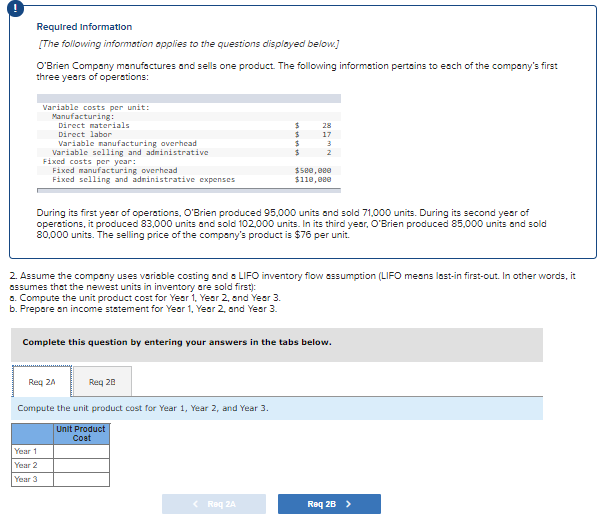

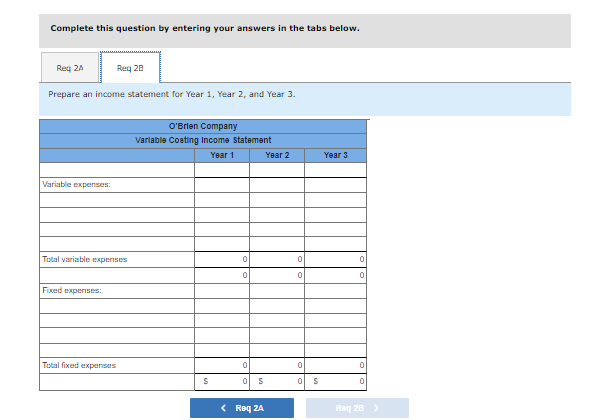

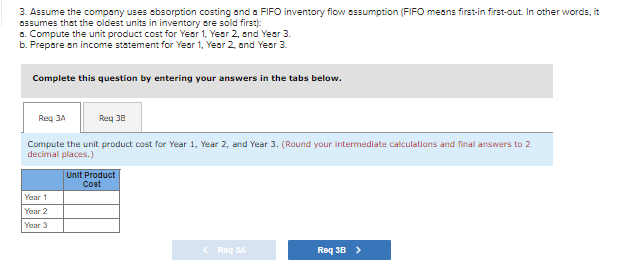

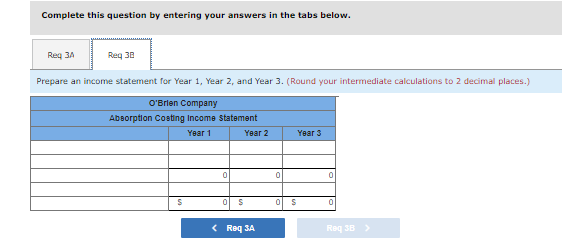

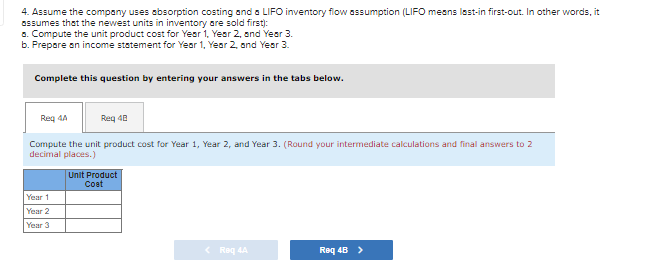

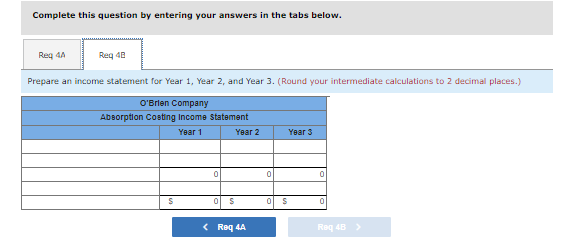

Required Information [The following information applies to the questions displayed below] O'Brien Company manufactures and sells one product. The following information pertains to each of the company's first three years of operations: Variable costs per unit: Manufacturing : Direct materials 28 Direct labor 17 Variable manufacturing overhead 3 Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead $580, 080 Fixed selling and administrative expenses $118, 080 During its first year of operations, O'Brien produced 95,000 units and sold 71,000 units. During its second year of operations, it produced 83,000 units and sold 102,000 units. In its third year, O'Brien produced 85,000 units and sold 80,000 units. The selling price of the company's product is $76 per unit. 2. Assume the company uses variable costing and s LIFO inventory flow assumption (LIFO means lost-in first-out. In other words, it assumes that the newest units in inventory are sold first): 3. Compute the unit product cost for Year 1, Year 2, and Year 3. b. Prepare an income statement for Year 1, Year 2, and Year 3. Complete this question by entering your answers in the tabs below. Reg 2A Req 28 Compute the unit product cost for Year 1, Year 2, and Year 3. Unit Product Coat Year 1 Year 2 Year 3 Complete this question by entering your answers in the tabs below. Req 24 Req 28 Prepare an income statement for Year 1, Year 2, and Year 3. O'Brien Company Variable Coating Income Statement Year 1 Year 2 Year 3 Variable expenses: Total variable expenses 0 Fixed expenses: Total fixed expenses 0 5 0 5 Complete this question by entering your answers in the tabs below. Reg 3A Req 38 Prepare an income statement for Year 1, Year 2, and Year 3. (Round your intermediate calculations to 2 decimal places.) O'Brien Company Absorption Coating Income Statement Year 1 Z JBBA Year 3 0 S S 4. Assume the company uses absorption costing and s LIFO inventory flow assumption (LIFO means last-in first-out. In other words, it assumes that the newest units in inventory are sold first): a. Compute the unit product cost for Year 1, Year 2, and Year 3. b. Prepare on income statement for Year 1, Year 2, and Year 3. Complete this question by entering your answers in the tabs below. Req 4A Req 48 Compute the unit product cost for Year 1, Year 2, and Year 3. ( Round your intermediate calculations and final answers to 2 decimal places.) Unit Product Coat Year 1 Year 2 Year 3 Complete this question by entering your answers in the tabs below. Reg 4A Reg 48 Prepare an income statement for Year 1, Year 2, and Year 3. ( Round your intermediate calculations to 2 decimal places.) O'Brien Company Absorption Coating Income Statement Year 1 Year 2 Year 3 0