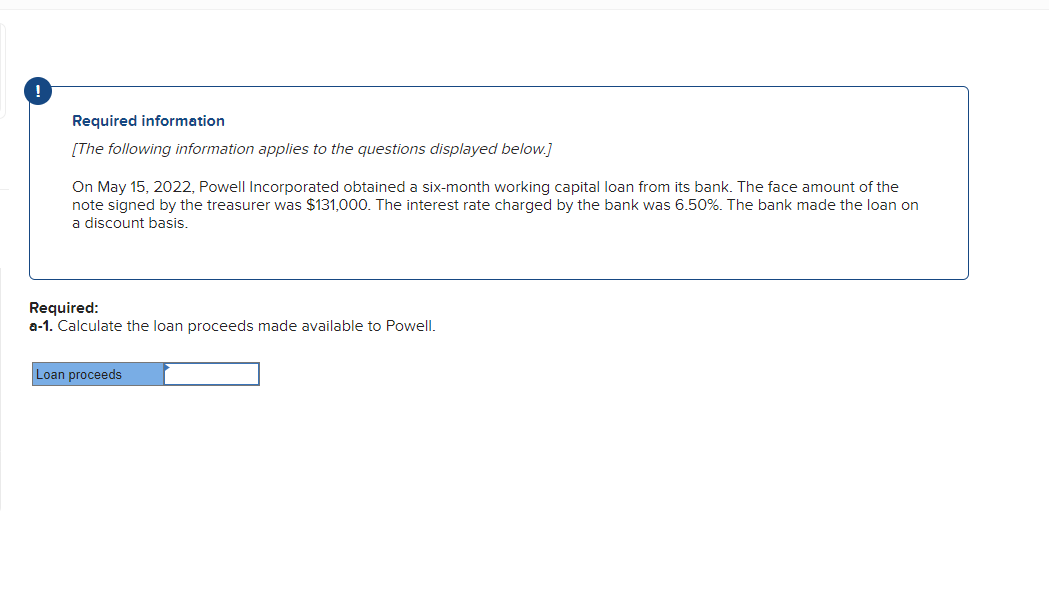

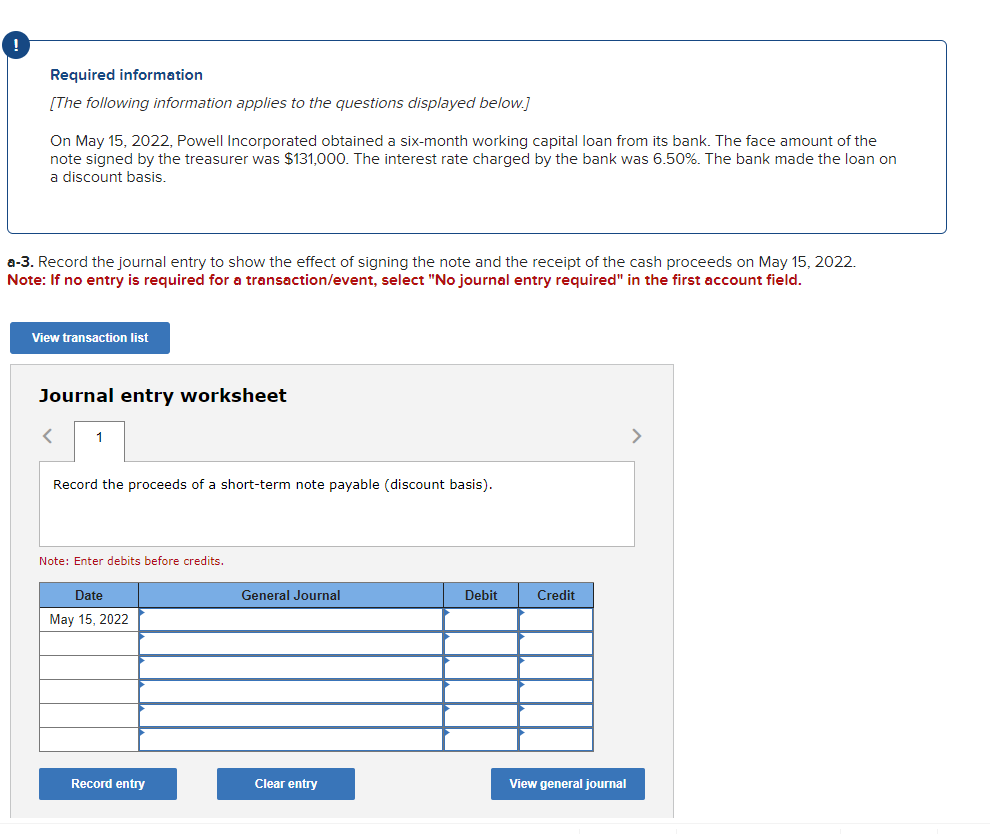

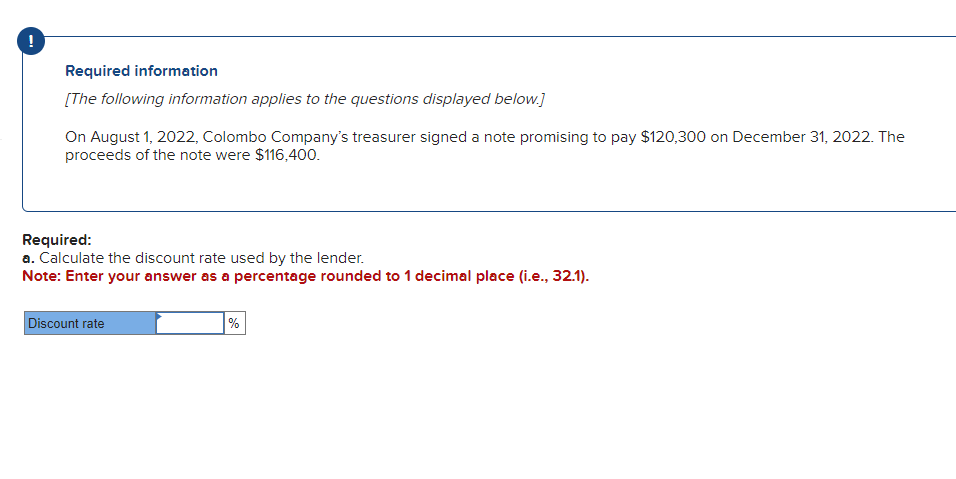

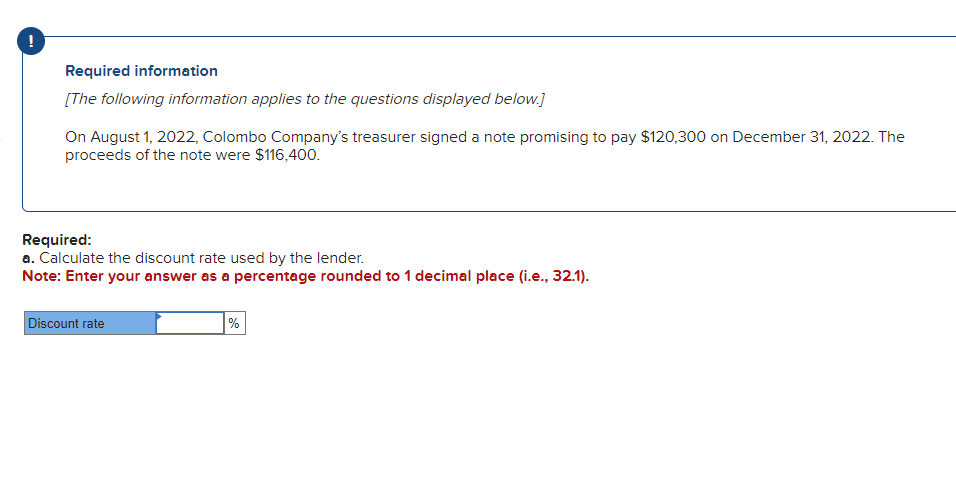

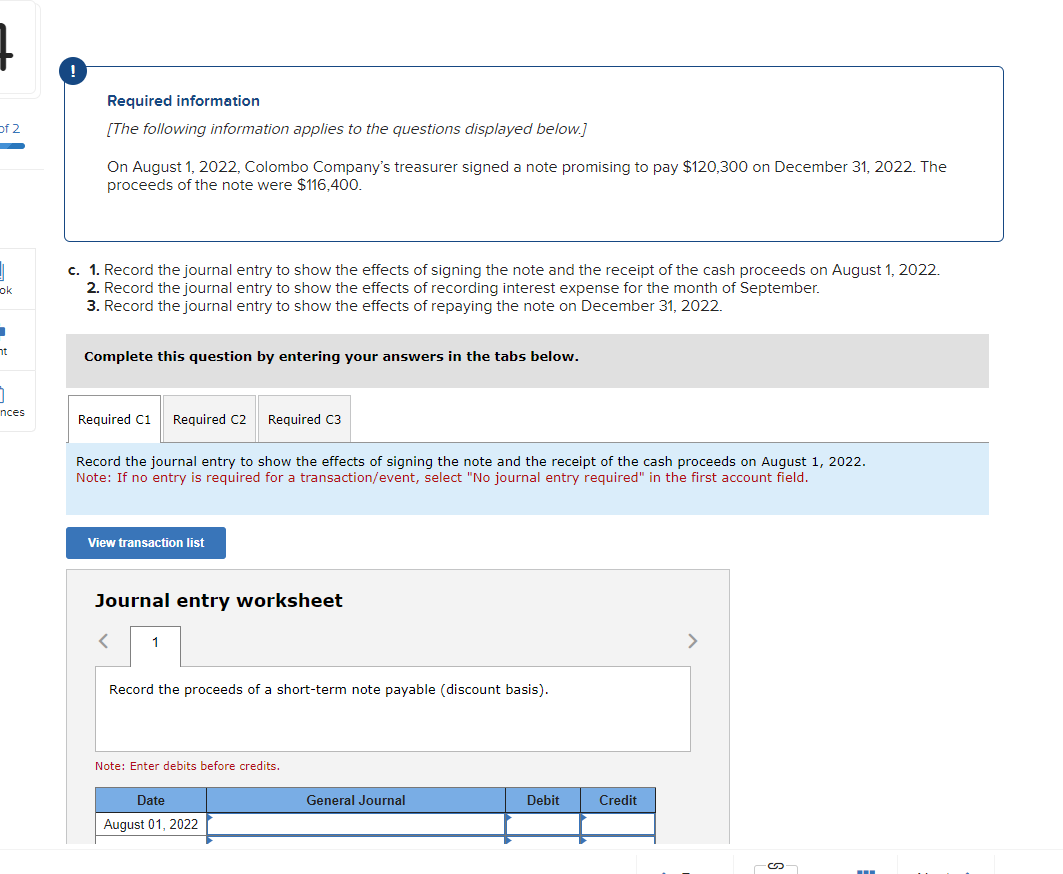

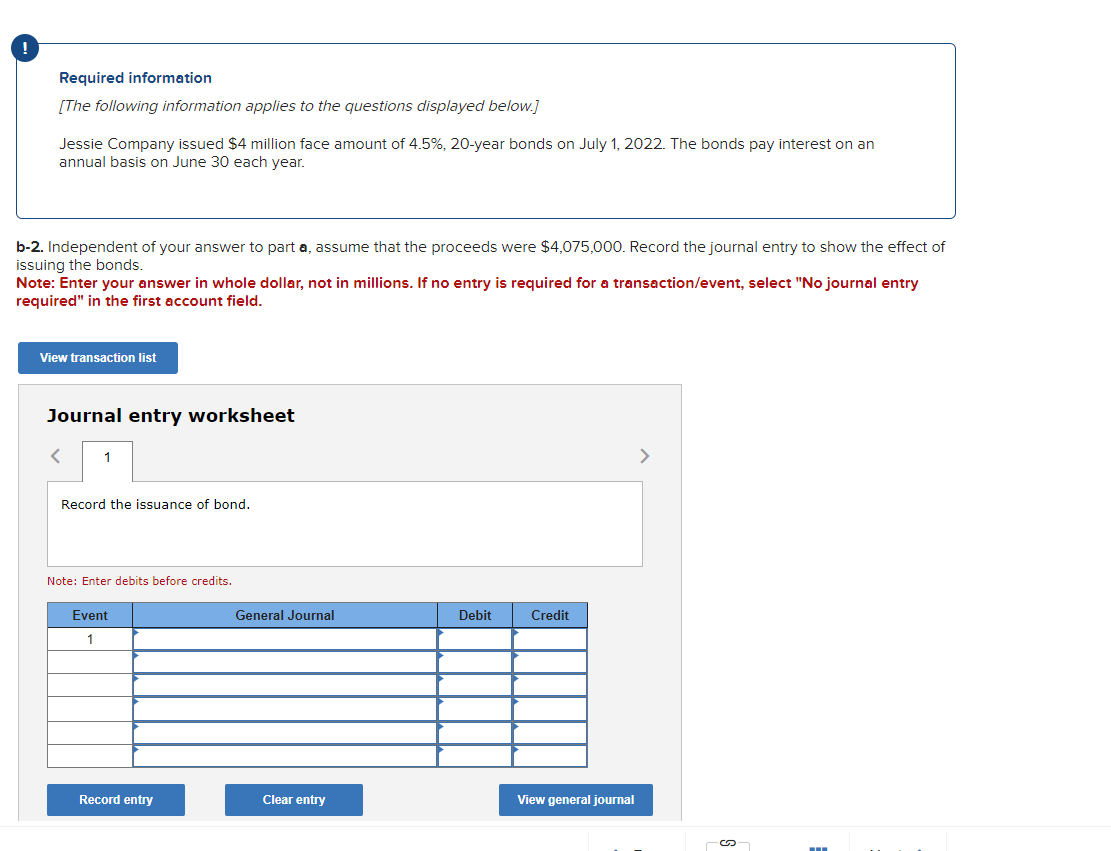

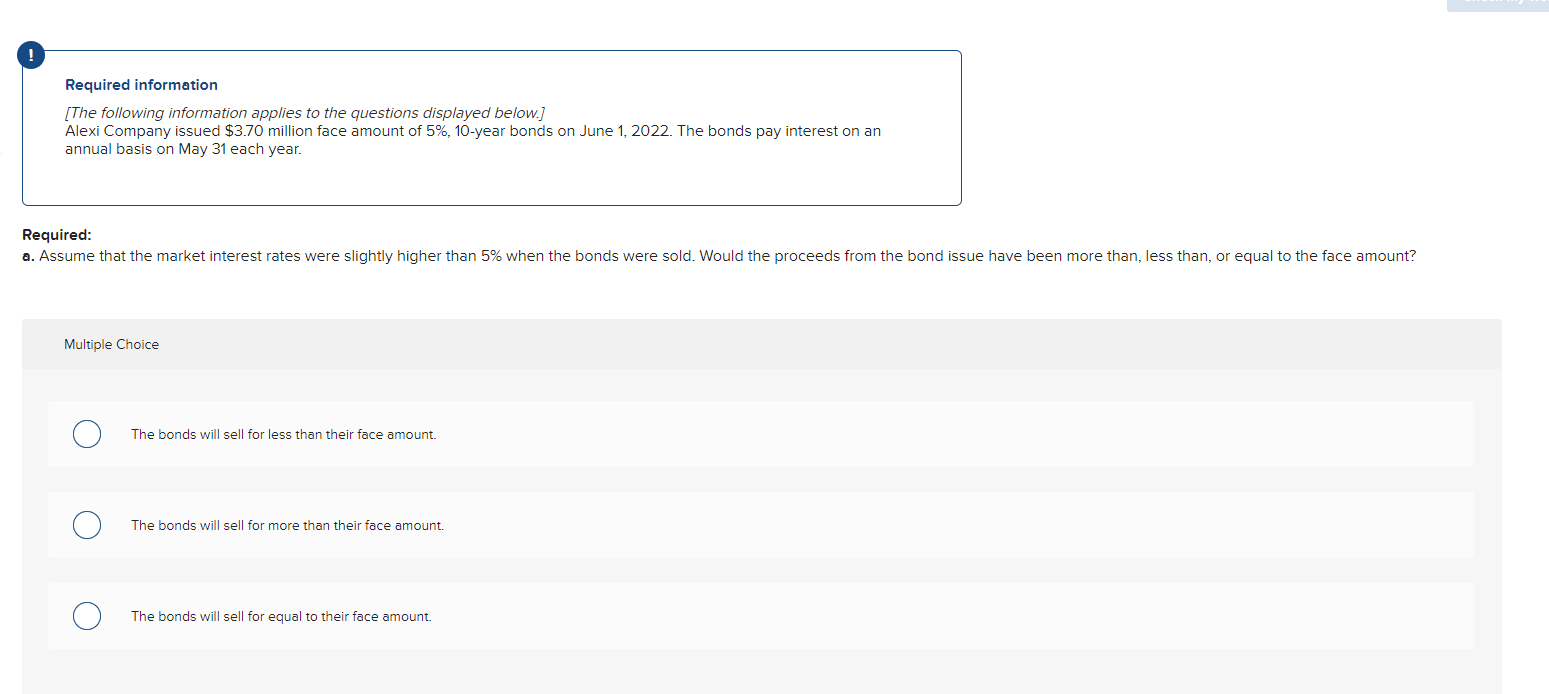

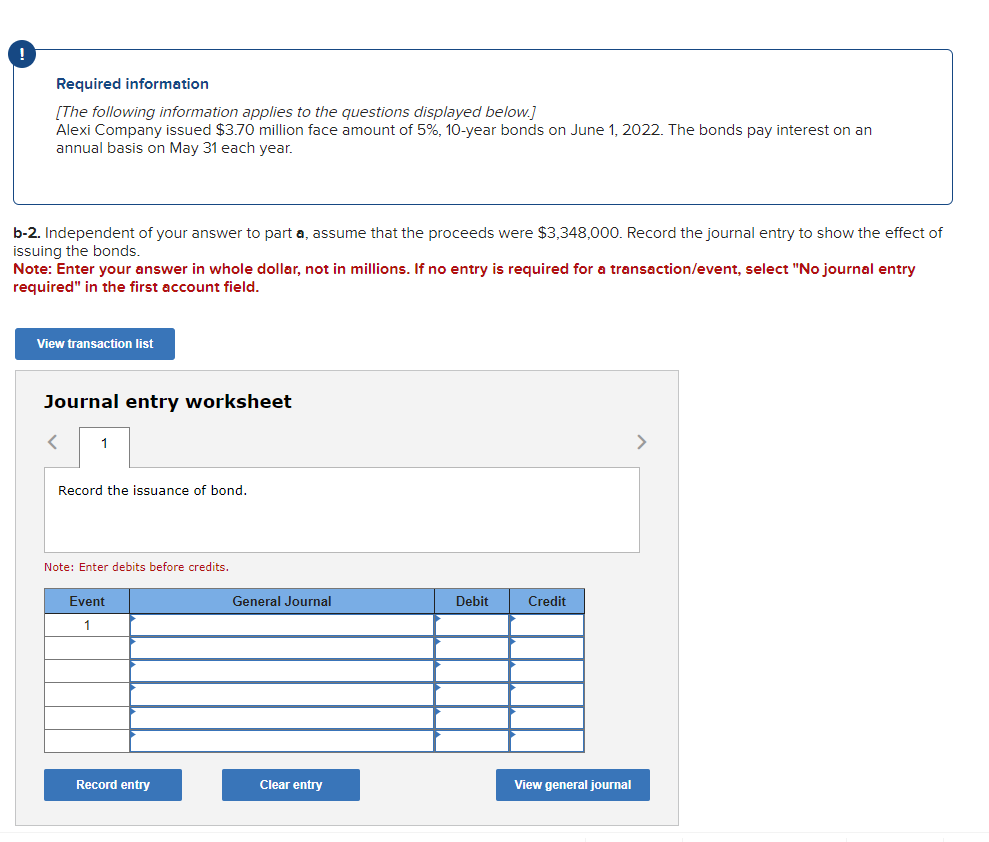

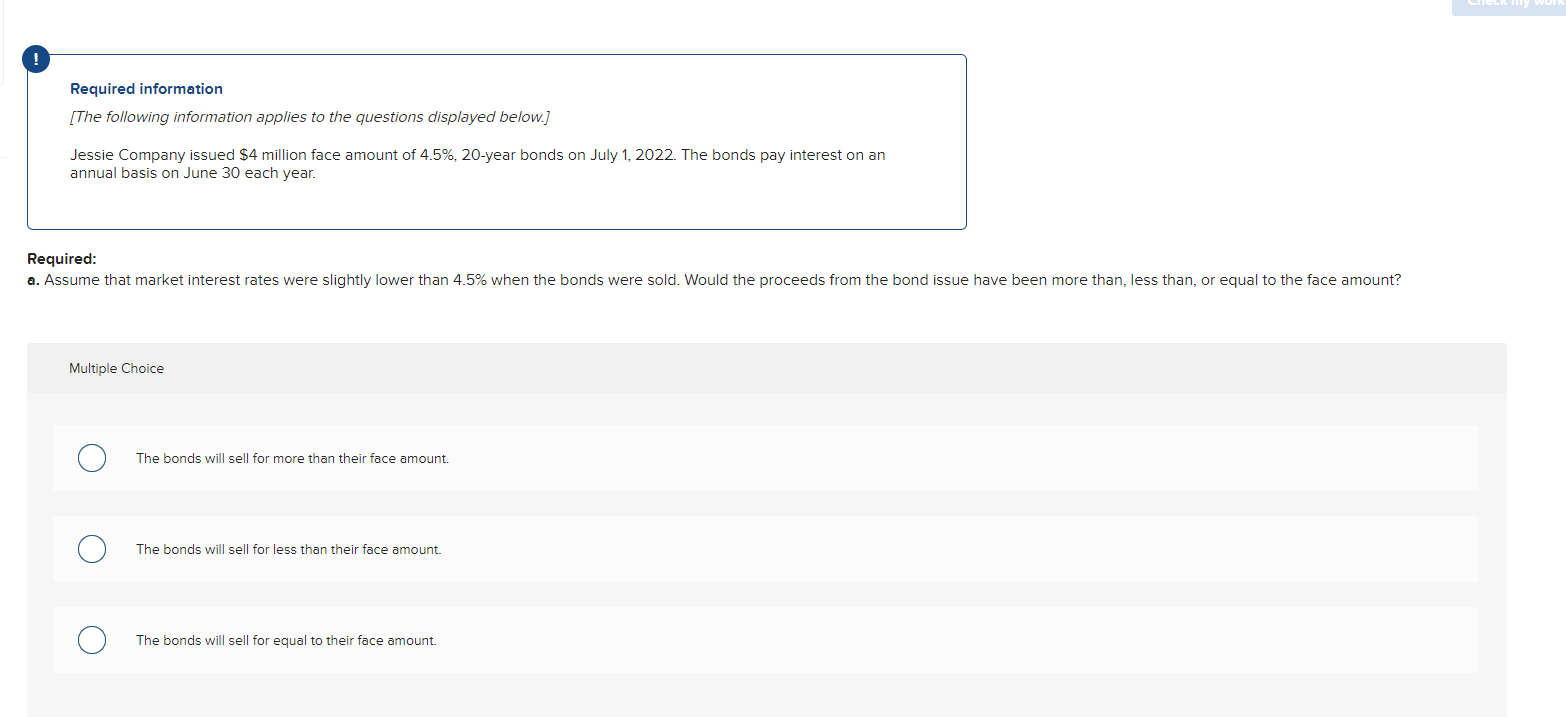

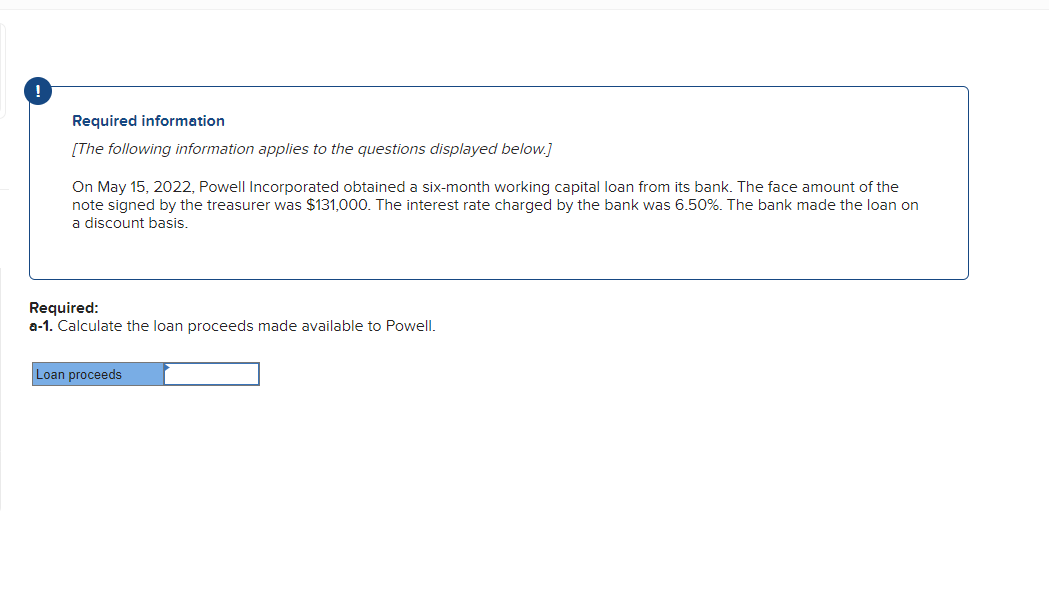

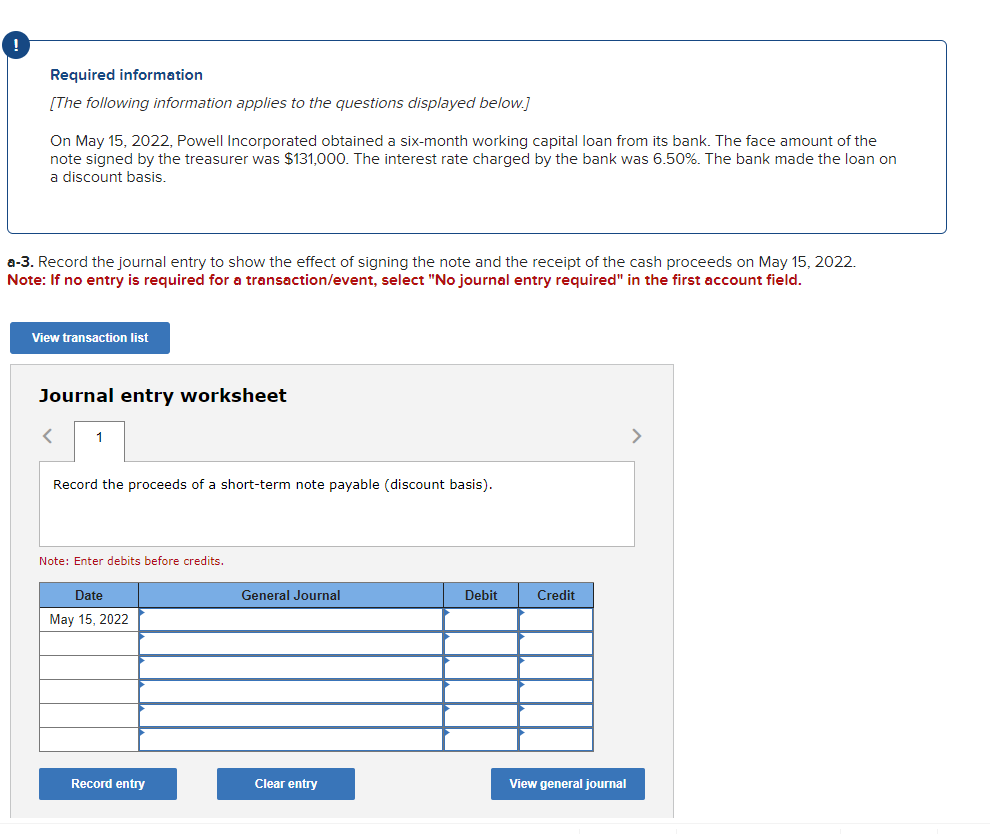

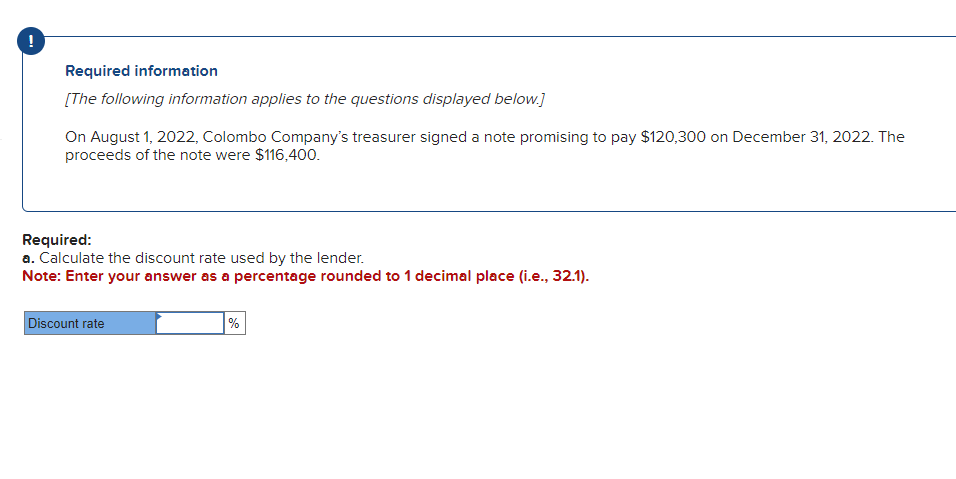

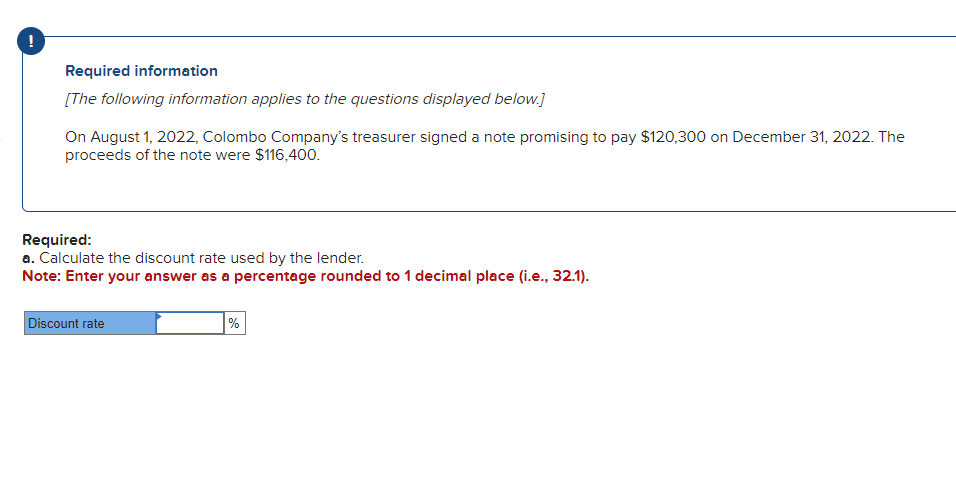

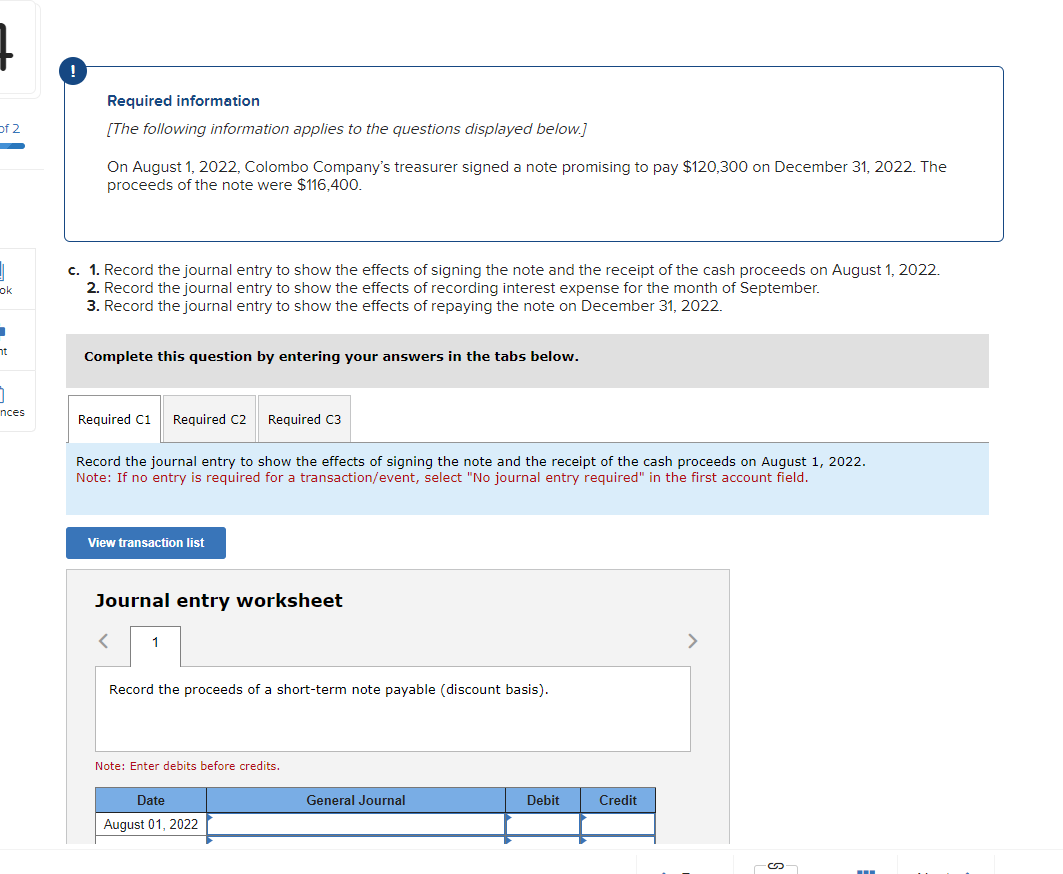

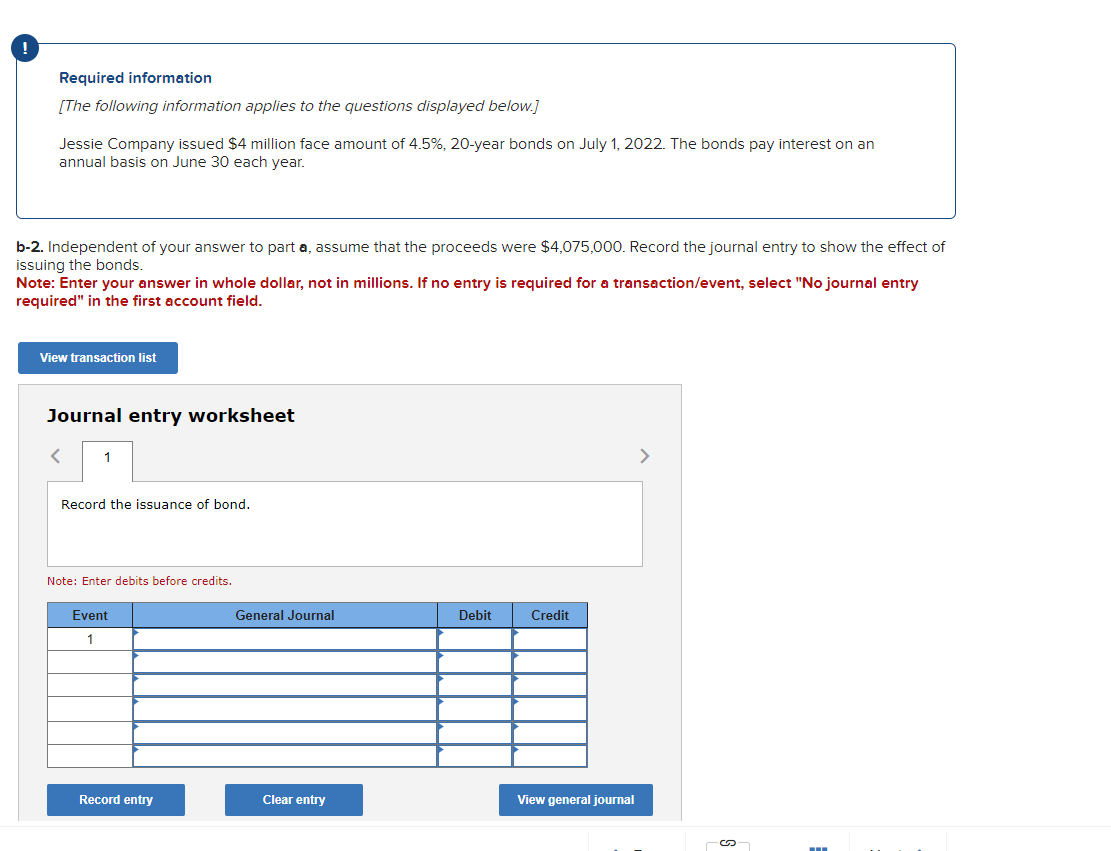

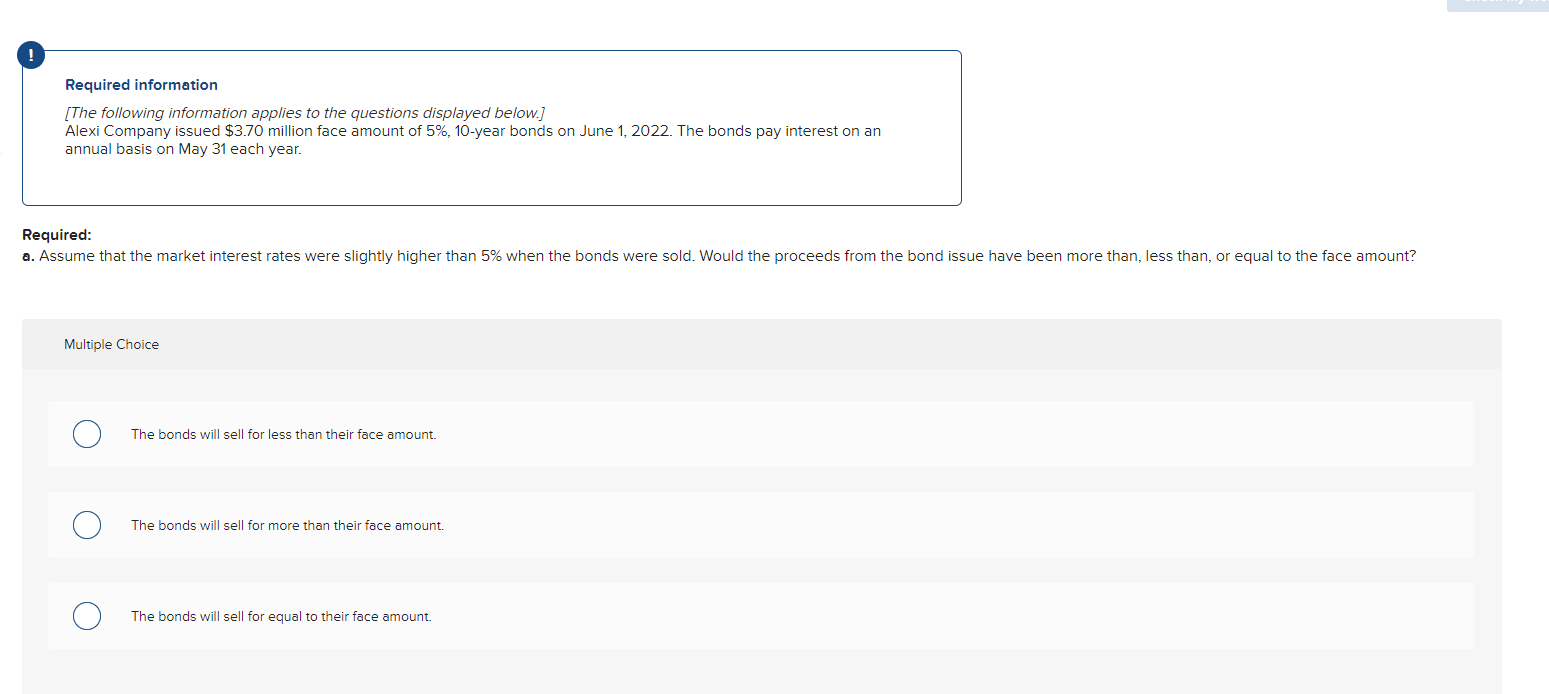

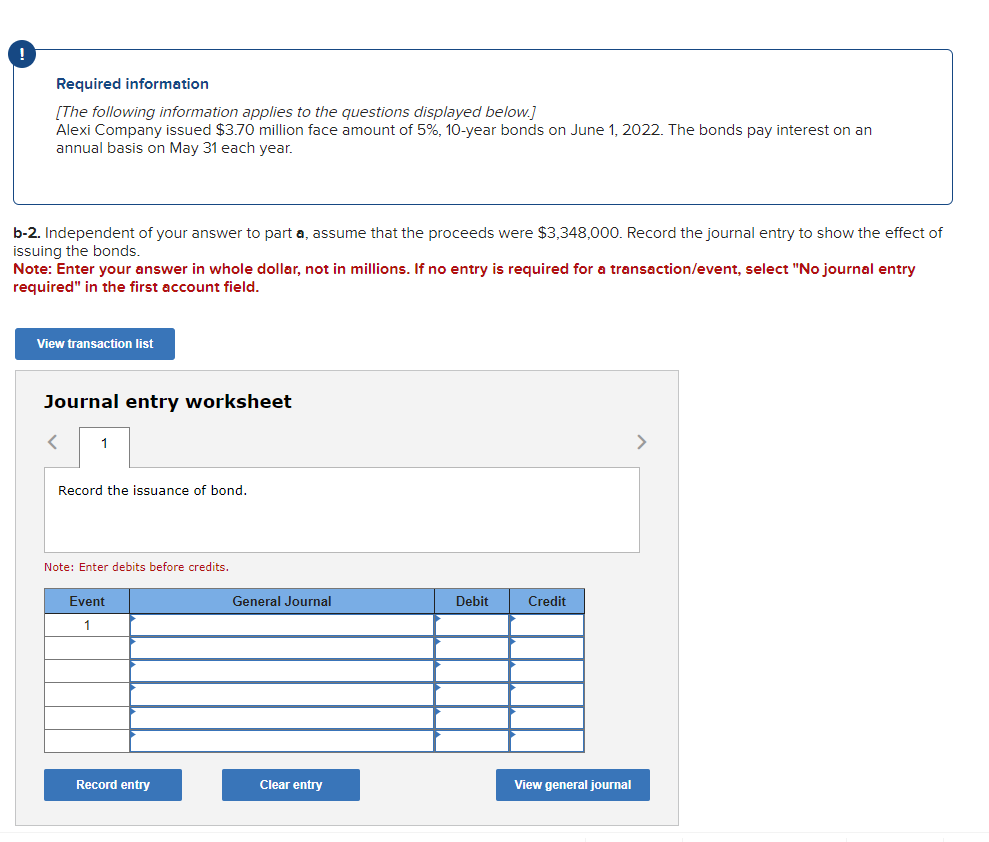

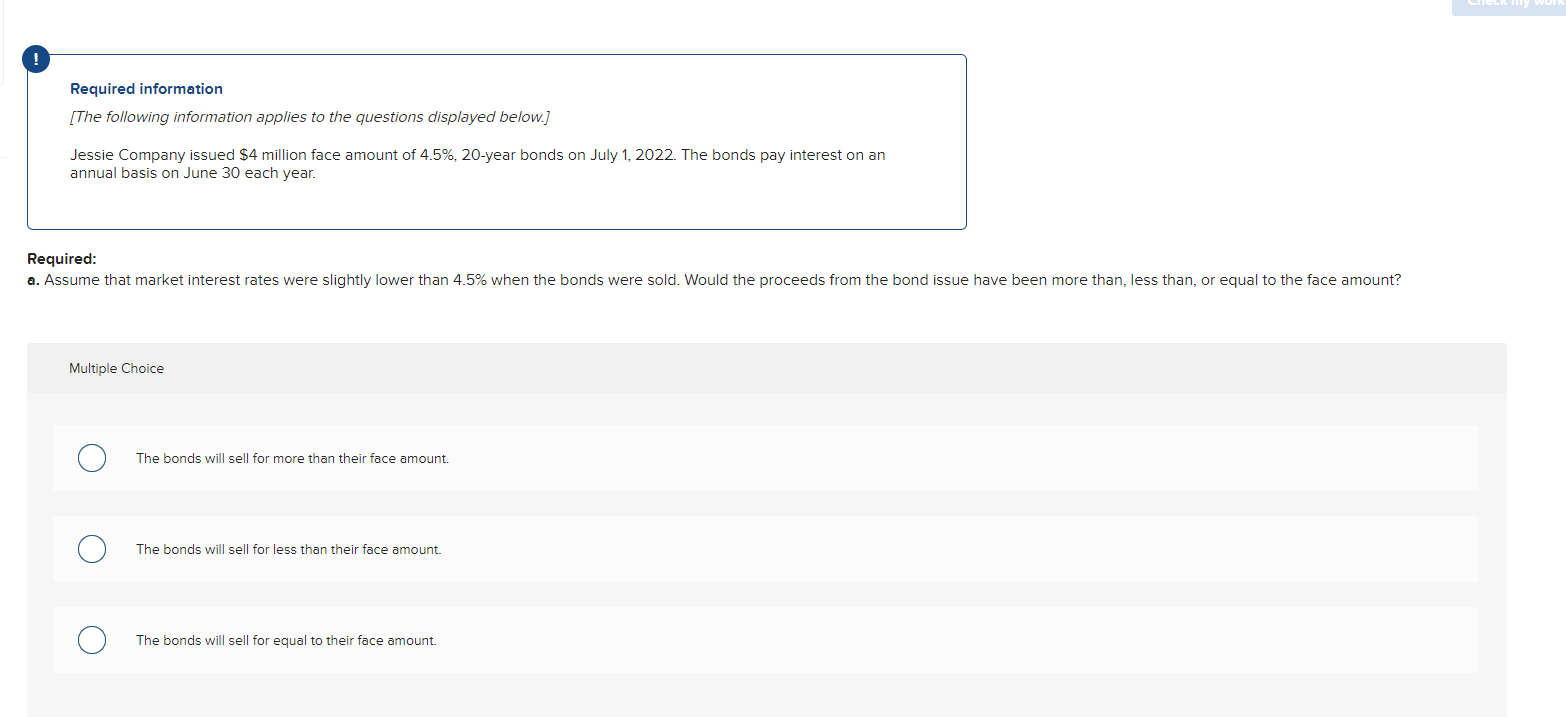

Required information [The following information applies to the questions displayed below.] On May 15, 2022, Powell Incorporated obtained a six-month working capital loan from its bank. The face amount of the note signed by the treasurer was $131,000. The interest rate charged by the bank was 6.50%. The bank made the loan on a discount basis. Required: a-1. Calculate the loan proceeds made available to Powell. Required information [The following information applies to the questions displayed below.] On May 15, 2022, Powell Incorporated obtained a six-month working capital loan from its bank. The face amount of the note signed by the treasurer was $131,000. The interest rate charged by the bank was 6.50%. The bank made the loan on a discount basis. -3. Record the journal entry to show the effect of signing the note and the receipt of the cash proceeds on May 15,2022. ote: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the proceeds of a short-term note payable (discount basis). Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] On August 1, 2022, Colombo Company's treasurer signed a note promising to pay $120,300 on December 31,2022 . The proceeds of the note were $116,400. Required: a. Calculate the discount rate used by the lender. Note: Enter your answer as a percentage rounded to 1 decimal place (i.e., 32.1). Required information [The following information applies to the questions displayed below.] On August 1, 2022, Colombo Company's treasurer signed a note promising to pay $120,300 on December 31,2022 . The proceeds of the note were $116,400. Required: a. Calculate the discount rate used by the lender. Note: Enter your answer as a percentage rounded to 1 decimal place (i.e., 32.1). Required information [The following information applies to the questions displayed below.] On August 1, 2022, Colombo Company's treasurer signed a note promising to pay $120,300 on December 31 , 2022. The proceeds of the note were $116,400. 1. Record the journal entry to show the effects of signing the note and the receipt of the cash proceeds on August 1,2022 . 2. Record the journal entry to show the effects of recording interest expense for the month of September. 3. Record the journal entry to show the effects of repaying the note on December 31,2022. Complete this question by entering your answers in the tabs below. Record the journal entry to show the effects of signing the note and the receipt of the cash proceeds on August 1,2022. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Required information [The following information applies to the questions displayed below.] Jessie Company issued $4 million face amount of 4.5%,20-year bonds on July 1,2022 . The bonds pay interest on an annual basis on June 30 each year. b-2. Independent of your answer to part a, assume that the proceeds were $4,075,000. Record the journal entry to show the effect of issuing the bonds. Note: Enter your answer in whole dollar, not in millions. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Required information [The following information applies to the questions displayed below.] Alexi Company issued $3.70 million face amount of 5%,10-year bonds on June 1,2022 . The bonds pay interest on an annual basis on May 31 each year. quired: Assume that the market interest rates were slightly higher than 5% when the bonds were sold. Would the proceeds from the bor Multiple Choice The bonds will sell for less than their face amount. The bonds will sell for more than their face amount. The bonds will sell for equal to their face amount. Required information [The following information applies to the questions displayed below.] Alexi Company issued $3.70 million face amount of 5%,10-year bonds on June 1,2022 . The bonds pay interest on an annual basis on May 31 each year. b-2. Independent of your answer to part a, assume that the proceeds were $3,348,000. Record the journal entry to show the effect of issuing the bonds. Note: Enter your answer in whole dollar, not in millions. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] Jessie Company issued $4 million face amount of 4.5%,20-year bonds on July 1,2022 . The bonds pay interest on an annual basis on June 30 each year. quired: Assume that market interest rates were slightly lower than 4.5% when the bonds were sold. Would the proceeds from the bond is Multiple Choice The bonds will sell for more than their face amount. The bonds will sell for less than their face amount. The bonds will sell for equal to their face amount. Required information [The following information applies to the questions displayed below.] On May 15, 2022, Powell Incorporated obtained a six-month working capital loan from its bank. The face amount of the note signed by the treasurer was $131,000. The interest rate charged by the bank was 6.50%. The bank made the loan on a discount basis. Required: a-1. Calculate the loan proceeds made available to Powell. Required information [The following information applies to the questions displayed below.] On May 15, 2022, Powell Incorporated obtained a six-month working capital loan from its bank. The face amount of the note signed by the treasurer was $131,000. The interest rate charged by the bank was 6.50%. The bank made the loan on a discount basis. -3. Record the journal entry to show the effect of signing the note and the receipt of the cash proceeds on May 15,2022. ote: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the proceeds of a short-term note payable (discount basis). Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] On August 1, 2022, Colombo Company's treasurer signed a note promising to pay $120,300 on December 31,2022 . The proceeds of the note were $116,400. Required: a. Calculate the discount rate used by the lender. Note: Enter your answer as a percentage rounded to 1 decimal place (i.e., 32.1). Required information [The following information applies to the questions displayed below.] On August 1, 2022, Colombo Company's treasurer signed a note promising to pay $120,300 on December 31,2022 . The proceeds of the note were $116,400. Required: a. Calculate the discount rate used by the lender. Note: Enter your answer as a percentage rounded to 1 decimal place (i.e., 32.1). Required information [The following information applies to the questions displayed below.] On August 1, 2022, Colombo Company's treasurer signed a note promising to pay $120,300 on December 31 , 2022. The proceeds of the note were $116,400. 1. Record the journal entry to show the effects of signing the note and the receipt of the cash proceeds on August 1,2022 . 2. Record the journal entry to show the effects of recording interest expense for the month of September. 3. Record the journal entry to show the effects of repaying the note on December 31,2022. Complete this question by entering your answers in the tabs below. Record the journal entry to show the effects of signing the note and the receipt of the cash proceeds on August 1,2022. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Required information [The following information applies to the questions displayed below.] Jessie Company issued $4 million face amount of 4.5%,20-year bonds on July 1,2022 . The bonds pay interest on an annual basis on June 30 each year. b-2. Independent of your answer to part a, assume that the proceeds were $4,075,000. Record the journal entry to show the effect of issuing the bonds. Note: Enter your answer in whole dollar, not in millions. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Required information [The following information applies to the questions displayed below.] Alexi Company issued $3.70 million face amount of 5%,10-year bonds on June 1,2022 . The bonds pay interest on an annual basis on May 31 each year. quired: Assume that the market interest rates were slightly higher than 5% when the bonds were sold. Would the proceeds from the bor Multiple Choice The bonds will sell for less than their face amount. The bonds will sell for more than their face amount. The bonds will sell for equal to their face amount. Required information [The following information applies to the questions displayed below.] Alexi Company issued $3.70 million face amount of 5%,10-year bonds on June 1,2022 . The bonds pay interest on an annual basis on May 31 each year. b-2. Independent of your answer to part a, assume that the proceeds were $3,348,000. Record the journal entry to show the effect of issuing the bonds. Note: Enter your answer in whole dollar, not in millions. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] Jessie Company issued $4 million face amount of 4.5%,20-year bonds on July 1,2022 . The bonds pay interest on an annual basis on June 30 each year. quired: Assume that market interest rates were slightly lower than 4.5% when the bonds were sold. Would the proceeds from the bond is Multiple Choice The bonds will sell for more than their face amount. The bonds will sell for less than their face amount. The bonds will sell for equal to their face amount