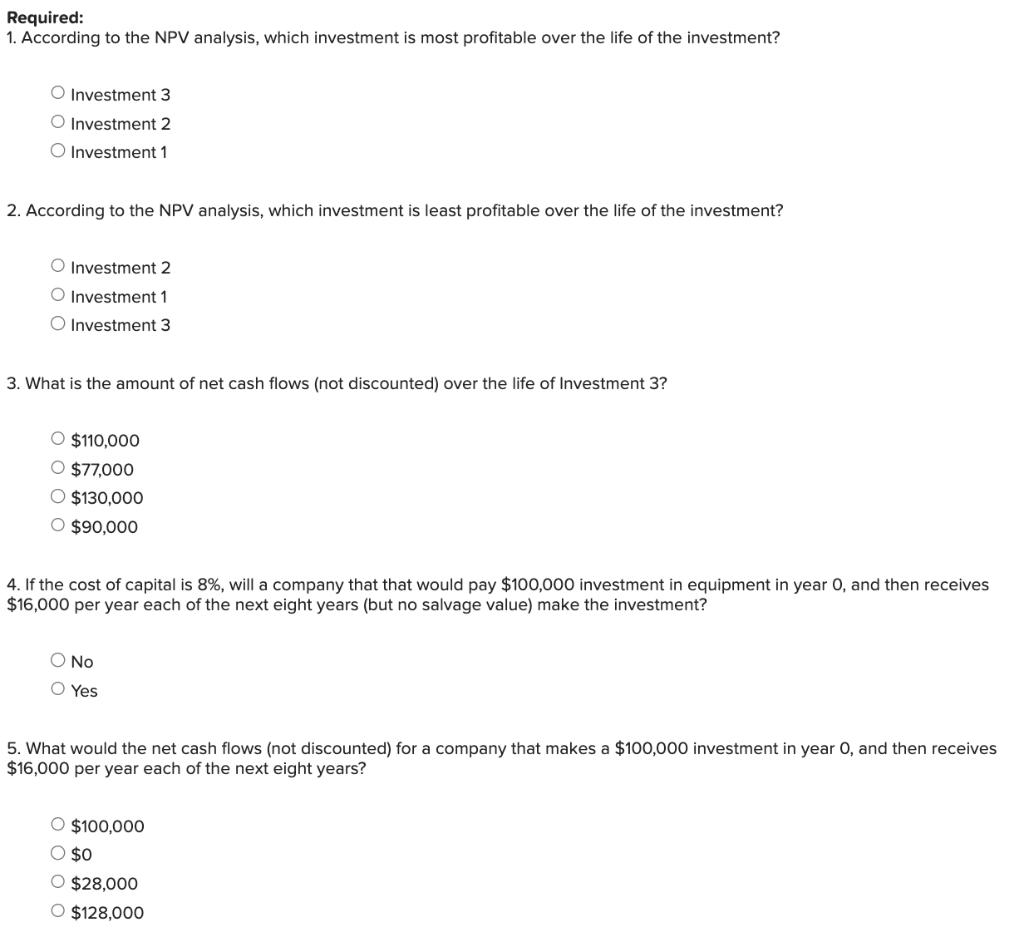

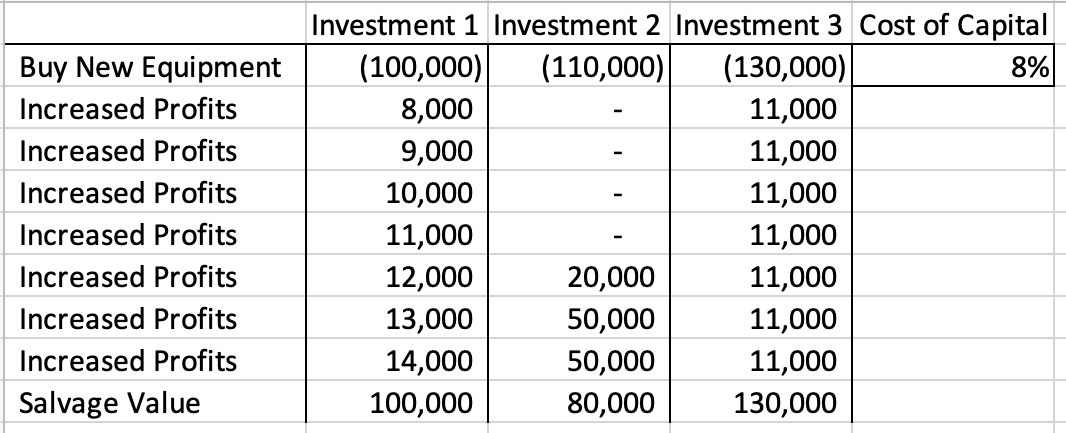

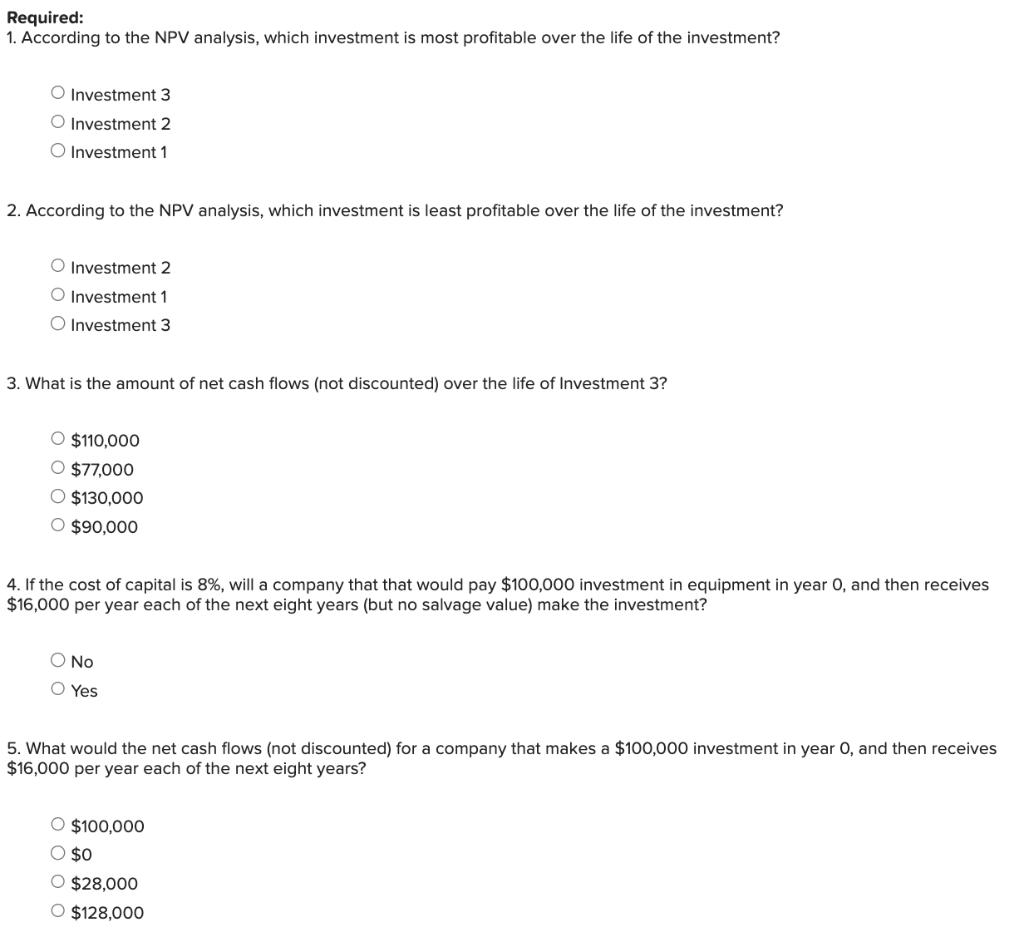

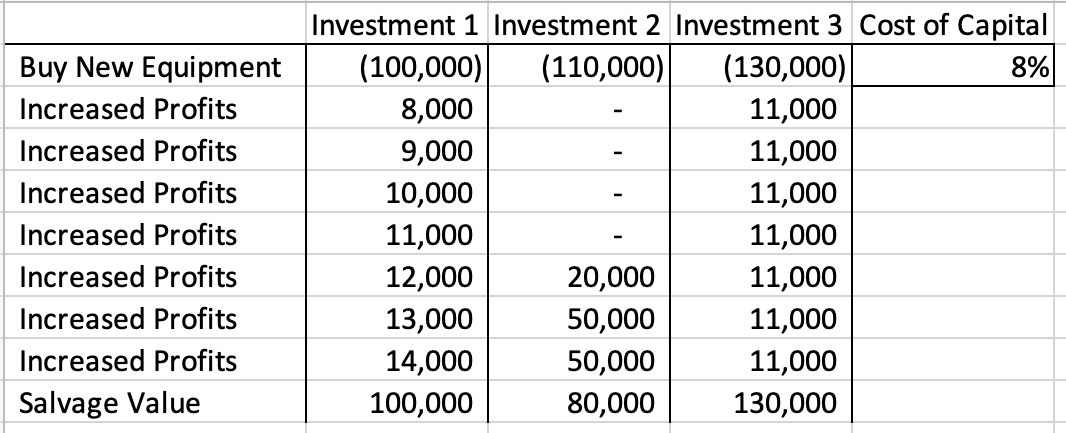

Required information [The following information applies to the questions displayed below.] Required: 1. Calculate the net cash flows over the life of each investment. 2. Use Excel's NPV() function to evaluate the potential capital investments. Ask the Question: How can NPV be used to evaluate potential capital investments? Master the Data: Apply the same steps as Lab 9-3 to the Lab 9-3 Alt Data.xlsx dataset. Mark Wagstaff is trying to evaluate the profitability of three investments. Use the Excel NPV() function to evaluate the potential investments. Software needed - Excel - Screen capture tool (Windows: Snipping Tool; Mac: Cmd+Shift+4) Data: Perform the Analysis: Refer to Lab 9-3 Alternate in the text for instructions and Lab 9-3 steps for each the of lab parts. Share the Story: We have done one level of analysis, the net present value, to evaluate the profitability of Investments 1 3. Required: 1. According to the NPV analysis, which investment is most profitable over the life of the investment? Investment 3 Investment 2 Investment 1 2. According to the NPV analysis, which investment is least profitable over the life of the investment? Investment 2 Investment 1 Investment 3 3. What is the amount of net cash flows (not discounted) over the life of Investment 3 ? $110,000$77,000$130,000$90,000 4. If the cost of capital is 8%, will a company that that would pay $100,000 investment in equipment in year 0 , and then receives $16,000 per year each of the next eight years (but no salvage value) make the investment? No Yes 5. What would the net cash flows (not discounted) for a company that makes a $100,000 investment in year 0 , and then receives $16,000 per year each of the next eight years? $100,000$0$28,000$128,000 Investment 1 Investment 2 Investment 3 Cost of Capital \begin{tabular}{|l|r|r|r|r|} \hline Buy New Equipment & (100,000) & (110,000) & (130,000) & 8% \\ \hline Increased Profits & 8,000 & - & 11,000 & \\ \hline Increased Profits & 9,000 & - & 11,000 & \\ \hline Increased Profits & 10,000 & - & 11,000 & \\ \hline Increased Profits & 11,000 & - & 11,000 & \\ \hline Increased Profits & 12,000 & 20,000 & 11,000 & \\ \hline Increased Profits & 13,000 & 50,000 & 11,000 & \\ \hline Increased Profits & 14,000 & 50,000 & 11,000 & \\ \hline Salvage Value & 100,000 & 80,000 & 130,000 & \\ \hline \end{tabular} Required information [The following information applies to the questions displayed below.] Required: 1. Calculate the net cash flows over the life of each investment. 2. Use Excel's NPV() function to evaluate the potential capital investments. Ask the Question: How can NPV be used to evaluate potential capital investments? Master the Data: Apply the same steps as Lab 9-3 to the Lab 9-3 Alt Data.xlsx dataset. Mark Wagstaff is trying to evaluate the profitability of three investments. Use the Excel NPV() function to evaluate the potential investments. Software needed - Excel - Screen capture tool (Windows: Snipping Tool; Mac: Cmd+Shift+4) Data: Perform the Analysis: Refer to Lab 9-3 Alternate in the text for instructions and Lab 9-3 steps for each the of lab parts. Share the Story: We have done one level of analysis, the net present value, to evaluate the profitability of Investments 1 3. Required: 1. According to the NPV analysis, which investment is most profitable over the life of the investment? Investment 3 Investment 2 Investment 1 2. According to the NPV analysis, which investment is least profitable over the life of the investment? Investment 2 Investment 1 Investment 3 3. What is the amount of net cash flows (not discounted) over the life of Investment 3 ? $110,000$77,000$130,000$90,000 4. If the cost of capital is 8%, will a company that that would pay $100,000 investment in equipment in year 0 , and then receives $16,000 per year each of the next eight years (but no salvage value) make the investment? No Yes 5. What would the net cash flows (not discounted) for a company that makes a $100,000 investment in year 0 , and then receives $16,000 per year each of the next eight years? $100,000$0$28,000$128,000 Investment 1 Investment 2 Investment 3 Cost of Capital \begin{tabular}{|l|r|r|r|r|} \hline Buy New Equipment & (100,000) & (110,000) & (130,000) & 8% \\ \hline Increased Profits & 8,000 & - & 11,000 & \\ \hline Increased Profits & 9,000 & - & 11,000 & \\ \hline Increased Profits & 10,000 & - & 11,000 & \\ \hline Increased Profits & 11,000 & - & 11,000 & \\ \hline Increased Profits & 12,000 & 20,000 & 11,000 & \\ \hline Increased Profits & 13,000 & 50,000 & 11,000 & \\ \hline Increased Profits & 14,000 & 50,000 & 11,000 & \\ \hline Salvage Value & 100,000 & 80,000 & 130,000 & \\ \hline \end{tabular}