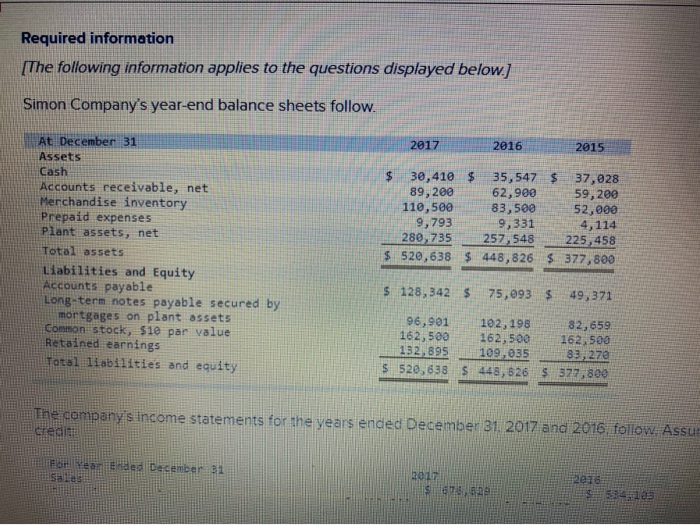

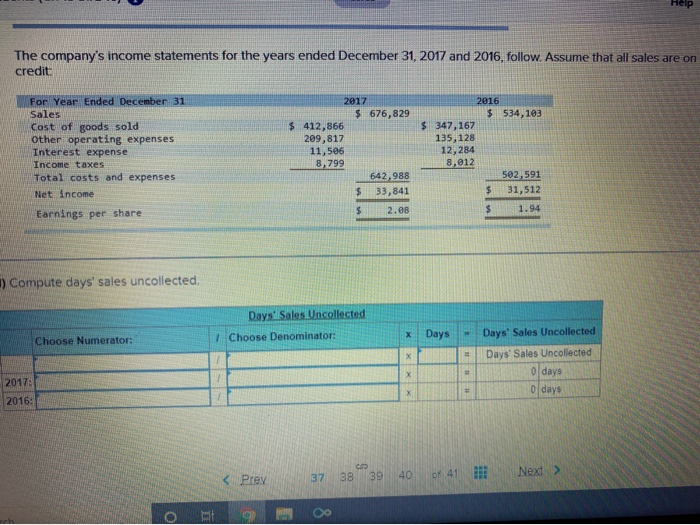

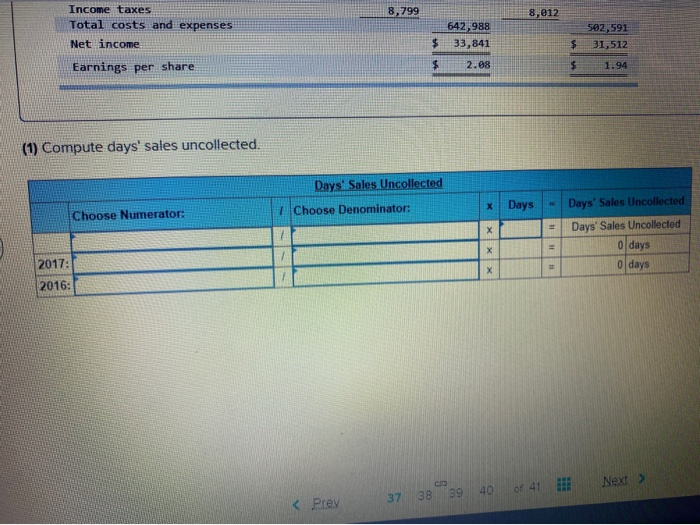

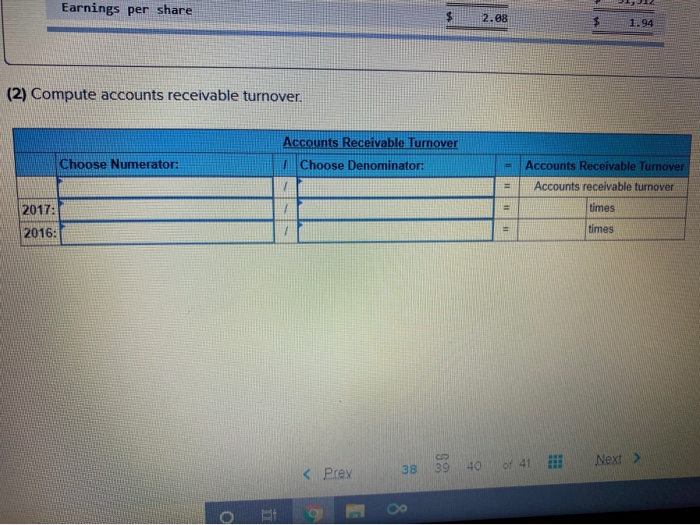

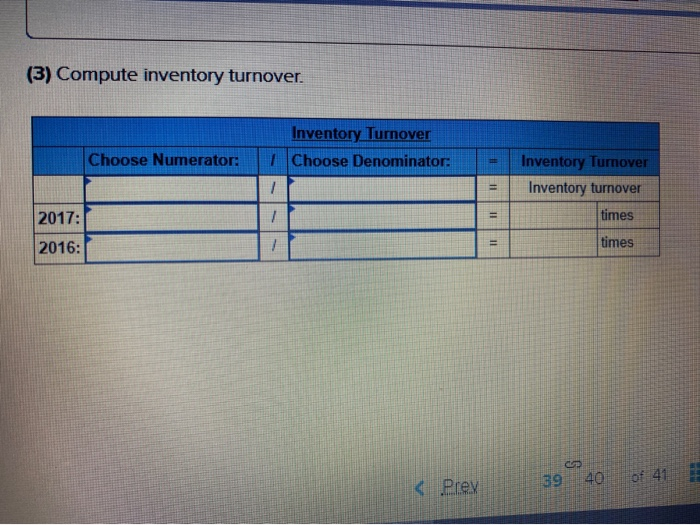

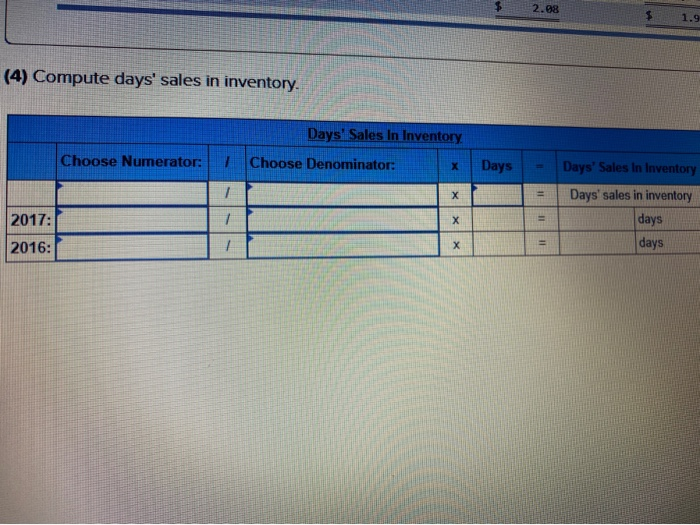

Required information [The following information applies to the questions displayed below.) Simon Company's year-end balance sheets follow. 2017 2016 2015 At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity 30,410 $ 35,547 $ 37,028 89, 2006 2,900 59, 200 110,500 8 3,500 52,000 9,793 9,331 4,114 280, 735257, 548 225,458 $ 520,638 $ 448,826 $ 377,800 $ 128,342 $ 75,093 $ 49,371 96,901 192,198 162,500 162,500 132,895 TL 109,035 $ 520,638 $ 448,526 82,659 162,500 83,270 $ 37,800 The company's income statements for the years ended December 31, 2017 and 2016, follow. Assur credit For yeandes December 31 30 678, Help The company's income statements for the years ended December 31, 2017 and 2016, follow. Assume that all sales are on credit: $ 676,829 For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income taxes Total costs and expenses Net income Earnings per share $ 412,866 209,817 11,506 8,799 2016 $ 534,103 $ 347, 167 135, 128 12284 8.012 502 591 $ 31,512 642.988 2.GE ) Compute days' sales uncollected. Days Sales Uncollected 7 Choose Denominator: Days - Choose Numerator: Days' Sales Uncollected Days' Sales Uncollected 0 days 0 days 2017 2016: O 0 8,799 HIILUN taxes Total costs and expenses Net income Earnings per share 642.988 33,841 502,591 31,512 $ 1.94 (1) Compute days' sales uncollected. Days' Sales Uncollected Choose Denominator: Choose Numerator: * Days - = Days' Sales Uncollected Days Sales Uncollected 0 days 2017 2016: Earnings per share (2) Compute accounts receivable turnover. Accounts Receivable Turnover Choose Denominator: Choose Numerator: Accounts Receivable Turnover Accounts receivable turnover times 2017: 2016: times 38 (3) Compute inventory turnover. Inventory Turnover I Choose Denominator Choose Numerator: Inventory Turnover Inventory turnover times 2017: 2016: times 39 40 of 41 2.08 1.9 (4) Compute days' sales in inventory. Days' Sales In Inventory Choose Denominator: Choose Numerator: Days Days' Sales In Inventory Days' sales in inventory days days 2017: 2016: XX