Answered step by step

Verified Expert Solution

Question

1 Approved Answer

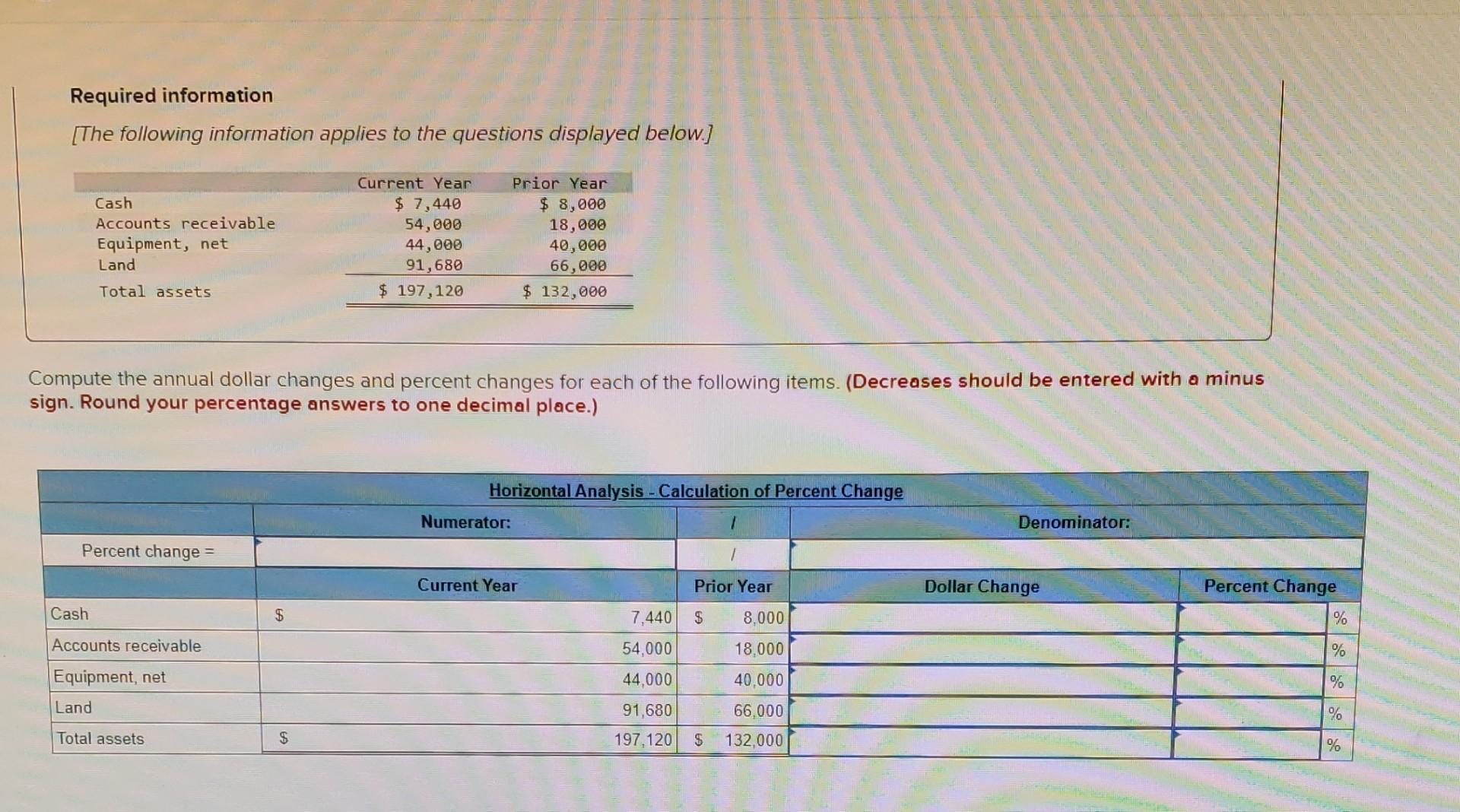

Required information [The following information applies to the questions displayed below.] Cash Accounts receivable Equipment, net Land Current Year $ 7,440 54,000 44,000 91,680 $

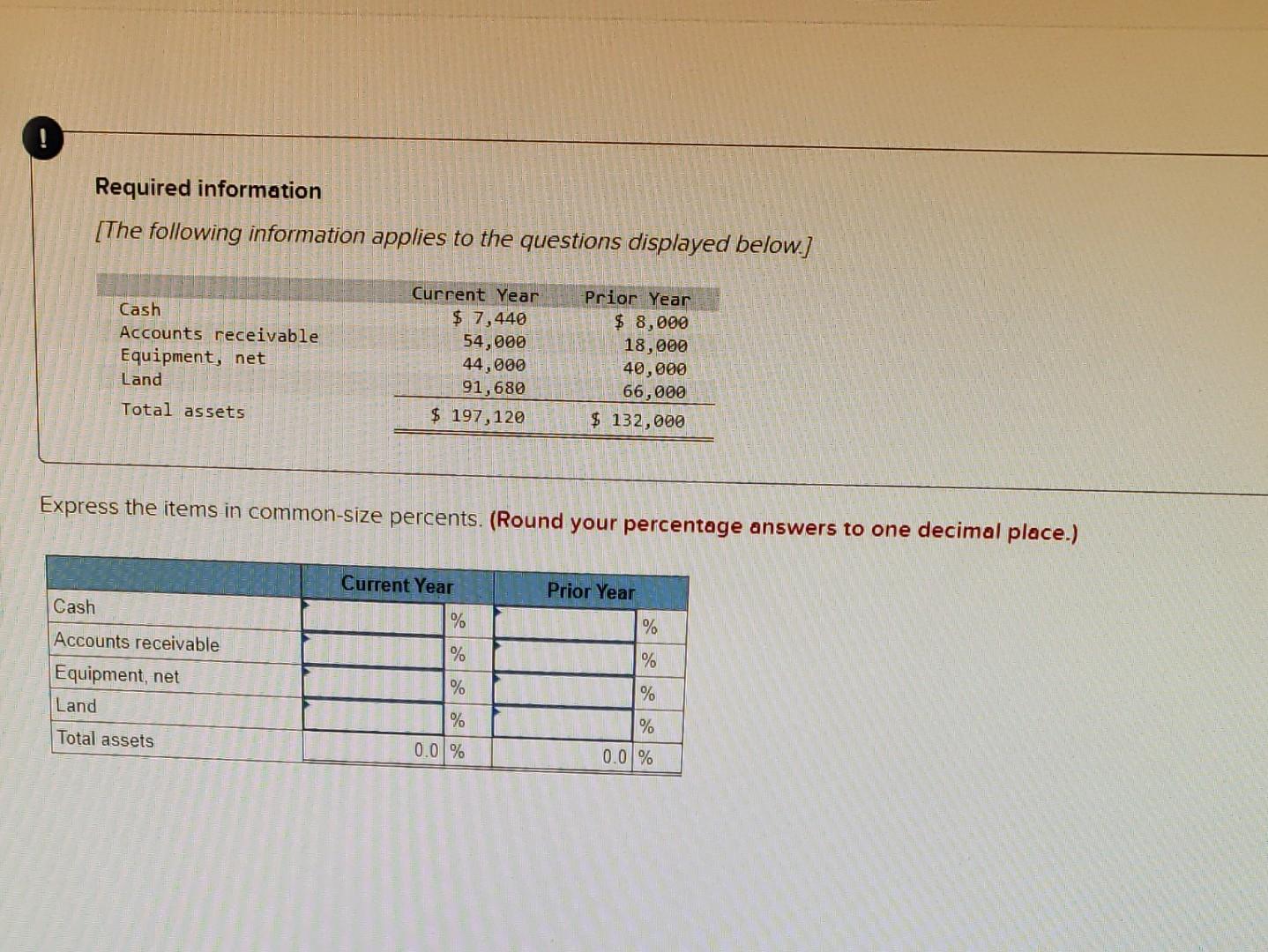

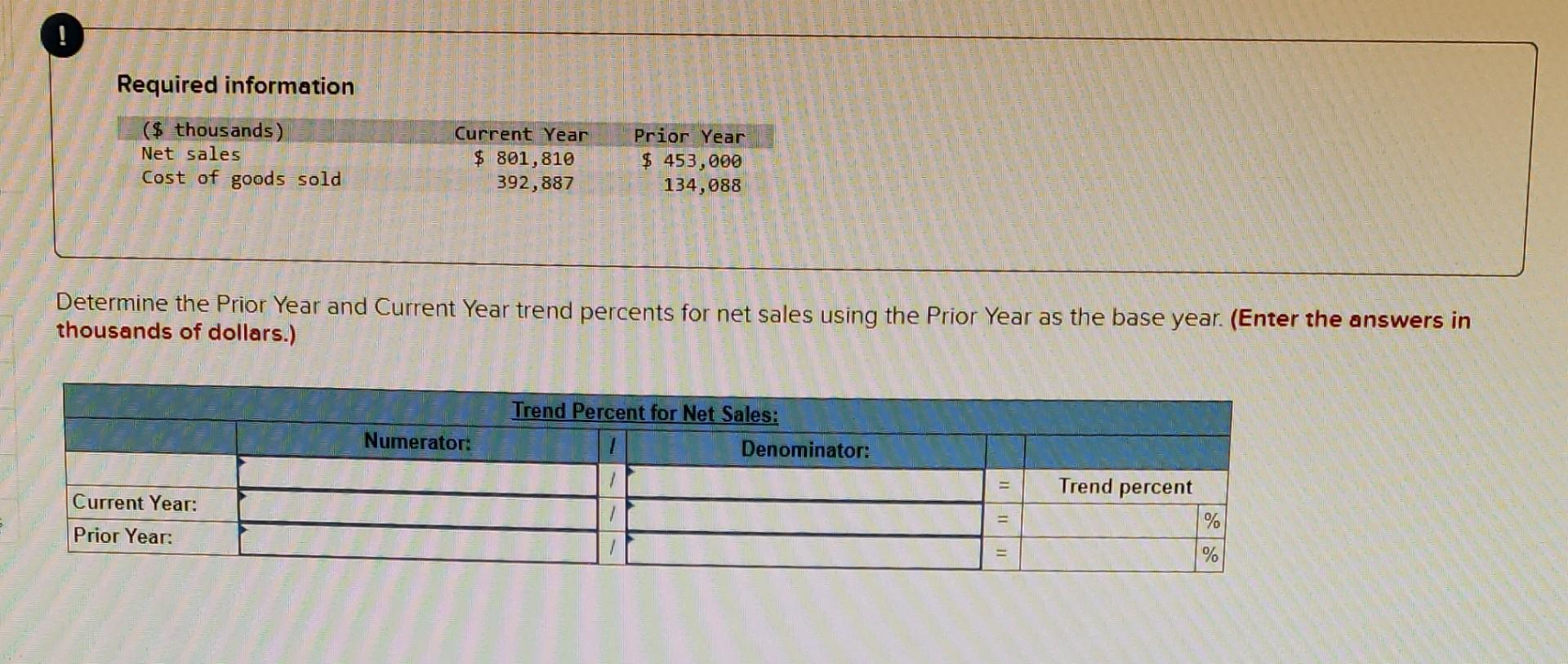

Required information [The following information applies to the questions displayed below.] Cash Accounts receivable Equipment, net Land Current Year $ 7,440 54,000 44,000 91,680 $ 197,120 Prior Year $ 8,000 18,000 40,000 66,000 $ 132,000 Total assets Compute the annual dollar changes and percent changes for each of the following items. (Decreases should be entered with a minus sign. Round your percentage answers to one decimal place.) Horizontal Analysis - Calculation of Percent Change Numerator: 1 Denominator: Percent change = / Current Year Prior Year Dollar Change Percent Change % Cash $ $ 8.000 Accounts receivable 7,440 54,000 44,000 18,000 % 40,000 % Equipment, net Land 91,680 66.000 % Total assets $ 197,120 $ 132,000 % Required information [The following information applies to the questions displayed below.] Cash Accounts receivable Equipment, net Land Current Year $ 7,440 54,000 44,000 91,680 $ 197,120 Prior Year $ 8,000 18,000 40,000 66,000 $ 132,000 Total assets Express the items in common-size percents. (Round your percentage answers to one decimal place.) Current Year Prior Year Cash % % % % Accounts receivable Equipment, net Land % % % % Total assets 0.0 % 0.0 % Required information ($ thousands) Net sales Cost of goods sold Current Year $ 801,810 392,887 Prior Year $ 453,000 134,088 Determine the Prior Year and Current Year trend percents for net sales using the Prior Year as the base year. (Enter the answers in thousands of dollars.) Trend Percent for Net Sales: Numerator: Denominator: Trend percent Current Year: = = = II % Prior Year: %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started