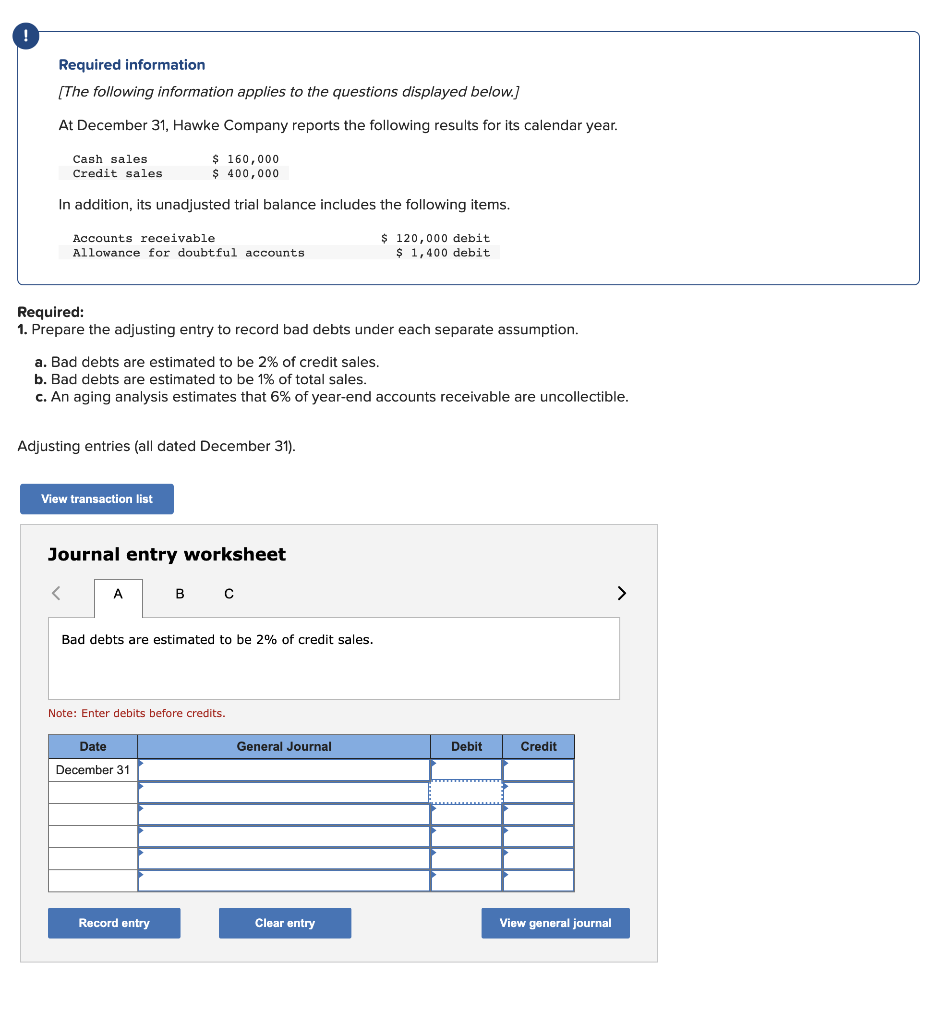

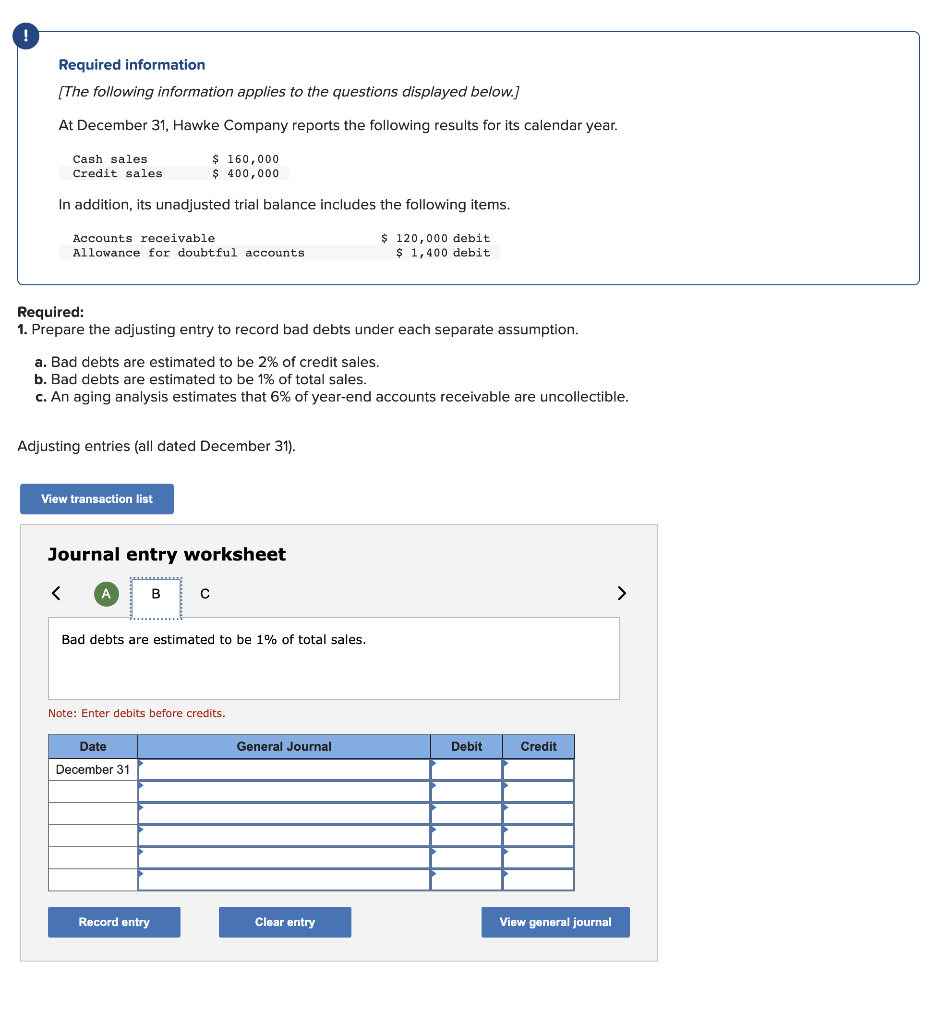

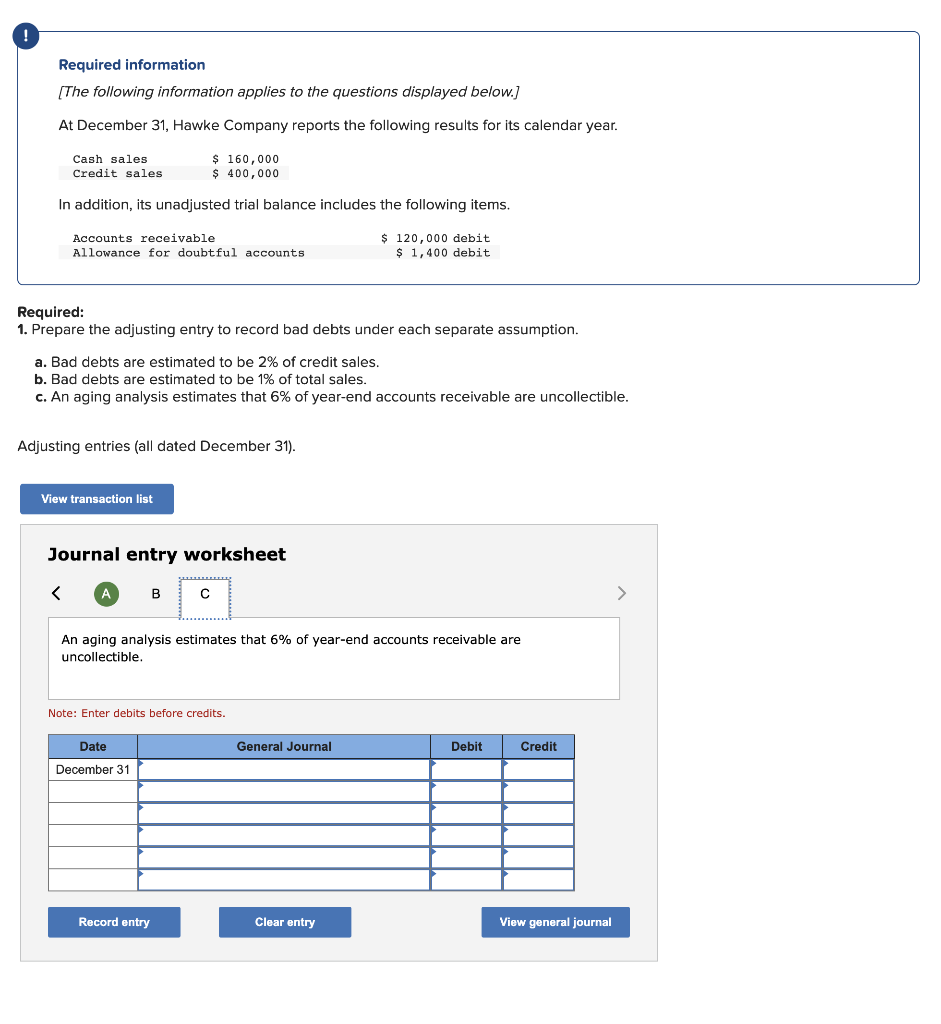

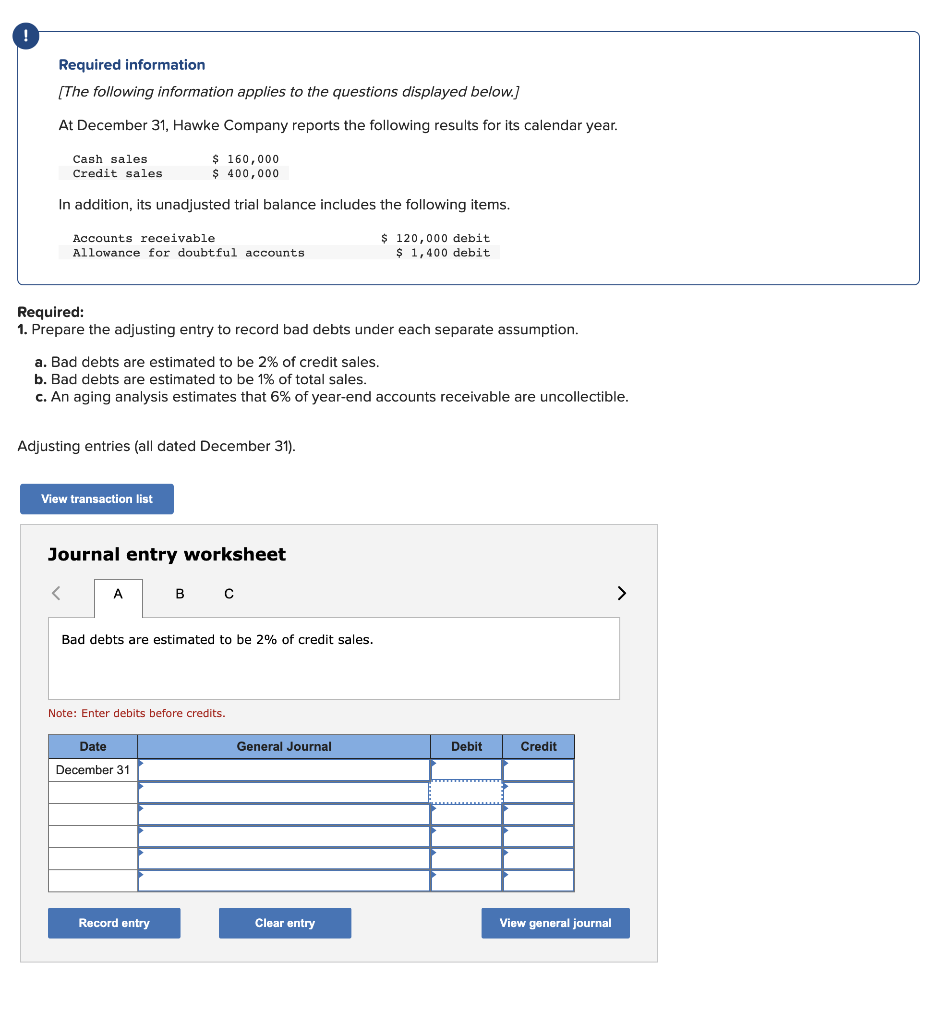

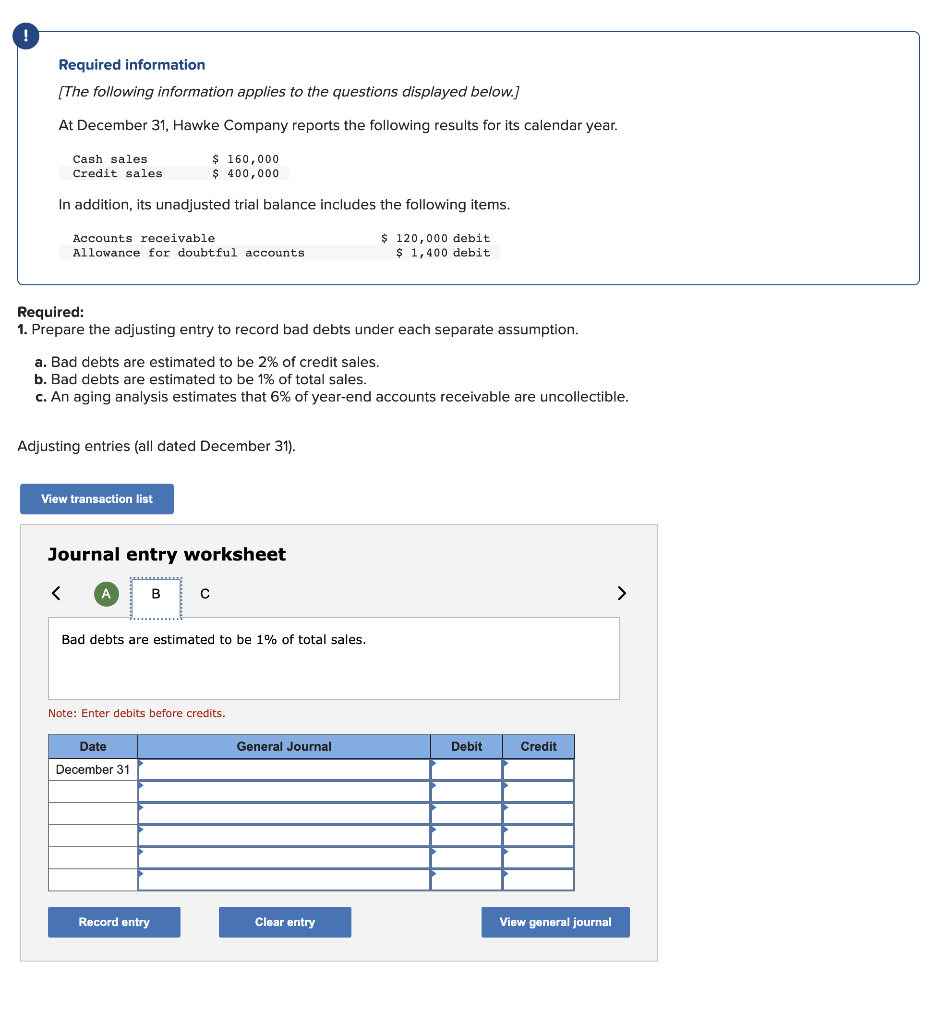

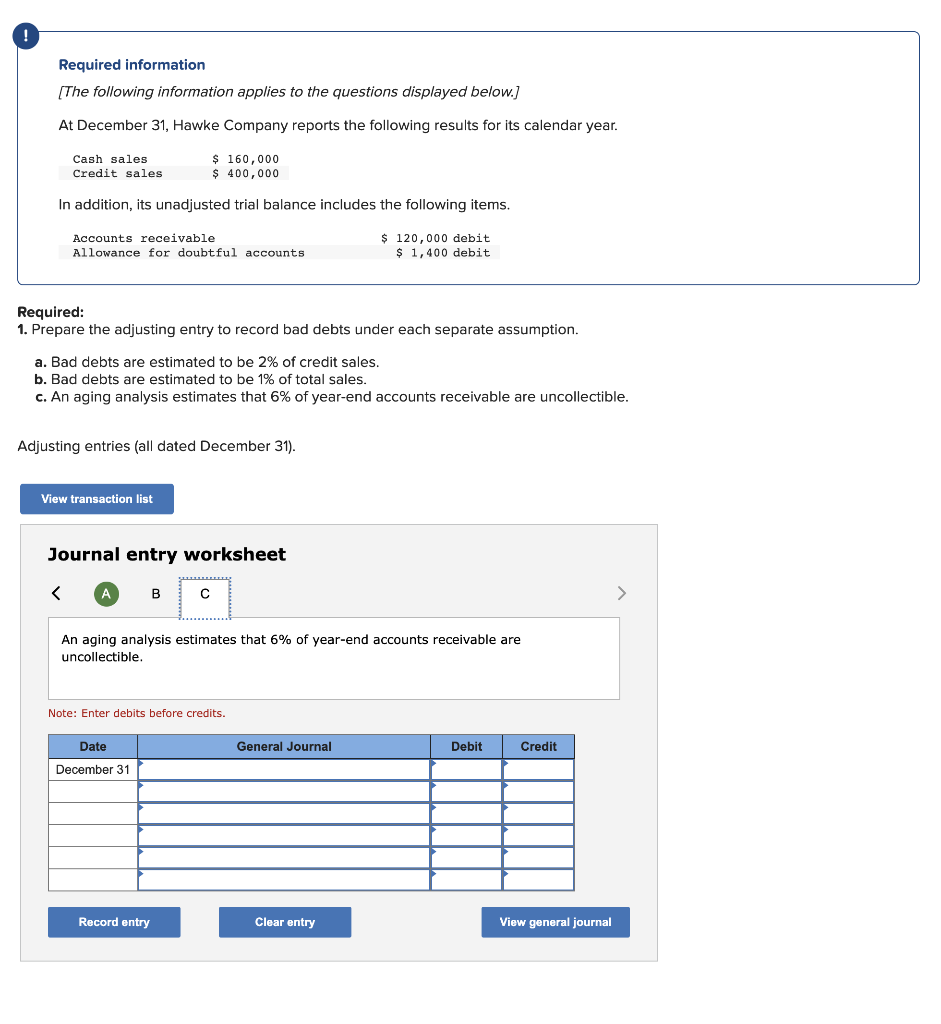

Required information [The following information applies to the questions displayed below.] At December 31, Hawke Company reports the following results for its calendar year. In addition, its unadjusted trial balance includes the following items. AccountsreceivableAllowancefordoubtfulaccounts$120,000debit$1,400debit Required: 1. Prepare the adjusting entry to record bad debts under each separate assumption. a. Bad debts are estimated to be 2% of credit sales. b. Bad debts are estimated to be 1% of total sales. c. An aging analysis estimates that 6% of year-end accounts receivable are uncollectible. Adjusting entries (all dated December 31). Journal entry worksheet Bad debts are estimated to be 2% of credit sales. Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] At December 31, Hawke Company reports the following results for its calendar year. In addition, its unadjusted trial balance includes the following items. AccountsreceivableAllowancefordoubtfulaccounts$120,000debit$1,400debit Required: 1. Prepare the adjusting entry to record bad debts under each separate assumption. a. Bad debts are estimated to be 2% of credit sales. b. Bad debts are estimated to be 1% of total sales. c. An aging analysis estimates that 6% of year-end accounts receivable are uncollectible. Adjusting entries (all dated December 31). Journal entry worksheet Bad debts are estimated to be 1% of total sales. Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] At December 31, Hawke Company reports the following results for its calendar year. In addition, its unadjusted trial balance includes the following items. AccountsreceivableAllowancefordoubtfulaccounts$120,000debit$1,400debit Required: 1. Prepare the adjusting entry to record bad debts under each separate assumption. a. Bad debts are estimated to be 2% of credit sales. b. Bad debts are estimated to be 1% of total sales. c. An aging analysis estimates that 6% of year-end accounts receivable are uncollectible. Adjusting entries (all dated December 31). Journal entry worksheet An aging analysis estimates that 6% of year-end accounts receivable are uncollectible. Note: Enter debits before credits