Answered step by step

Verified Expert Solution

Question

1 Approved Answer

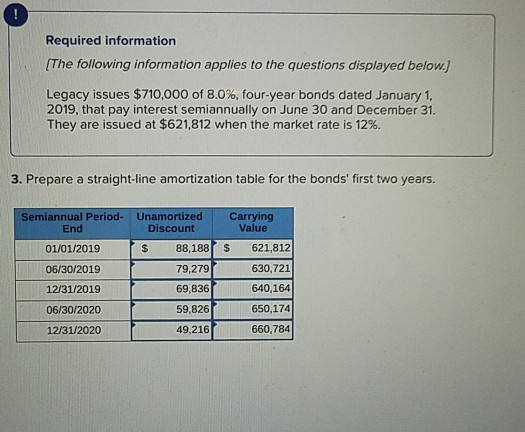

Required information [The following information applies to the questions displayed below.) Legacy issues $710,000 of 8.0%, four-year bonds dated January 1. 2019, that pay interest

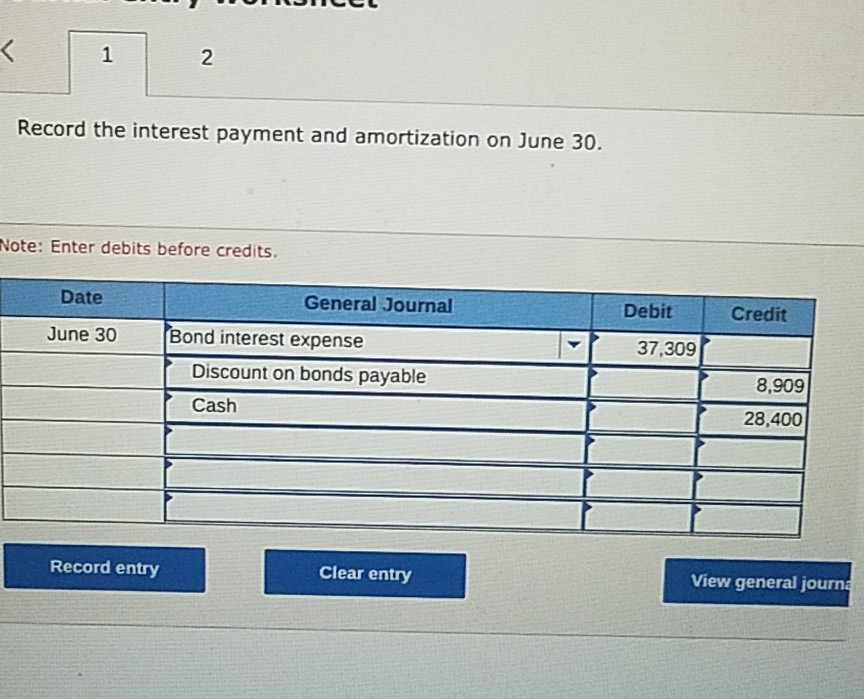

Required information [The following information applies to the questions displayed below.) Legacy issues $710,000 of 8.0%, four-year bonds dated January 1. 2019, that pay interest semiannually on June 30 and December 31. They are issued at $621,812 when the market rate is 12%. 3. Prepare a straight-line amortization table for the bonds' first two years. Semiannual Period- Unamortized End Discount 01/01/2019 $ 88,188 06/30/2019 79,279 12/31/2019 69,836 06/30/2020 59,826 12/31/2020 49,216 Carrying Value $ 621,812 630,721 640,164 650,174 660,784 -VINUICEU Record the interest payment and amortization on June 30. Vote: Enter debits before credits. Date Credit General Journal Bond interest expense Discount on bonds payable Debit 37,309/ June 30 8,909 Cash 28,400 Record entry Clear entry View general journa Record the interest payment and amortization on December 31. Note: Enter debits before credits. Date General Journal Debit Credit December 31 Record entry Clear entry View general jou

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started