Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required Information [The following information applies to the questions displayed below.] The following transactions apply to Jova Company for Year 1, the first year of

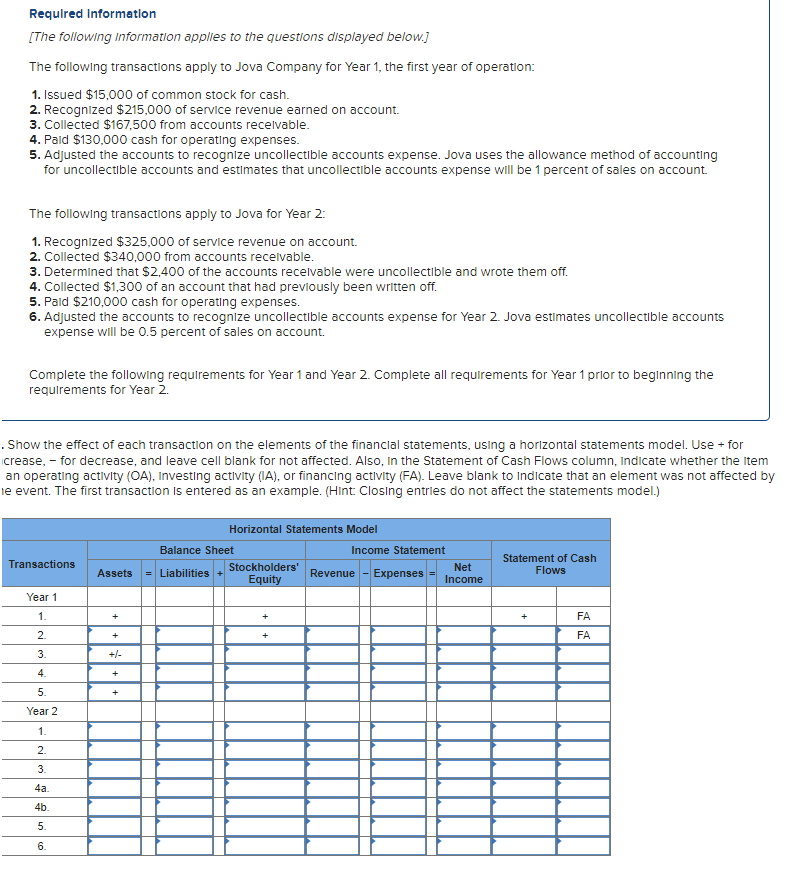

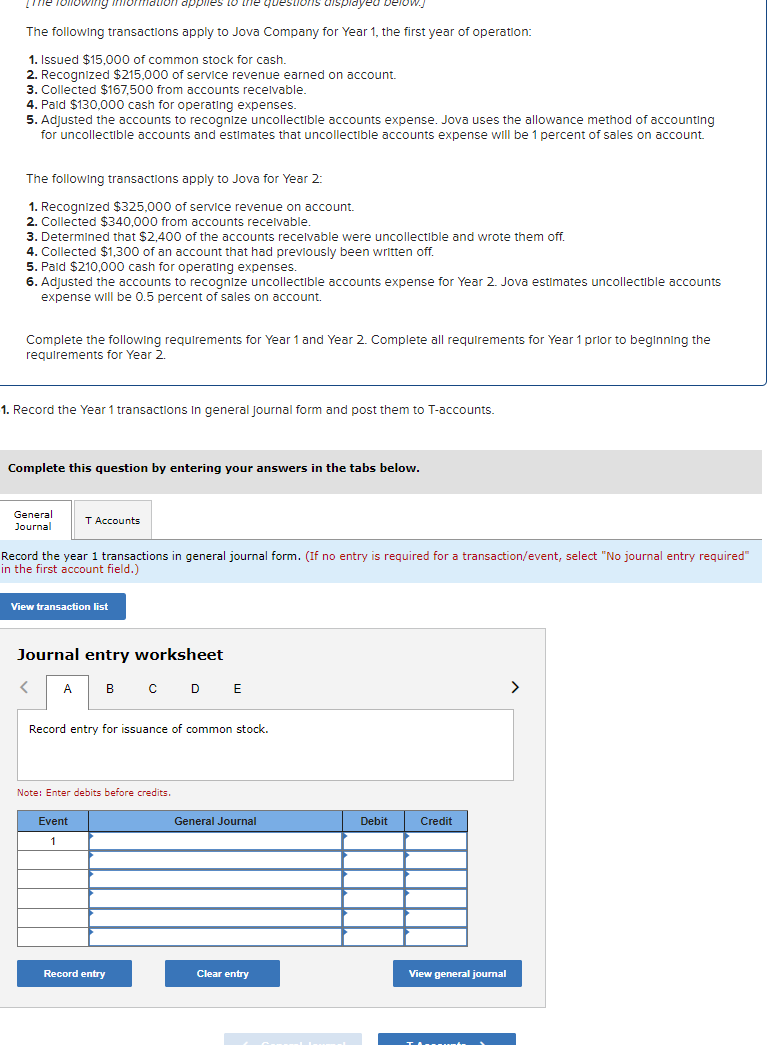

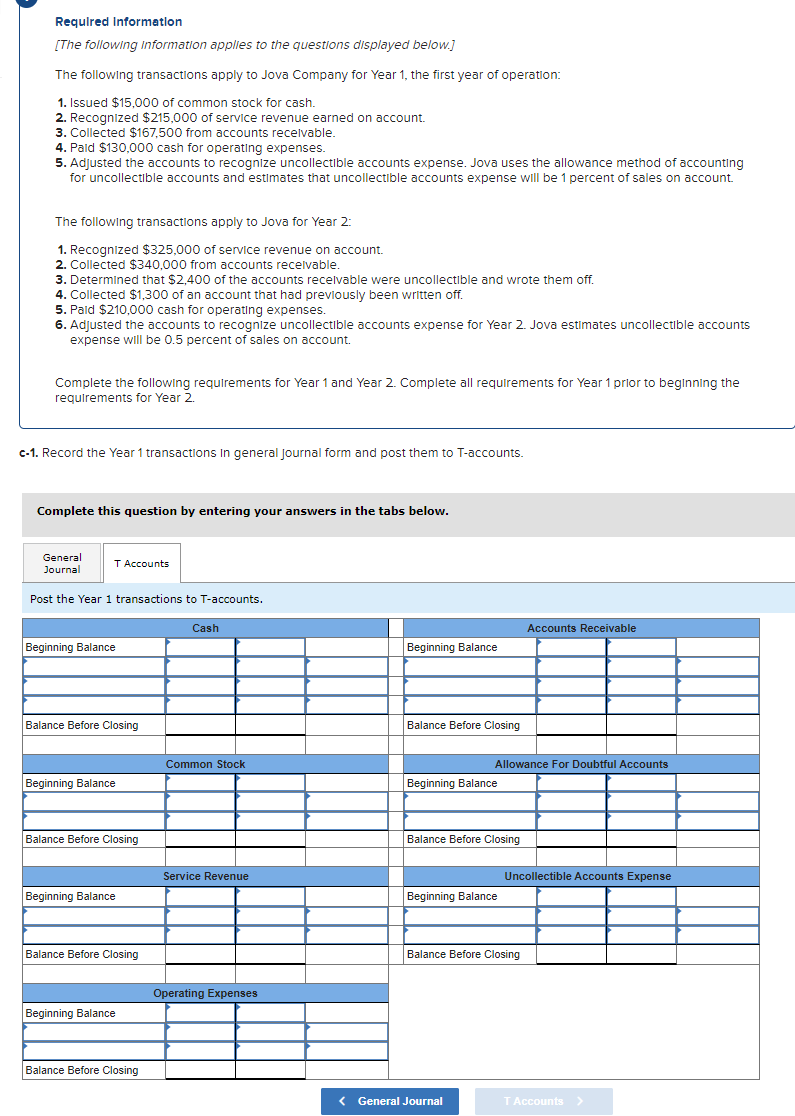

Required Information [The following information applies to the questions displayed below.] The following transactions apply to Jova Company for Year 1, the first year of operation: 1. Issued $15,000 of common stock for cash. 2. Recognized $215,000 of service revenue earned on account. 3. Collected $167,500 from accounts recelvable. 4. Pald $130,000 cash for operating expenses. 5. Adjusted the accounts to recognize uncollectible accounts expense. Jova uses the allowance method of accounting for uncollectlble accounts and estimates that uncollectlble accounts expense will be 1 percent of sales on account. The following transactions apply to Jova for Year 2: 1. Recognized $325,000 of service revenue on account. 2. Collected $340,000 from accounts recelvable. 3. Determined that $2,400 of the accounts recelvable were uncollectible and wrote them off. 4. Collected $1,300 of an account that had prevlously been written off. 5. Pald $210,000 cash for operating expenses. 6. Adjusted the accounts to recognize uncollectible accounts expense for Year 2. Jova estimates uncollectible accounts expense will be 0.5 percent of sales on account. Complete the following requirements for Year 1 and Year 2 . Complete all requirements for Year 1 prlor to beginning the requirements for Year 2. Show the effect of each transaction on the elements of the financlal statements, using a horlzontal statements model. Use + for crease, - for decrease, and leave cell blank for not affected. Also, In the Statement of Cash Flows column, Indicate whether the Item an operating activity (OA), Investing actlvity (IA), or financing actlvity (FA). Leave blank to Indicate that an element was not affected by e event. The first transaction is entered as an example. (Hint Closing entrles do not affect the statements model.) The following transactions apply to Jova Company for Year 1, the first year of operation: 1. Issued $15,000 of common stock for cash. 2. Recognized $215,000 of service revenue earned on account. 3. Collected $167,500 from accounts recelvable. 4. Pald $130,000 cash for operating expenses. 5. Adjusted the accounts to recognize uncollectlble accounts expense. Jova uses the allowance method of accounting for uncollectlble accounts and estimates that uncollectlble accounts expense will be 1 percent of sales on account. The following transactions apply to Jova for Year 2: 1. Recognized $325,000 of service revenue on account. 2. Collected $340,000 from accounts recelvable. 3. Determined that $2,400 of the accounts recelvable were uncollectible and wrote them off. 4. Collected $1,300 of an account that had previously been written off. 5. Pald $210,000 cash for operating expenses. 6. Adjusted the accounts to recognize uncollectible accounts expense for Year 2. Jova estimates uncollectlble accounts expense will be 0.5 percent of sales on account. Complete the following requirements for Year 1 and Year 2 . Complete all requirements for Year 1 prior to beginning the requirements for Year 2. 1. Record the Year 1 transactions In general journal form and post them to T-accounts. Complete this question by entering your answers in the tabs below. Record the year 1 transactions in general journal form. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet D E Note: Enter debits before credits. Required Information [The following information applies to the questions displayed below.] The following transactions apply to Jova Company for Year 1, the first year of operation: 1. Issued $15,000 of common stock for cash. 2. Recognized $215,000 of service revenue earned on account. 3. Collected $167,500 from accounts recelvable. 4. Pald $130,000 cash for operating expenses. 5. Adjusted the accounts to recognize uncollectlble accounts expense. Jova uses the allowance method of accounting for uncollectlble accounts and estimates that uncollectlble accounts expense will be 1 percent of sales on account. The following transactions apply to Jova for Year 2: 1. Recognized $325,000 of service revenue on account. 2. Collected $340,000 from accounts recelvable. 3. Determined that $2,400 of the accounts recelvable were uncollectlble and wrote them off. 4. Collected $1,300 of an account that had previously been written off. 5. Pald $210,000 cash for operating expenses. 6. Adjusted the accounts to recognize uncollectible accounts expense for Year 2 . Jova estimates uncollectlble accounts expense will be 0.5 percent of sales on account. Complete the following requirements for Year 1 and Year 2. Complete all requirements for Year 1 prior to beginning the requirements for Year 2. c-1. Record the Year 1 transactions In general journal form and post them to T-accounts. Complete this question by entering your answers in the tabs below. Post the Year 1 transactions to T-accounts. Required Information [The following information applies to the questions displayed below.] The following transactions apply to Jova Company for Year 1, the first year of operation: 1. Issued $15,000 of common stock for cash. 2. Recognized $215,000 of service revenue earned on account. 3. Collected $167,500 from accounts recelvable. 4. Pald $130,000 cash for operating expenses. 5. Adjusted the accounts to recognize uncollectible accounts expense. Jova uses the allowance method of accounting for uncollectlble accounts and estimates that uncollectlble accounts expense will be 1 percent of sales on account. The following transactions apply to Jova for Year 2: 1. Recognized $325,000 of service revenue on account. 2. Collected $340,000 from accounts recelvable. 3. Determined that $2,400 of the accounts recelvable were uncollectible and wrote them off. 4. Collected $1,300 of an account that had prevlously been written off. 5. Pald $210,000 cash for operating expenses. 6. Adjusted the accounts to recognize uncollectible accounts expense for Year 2. Jova estimates uncollectible accounts expense will be 0.5 percent of sales on account. Complete the following requirements for Year 1 and Year 2 . Complete all requirements for Year 1 prlor to beginning the requirements for Year 2. Show the effect of each transaction on the elements of the financlal statements, using a horlzontal statements model. Use + for crease, - for decrease, and leave cell blank for not affected. Also, In the Statement of Cash Flows column, Indicate whether the Item an operating activity (OA), Investing actlvity (IA), or financing actlvity (FA). Leave blank to Indicate that an element was not affected by e event. The first transaction is entered as an example. (Hint Closing entrles do not affect the statements model.) The following transactions apply to Jova Company for Year 1, the first year of operation: 1. Issued $15,000 of common stock for cash. 2. Recognized $215,000 of service revenue earned on account. 3. Collected $167,500 from accounts recelvable. 4. Pald $130,000 cash for operating expenses. 5. Adjusted the accounts to recognize uncollectlble accounts expense. Jova uses the allowance method of accounting for uncollectlble accounts and estimates that uncollectlble accounts expense will be 1 percent of sales on account. The following transactions apply to Jova for Year 2: 1. Recognized $325,000 of service revenue on account. 2. Collected $340,000 from accounts recelvable. 3. Determined that $2,400 of the accounts recelvable were uncollectible and wrote them off. 4. Collected $1,300 of an account that had previously been written off. 5. Pald $210,000 cash for operating expenses. 6. Adjusted the accounts to recognize uncollectible accounts expense for Year 2. Jova estimates uncollectlble accounts expense will be 0.5 percent of sales on account. Complete the following requirements for Year 1 and Year 2 . Complete all requirements for Year 1 prior to beginning the requirements for Year 2. 1. Record the Year 1 transactions In general journal form and post them to T-accounts. Complete this question by entering your answers in the tabs below. Record the year 1 transactions in general journal form. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet D E Note: Enter debits before credits. Required Information [The following information applies to the questions displayed below.] The following transactions apply to Jova Company for Year 1, the first year of operation: 1. Issued $15,000 of common stock for cash. 2. Recognized $215,000 of service revenue earned on account. 3. Collected $167,500 from accounts recelvable. 4. Pald $130,000 cash for operating expenses. 5. Adjusted the accounts to recognize uncollectlble accounts expense. Jova uses the allowance method of accounting for uncollectlble accounts and estimates that uncollectlble accounts expense will be 1 percent of sales on account. The following transactions apply to Jova for Year 2: 1. Recognized $325,000 of service revenue on account. 2. Collected $340,000 from accounts recelvable. 3. Determined that $2,400 of the accounts recelvable were uncollectlble and wrote them off. 4. Collected $1,300 of an account that had previously been written off. 5. Pald $210,000 cash for operating expenses. 6. Adjusted the accounts to recognize uncollectible accounts expense for Year 2 . Jova estimates uncollectlble accounts expense will be 0.5 percent of sales on account. Complete the following requirements for Year 1 and Year 2. Complete all requirements for Year 1 prior to beginning the requirements for Year 2. c-1. Record the Year 1 transactions In general journal form and post them to T-accounts. Complete this question by entering your answers in the tabs below. Post the Year 1 transactions to T-accounts

Required Information [The following information applies to the questions displayed below.] The following transactions apply to Jova Company for Year 1, the first year of operation: 1. Issued $15,000 of common stock for cash. 2. Recognized $215,000 of service revenue earned on account. 3. Collected $167,500 from accounts recelvable. 4. Pald $130,000 cash for operating expenses. 5. Adjusted the accounts to recognize uncollectible accounts expense. Jova uses the allowance method of accounting for uncollectlble accounts and estimates that uncollectlble accounts expense will be 1 percent of sales on account. The following transactions apply to Jova for Year 2: 1. Recognized $325,000 of service revenue on account. 2. Collected $340,000 from accounts recelvable. 3. Determined that $2,400 of the accounts recelvable were uncollectible and wrote them off. 4. Collected $1,300 of an account that had prevlously been written off. 5. Pald $210,000 cash for operating expenses. 6. Adjusted the accounts to recognize uncollectible accounts expense for Year 2. Jova estimates uncollectible accounts expense will be 0.5 percent of sales on account. Complete the following requirements for Year 1 and Year 2 . Complete all requirements for Year 1 prlor to beginning the requirements for Year 2. Show the effect of each transaction on the elements of the financlal statements, using a horlzontal statements model. Use + for crease, - for decrease, and leave cell blank for not affected. Also, In the Statement of Cash Flows column, Indicate whether the Item an operating activity (OA), Investing actlvity (IA), or financing actlvity (FA). Leave blank to Indicate that an element was not affected by e event. The first transaction is entered as an example. (Hint Closing entrles do not affect the statements model.) The following transactions apply to Jova Company for Year 1, the first year of operation: 1. Issued $15,000 of common stock for cash. 2. Recognized $215,000 of service revenue earned on account. 3. Collected $167,500 from accounts recelvable. 4. Pald $130,000 cash for operating expenses. 5. Adjusted the accounts to recognize uncollectlble accounts expense. Jova uses the allowance method of accounting for uncollectlble accounts and estimates that uncollectlble accounts expense will be 1 percent of sales on account. The following transactions apply to Jova for Year 2: 1. Recognized $325,000 of service revenue on account. 2. Collected $340,000 from accounts recelvable. 3. Determined that $2,400 of the accounts recelvable were uncollectible and wrote them off. 4. Collected $1,300 of an account that had previously been written off. 5. Pald $210,000 cash for operating expenses. 6. Adjusted the accounts to recognize uncollectible accounts expense for Year 2. Jova estimates uncollectlble accounts expense will be 0.5 percent of sales on account. Complete the following requirements for Year 1 and Year 2 . Complete all requirements for Year 1 prior to beginning the requirements for Year 2. 1. Record the Year 1 transactions In general journal form and post them to T-accounts. Complete this question by entering your answers in the tabs below. Record the year 1 transactions in general journal form. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet D E Note: Enter debits before credits. Required Information [The following information applies to the questions displayed below.] The following transactions apply to Jova Company for Year 1, the first year of operation: 1. Issued $15,000 of common stock for cash. 2. Recognized $215,000 of service revenue earned on account. 3. Collected $167,500 from accounts recelvable. 4. Pald $130,000 cash for operating expenses. 5. Adjusted the accounts to recognize uncollectlble accounts expense. Jova uses the allowance method of accounting for uncollectlble accounts and estimates that uncollectlble accounts expense will be 1 percent of sales on account. The following transactions apply to Jova for Year 2: 1. Recognized $325,000 of service revenue on account. 2. Collected $340,000 from accounts recelvable. 3. Determined that $2,400 of the accounts recelvable were uncollectlble and wrote them off. 4. Collected $1,300 of an account that had previously been written off. 5. Pald $210,000 cash for operating expenses. 6. Adjusted the accounts to recognize uncollectible accounts expense for Year 2 . Jova estimates uncollectlble accounts expense will be 0.5 percent of sales on account. Complete the following requirements for Year 1 and Year 2. Complete all requirements for Year 1 prior to beginning the requirements for Year 2. c-1. Record the Year 1 transactions In general journal form and post them to T-accounts. Complete this question by entering your answers in the tabs below. Post the Year 1 transactions to T-accounts. Required Information [The following information applies to the questions displayed below.] The following transactions apply to Jova Company for Year 1, the first year of operation: 1. Issued $15,000 of common stock for cash. 2. Recognized $215,000 of service revenue earned on account. 3. Collected $167,500 from accounts recelvable. 4. Pald $130,000 cash for operating expenses. 5. Adjusted the accounts to recognize uncollectible accounts expense. Jova uses the allowance method of accounting for uncollectlble accounts and estimates that uncollectlble accounts expense will be 1 percent of sales on account. The following transactions apply to Jova for Year 2: 1. Recognized $325,000 of service revenue on account. 2. Collected $340,000 from accounts recelvable. 3. Determined that $2,400 of the accounts recelvable were uncollectible and wrote them off. 4. Collected $1,300 of an account that had prevlously been written off. 5. Pald $210,000 cash for operating expenses. 6. Adjusted the accounts to recognize uncollectible accounts expense for Year 2. Jova estimates uncollectible accounts expense will be 0.5 percent of sales on account. Complete the following requirements for Year 1 and Year 2 . Complete all requirements for Year 1 prlor to beginning the requirements for Year 2. Show the effect of each transaction on the elements of the financlal statements, using a horlzontal statements model. Use + for crease, - for decrease, and leave cell blank for not affected. Also, In the Statement of Cash Flows column, Indicate whether the Item an operating activity (OA), Investing actlvity (IA), or financing actlvity (FA). Leave blank to Indicate that an element was not affected by e event. The first transaction is entered as an example. (Hint Closing entrles do not affect the statements model.) The following transactions apply to Jova Company for Year 1, the first year of operation: 1. Issued $15,000 of common stock for cash. 2. Recognized $215,000 of service revenue earned on account. 3. Collected $167,500 from accounts recelvable. 4. Pald $130,000 cash for operating expenses. 5. Adjusted the accounts to recognize uncollectlble accounts expense. Jova uses the allowance method of accounting for uncollectlble accounts and estimates that uncollectlble accounts expense will be 1 percent of sales on account. The following transactions apply to Jova for Year 2: 1. Recognized $325,000 of service revenue on account. 2. Collected $340,000 from accounts recelvable. 3. Determined that $2,400 of the accounts recelvable were uncollectible and wrote them off. 4. Collected $1,300 of an account that had previously been written off. 5. Pald $210,000 cash for operating expenses. 6. Adjusted the accounts to recognize uncollectible accounts expense for Year 2. Jova estimates uncollectlble accounts expense will be 0.5 percent of sales on account. Complete the following requirements for Year 1 and Year 2 . Complete all requirements for Year 1 prior to beginning the requirements for Year 2. 1. Record the Year 1 transactions In general journal form and post them to T-accounts. Complete this question by entering your answers in the tabs below. Record the year 1 transactions in general journal form. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet D E Note: Enter debits before credits. Required Information [The following information applies to the questions displayed below.] The following transactions apply to Jova Company for Year 1, the first year of operation: 1. Issued $15,000 of common stock for cash. 2. Recognized $215,000 of service revenue earned on account. 3. Collected $167,500 from accounts recelvable. 4. Pald $130,000 cash for operating expenses. 5. Adjusted the accounts to recognize uncollectlble accounts expense. Jova uses the allowance method of accounting for uncollectlble accounts and estimates that uncollectlble accounts expense will be 1 percent of sales on account. The following transactions apply to Jova for Year 2: 1. Recognized $325,000 of service revenue on account. 2. Collected $340,000 from accounts recelvable. 3. Determined that $2,400 of the accounts recelvable were uncollectlble and wrote them off. 4. Collected $1,300 of an account that had previously been written off. 5. Pald $210,000 cash for operating expenses. 6. Adjusted the accounts to recognize uncollectible accounts expense for Year 2 . Jova estimates uncollectlble accounts expense will be 0.5 percent of sales on account. Complete the following requirements for Year 1 and Year 2. Complete all requirements for Year 1 prior to beginning the requirements for Year 2. c-1. Record the Year 1 transactions In general journal form and post them to T-accounts. Complete this question by entering your answers in the tabs below. Post the Year 1 transactions to T-accounts Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started