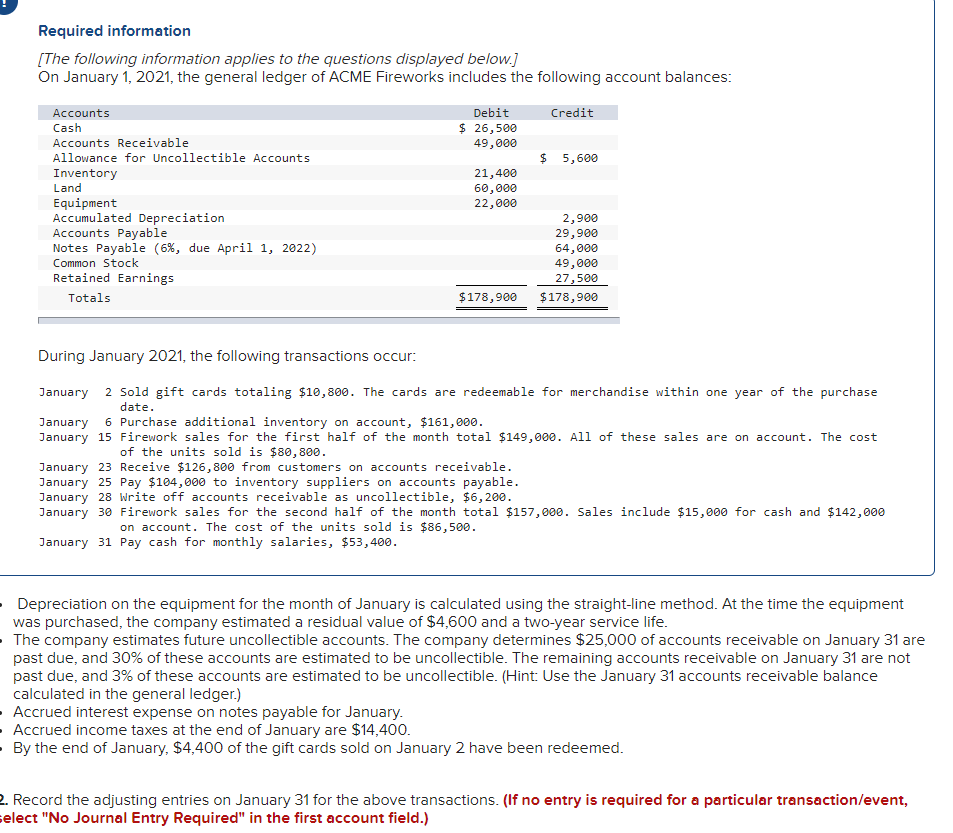

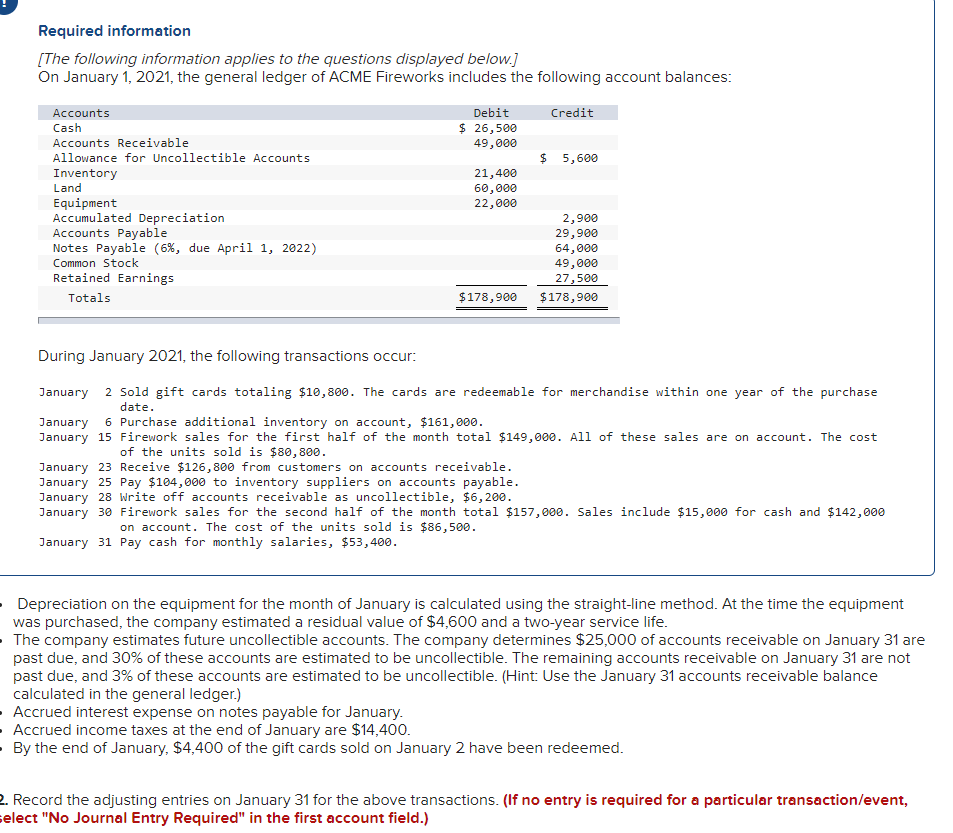

Required information [The following information applies to the questions displayed below.) On January 1, 2021, the general ledger of ACME Fireworks includes the following account balances: Accounts Debit Credit Cash $ 26,500 Accounts Receivable 49,000 Allowance for Uncollectible Accounts $ 5,600 Inventory 21,400 Land 60,000 Equipment 22,000 Accumulated Depreciation 2,900 Accounts Payable 29,900 Notes Payable (6%, due April 1, 2022) 64,000 Common Stock 49,000 Retained Earnings 27,500 Totals $ 178,900 $ 178,900 During January 2021, the following transactions occur: January 2 Sold gift cards totaling $10,800. The cards are redeemable for merchandise within one year of the purchase date. January 6 Purchase additional inventory on account, $161,000. January 15 Firework sales for the first half of the month total $149,000. All of these sales are on account. The cost of the units sold is $80,800. January 23 Receive $126,800 from customers on accounts receivable. January 25 Pay $184,000 to inventory suppliers on accounts payable. January 28 Write off accounts receivable as uncollectible, $6,200. January 30 Firework sales for the second half of the month total $157,000. Sales include $15,000 for cash and $142,000 on account. The cost of the units sold is $86,500. January 31 Pay cash for monthly salaries, $53,400. Depreciation on the equipment for the month of January is calculated using the straight-line method. At the time the equipment was purchased, the company estimated a residual value of $4,600 and a two-year service life. The company estimates future uncollectible accounts. The company determines $25,000 of accounts receivable on January 31 are past due, and 30% of these accounts are estimated to be uncollectible. The remaining accounts receivable on January 31 are not past due, and 3% of these accounts are estimated to be uncollectible. (Hint: Use the January 31 accounts receivable balance calculated in the general ledger.) Accrued interest expense on notes payable for January. Accrued income taxes at the end of January are $14,400. By the end of January, $4,400 of the gift cards sold on January 2 have been redeemed. 2. Record the adjusting entries on January 31 for the above transactions. (If no entry is required for a particular transaction/event, elect "No Journal Entry Required" in the first account field.)