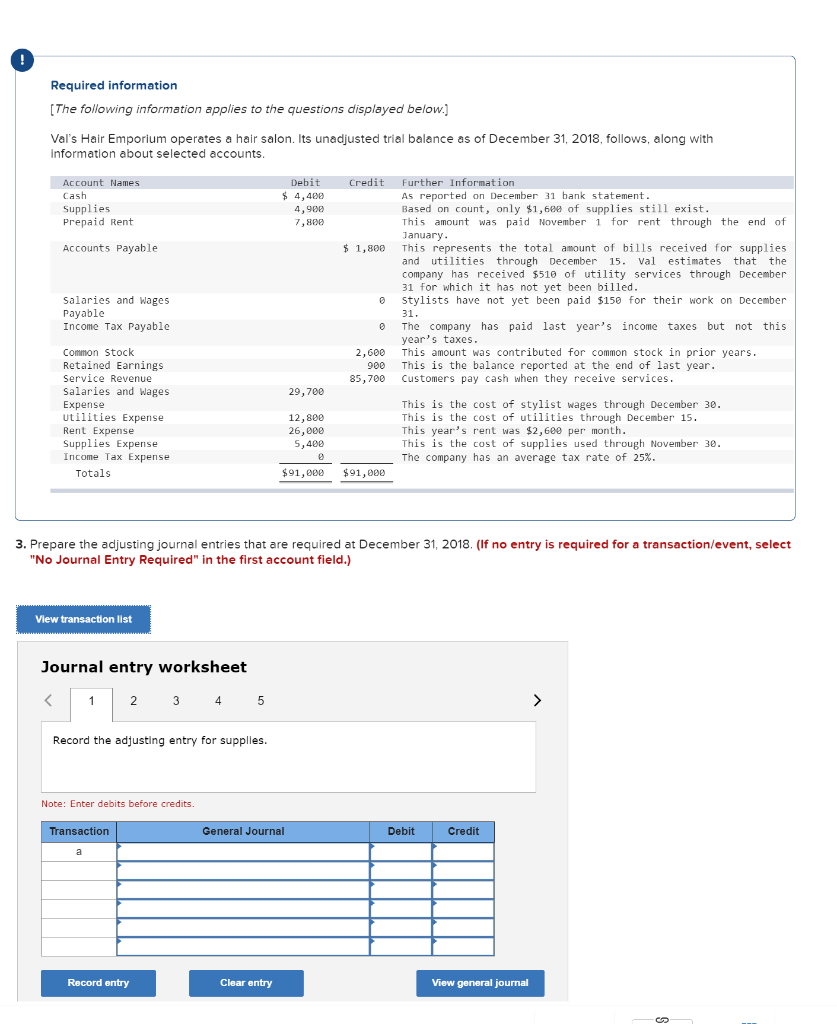

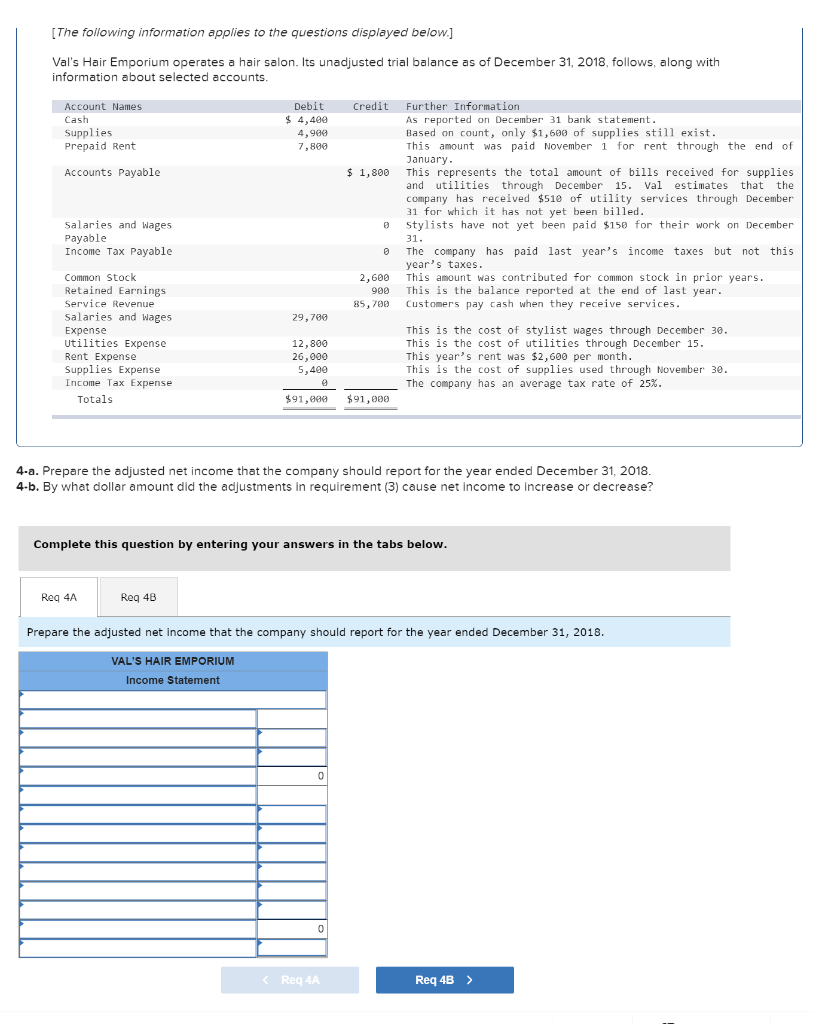

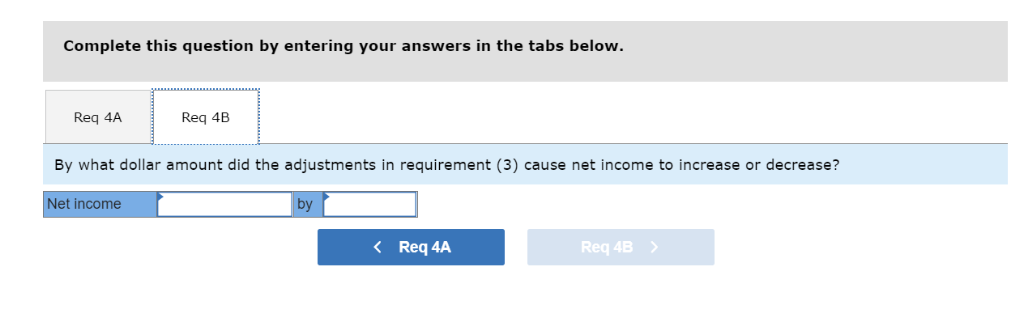

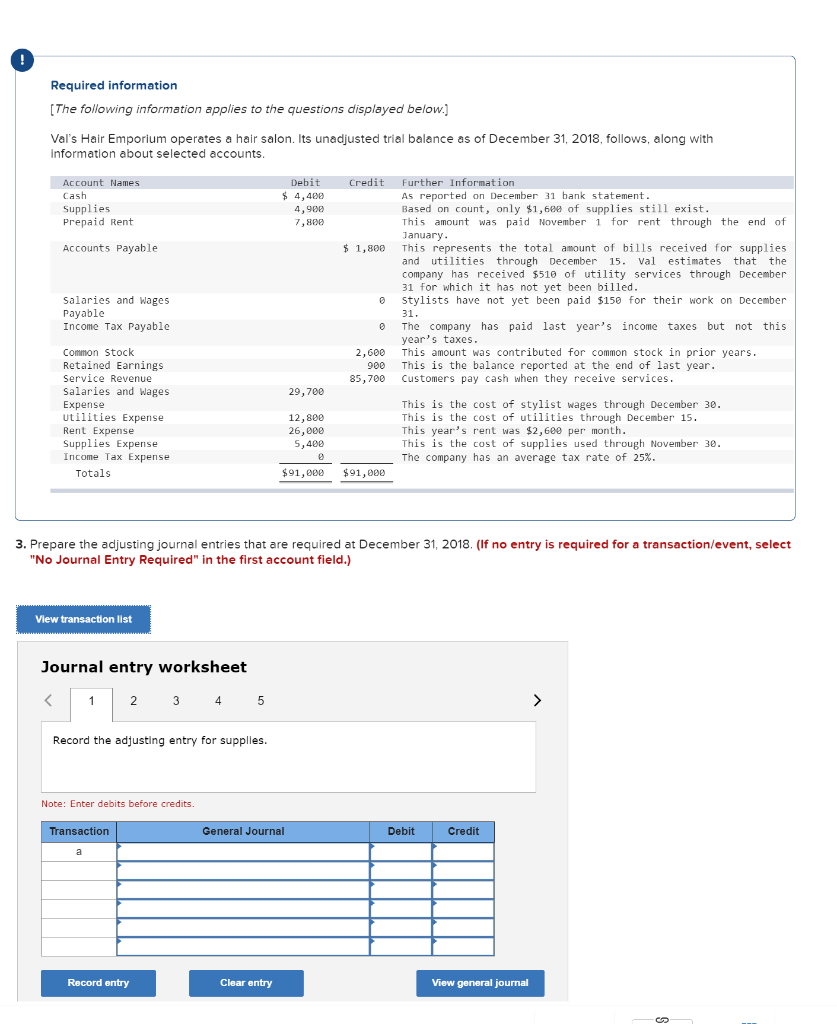

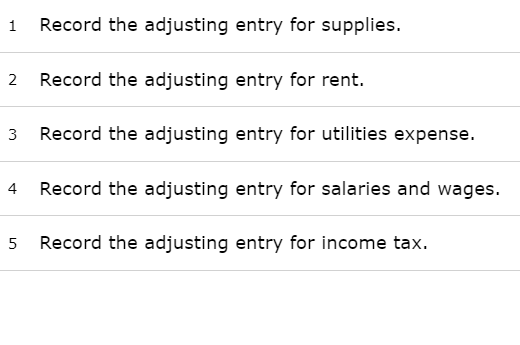

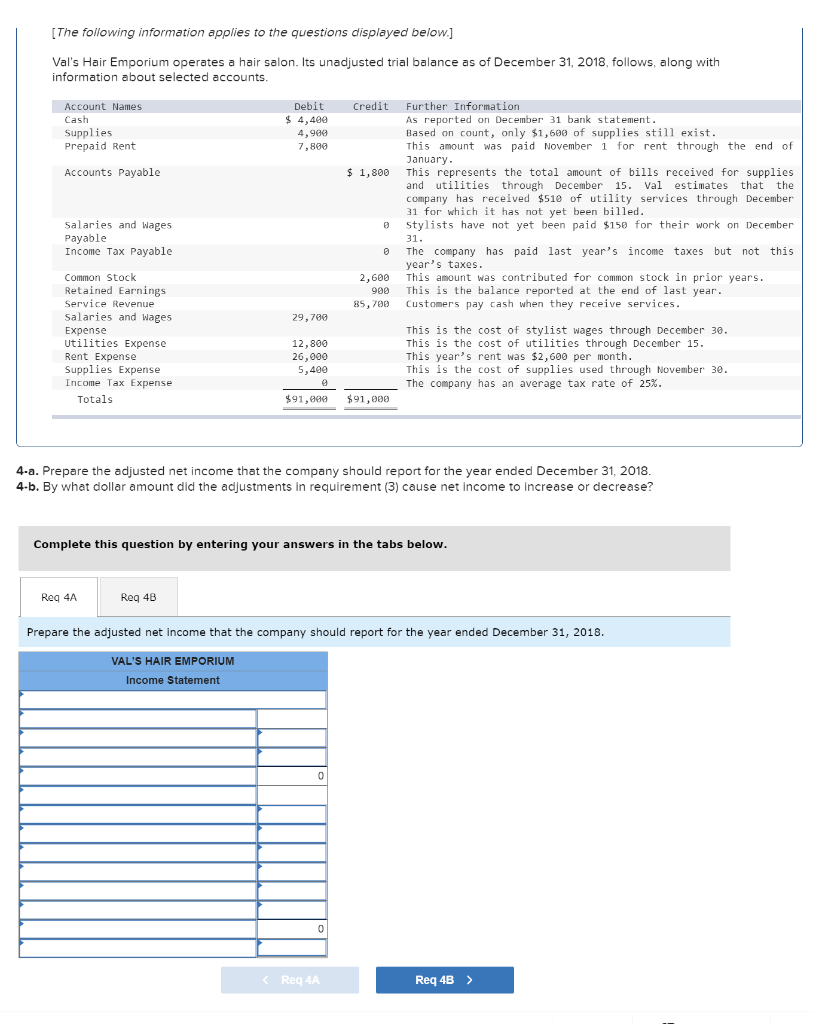

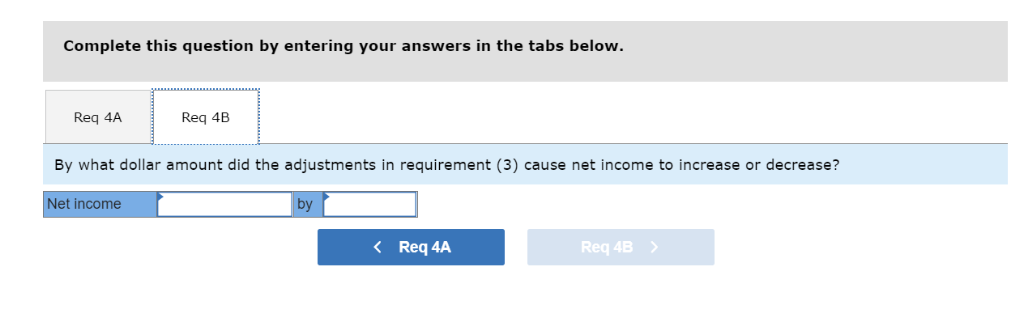

Required information [The following information applies to the questions displayed below.) Val's Hair Emporium operates a hair salon. Its unadjusted trial balance as of December 31, 2018, follows, along with information about selected accounts nt Names Cash Supplies Prepaid Rent % 4,400 4,988 7, 808 As reported on December 31 bank statement Based on count, only $1,6ee of supplies still exist This amount was paid November 1 for rent through the end of anuary Accounts Payable 1,800 This represents the total amount of bills received for supplies and utilities through December 15. Val estimates that the company has received $510 of utility services through December 31 for which it has not yet been billed salaries and Wages Payable Income Tax Payable 0 Stylists have not yet been paid $150 for their work on December 31 0 The company has paid last year's income taxes but not this year's taxes. Common Stock Retained Earnings Service Revenue Salaries and Wages Expense Utilities Expense Rent Expense Supplies Expense Income Tax Expense 2,600 This amount was contributed for common stock in prior years 900 This is the balance reported at the end of last year 85,700 Customers pay cash when they receive services 29,700 12,800 26,000 S,400 This is the cost of stylist wages through December 30 This is the cost of utilities through December 15 This year's rent was $2,6ee per month This is the cost of supplies used through November 30 The company has an average tax rate of 25% Totals $91,000 $91,000 3. Prepare the adjusting journal entries that are required at December 31, 2018. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the adjusting entry for supplles Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journal 1 Record the adjusting entry for supplies. 2 Record the adjusting entry for rent. 3 Record the adjusting entry for utilities expense. 4 Record the adjusting entry for salaries and wages. 5 Record the adjusting entry for income tax. The following information applies to the questions displayed below] Val's Hair Emporium operates a hair salon. Its unadjusted trial balance as of December 31, 2018, follows, along with information about selected accounts Account Names Cash Supplies Prepaid Rent Debit Credit Further Information 4,480 4,980 7,800 As reported on December 31 bank statement Based on count, only $1,68 of supplies still exist This amount was paid November 1 for rent through the end of anuary Accounts Payable $ 1,800 This represents the total amount of bills received for supplies and utilities through December 15. Val estimates that the company has received $51e of utility services through December 31 for which it has not yet been billed Salaries and Wages Payable Income Tax Payable stylists have not yet been paid $150 for their work on December 31 0 The company has paid last year's income taxes but not this year's taxes. Common Stock Retained Earnings Service Revenue salaries and Wages Expense Utilities Expense Rent Expense Supplies Expense Income Tax Expense 2,600 This amount was contributed for common stock in prior years 900 This is the balance reported at the end of last year. 85,700 Customers pay cash when they receive services 29,780 12,800 26,000 5,400 This is the cost of stylist wages through December 30 This is the cost of utilities through December 15 This year's rent was $2,600 per month This is the cost of supplies used through November 30 The company has an average tax rate of 25% Totals $91 ,000 %91 ,000 4-a. Prepare the adjusted net income that the company should report for the year ended December 31, 2018 4-b. By what dollar amount dld the adjustments in requirement (3) cause net income to increase or decrease? Complete this question by entering your answers in the tabs below Req 4A Req 4B Prepare the adjusted net income that the company should report for the year ended December 31, 2018 VAL'S HAIR EMPORIUM Income Statement Reqg 4A Req 4B> Complete this question by entering your answers in the tabs below. Req 4A Req 4B By what dollar amount did the adjustments in requirement (3) cause net income to increase or decrease? by Net income