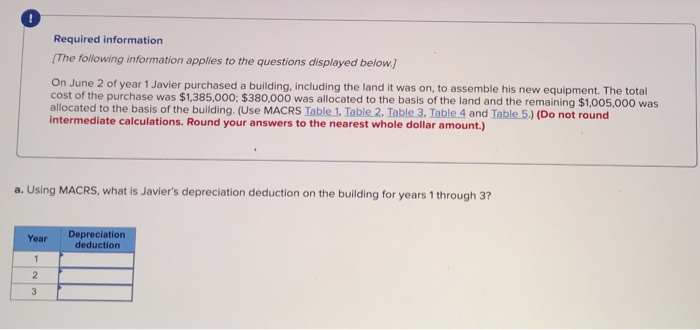

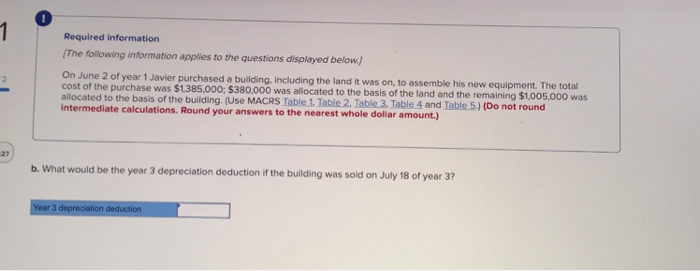

Required information The following information applies to the questions displayed below.) On June 2 of year 1 Javier purchased a building, including the land it was on, to assemble his new equipment. The total cost of the purchase was $1,385,000: $380,000 was allocated to the basis of the land and the remaining $1,005,000 was allocated to the basis of the building. (Use MACRS Table 1. Table 2. Table 3. Table 4 and Table 5.) (Do not round Intermediate calculations. Round your answers to the nearest whole dollar amount.) a. Using MACRS, what is Javier's depreciation deduction on the building for years 1 through 3? Year Depreciation deduction Required information The following information applies to the questions displayed below) On June 2 of year 1 Javier purchased a building, including the land it was on, to assemble his new equipment. The total cost of the purchase was $1,385,000: $380,000 was allocated to the basis of the land and the remaining $1.005.000 was allocated to the basis of the building. (Use MACRS Table 1. Table 2. Table 3. Table 4 and Table 5.) (Do not round Intermediate calculations. Round your answers to the nearest whole dollar amount.) b. What would be the year 3 depreciation deduction if the building was sold on July 18 of year 3? Year 3 depreciation deduction Required information The following information applies to the questions displayed below.) On June 2 of year 1 Javier purchased a building, including the land it was on, to assemble his new equipment. The total cost of the purchase was $1,385,000: $380,000 was allocated to the basis of the land and the remaining $1,005,000 was allocated to the basis of the building. (Use MACRS Table 1. Table 2. Table 3. Table 4 and Table 5.) (Do not round Intermediate calculations. Round your answers to the nearest whole dollar amount.) a. Using MACRS, what is Javier's depreciation deduction on the building for years 1 through 3? Year Depreciation deduction Required information The following information applies to the questions displayed below) On June 2 of year 1 Javier purchased a building, including the land it was on, to assemble his new equipment. The total cost of the purchase was $1,385,000: $380,000 was allocated to the basis of the land and the remaining $1.005.000 was allocated to the basis of the building. (Use MACRS Table 1. Table 2. Table 3. Table 4 and Table 5.) (Do not round Intermediate calculations. Round your answers to the nearest whole dollar amount.) b. What would be the year 3 depreciation deduction if the building was sold on July 18 of year 3? Year 3 depreciation deduction