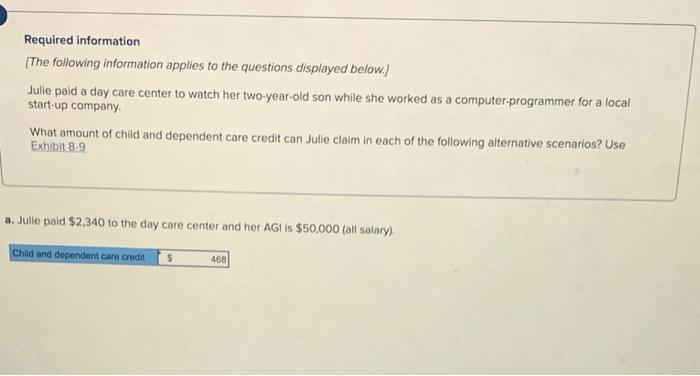

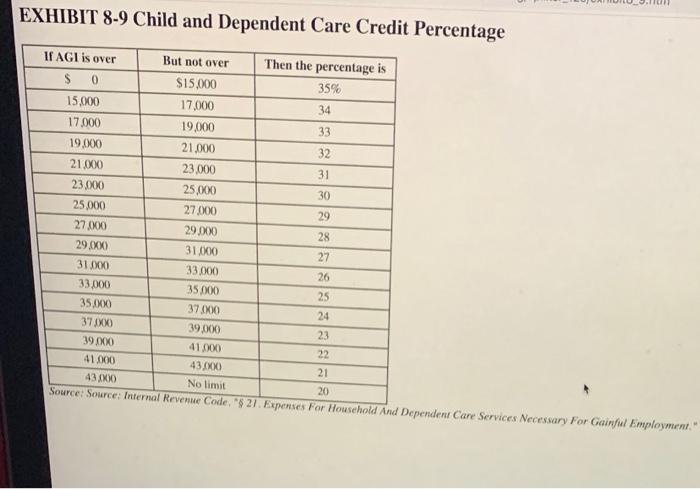

Required information [The following information applies to the questions displayed below) Julle paid a day care center to watch her two-year-old son while she worked as a computer programmer for a local start-up company What amount of child and dependent care credit can Julie claim in each of the following alternative scenarios? Use Exhibit 8.9 a. Julie paid $2,340 to the day care center and her AGI is $50,000 (all salary) Child and dependent care credit 468 EXHIBIT 8-9 Child and Dependent Care Credit Percentage If AGI is over But not over Then the percentage is $ 0 $15.000 35% 15.000 17,000 34 17.000 19.000 33 19.000 21.000 32 21.000 23.000 31 23000 25,000 30 25,000 27.000 29 27.000 29.000 28 29.000 31.000 27 31.000 33.000 26 33.000 35000 25 35.000 37.000 24 37200 39.000 23 39.000 41000 22 41000 43.00 21 430 No limit 20 Source: Source: Internal Revenue Code, "$ 21. Expenses For Household And Dependent Care Services Necessary for Gainel Employment." Required information [The following information applies to the questions displayed below) Julie paid a day care center to watch her two-year-old son while she worked as a computer programmer for a local start-up company What amount of child and dependent care credit can Julie claim in each of the following alternative scenarios? Use Exhibit 8-9 - b. Julle paid $5,850 to the day care center and her AGI is $50,000 (all salary) Child and dependent care credit Shaved Help Save Required information [The following information applies to the questions displayed below.) Julie paid a day care center to watch her two-year-old son while she worked as a computer programmer for a local start-up company What amount of child and dependent care credit can Julie claim in each of the following alternative scenarios? Use Exhibit 89 c. Julie paid $4,850 to the day care center and her AGI is $25,000 (all salary) Child and dependent care credit Required information (The following information applies to the questions displayed below.) Julle paid a day care center to watch her two-year-old son while she worked as a computer programmer for a local start-up company What amount of child and dependent care credit can Julie claim in each of the following alternative scenarios? Use Exhibit 8.9 d. Julie paid $2,340 to the day care center and her AGI is $14,000 (all salary) Child and dependent care credit Required information (The following information applies to the questions displayed below.) Julle paid a day care center to watch her two-year-old son while she worked as a computer programmer for a local start-up company What amount of child and dependent care credit can Julle claim in each of the following alternative scenarios? Use Exhibit 8-9 e. Julie paid $4,850 to the day care center and her AGI is $14,000 ($2,340 salary and $11,660 unearned income). Child and dependent care credit