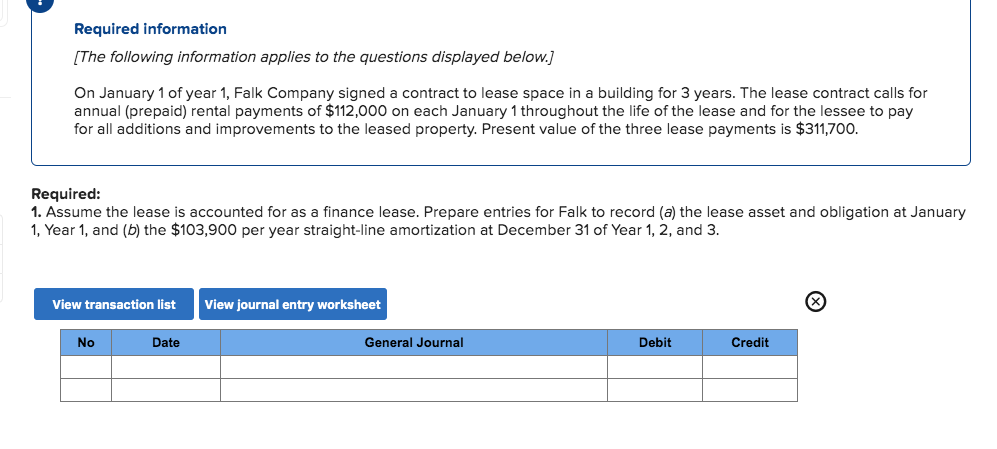

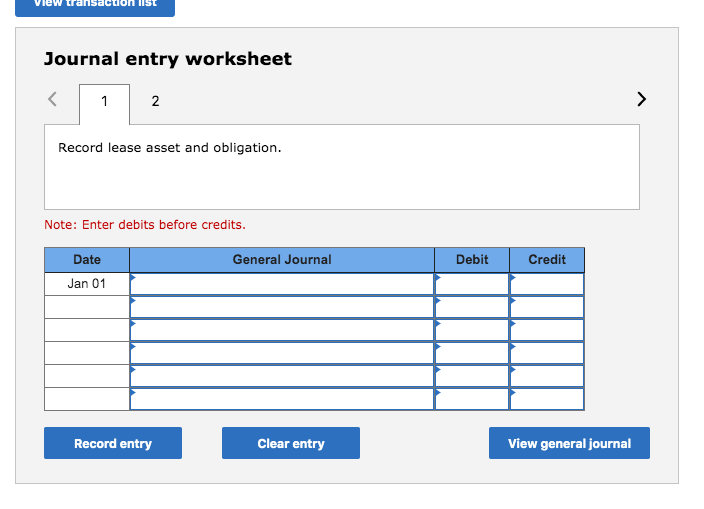

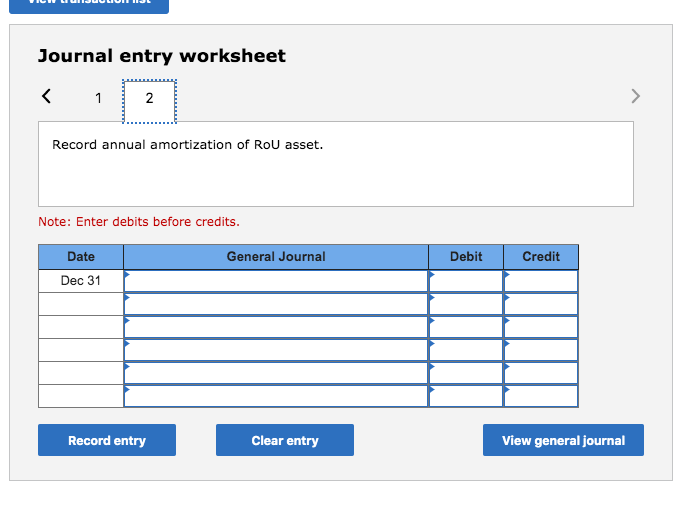

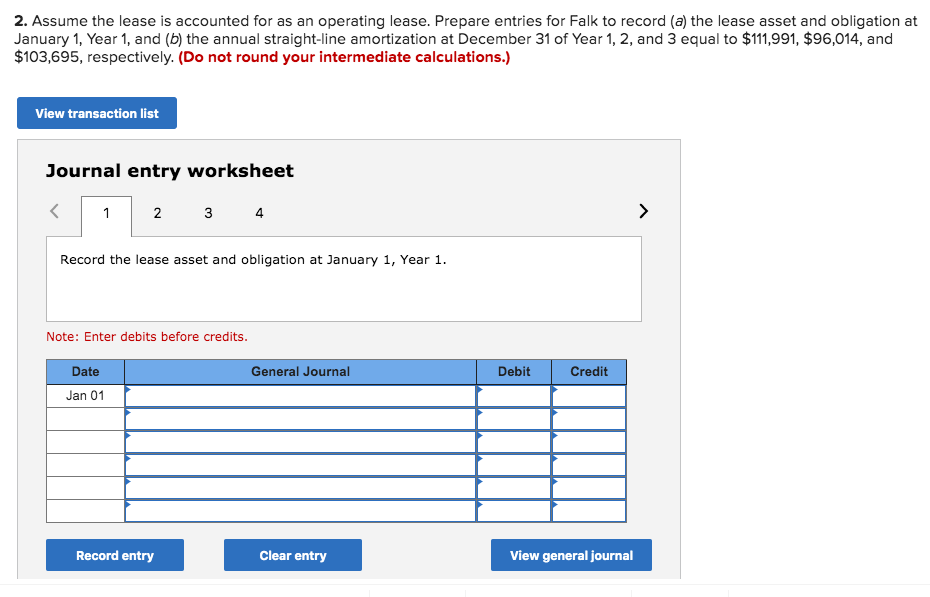

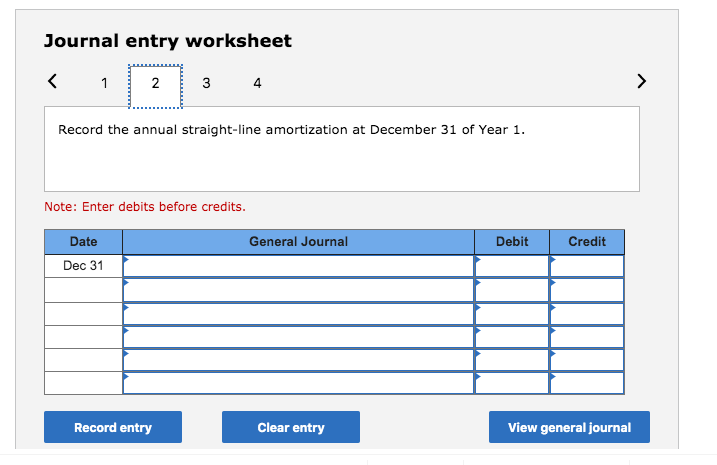

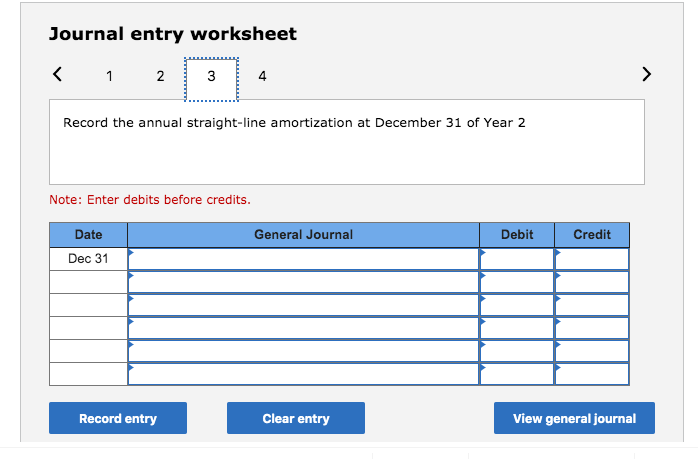

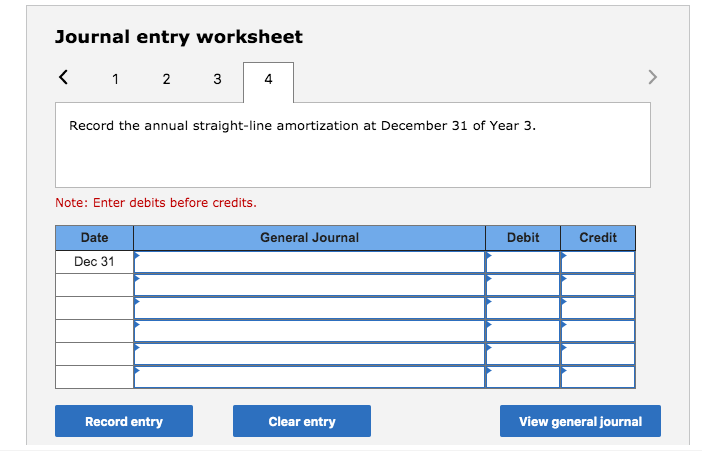

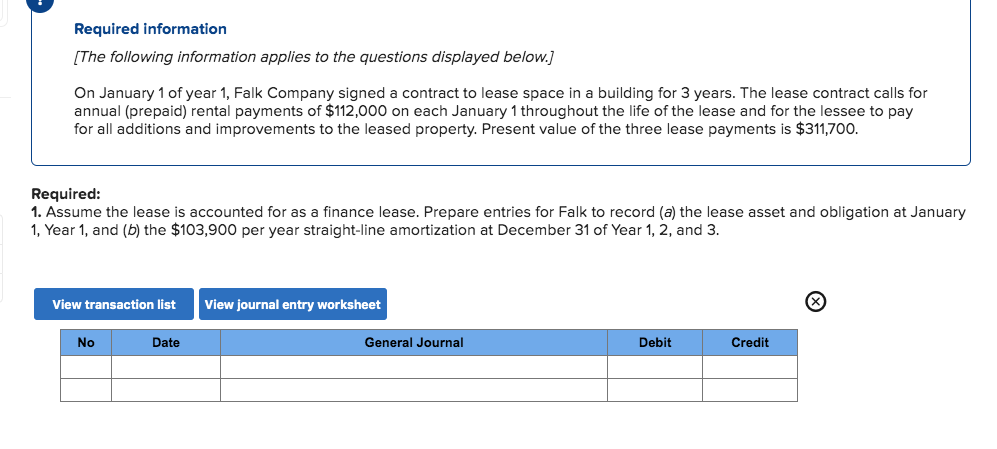

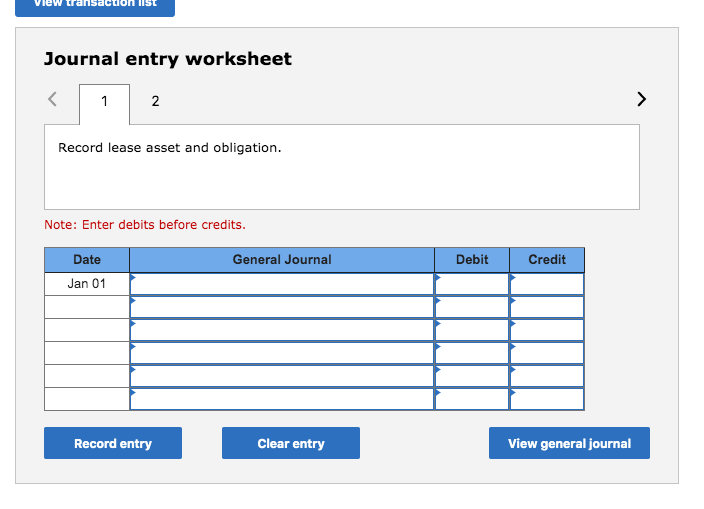

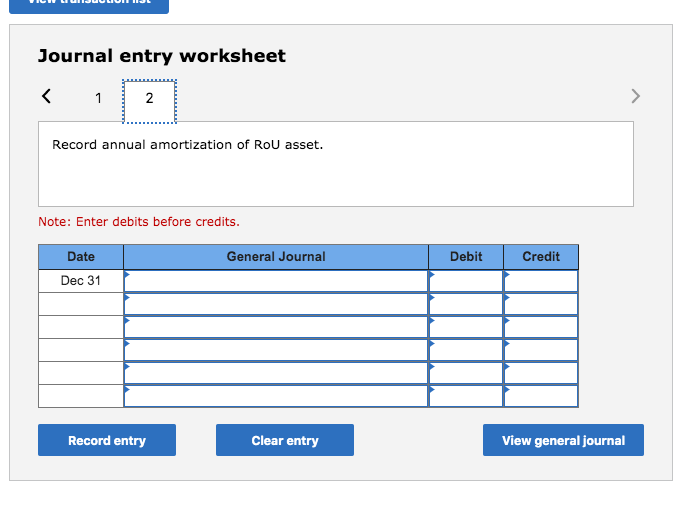

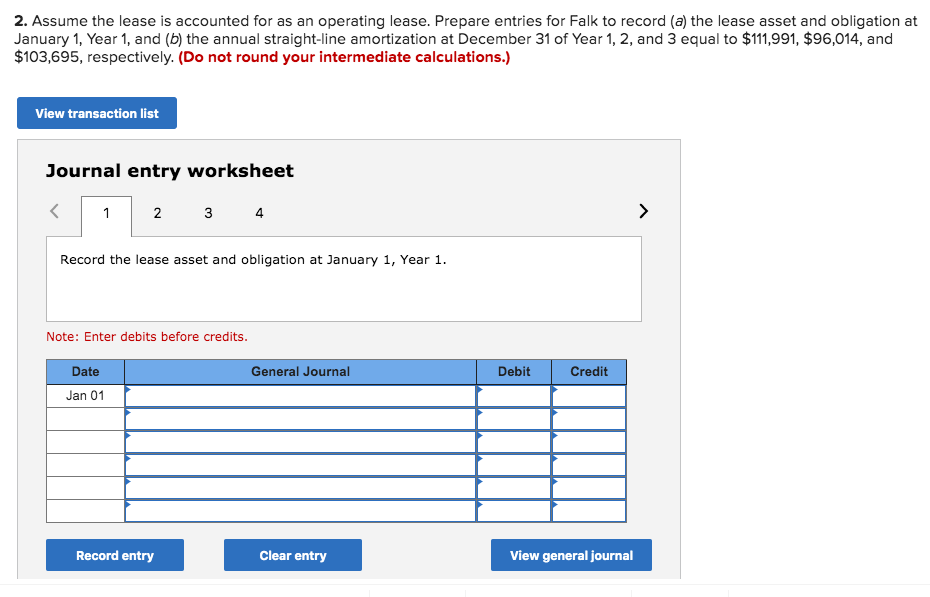

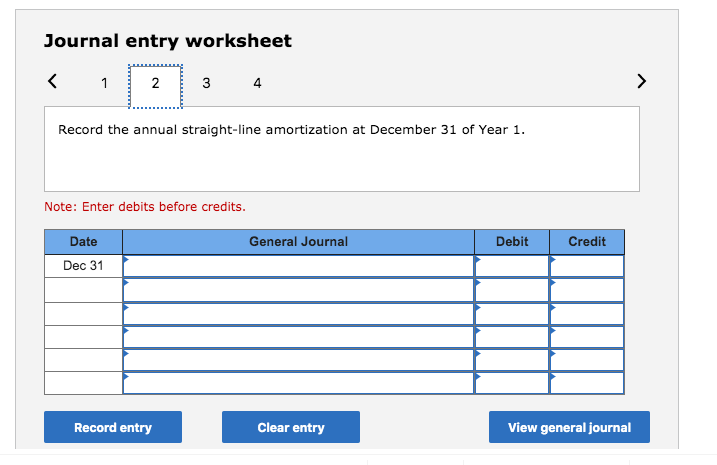

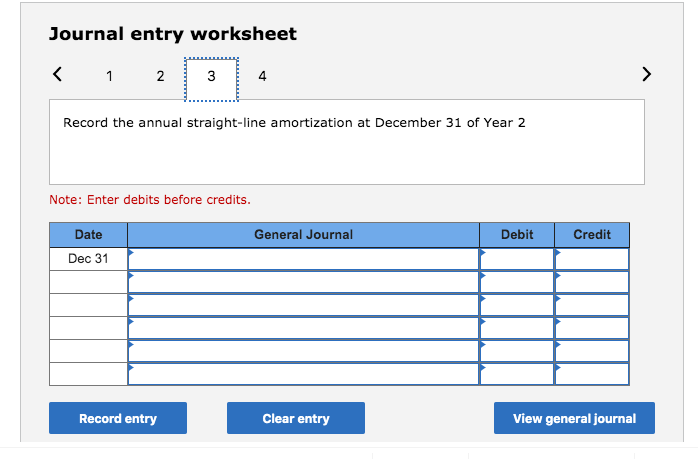

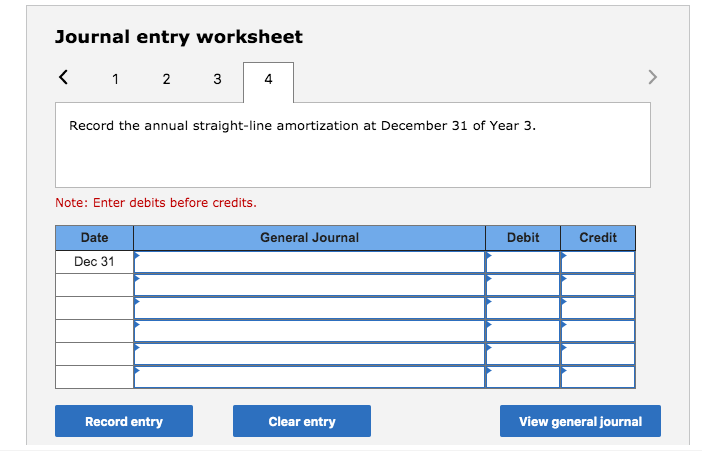

Required information The following information applies to the questions displayed below. On January 1 of year 1, Falk Company signed a contract to lease space in a building for 3 years. The lease contract calls for annual (prepaid) rental payments of $112,000 on each January 1 throughout the life of the lease and for the lessee to pay for all additions and improvements to the leased property. Present value of the three lease payments is $311,700. Required: 1. Assume the lease is accounted for as a finance lease. Prepare entries for Falk to record (a) the lease asset and obligation at January 1, Year 1, and (b) the $103,900 per year straight-line amortization at December 31 of Year 1, 2, and 3. View transaction list View journal entry worksheet No Date General Journal Debit Credit Journal entry worksheet 2 Record lease asset and obligation. Note: Enter debits before credits. Date General Journal Debit Credit Jan 01 Clear entry View general journal Record entry Journal entry worksheet 2 Record annual amortization of RoU asset. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31 Record entry Clear entry View general journal 2. Assume the lease is accounted for as an operating lease. Prepare entries for Falk to record (a) the lease asset and obligation at January 1, Year 1, and (b) the annual straight-line amortization at December 31 of Year 1, 2, and 3 equal to $111,991, $96,014, and $103,695, respectively. (Do not round your intermediate calculations.) View transaction list Journal entry worksheet 4 Record the lease asset and obligation at January 1, Year 1. Note: Enter debits before credits. Credit Date General Journal Debit Jan 01 View general journal Record entry Clear entry Journal entry worksheet 4 Record the annual straight-line amortization at December 31 of Year 1. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31 View general journal Record entry Clear entry Journal entry worksheet 4 Record the annual straight-line amortization at December 31 of Year2 Note: Enter debits before credits. Date General Journal Debit Credit Dec 31 Record entry Clear entry View general journal Journal entry worksheet 4 Record the annual straight-line amortization at December 31 of Year 3. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31 Record entry Clear entry View general journal