Answered step by step

Verified Expert Solution

Question

1 Approved Answer

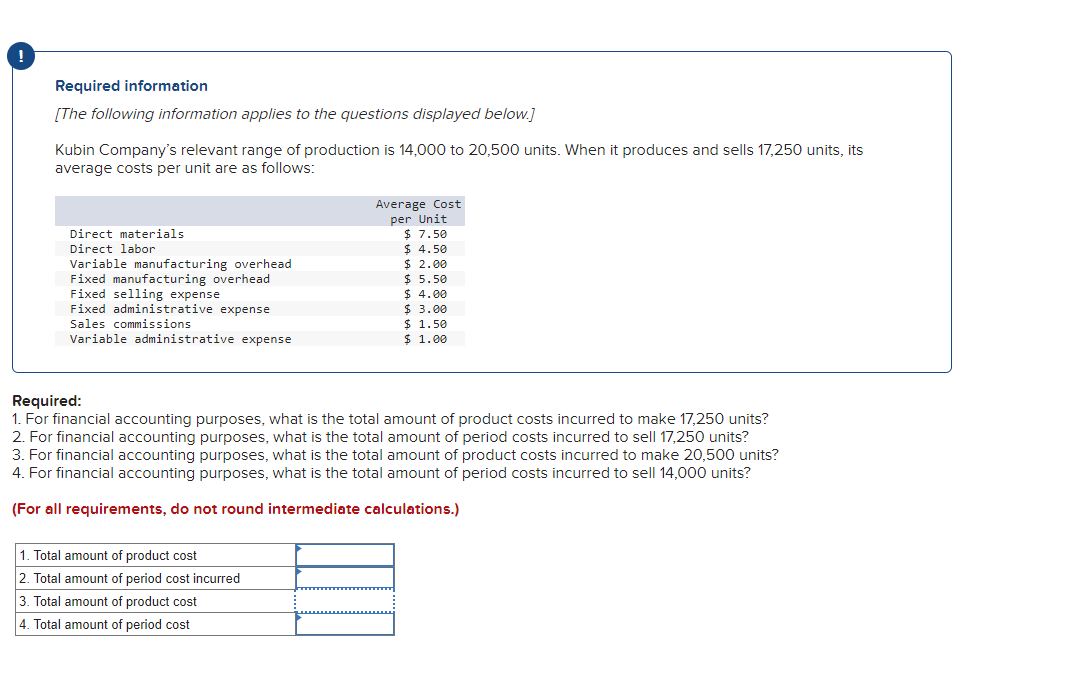

Required information [The following information applies to the questions displayed below.] Kubin Company's relevant range of production is 14,000 to 20,500 units. When it produces

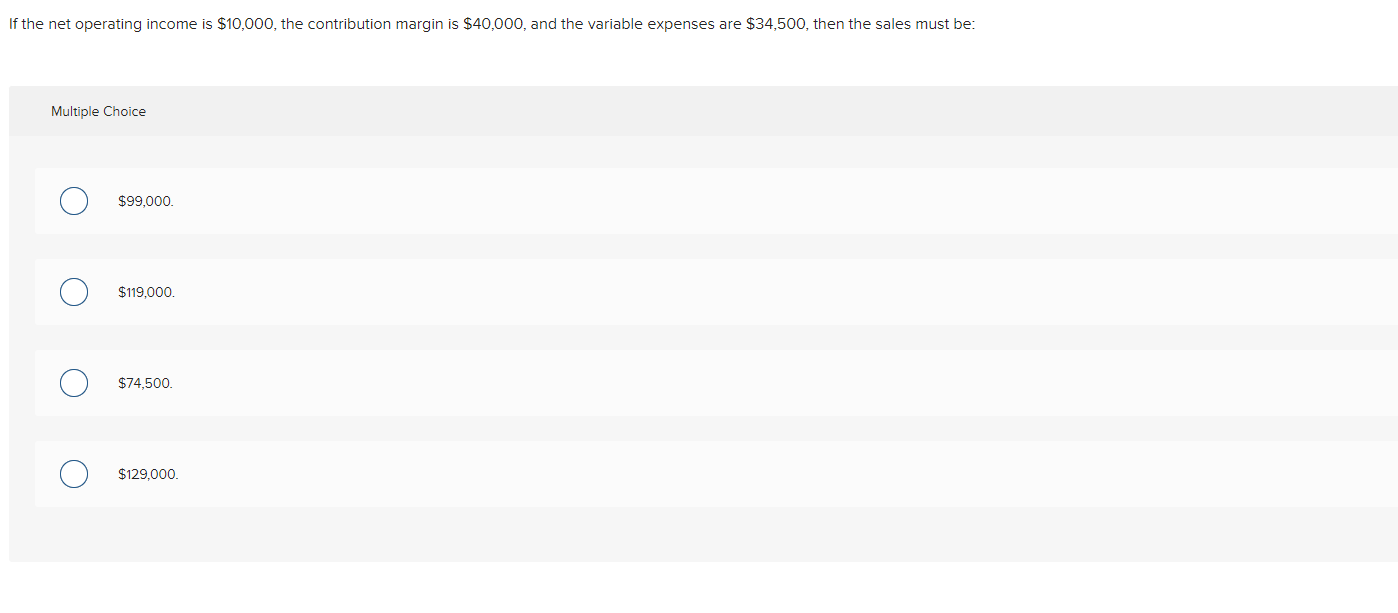

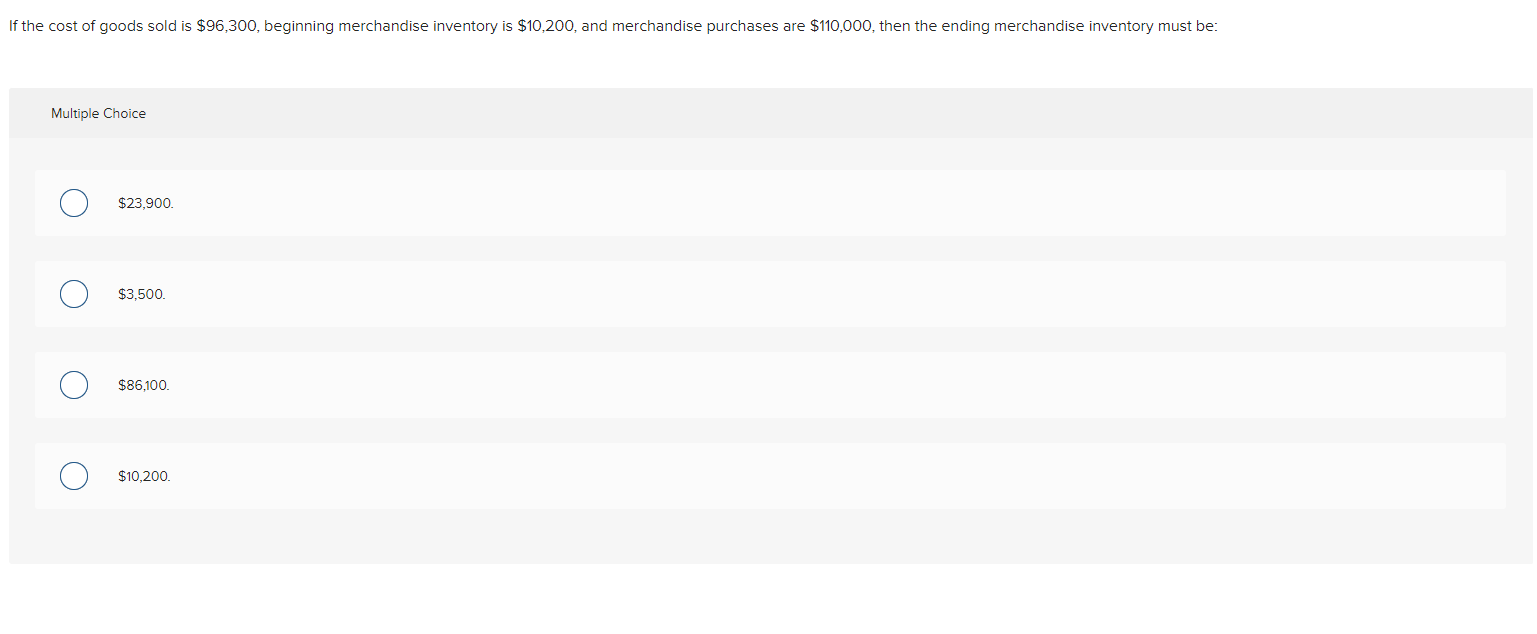

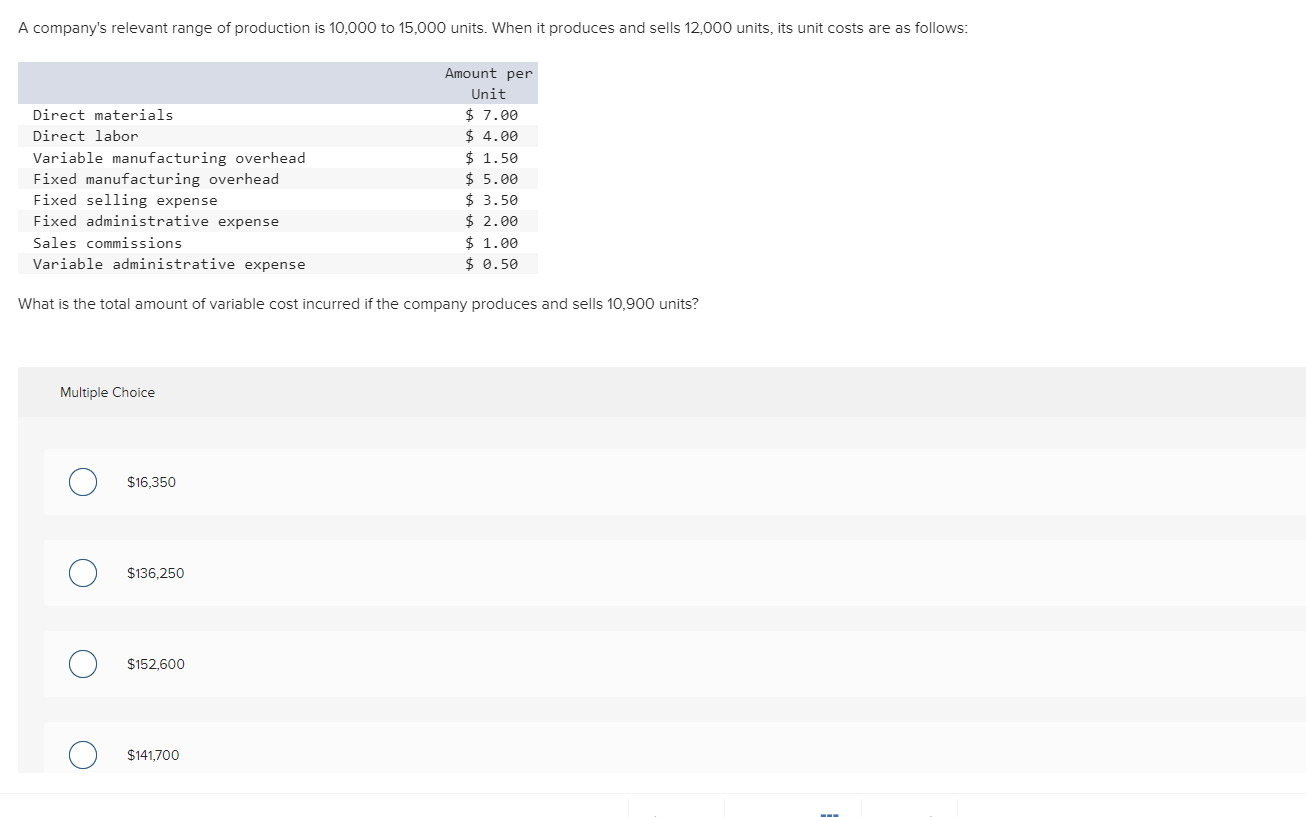

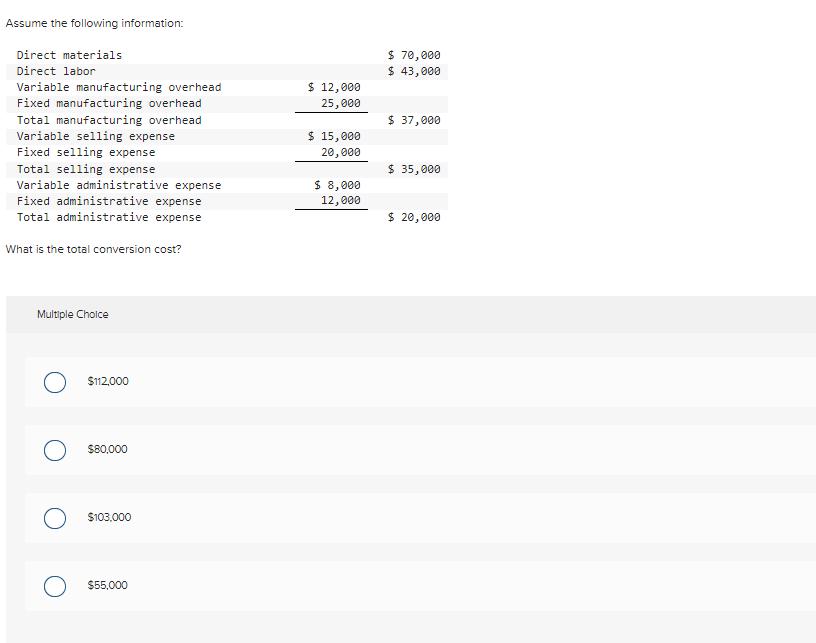

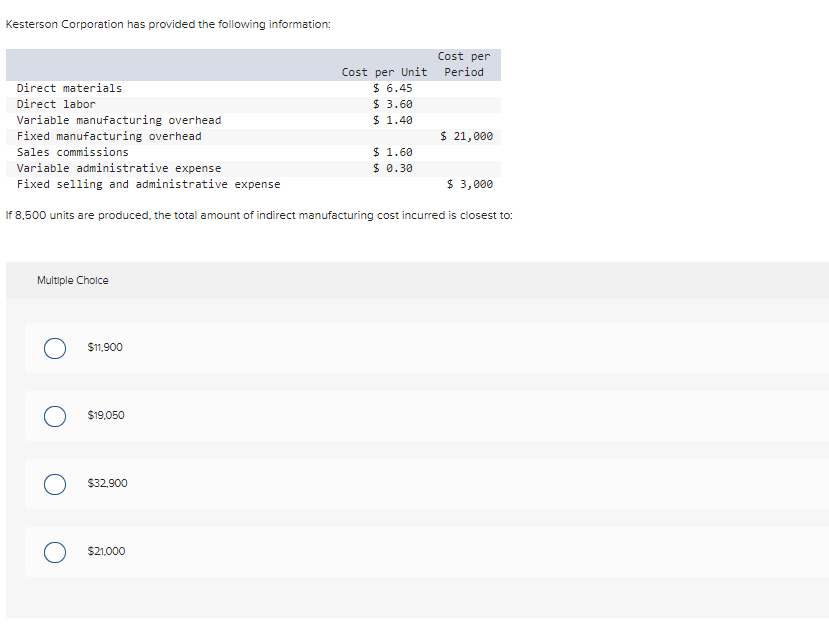

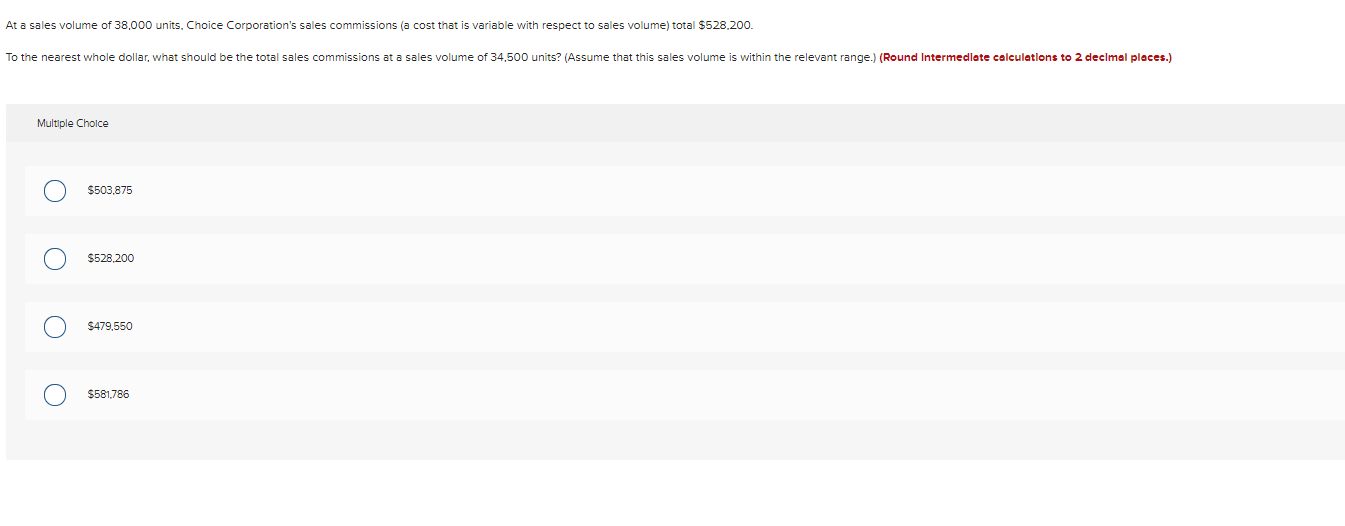

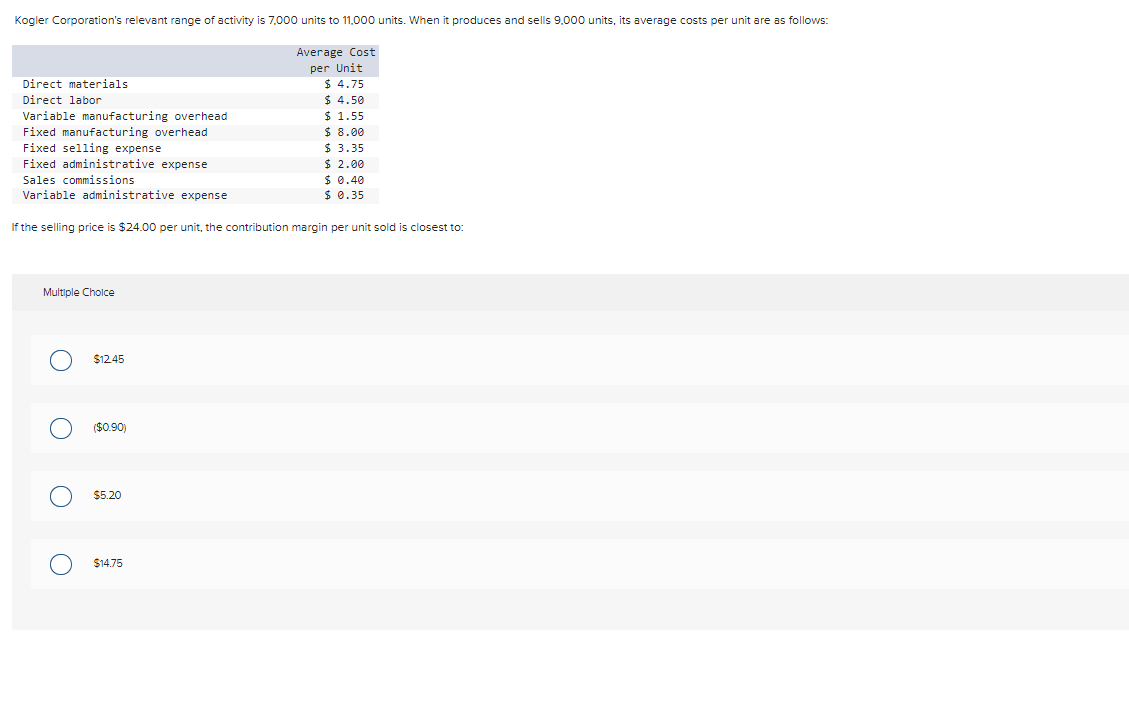

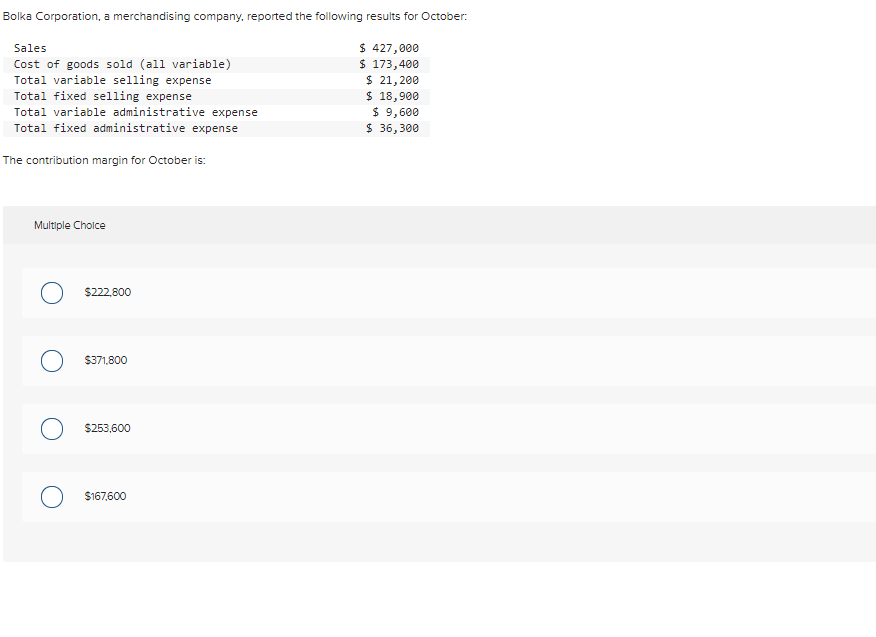

Required information [The following information applies to the questions displayed below.] Kubin Company's relevant range of production is 14,000 to 20,500 units. When it produces and sells 17,250 units, its average costs per unit are as follows: Required: 1. For financial accounting purposes, what is the total amount of product costs incurred to make 17,250 units? 2. For financial accounting purposes, what is the total amount of period costs incurred to sell 17,250 units? 3. For financial accounting purposes, what is the total amount of product costs incurred to make 20,500 units? 4. For financial accounting purposes, what is the total amount of period costs incurred to sell 14,000 units? (For all requirements, do not round intermediate calculations.) the net operating income is $10,000, the contribution margin is $40,000, and the variable expenses are $34,500, then the sales must be: Multiple Choice $99,000. $119,000. $74,500. $129,000. If the cost of goods sold is $96,300, beginning merchandise inventory is $10,200, and merchandise purchases are $110,000, then the ending merchandise inventory must be: Multiple Choice $23,900. $3,500. $86,100. $10,200. What is the total amount of variable cost incurred if the company produces and sells 10,900 units? Multiple Choice $16,350 $136,250 $152,600 $141,700 Assume the following information: What is the total conversion cost? Multiple Choice $112,000 $80,000 $103,000 $55,000 Kesterson Corporation has provided the following information: If 8,500 units are produced, the total amount of indirect manufacturing cost incurred is closest to: Multiple Cholce $11,900 $19,050 $32,900 $21,000 At a sales volume of 38,000 units, Choice Corporation's sales commissions (a cost that is variable with respect to sales volume) total $528,200. Multiple Choice $503,875 $528,200 $479,550 $581,786 If the selling price is $24.00 per unit, the contribution margin per unit sold is closest to: Multiple Choice $1245 ($0.90) $5.20 $14.75 Bolka Corporation, a merchandising company, reported the following results for October: The contribution margin for October is: Multiple Choice $222,800 $371,800 $253,600 $167,600

Required information [The following information applies to the questions displayed below.] Kubin Company's relevant range of production is 14,000 to 20,500 units. When it produces and sells 17,250 units, its average costs per unit are as follows: Required: 1. For financial accounting purposes, what is the total amount of product costs incurred to make 17,250 units? 2. For financial accounting purposes, what is the total amount of period costs incurred to sell 17,250 units? 3. For financial accounting purposes, what is the total amount of product costs incurred to make 20,500 units? 4. For financial accounting purposes, what is the total amount of period costs incurred to sell 14,000 units? (For all requirements, do not round intermediate calculations.) the net operating income is $10,000, the contribution margin is $40,000, and the variable expenses are $34,500, then the sales must be: Multiple Choice $99,000. $119,000. $74,500. $129,000. If the cost of goods sold is $96,300, beginning merchandise inventory is $10,200, and merchandise purchases are $110,000, then the ending merchandise inventory must be: Multiple Choice $23,900. $3,500. $86,100. $10,200. What is the total amount of variable cost incurred if the company produces and sells 10,900 units? Multiple Choice $16,350 $136,250 $152,600 $141,700 Assume the following information: What is the total conversion cost? Multiple Choice $112,000 $80,000 $103,000 $55,000 Kesterson Corporation has provided the following information: If 8,500 units are produced, the total amount of indirect manufacturing cost incurred is closest to: Multiple Cholce $11,900 $19,050 $32,900 $21,000 At a sales volume of 38,000 units, Choice Corporation's sales commissions (a cost that is variable with respect to sales volume) total $528,200. Multiple Choice $503,875 $528,200 $479,550 $581,786 If the selling price is $24.00 per unit, the contribution margin per unit sold is closest to: Multiple Choice $1245 ($0.90) $5.20 $14.75 Bolka Corporation, a merchandising company, reported the following results for October: The contribution margin for October is: Multiple Choice $222,800 $371,800 $253,600 $167,600 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started