 10/1/2019 SSN: 847-55-9951 81-Peppi Sylvia Peppinico 291 Antioch Road Logan, UT 84321 435-555-2244 Job title: Craftsman 01-Varde Stevon Varden 333 Justin Drive Logan, UT 84321 435-555-9981 Job title: Craftsman Married, 2 withholding allowances Nonexempt $42,980/year Start Date: 10/1/2019 SSN: 022-66-1131 82-Hisso Leonard Hissop 531 5th Street Logan, UT 84321 435-555-5858 Job title: Purchasing/Shipping Single, 4 withholding allowances Nonexempt $49,580/year Start Date: 10/1/2019 SSN: 311-22-6698 Single, 1 withholding allowance Nonexempt $36,800/year Start Date: 10/1/2019 SSN: 555-55-5555 Be-Succe Student Success 1650 South Street Logan, UT 84321 435-556-1211 Job title: Accounting Clerk Total deposits made for the quarter is $10.875.10. Monthly tax liability: October November December $5,550.41 5,324.69 2,557.16 FUTA tax deposited for the year, including any overpayment applied from a prior year is $248.11. If you have submitted Part 1 already, it is recommended that you access your submission while attempting Part 2, as you will need the information from Part 1 in order to complete all applicable tax forms. For additional instructions on how to navigate and work through through Part 2 of this project, please download the student project guide here. Complete this question by entering your answers in the tabs below. 940 PG 1 940 PG 2 Complete Page 1 of Form 940. (Round your intermediate computations and final answers to 2 decimal places.) Form 940 for 2019: Employer's Annual Federal Unemployment (FUTA) Tax Return 850113 Department of the Treasury - Internal Revenue Service OMB No. 1545-0028 Employer identification number (EIN) 91-7444533 Type of Return (Check all that apply.) Name (not your trade name) Mark Wayland Amended Trade name (if any) Wayland Custom Woodworking b. Successor employer Addresa 1716 Nichol Street No payments to employees in 2019 Nun Street Suite or room umber Logan UT 84321 Final: Business closed or stopped paying City State (NN) ZIP code wages d. 1a Go to www.irs.gov/Form940 for instructions and the latest information. Foreign country name Foreign Province/county Foreign Postal code Read the separate instructions before you complete this form. Please type or print within the boxes Part 1: Tell us about your return. If any line does NOT apply, leave it blank. See instructions before completing Part 1. 1a If you had to pay state unemployment tax in one state only, enter the state abbreviation (in Capital Letters) Check here 1b If you had to pay state unemployment tax In more than one state, you are a multi-state employer 1b Complete Schedule A(Form 940) Check here 2 If you paid wages in a state that is subject to CREDIT REDUCTION 2 Complete Schedule A (Form 940) Part 2: Determine your FUTA tax before adjustments. If any line does NOT apply, leave it blank. 3 Total payments to all omployees 4 Payments exempt from FUTA tax Check all that apply: 4a. Fringe benefits 40. Retirement/Pension 4e. Other 4b. Group-term life insurance 4d. Dependent care 5 Total of payments made to each employee in excess of $7,000 6 Subtotal (line 4 + line 5 = line 6) 0.00 7 Total taxable FUTA wages (line 3 - line 6 = line 7) (see instructions) 7 0.00 3 FUTA tax before adjustments (line 7 x 0.008 = line ) 0.00 6 09 10 11 Part 3: Determine your adjustments. If any line does NOT apply, leave it blank. 9 IT ALL of the taxable FUTA wages you paid were excluded from state unemployment tax, multiply line 7 by 0.054 (line 7 x 0.054 = line 9). Go to line 12 10 IF SOME of the taxable FUTA wages you paid were excluded from state unemployment tax, OR you pald ANY state unemployment tax late (after the due date for filing Form 940), complete the worksheet in the instructions. Enter the amount from line 7 of the worksheet 11 If credit reduction applies, enter the total from Schedule A (Form 940) Part 4: Determine your FUTA tax and balance due or overpayment. If any line does NOT apply, leave it blank. 12 Total FUTA tax after adjustments (lines 8 + 9 + 10 + 11 = line 12) 13 FUTA tax deposited for the year. Including any overpayment applied from a prior year 14 Balance due (If line 12 is more than line 13, enter the excess on line 14.) If line 14 is more than $500, you must deposit your tax. If line 14 is $500 or less, you may pay with this return. (see instructions) 15 Overpayment (If line 13 is more than line 12, enter the excess on line 15 and check a box below.) You MUST complete both pages of this form and SIGN It. Check one: Apply to next return 0.00 12 13 14 15 Send a refund. Next Form 940 (2019) For Privacy Act and Paperwork Reduction Act Notice, see the back of Form 940-V, Payment Voucher. Cat No. 112340 THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. 2020 McGraw-Hill Education. Complete this question by entering your answers in the tabs below. 940 PG 1 940 PG 2 Name (not your trade name 16a 16b 16c Complete Page 2 of Form 940. (Round your intermediate computations and final answers to 2 decimal places.) Employer identification number (EIN) Mark Wayland 91-7444533 Part 5: Report your FUTA tax liability by quarter only if line 12 is more than $500. If not, go to Part 6 16 Report the amount of your FUTA tax lability for each quarter; do NOT enter the amount you deposited. If you had no lability for a quarter, leave the line blank. 16a 1st quarter (January 1 - March 31) 16b 2nd quarter (April 1 - June 30) 16C 3rd quarter (July 1 - September 30) 16d 4th quarter (October 1 - December 31) 17 Total tax liability for the year (line 16a + 160 + 16C + 16 = line 17) 0.00 Total must equal line 12 Part 6 May we speak with your third-party designee? Do you want to allow an employee, a paid tax preparer, or another person to discuss the return with the IRS? See the Instructions for detalle. Yes. Designee's name and phone number Select a 5-digit Personal Identification Number (PIN) to use when talking to IRS No. Sign here. You MUST complete both pages of this form and SIGN it. 160 17 Part 7: Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete, and that no part of any payment made to a state unemployment fund claimed as a credit was, or is to be deducted from the payments made to employees. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. Sign your name here Print your name here Mark Wayland Print your title here Owner/President Date (mm/ddlyyyy) 01/15/2020 Best daytime phone (XXXXXXXXX) 435-555-9877 Paid Preparer Use Only Check if you are self-employed Preparer's name PTIN Preparer's signature Date (muiddlyyyy) Firm's name (ar yours if self employed) EIN Address Phone City State (NN) ZIP code Page 2 Form 940 (2019) THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM IT SELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL 2020 McGraw-Hill Education.