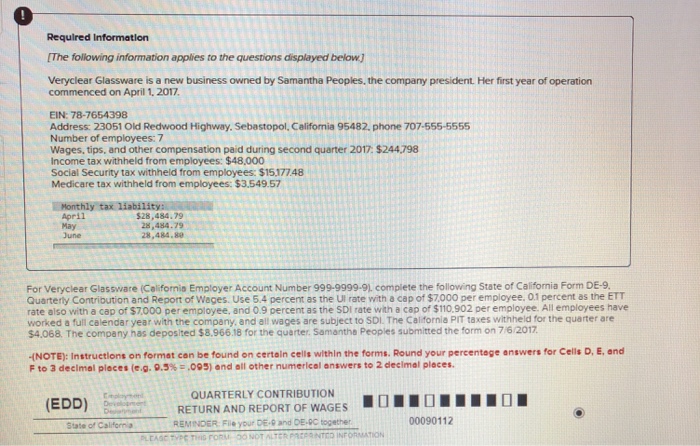

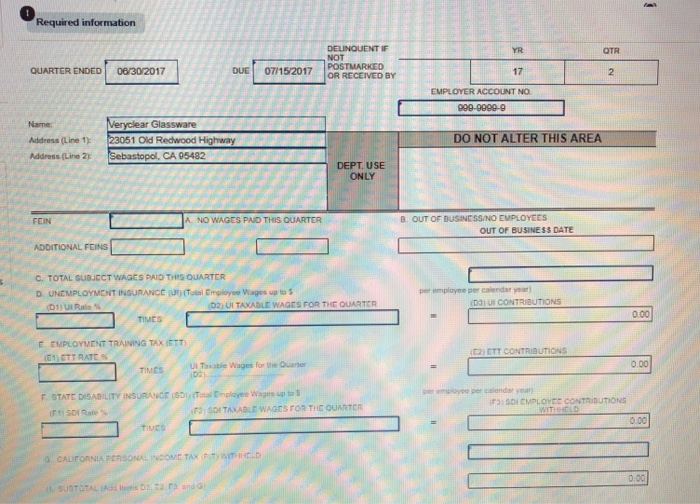

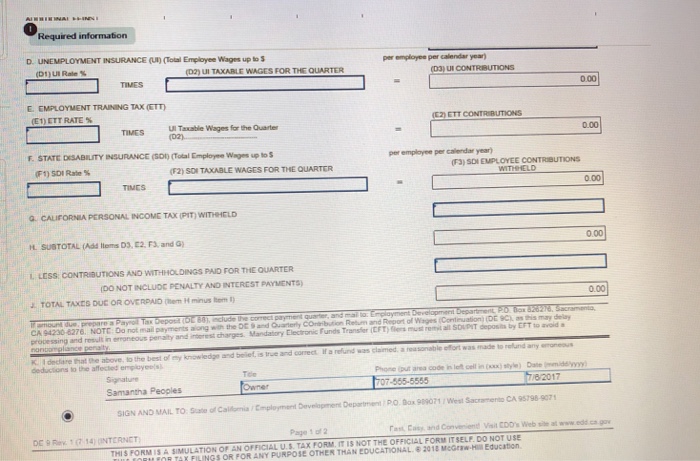

Required Information The following information applies to the questions displayed below) Veryclear Glassware is a new business owned by Samantha Peoples, the company president. Her first year of operation commenced on April 1, 2017. EIN: 78-7654398 Address: 23051 Old Redwood Highway. Sebastopol, Califormia 95482. phone 707-555-5555 Number of employees: 7 Wages, tips, and other compensation paid during second quarter 2017: $244.798 Income tax withheld from employees: $48,000 Social Security tax withheld from employees: $1517748 Medicare tax withheld from employees:$3.549.57 Monthly tax liabil April May June $28,484.79 28,484.79 28,484.8 For Veryclear Glassware (Celifornis Employer Account Number 999-9999-9) complete the following State of California Form DE-9. Quarterly Contribution and Report of Wages. Use 5.4 percent as the Ul rate with a cap of $7000 per employee, 0.1 percent as the ETT rate also with a cap of $7000 per employee, and 0.9 percent as the SDI rate with a cap of $110.902 per employee. All employees have worked a full calendar year with the company, and all wages are subject to SDI. The California PIT taxes withheld for the quarter are $4.068 The company has deposited $8.966.18 for the quarter. Samanthe Peopies submitted the form on 7/6/2017 -(NOTE): Instruetions on format con be found on certain cells within the forms. Round your percentage answers for Cells D, E, and F to 3 decimal places (e.g9.5% : .095)nd ell other numericel answers to 2 deelmal pleces. QUARTERLY CONTRIBUTION RETURN AND REPORT OF WAGES []"[]""11. (EDD State of California REMINDER File your DE-9 and DE-DC together 00090112 Required Information The following information applies to the questions displayed below) Veryclear Glassware is a new business owned by Samantha Peoples, the company president. Her first year of operation commenced on April 1, 2017. EIN: 78-7654398 Address: 23051 Old Redwood Highway. Sebastopol, Califormia 95482. phone 707-555-5555 Number of employees: 7 Wages, tips, and other compensation paid during second quarter 2017: $244.798 Income tax withheld from employees: $48,000 Social Security tax withheld from employees: $1517748 Medicare tax withheld from employees:$3.549.57 Monthly tax liabil April May June $28,484.79 28,484.79 28,484.8 For Veryclear Glassware (Celifornis Employer Account Number 999-9999-9) complete the following State of California Form DE-9. Quarterly Contribution and Report of Wages. Use 5.4 percent as the Ul rate with a cap of $7000 per employee, 0.1 percent as the ETT rate also with a cap of $7000 per employee, and 0.9 percent as the SDI rate with a cap of $110.902 per employee. All employees have worked a full calendar year with the company, and all wages are subject to SDI. The California PIT taxes withheld for the quarter are $4.068 The company has deposited $8.966.18 for the quarter. Samanthe Peopies submitted the form on 7/6/2017 -(NOTE): Instruetions on format con be found on certain cells within the forms. Round your percentage answers for Cells D, E, and F to 3 decimal places (e.g9.5% : .095)nd ell other numericel answers to 2 deelmal pleces. QUARTERLY CONTRIBUTION RETURN AND REPORT OF WAGES []"[]""11. (EDD State of California REMINDER File your DE-9 and DE-DC together 00090112