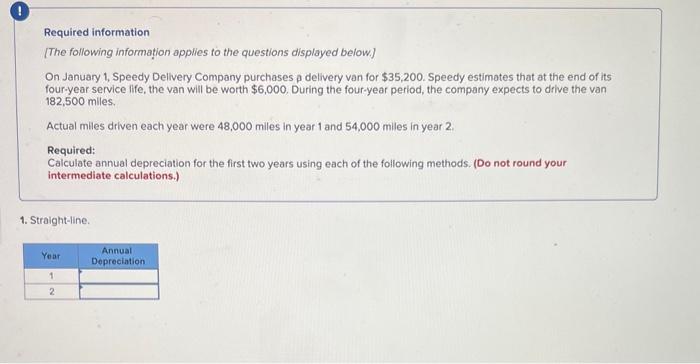

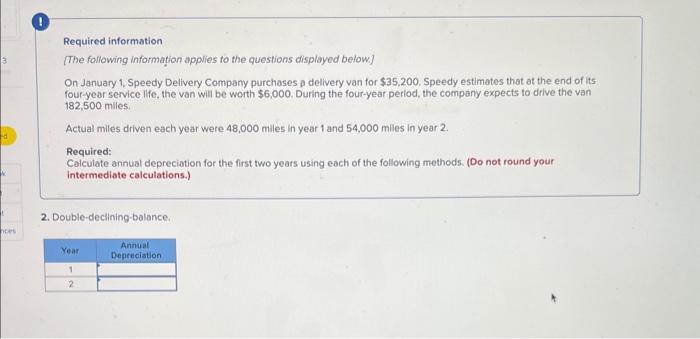

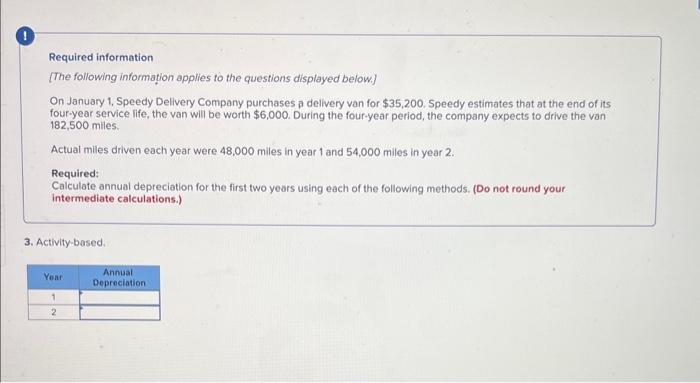

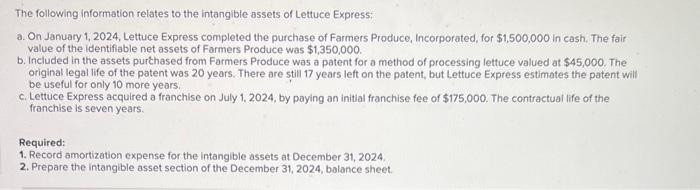

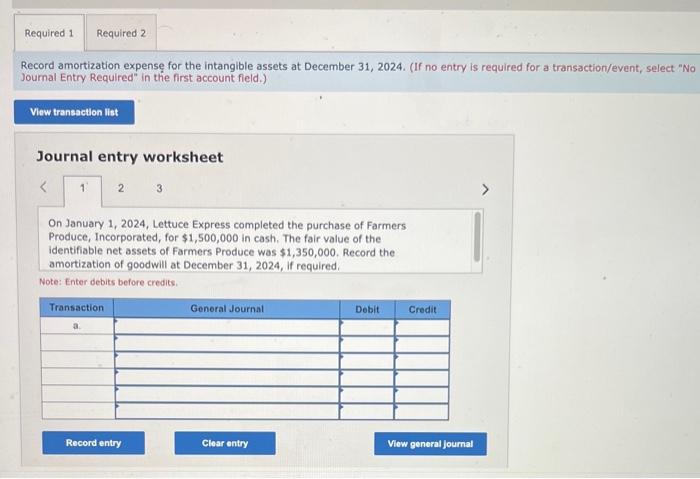

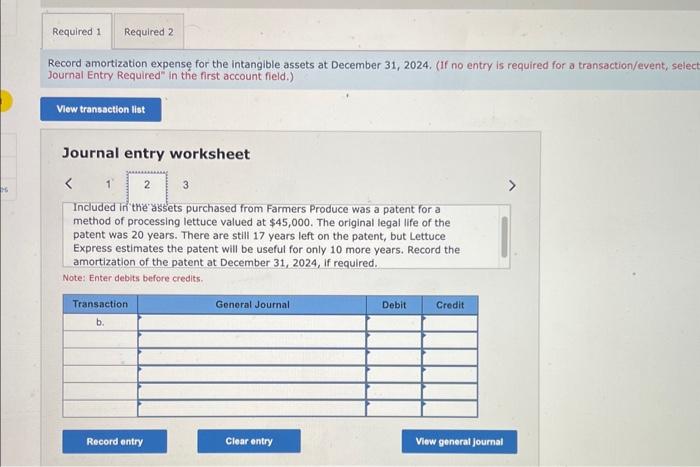

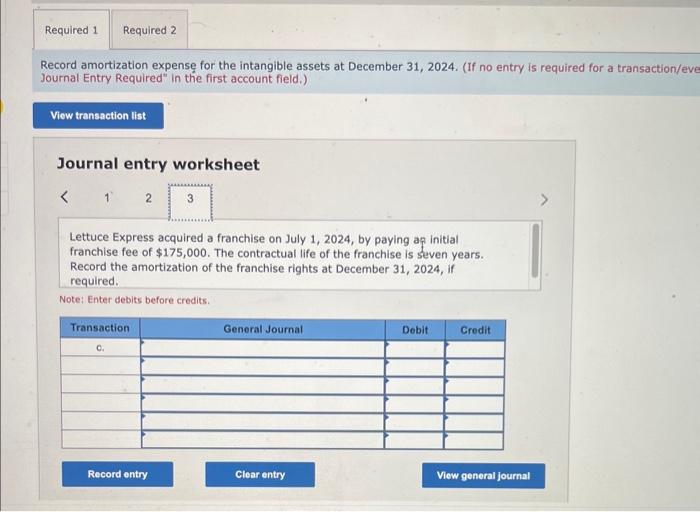

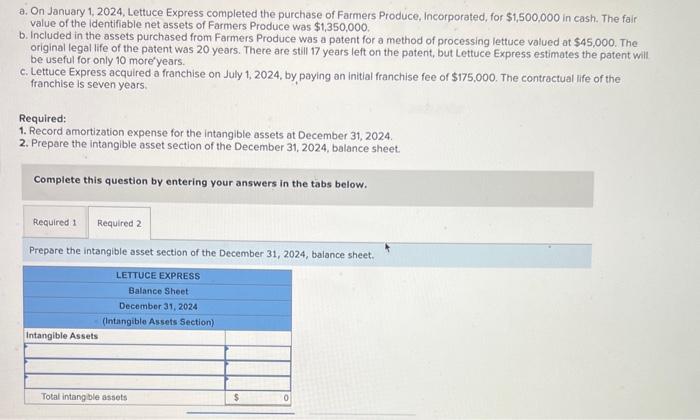

Required information [The following information applies to the questions displayed below.] On January 1, Speedy Delvery Company purchases delivery van for $35,200. Speedy estimates that at the end of its four-year service life, the van will be worth $6,000. During the four-year period, the company expects to difve the van 182,500 miles. Actual miles driven each year were 48,000 miles in year 1 and 54,000 miles in year 2. Required: Calculate annual depreciation for the first two years using each of the following methods. (Do not round your intermediate calculations.) 1. Straight-line. Required information [The following information applies to the questions displayed below.] On January 1, Speedy Delivery Company purchases a delivery van for $35,200. Speedy estimates that at the enid of its four-year service life, the van will be worth $6,000. During the four-year period, the company expects to drive the van 182,500 miles: Actual miles driven each year were 48,000 miles in year 1 and 54,000 miles in year 2. Required: Calculate annual depreciation for the first two years using each of the following methods. (Do not round your intermediate calculations.) 2. Double-declining-balance, Required information [The following information applies to the questions displayed below.] On January 1, Speedy Delivery Company purchases a delivery van for $35,200. Speedy estimates that at the end of its four-year service life, the van will be worth $6,000. During the four-year period, the company expects to drive the van 182,500 miles. Actual miles driven each year were 48,000 miles in year 1 and 54,000 miles in year 2. Required: Calculate annual depreciation for the first two years using each of the following methods. (Do not round your intermediate calculations.) 3. Activity-based. The following information relates to the intangible assets of Lettuce Express: a. On January 1, 2024, Lettuce Express completed the purchase of Farmers Produce, Incorporated, for $1,500,000 in cash. The fair value of the identifiable net assets of Farmers Produce was $1,350,000. b. Included in the assets purchased from Farmers Produce was a patent for a method of processing lettuce valued at $45,000. The original legal life of the patent was 20 years. There are still 17 years left on the patent, but Lettuce Express estimates the patent will be useful for only 10 more years. c. Lettuce Express acquired a franchise on July 1, 2024, by paying an initial franchise fee of $175,000. The contractual life of the franchise is seven years. Required: 1. Record amortization expense for the Intangible assets at December 31, 2024 . 2. Prepare the intangible asset section of the December 31, 2024, balance sheet. Record amortization expens for the intangible assets at December 31, 2024. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account fleld.) Journal entry worksheet On January 1, 2024, Lettuce Express completed the purchase of Farmers Produce, Incorporated, for $1,500,000 in cash. The fair value of the identifiable net assets of Farmers Produce was $1,350,000. Record the amortization of goodwill at December 31,2024 , if required, Note: Enter debits before credits. Record amortization expens for the intangible assets at December 31, 2024. (If no entry is required for a transaction/event, selec Journal Entry Required" in the first account field.) Journal entry worksheet Induded in the assets purchased from Farmers Produce was a patent for a method of processing lettuce valued at $45,000. The original legal life of the patent was 20 years. There are still 17 years left on the patent, but Lettuce Express estimates the patent will be useful for only 10 more years. Record the amortization of the patent at December 31,2024 , if required. Note: Enter debits before credits. Record amortization expens for the intangible assets at December 31, 2024. (If no entry is required for a transaction/eve Journal Entry Required" in the first account field.) Journal entry worksheet Lettuce Express acquired a franchise on July 1, 2024, by paying ap initial franchise fee of $175,000. The contractual life of the franchise is seven years. Record the amortization of the franchise rights at December 31,2024 , if required. Note: Enter debits before credits. a. On January 1, 2024, Lettuce Express completed the purchase of Farmers Produce, Incorporated, for $1,500,000 in cash. The fair value of the identifiable net assets of Farmers Produce was $1,350,000. b. Included in the assets purchased from Farmers Produce was a patent for a method of processing lettuce valued at $45,000. The original legal life of the patent was 20 years. There are still 17 years left on the patent, but Lettuce Express estimates the patent will be useful for only 10 more'years. c. Lettuce Express acquired a franchise on July 1, 2024, by paying an initial franchise fee of $175,000. The contractual life of the franchise is seven years. Required: 1. Record amortization expense for the intangible assets at December 31,2024. 2. Prepare the intangible asset section of the December 31,2024 , balance sheet. Complete this question by entering your answers in the tabs below. Prepare the intangible asset section of the December 31,2024 , balance sheet