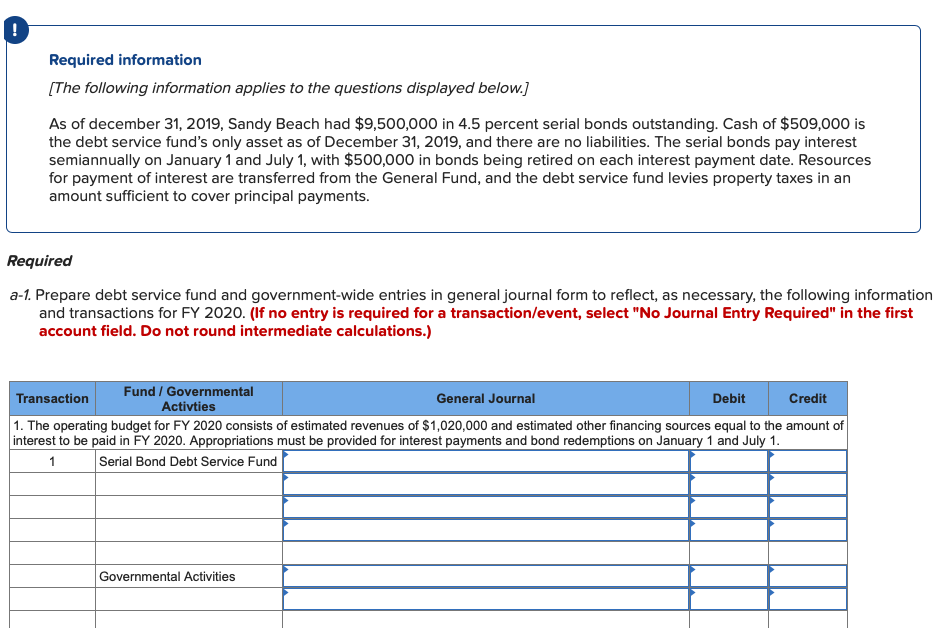

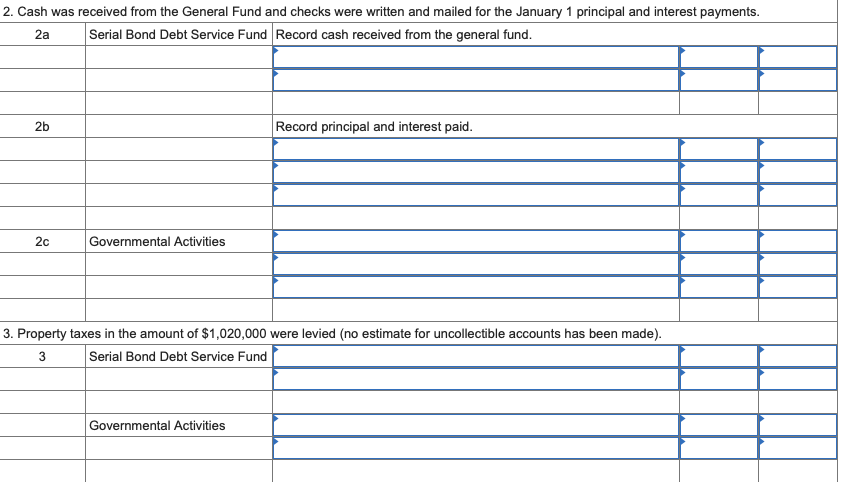

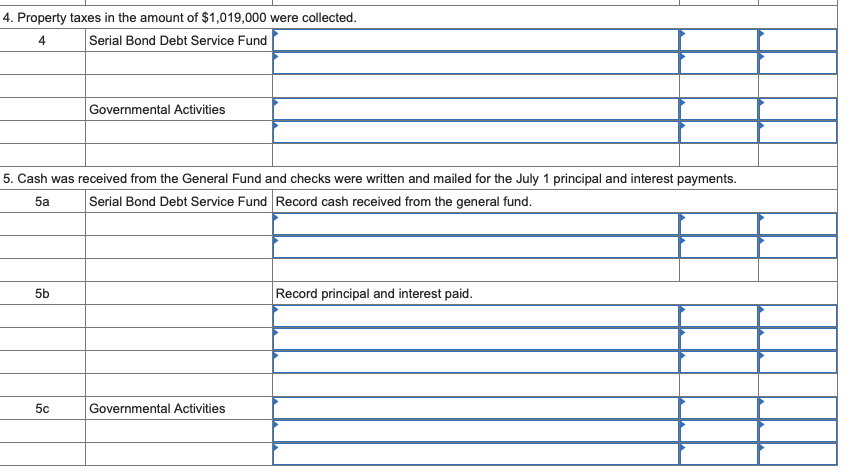

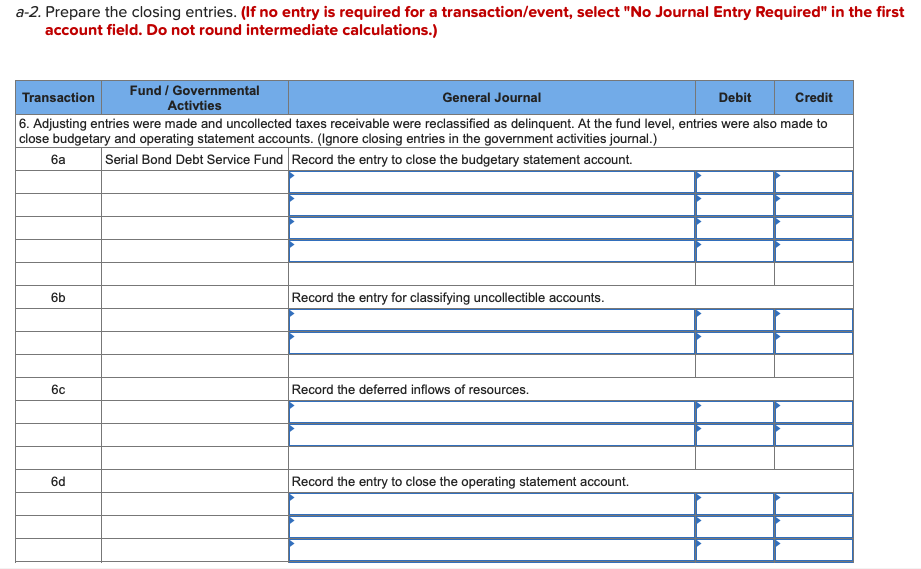

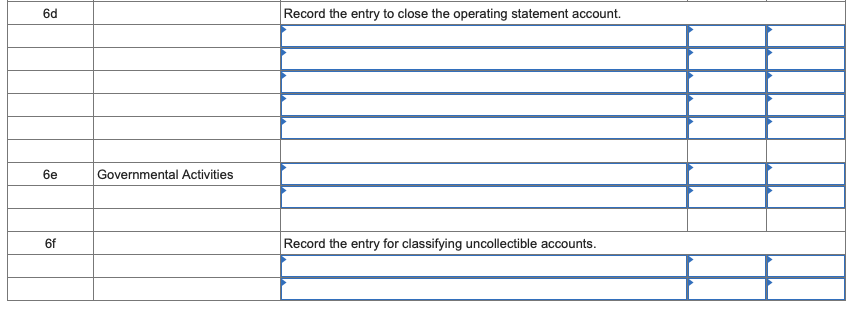

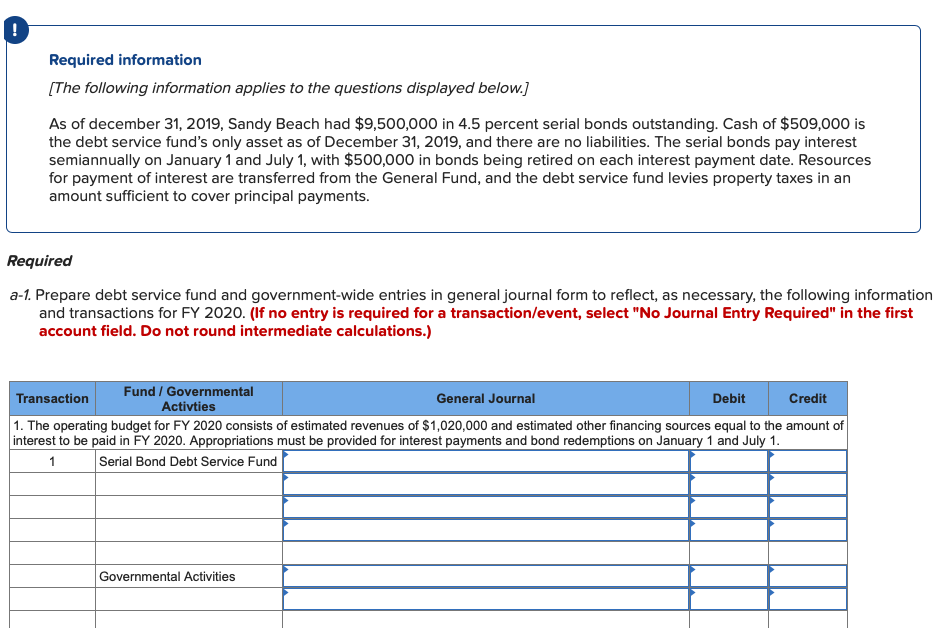

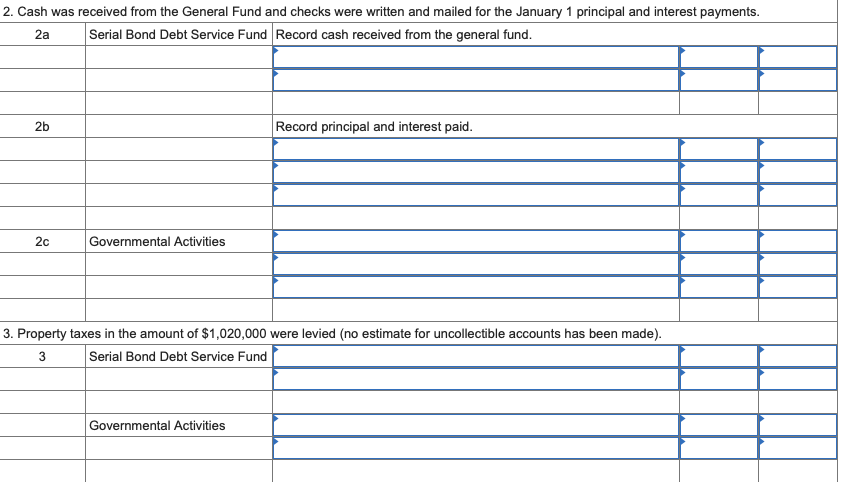

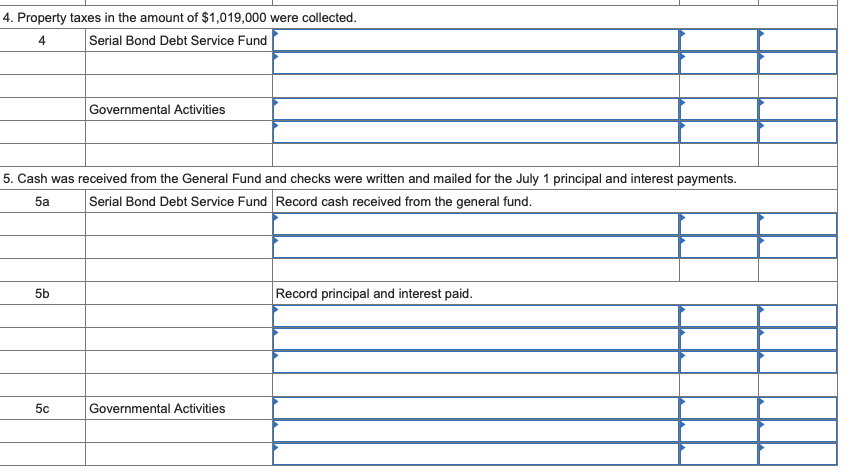

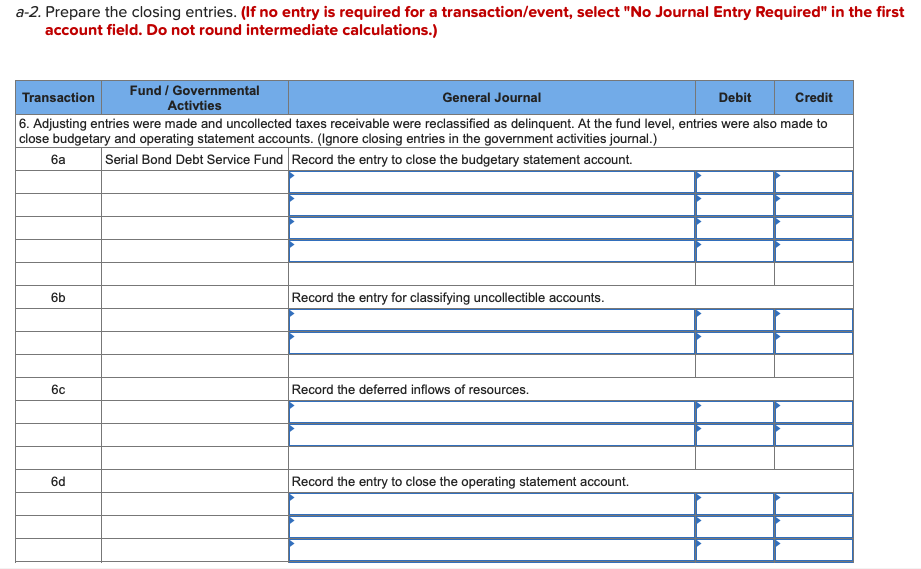

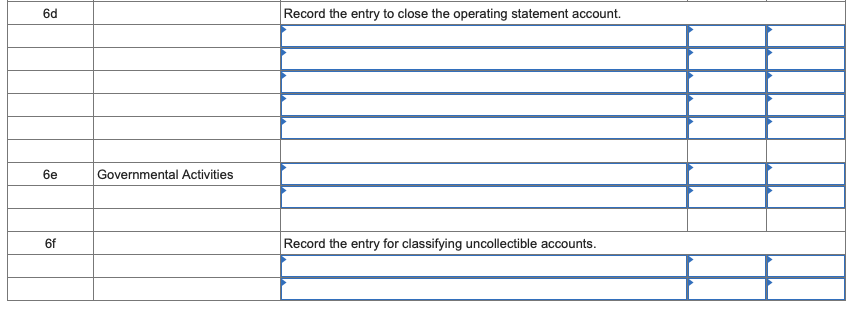

Required information [The following information applies to the questions displayed below.] As of december 31, 2019, Sandy Beach had $9,500,000 in 4.5 percent serial bonds outstanding. Cash of $509,000 is the debt service fund's only asset as of December 31, 2019, and there are no liabilities. The serial bonds pay interest semiannually on January 1 and July 1, with $500,000 in bonds being retired on each interest payment date. Resources for payment of interest are transferred from the General Fund, and the debt service fund levies property taxes in an amount sufficient to cover principal payments. Required a-1. Prepare debt service fund and government-wide entries in general journal form to reflect, as necessary, the following information and transactions for FY 2020. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations.) Transaction Fund / Governmental General Journal Debit Credit Activties 1. The operating budget for FY 2020 consists of estimated revenues of $1,020,000 and estimated other financing sources equal to the amount of interest to be paid in FY 2020. Appropriations must be provided for interest payments and bond redemptions on January 1 and July 1. 1 Serial Bond Debt Service Fund Governmental Activities 2. Cash was received from the General Fund and checks were written and mailed for the January 1 principal and interest payments. 2a Serial Bond Debt Service Fund Record cash received from the general fund. 2b Record principal and interest paid. 2c Governmental Activities 3. Property taxes in the amount of $1,020,000 were levied (no estimate for uncollectible accounts has been made). Serial Bond Debt Service Fund 3 Governmental Activities 4. Property taxes in the amount of $1,019,000 were collected. 4 Serial Bond Debt Service Fund Governmental Activities 5. Cash was received from the General Fund and checks were written and mailed for the July 1 principal and interest payments. 5 Serial Bond Debt Service Fund Record cash received from the general fund. 5b Record principal and interest paid. 5c Governmental Activities a-2. Prepare the closing entries. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations.) Transaction Fund / Governmental General Journal Debit Credit Activties 6. Adjusting entries were made and uncollected taxes receivable were reclassified as delinquent. At the fund level, entries were also made to close budgetary and operating statement accounts. (Ignore closing entries in the government activities journal.) Serial Bond Debt Service Fund Record the entry to close the budgetary statement account. 6b Record the entry for classifying uncollectible accounts. 6c Record the deferred inflows of resources. 6d Record the entry to close the operating statement account. 6d Record the entry to close the operating statement account. 6e Governmental Activities 6f Record the entry for classifying uncollectible accounts