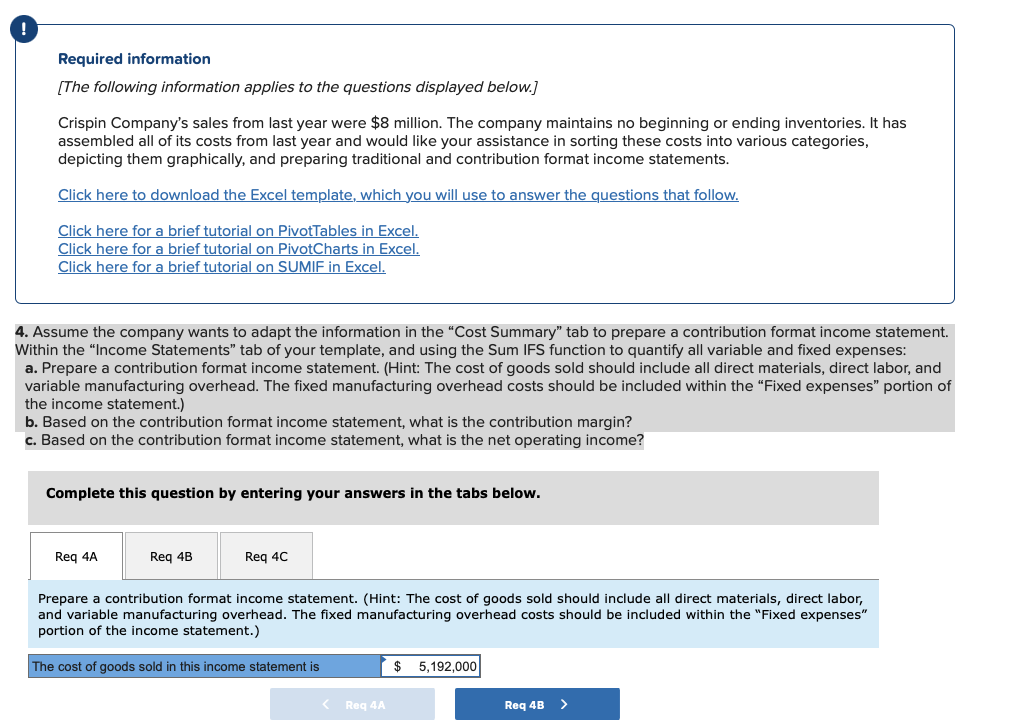

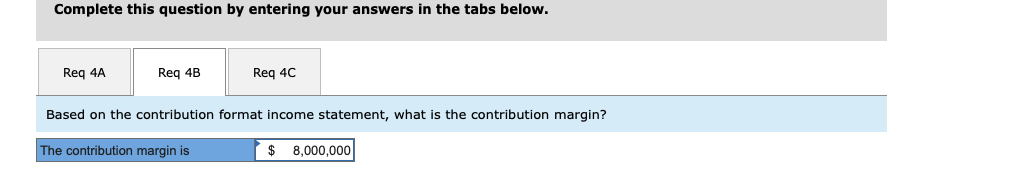

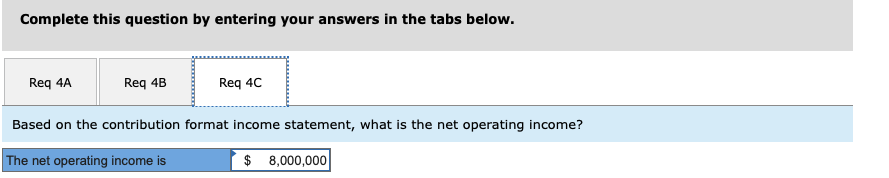

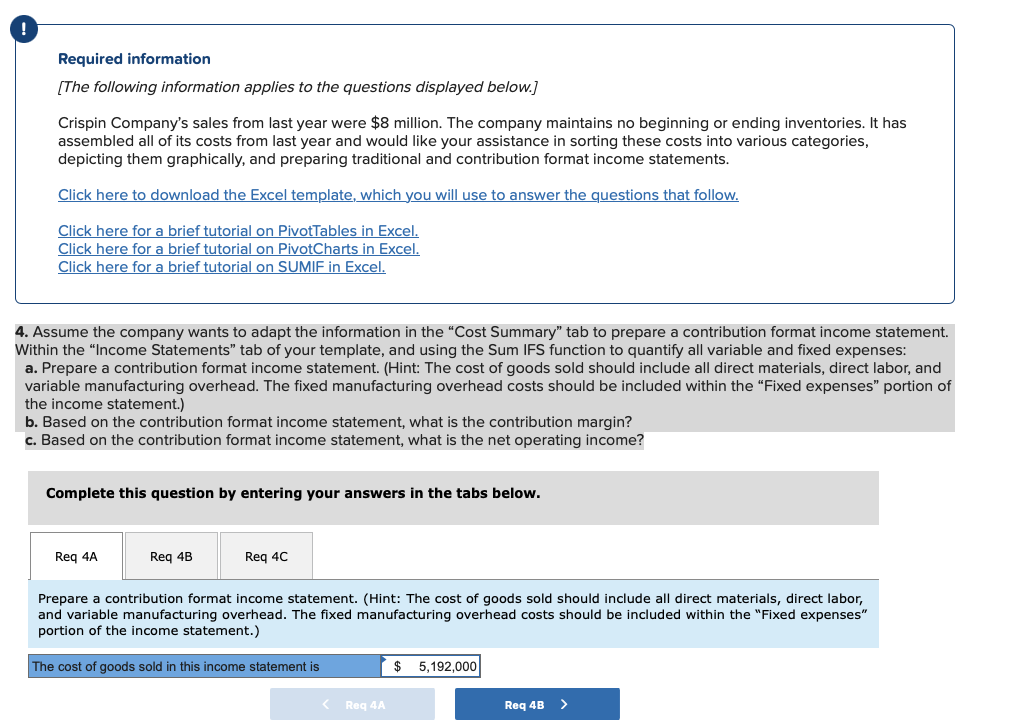

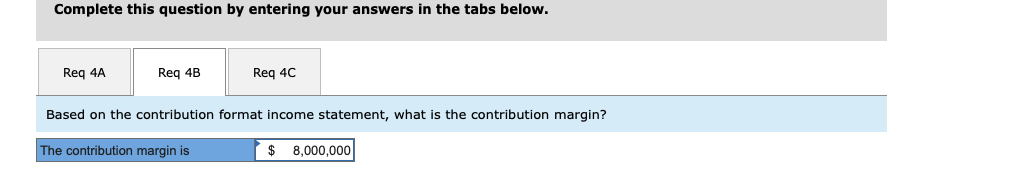

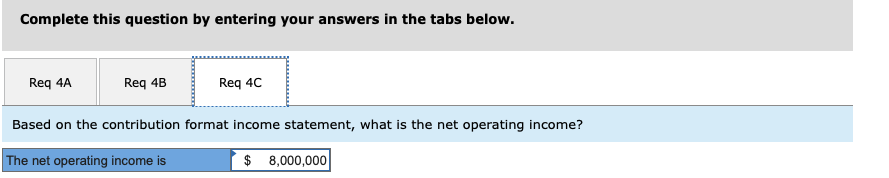

Required information [The following information applies to the questions displayed below.] Crispin Company's sales from last year were $8 million. The company maintains no beginning or ending inventories. It has assembled all of its costs from last year and would like your assistance in sorting these costs into various categories, depicting them graphically, and preparing traditional and contribution format income statements. Click here to download the Excel template, which you will use to answer the questions that follow. Click here for a brief tutorial on PivotTables in Excel. Click here for a brief tutorial on PivotCharts in Excel. Click here for a brief tutorial on SUMIF in Excel. 4. Assume the company wants to adapt the information in the "Cost Summary" tab to prepare a contribution format income statemer Nithin the "Income Statements" tab of your template, and using the Sum IFS function to quantify all variable and fixed expenses: a. Prepare a contribution format income statement. (Hint: The cost of goods sold should include all direct materials, direct labor, anc variable manufacturing overhead. The fixed manufacturing overhead costs should be included within the "Fixed expenses" portion the income statement.) b. Based on the contribution format income statement, what is the contribution margin? c. Based on the contribution format income statement, what is the net operating income? Complete this question by entering your answers in the tabs below. Prepare a contribution format income statement. (Hint: The cost of goods sold should include all direct materials, direct labor, and variable manufacturing overhead. The fixed manufacturing overhead costs should be included within the "Fixed expenses" portion of the income statement.) Complete this question by entering your answers in the tabs below. Based on the contribution format income statement, what is the contribution margin? Complete this question by entering your answers in the tabs below. Based on the contribution format income statement, what is the net operating income? Required information [The following information applies to the questions displayed below.] Crispin Company's sales from last year were $8 million. The company maintains no beginning or ending inventories. It has assembled all of its costs from last year and would like your assistance in sorting these costs into various categories, depicting them graphically, and preparing traditional and contribution format income statements. Click here to download the Excel template, which you will use to answer the questions that follow. Click here for a brief tutorial on PivotTables in Excel. Click here for a brief tutorial on PivotCharts in Excel. Click here for a brief tutorial on SUMIF in Excel. 4. Assume the company wants to adapt the information in the "Cost Summary" tab to prepare a contribution format income statemer Nithin the "Income Statements" tab of your template, and using the Sum IFS function to quantify all variable and fixed expenses: a. Prepare a contribution format income statement. (Hint: The cost of goods sold should include all direct materials, direct labor, anc variable manufacturing overhead. The fixed manufacturing overhead costs should be included within the "Fixed expenses" portion the income statement.) b. Based on the contribution format income statement, what is the contribution margin? c. Based on the contribution format income statement, what is the net operating income? Complete this question by entering your answers in the tabs below. Prepare a contribution format income statement. (Hint: The cost of goods sold should include all direct materials, direct labor, and variable manufacturing overhead. The fixed manufacturing overhead costs should be included within the "Fixed expenses" portion of the income statement.) Complete this question by entering your answers in the tabs below. Based on the contribution format income statement, what is the contribution margin? Complete this question by entering your answers in the tabs below. Based on the contribution format income statement, what is the net operating income