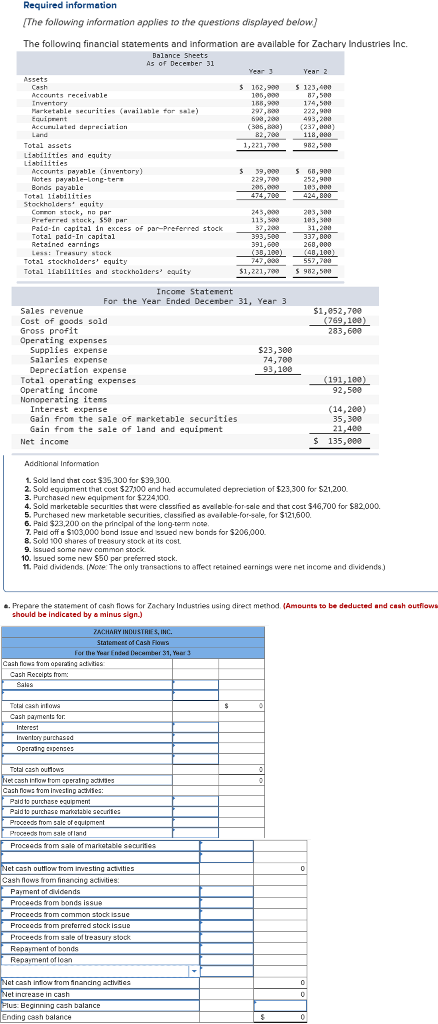

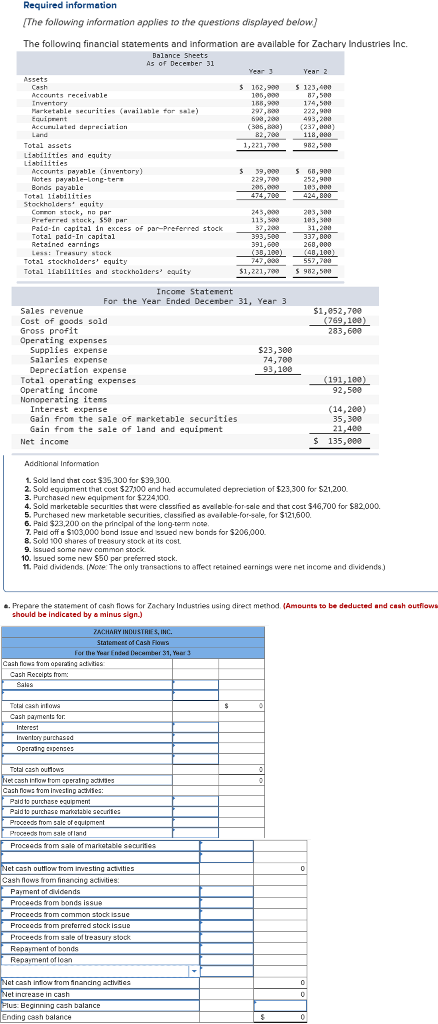

Required information [The following information applies to the questions displayed below.] The following financial statements and information are available for Zachary Industries Inc. Balance Sheets As of December 31 Year 3 Year 2 Assets Cash $ 162,999 $ 123,400 Accounts receivable 195,099 87,500 174,500 Inventory 188,900 297,899 222,980 Marketable securities (available for sale) Equipment 698,208 493,200 Accumulated depreciation (237,888) (386,888) 82,700 Land 118,000 Total assets 1,221,799 982,500 Liabilities and equity Liabilities $39.000 39,990 $ 68,900 Accounts payable (inventory) Notes payable-Long-ter Bonds payable 229,700 252,900 205,000 105,000 474,700 424,800 Total liabilities Stockholders' equity Common stock, no par 245,999 205,300 Preferred stock, $50 par 113,388 103,300 Paid-in capital in excess of par-Preferred stock 37,200 31,200 Total paid-In capital 393,500 337,000 Retained earnings 391,000 260,000 Less: Treasury stock (35,100) (48,100) Total stockholders' equity 747,000 557,788 Total liabilities and stockholders' equity $1,221,700 $ 982.500 Income Statement For the Year Ended December 31, Year 3 Sales revenue Cost of goods sold Gross profit Operating expenses $23,300 74,700 93,100 $1,052,700 (769,100) 283,600 Supplies expense Salaries expense Depreciation expensel Total operating expenses (191,100) 92,500 Operating income Nonoperating items Interest expense Gain from the sale of marketable securities Gain from the sale of land and equipment (14,200) 35,300 21,400 Net income $ 135,000 Additional Information 1. Sold land that cost $35,300 for $39,300. 2. Sold equipment that cost $27,100 and hed accumulated depreciation of $23,300 for $21,200. 3. Purchased new equipment for $224,100. 4. Sold marketable securities that were classified as available for sale and that cost $46,700 for $82,000. 5. Purchased new merketable securities, classified as available-for-sale, for $121,600. 6. Paid $23,200 on the principal of the long-term note. 7. Pald off a $103,000 band issue and issued new bonds for $206,000. 8. Sold 100 shares of treasury stock at its cost. 9. Issued some new common stock. 10. Issued some new $50 per preferred stock. 11. Paid dividends. (Note: The only transactions to affect retained earnings were net income and dividends.) a. Prepare the statement of cash flows for Zachary Industries using direct method. (Amounts to be deducted and cash outflows should be indicated by a minus sign.) ZACHARY INDUSTRIES, INC Statement of Cash Flows For the Year Ended December 31, Year 3 Cash flows from operating activities: Cash Receipts from Salas Total cash infowa 0 Cash payments for Internet Inventory purchased Operating expenses Total cash outflows Net cash flow from operating acties Cash flows from Investing acties: Pald to purchase equipment Paid to purchase marketable securities Proceeds from sale of equipment Proceeds from sale of land Proceeds from sale of marketable securities Net cash outflow from investing activities Cash flows from financing activities: Payment of dividends Proceeds from bonds issue Proceeds from common stock issue Proceeds from preferred stock issue Proceeds from sale of treasury stock Repayment of bonds Repayment of loan Net cash inflow from financing activities Net increase in cash Plus: Beginning cash balance Ending cash balance $ 0 $ 0 0 0 0