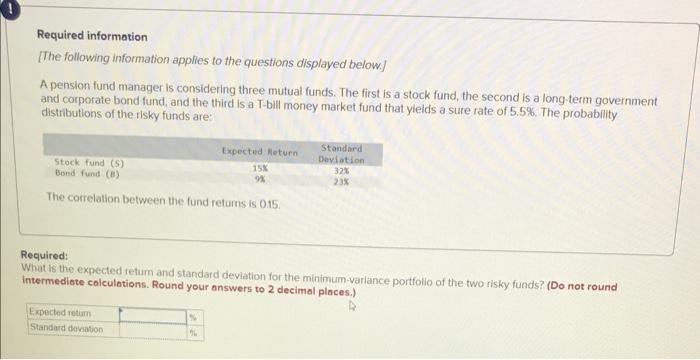

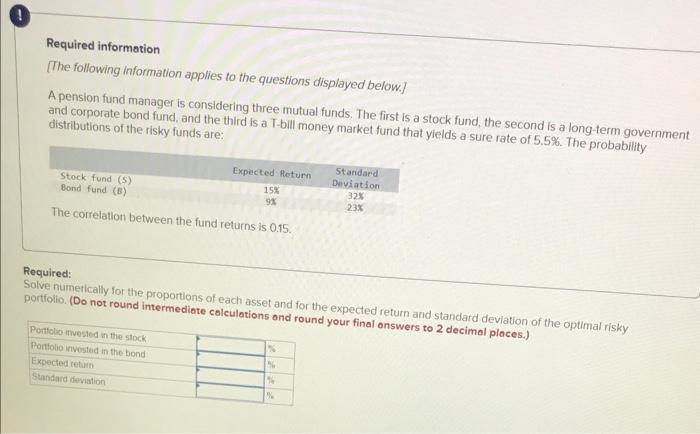

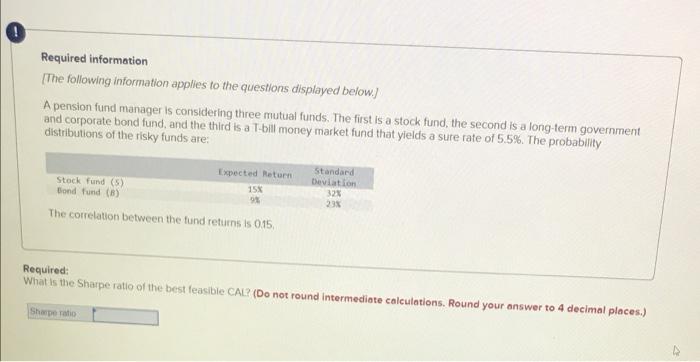

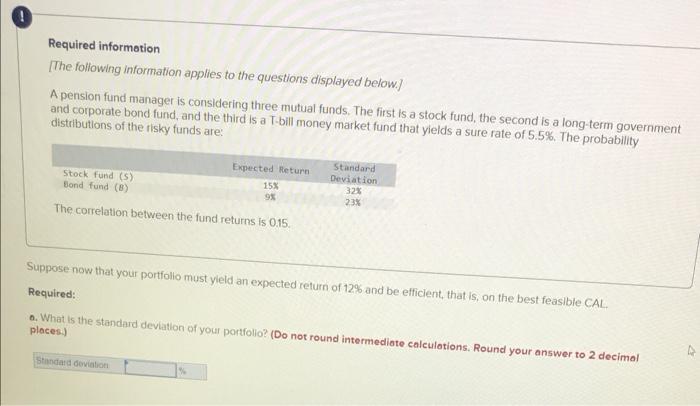

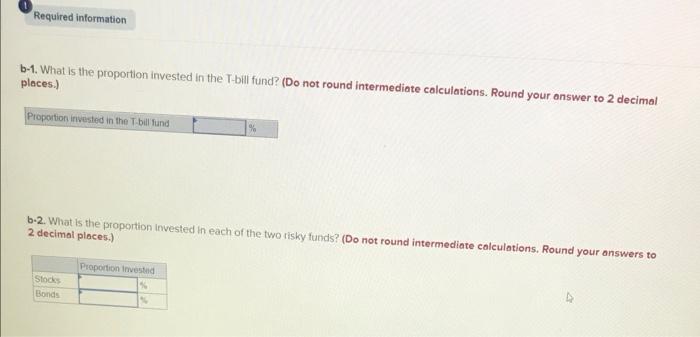

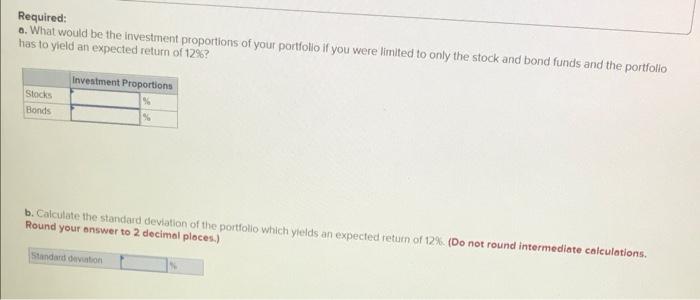

Required information [The following information applies to the questions displayed below.) A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-bill money market fund that yields a sure rate of 5.5%. The probability distributions of the risky funds are: Stock fund (5) Bond fund (8) Expected Return 15% 9% Standard Deviation 32% 23% The correlation between the fund returns is 0.15. Required: What is the expected retum and standard deviation for the minimum variance portfolio of the two risky funds? (Do not round Intermediate calculations. Round your answers to 2 decimal places.) Expected rotum Standard deviation ! Required information (The following information applies to the questions displayed below.) A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-bill money market fund that ylelds a sure rate of 5.5%. The probability distributions of the risky funds are: Stock fund (5) Bond fund (B) Expected Return 15% 9 Standard Deviation 32% 23% The correlation between the fund returns is 0.15. Required: Solve numerically for the proportions of each asset and for the expected return and standard deviation of the optimal risky portfolio. (Do not round intermediate calculations and round your final answers to 2 decimal places.) Portfolio invested in the stock Portfolio invested in the bond Expected retum Standard deviation Required information (The following information applies to the questions displayed below.) A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-bill money market fund that yields a sure rate of 5.5%. The probabilly distributions of the risky funds are Stock fund (5) Bond fund (8) Expected Return 15% Standard Davlation 32x 233 The correlation between the fund returns is 0.15 Required: What is the Sharpe ratio of the best feasible CAL? (Do not round intermediate calculations. Round your answer to 4 decimal places.) Sharpe Required information (The following information applies to the questions displayed below.) A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-bill money market fund that yields a sure rate of 5.5%. The probability distributions of the risky funds are: Stock fund (5) Bond fund (8) Expected Return 15% 9% Standard Deviation 32% 23% The correlation between the fund returns is 0.15. Suppose now that your portfolio must yield an expected return of 12% and be efficient, that is on the best feasible CAL Required: a. What is the standard deviation of your portfolio? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Standard deviation Required information b-1. What is the proportion invested in the T-billfund? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Proportion invested in the T.ba tund b-2. What is the proportion invested in each of the two tisky funds? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Proportion invested (stocks (Bonds Required: a. What would be the investment proportions of your portfollo if you were limited to only the stock and bond funds and the portfolio has to yield an expected return of 12%? Investment Proportions Stocks (Bonds b. Calculate the standard deviation of the portfolio which yields an expected return of 12% (Do not round intermediate calculations. Round your answer to 2 decimal places.) Standard deviation