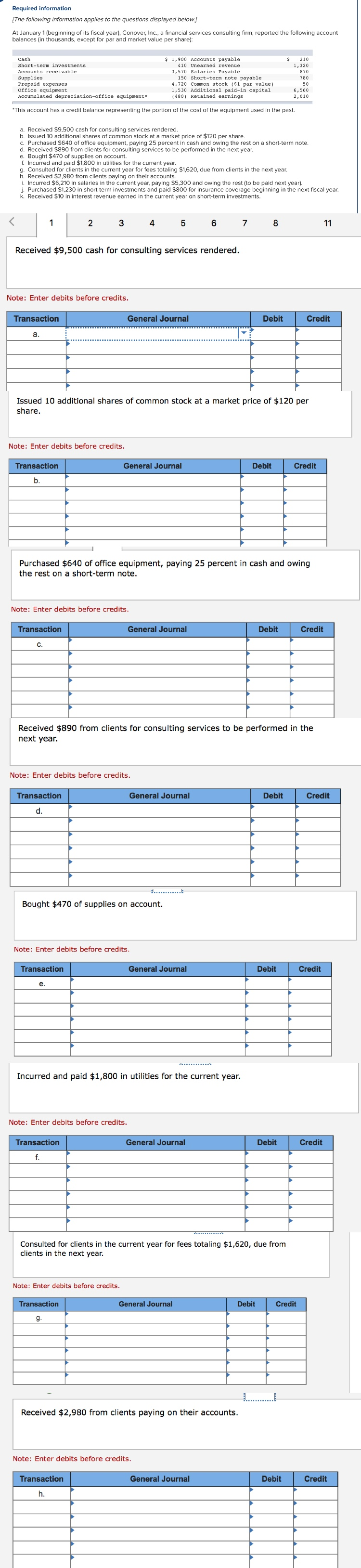

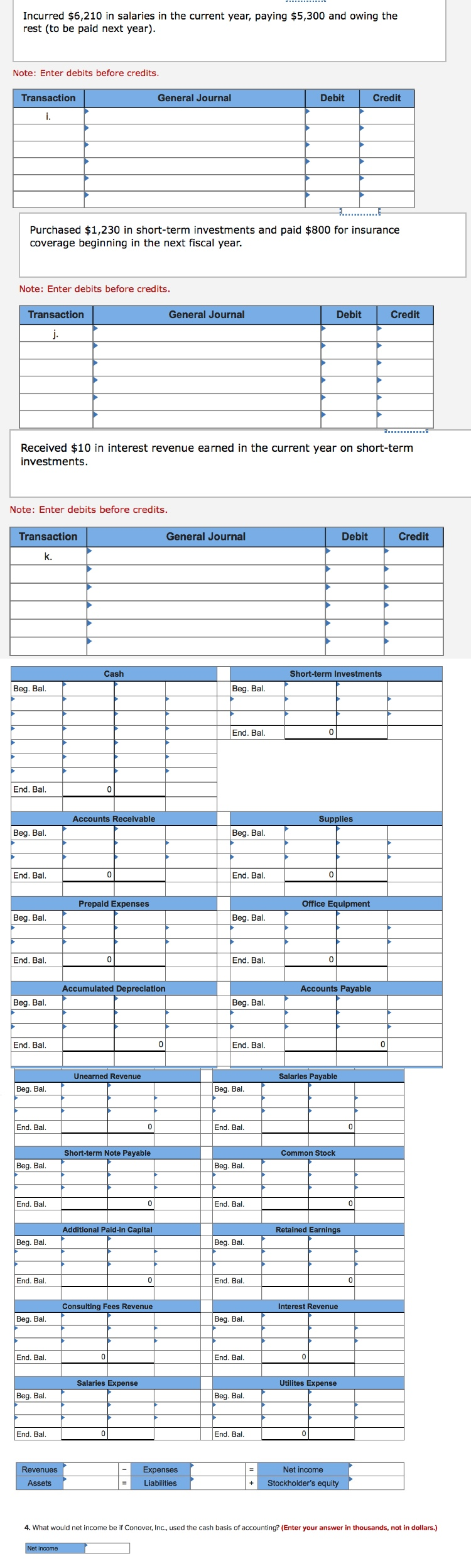

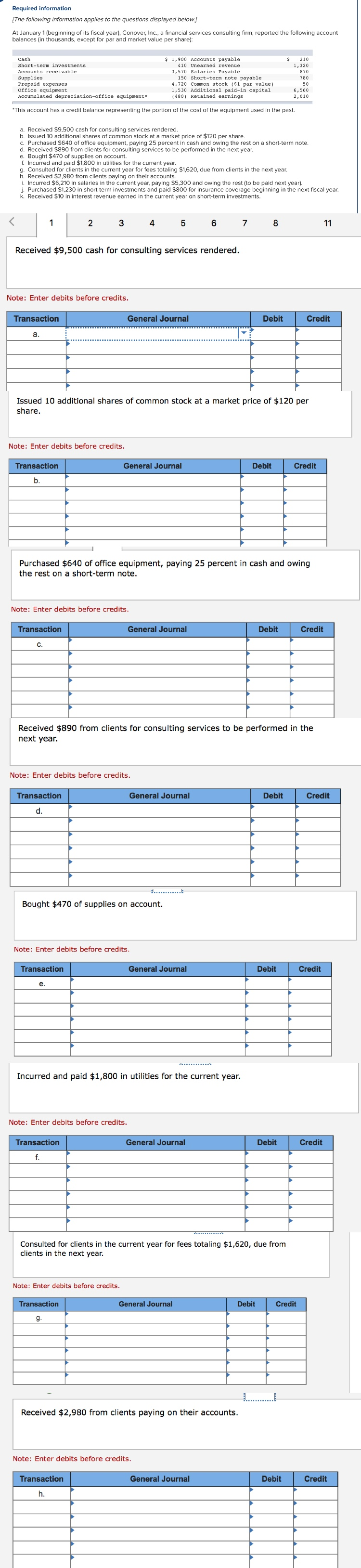

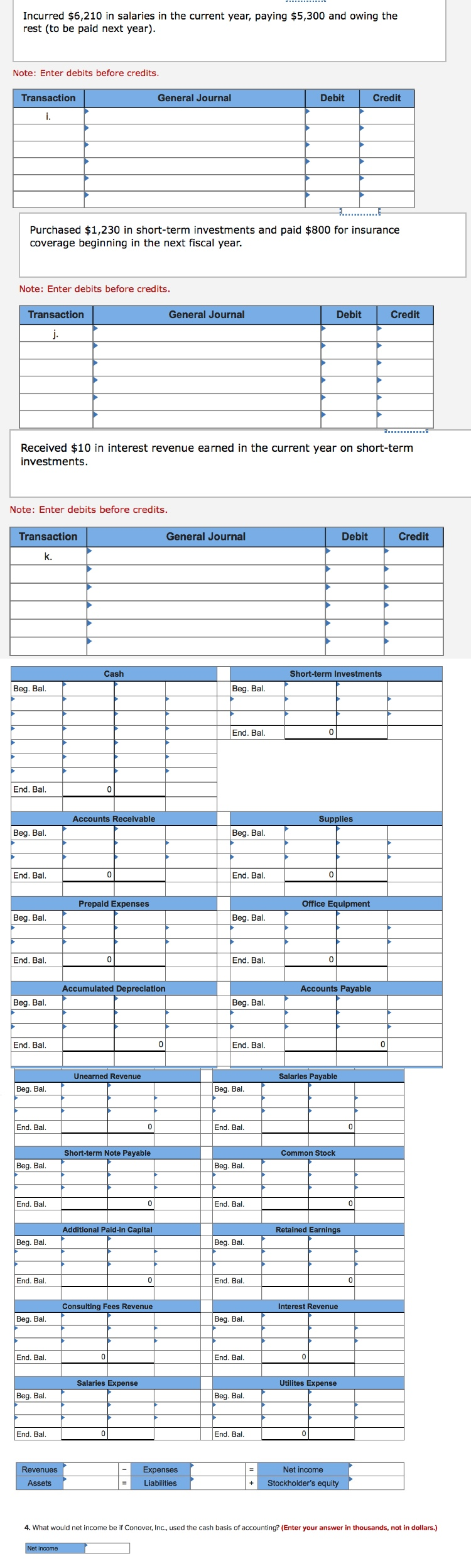

Required information The following information applies to the questions displayed below.) At January 1 (beginning of its fiscal year), Conover, Inc., a financial services consulting firm, reported the following account balances in thousands, except for par and market value per share): $ Cash Short-term investments Accounts receivable Supplies Prepaid expenses office equipment Accumulated depreciation-office equipment* $ 1,900 Accounts payable 410 Unearned revenue 3,570 Salaries Payable 150 Short-term note payable 4,720 Common stock ($1 par value) 1,530 Additional paid-in capital (480) Retained earnings 210 1,320 870 780 50 6,560 2,010 *This account has a credit balance representing the portion of the cost of the equipment used in the past. a. Received $9,500 cash for consulting services rendered. b. Issued 10 additional shares of common stock at a market price of $120 per share. C. Purchased $640 of office equipment, paying 25 percent in cash and owing the rest on a short-term note. d. Received $890 from clients for consulting services to be performed in the next year. e. Bought $470 of supplies on account. f. Incurred and paid $1,800 in utilities for the current year. g. Consulted for clients in the current year for fees totaling $1,620, due from clients in the next year. h. Received $2,980 from clients paying on their accounts. i. Incurred $6,210 in salaries in the current year, paying $5,300 and owing the rest (to be paid next year). 1. Purchased $1,230 in short-term investments and paid $800 for insurance coverage beginning in the next fiscal year. k. Received $10 in interest revenue earned in the current year on short-term investments. 2 3 4 5 6 7 8 11 Received $9,500 cash for consulting services rendered. Note: Enter debits before credits. Transaction General Journal Debit Credit Issued 10 additional shares of common stock at a market price of $120 per share. Note: Enter debits before credits. Transaction General Journal Debit Credit Purchased $640 of office equipment, paying 25 percent in cash and owing the rest on a short-term note. Note: Enter debits before credits. Transaction General Journal Debit Credit Received $890 from clients for consulting services to be performed in the next year. Note: Enter debits before credits. Transaction General Journal Debit Credit Bought $470 of supplies on account. Note: Enter debits before credits. Transaction General Journal Debit Credit Incurred and paid $1,800 in utilities for the current year. Note: Enter debits before credits. Transaction General Journal Debit Credit f. Consulted for clients in the current year for fees totaling $1,620, due from clients in the next year. Note: Enter debits before credits. Transaction General Journal Debit Credit Received $2,980 from clients paying on their accounts. Note: Enter debits before credits. Transaction General Journal Debit Credit Incurred $6,210 in salaries in the current year, paying $5,300 and owing the rest (to be paid next year). Note: Enter debits before credits. Transaction General Journal Debit Credit Purchased $1,230 in short-term investments and paid $800 for insurance coverage beginning in the next fiscal year. Note: Enter debits before credits. Transaction General Journal Debit Credit Received $10 in interest revenue earned in the current year on short-term investments. Note: Enter debits before credits. Transaction General Journal Debit Credit Cash Short-term Investments Beg. Bal. Beg. Bal. End. Bal. 0 End. Bal. Accounts Receivable Supplies Beg. Bal. Beg. Bal. End. Bal. End. Bal. Prepaid Expenses Office Equipment Beg. Bal. Beg. Bal. End. Bal. End. Bal. Accumulated Depreciation Accounts Payable Beg. Bal. Beg. Bal. End. Bal. 0 End. Bal. Unearned Revenue Salarles Payable Beg. Bal. Beg. Bal. End. Bal. End. Bal. Short-term Note Payable Common Stock Beg. Bal. Beg. Bal. End. Bal. End. Bal. Additional Paid-in Capital Retained Earnings Beg. Bal. Beg. Bal. End. Bal. End. Bal. Consulting Fees Revenue Interest Revenue Beg. Bal. Beg. Bal. End. Bal. End. Bal. Salaries Expense Utilites Expense Beg. Bal. Beg. Bal. End. Bal. End. Bal. Revenues Expenses Liabilities Net income Stockholder's equity Assets 4. What would net income be if Conover, Inc., used the cash basis of accounting? (Enter your answer in thousands, not in dollars.) Net income