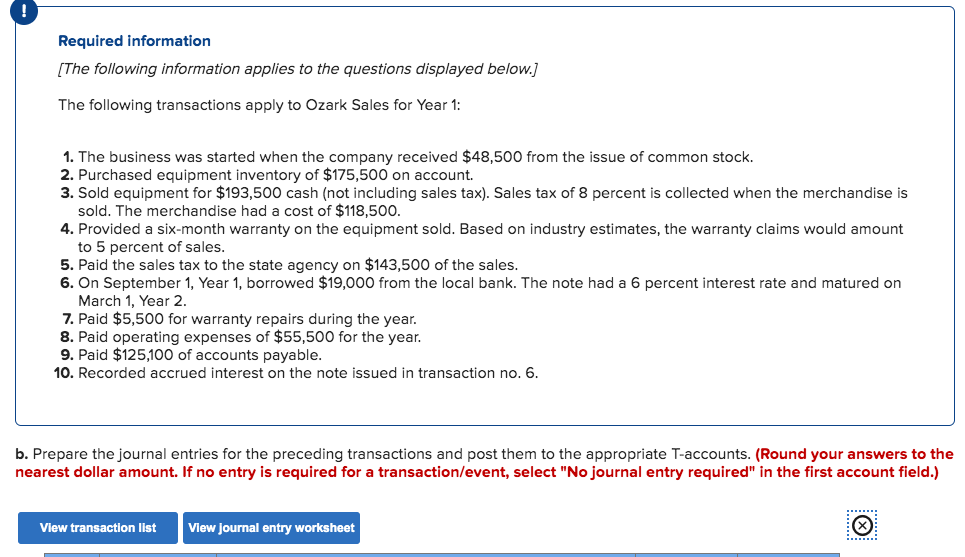

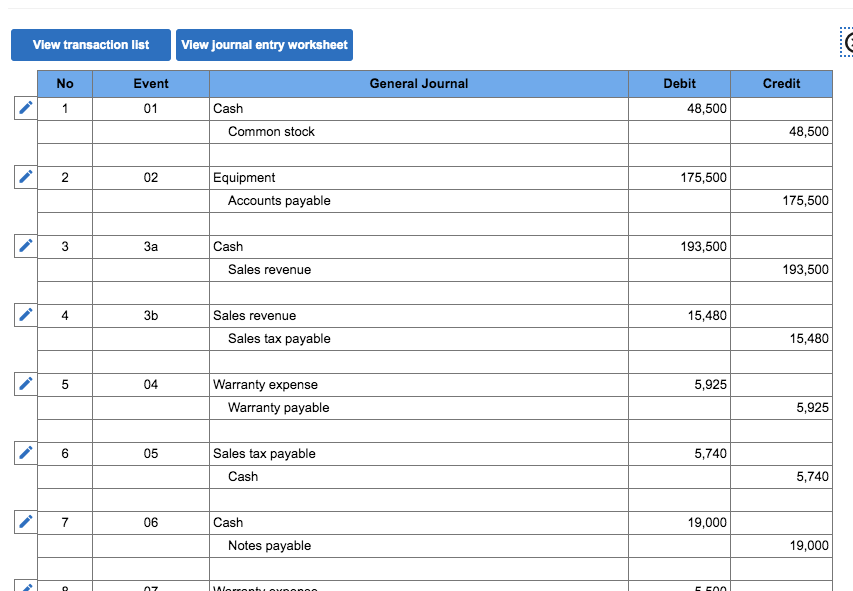

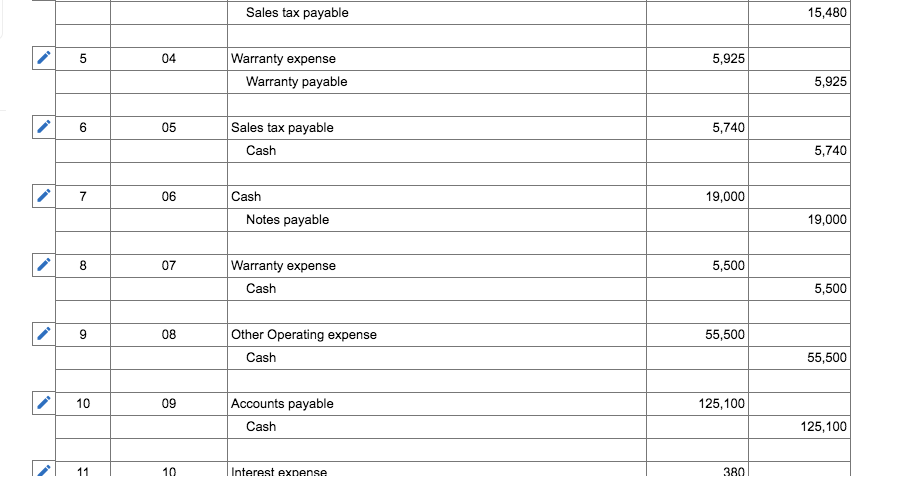

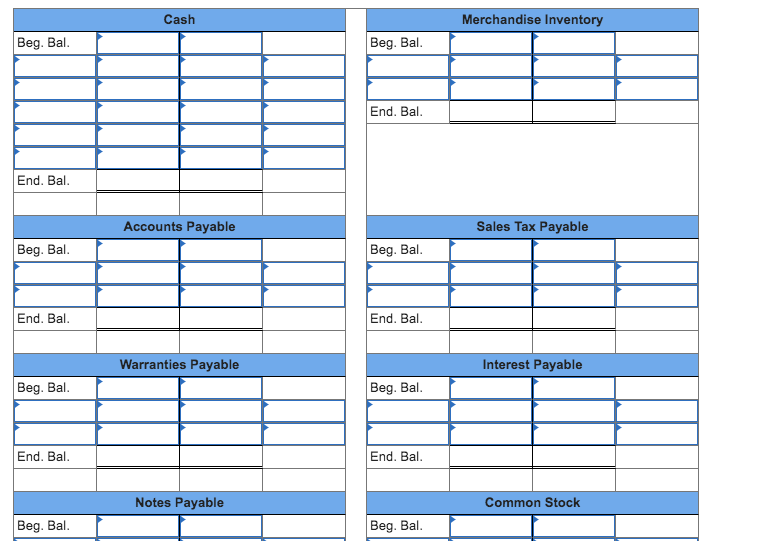

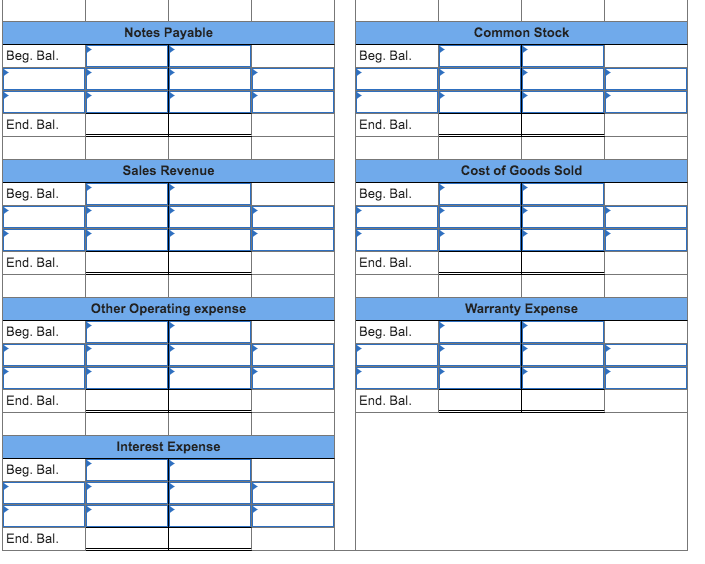

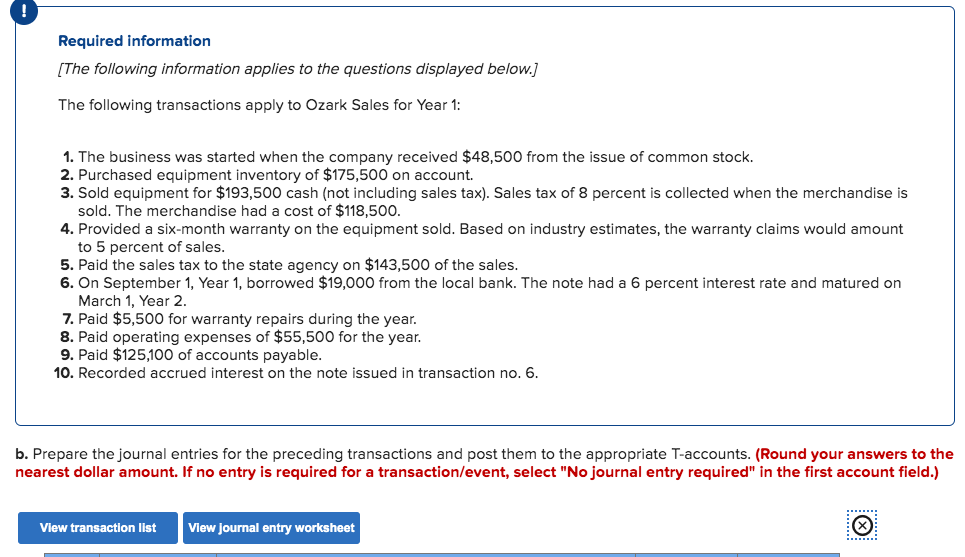

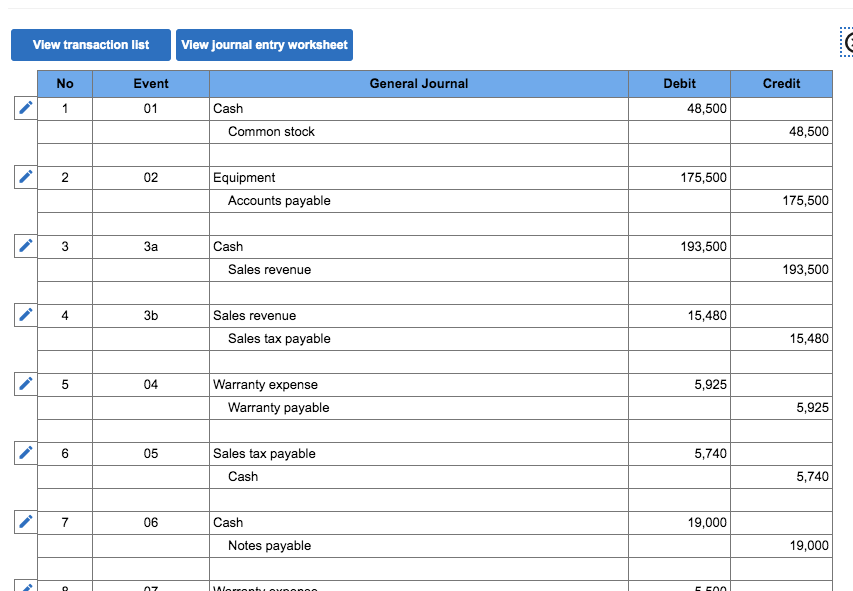

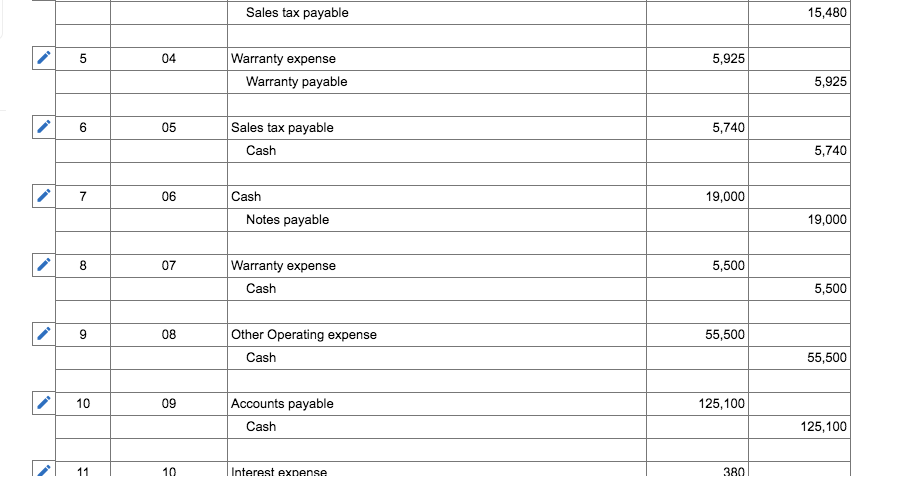

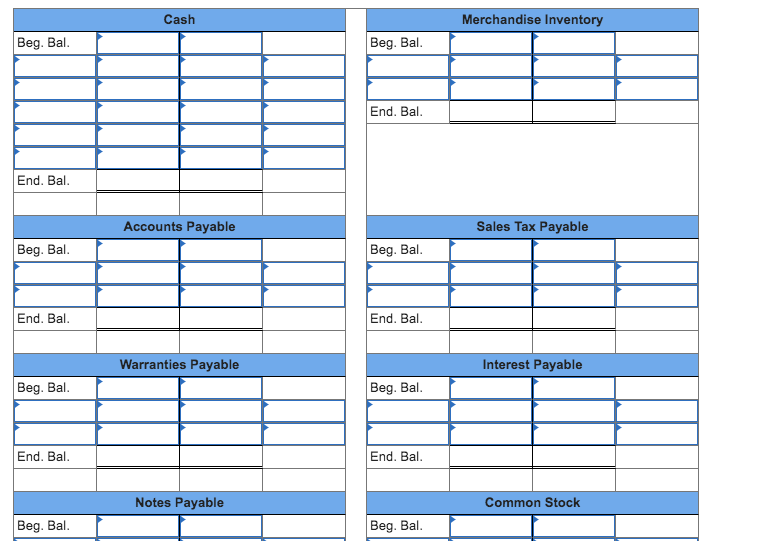

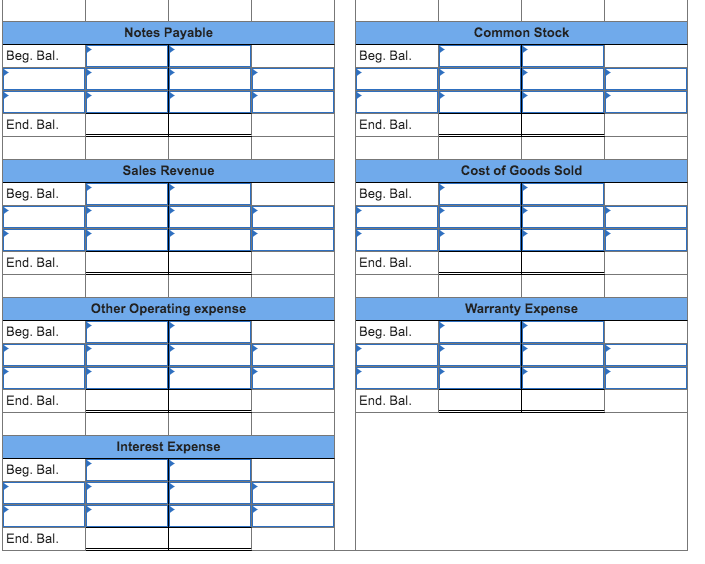

Required information (The following information applies to the questions displayed below.) The following transactions apply to Ozark Sales for Year 1: 1. The business was started when the company received $48,500 from the issue of common stock. 2. Purchased equipment inventory of $175,500 on account 3. Sold equipment for $193,500 cash (not including sales tax). Sales tax of 8 percent is collected when the merchandise is sold. The merchandise had a cost of $118,500. 4. Provided a six-month warranty on the equipment sold. Based on industry estimates, the warranty claims would amount to 5 percent of sales. 5. Paid the sales tax to the state agency on $143,500 of the sales. 6. On September 1, Year 1, borrowed $19,000 from the local bank. The note had a 6 percent interest rate and matured on March 1, Year 2 7. Paid $5,500 for warranty repairs during the year. 8. Paid operating expenses of $55,500 for the year. 9. Paid $125,100 of accounts payable. 10. Recorded accrued interest on the note issued in transaction no. 6. b. Prepare the journal entries for the preceding transactions and post them to the appropriate T-accounts. (Round your answers to the nearest dollar amount. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list View journal entry worksheet View transaction list View Journal entry worksheet :: No Event General Journal Debit Credit 1 01 48,500 Cash Common stock 48,500 02 175,500 N Equipment Accounts payable 175,500 3 193,500 Cash Sales revenue 193,500 4 3b 15,480 Sales revenue Sales tax payable 15,480 5 04 5,925 Warranty expense Warranty payable 5,925 6 05 5,740 Sales tax payable Cash 5,740 7 06 Cash 19,000 Notes payable 19,000 7 FE Sales tax payable 15,480 04 5,925 Warranty expense Warranty payable 5,925 6 05 5,740 Sales tax payable Cash 5,740 7 06 19,000 Cash Notes payable 19,000 8 07 5,500 Warranty expense Cash 5,500 9 08 55,500 Other Operating expense Cash 55,500 10 09 125,100 Accounts payable Cash 125, 100 11 10 Interest expense 380 Cash Merchandise Inventory Beg. Bal. Beg. Bal. End. Bal. End. Bal. Accounts Payable Sales Tax Payable Beg. Bal. Beg. Bal. End. Bal. End. Bal. Warranties Payable Interest Payable Beg. Bal. Beg. Bal. End. Bal. End. Bal. Notes Payable Common Stock Beg. Bal. Beg. Bal. Notes Payable Common Stock Beg. Bal. Beg. Bal. End. Bal. End. Bal. Sales Revenue Cost of Goods Sold Beg. Bal. Beg. Bal. End. Bal. End. Bal. Other Operating expense Warranty Expense Beg. Bal. Beg. Bal. End. Bal. End. Bal. Interest Expense Beg. Bal. End. Bal