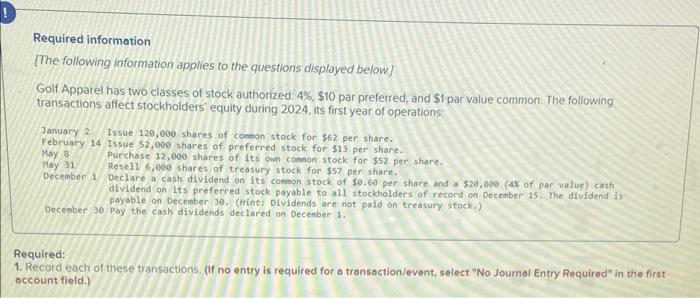

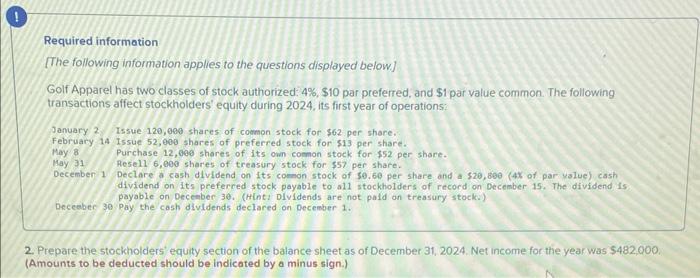

Required information [The following information applies to the questions displayed below] Golf Apparel has two classes of stock authorized 4%,$10 par preferred, and $1 par value common. The following transactions affect stockholders equity during 2024, its first year of operations: January 2. Issue 120, 600 shares of comon stock for $62 per share. February 14 1ssue 52 , 600 shares of preferred stock for $13 per share. May 8 Purchase 12,000 shares of its oun common stock for $52 per share. Moy 31 Resel1 6,000 shares of treasury stock for $57 per share. December 1 Declare a cash dividend on its combon stock of 50.60 per share and a 520,300 (4k of par value) cash dividend on Its preferred stock payable to all stockholders of record on December 15. The dividend is payable on December 30 . (Hint: Olvidends are not poid on treasury stock.) December 30 Pay the cash dividends declared on Decenber 1. Required: 1. Record easch of these transactions. (If no entry is required for a transoction/event, select "No Joumal Entry Required" in the first occount field.) Required information [The following information applies to the questions displayed below] Golf Apparel has two classes of stock authorized: 4%,$10 par preferred, and $1 par value common. The following transactions affect stockholders' equity during 2024, its first year of operations: January 2 Issue 120,000 shares of comon stock for $62 per shore. February 14 is sue 52,900 shares of preferred stock for $13 per share. May 8 Purchase 12,000 shares of its own comon stock for $52 per share. May 31 Resell 6,000 shares of treasury stock for $57 per share. December 1 Declare a cash dlvidend on Its comon stock of 50.60 per share and a 520,800 (4x of par yalue) cash dividend on its preferred stock payable to al1 stockholders of record on December 15. The dividend is payable on December 30. (Hinti Dlvidends are not paid on treasury stock-) Deceaber 30 Pay the cash divldends declared on December 1. 2. Prepare the stockholders' equity section of the balance sheet as of December 31, 2024. Net income for the year was $482, 000. (Amounts to be deducted should be indicated by a minus sign.)