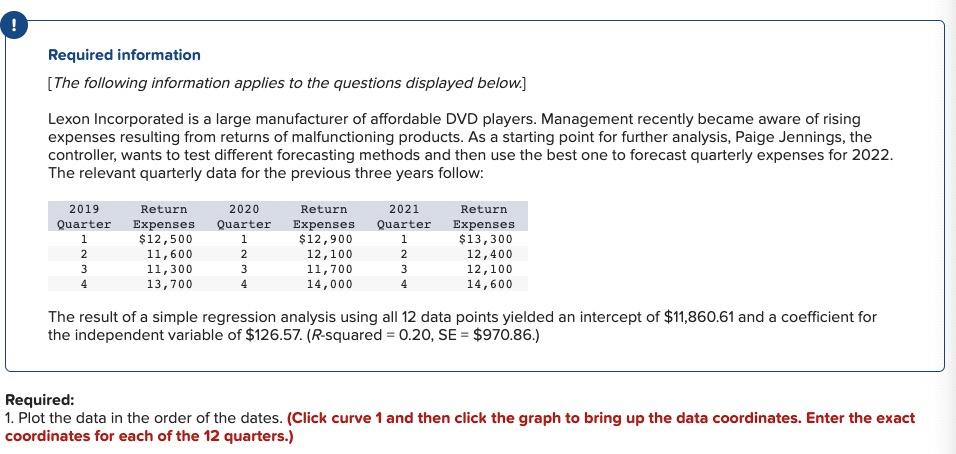

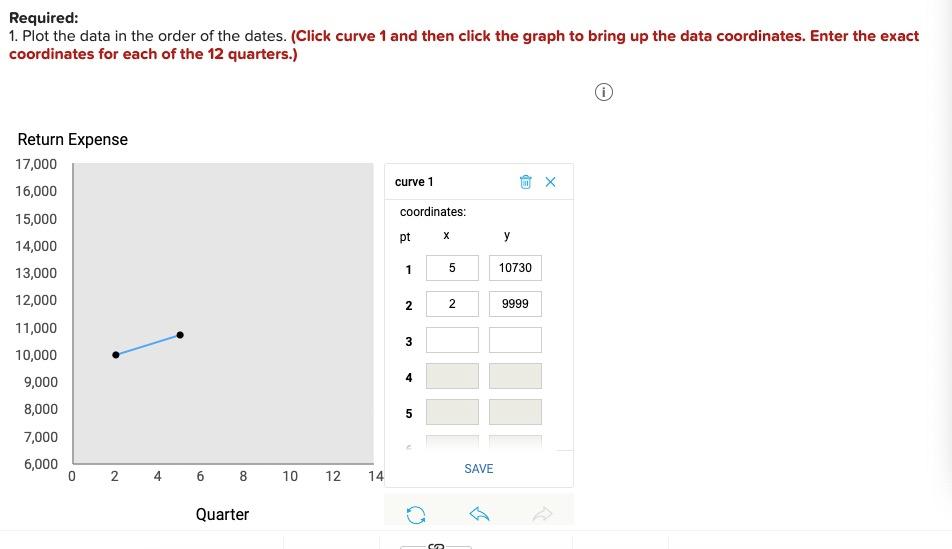

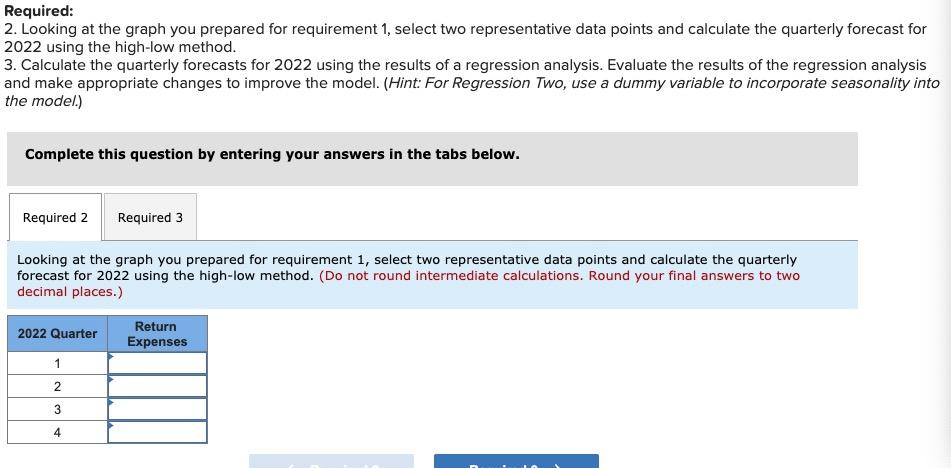

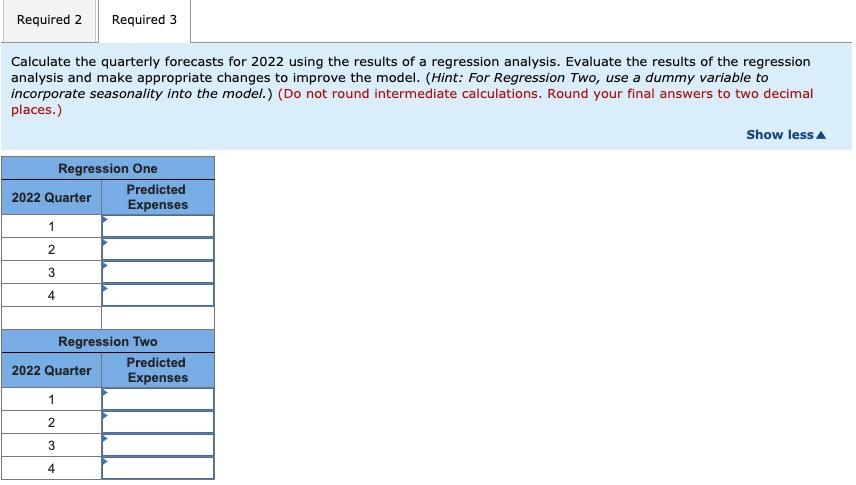

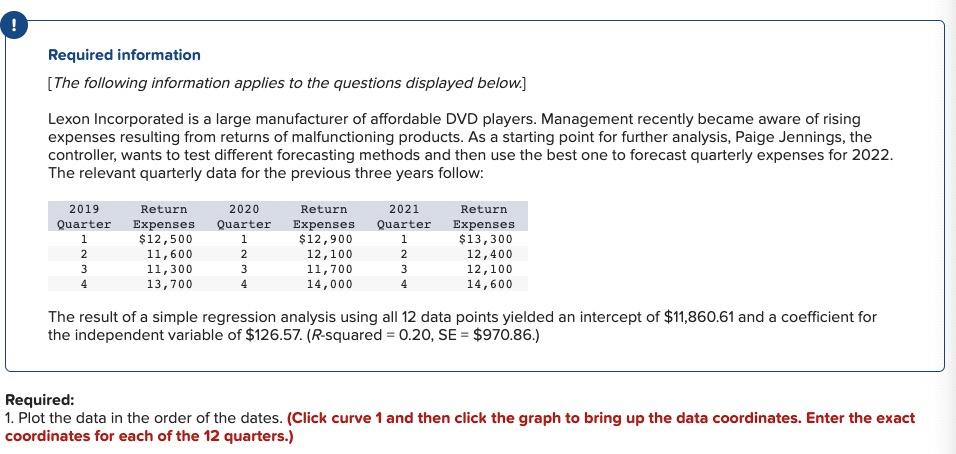

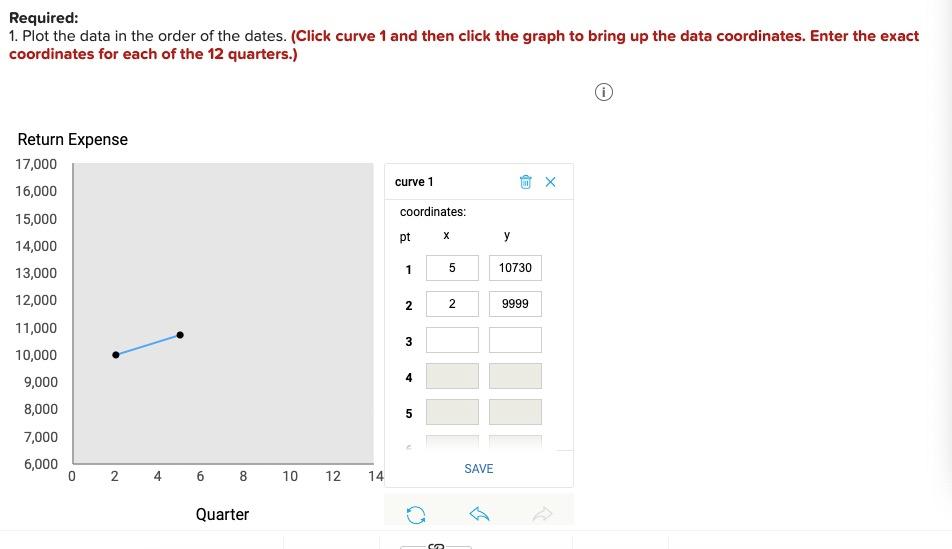

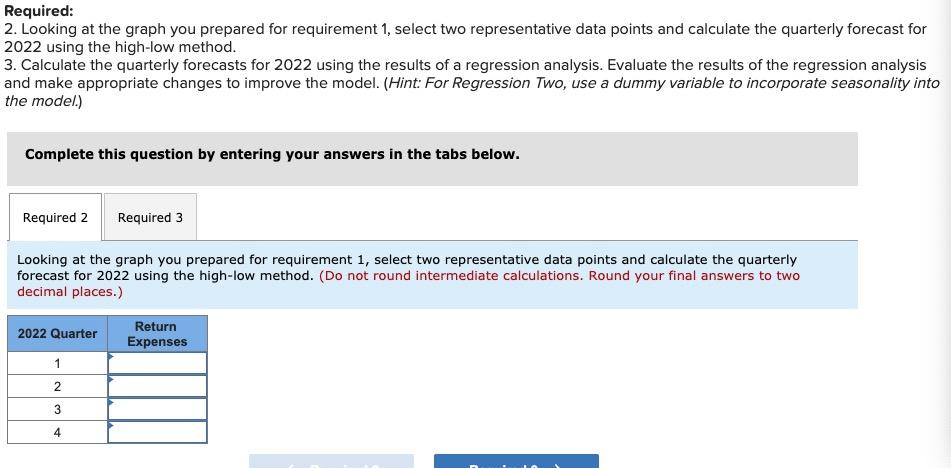

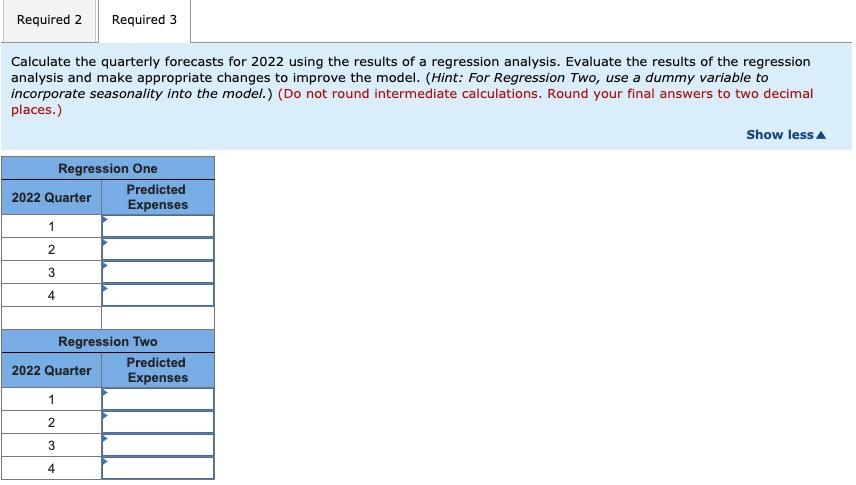

Required information [The following information applies to the questions displayed below.) Lexon Incorporated is a large manufacturer of affordable DVD players. Management recently became aware of rising expenses resulting from returns of malfunctioning products. As a starting point for further analysis, Paige Jennings, the controller, wants to test different forecasting methods and then use the best one to forecast quarterly expenses for 2022. The relevant quarterly data for the previous three years follow: 2019 Quarter 1 2 3 4 Return Expenses $ 12,500 11,600 11,300 13,700 2020 Return Quarter Expenses 1 $12,900 2 12,100 3 11,700 4 14,000 2021 Quarter 1 2 3 4 Return Expenses $13,300 12,400 12,100 14,600 The result of a simple regression analysis using all 12 data points yielded an intercept of $11,860.61 and a coefficient for the independent variable of $126.57. (R-squared = 0.20, SE = $970.86.) Required: 1. Plot the data in the order of the dates. (Click curve 1 and then click the graph to bring up the data coordinates. Enter the exact coordinates for each of the 12 quarters.) Required: 1. Plot the data in the order of the dates. (Click curve 1 and then click the graph to bring up the data coordinates. Enter the exact coordinates for each of the 12 quarters.) curve 1 de coordinates: pt 1 5 10730 Return Expense 17,000 16,000 15,000 14,000 13,000 12,000 11,000 10,000 9,000 8,000 7,000 6,000 0 2 2 2 9999 3 4 5 SAVE 4 6 8 10 12 14 Quarter S Required: 2. Looking at the graph you prepared for requirement 1, select two representative data points and calculate the quarterly forecast for 2022 using the high-low method. 3. Calculate the quarterly forecasts for 2022 using the results of a regression analysis. Evaluate the results of the regression analysis and make appropriate changes to improve the model. (Hint: For Regression Two, use a dummy variable to incorporate seasonality into the model.) Complete this question by entering your answers in the tabs below. Required 2 Required 3 Looking at the graph you prepared for requirement 1, select two representative data points and calculate the quarterly forecast for 2022 using the high-low method. (Do not round intermediate calculations. Round your final answers to two decimal places.) 2022 Quarter Return Expenses 1 2 3 4 Required 2 Required 3 Calculate the quarterly forecasts for 2022 using the results of a regression analysis. Evaluate the results of the regression analysis and make appropriate changes to improve the model. (Hint: For Regression Two, use a dummy variable to incorporate seasonality into the model.) (Do not round intermediate calculations. Round your final answers to two decimal places.) Show less Regression One Predicted 2022 Quarter Expenses 1 2 3 4 Regression Two Predicted 2022 Quarter Expenses 1 2 3 4 Required information [The following information applies to the questions displayed below.) Lexon Incorporated is a large manufacturer of affordable DVD players. Management recently became aware of rising expenses resulting from returns of malfunctioning products. As a starting point for further analysis, Paige Jennings, the controller, wants to test different forecasting methods and then use the best one to forecast quarterly expenses for 2022. The relevant quarterly data for the previous three years follow: 2019 Quarter 1 2 3 4 Return Expenses $ 12,500 11,600 11,300 13,700 2020 Return Quarter Expenses 1 $12,900 2 12,100 3 11,700 4 14,000 2021 Quarter 1 2 3 4 Return Expenses $13,300 12,400 12,100 14,600 The result of a simple regression analysis using all 12 data points yielded an intercept of $11,860.61 and a coefficient for the independent variable of $126.57. (R-squared = 0.20, SE = $970.86.) Required: 1. Plot the data in the order of the dates. (Click curve 1 and then click the graph to bring up the data coordinates. Enter the exact coordinates for each of the 12 quarters.) Required: 1. Plot the data in the order of the dates. (Click curve 1 and then click the graph to bring up the data coordinates. Enter the exact coordinates for each of the 12 quarters.) curve 1 de coordinates: pt 1 5 10730 Return Expense 17,000 16,000 15,000 14,000 13,000 12,000 11,000 10,000 9,000 8,000 7,000 6,000 0 2 2 2 9999 3 4 5 SAVE 4 6 8 10 12 14 Quarter S Required: 2. Looking at the graph you prepared for requirement 1, select two representative data points and calculate the quarterly forecast for 2022 using the high-low method. 3. Calculate the quarterly forecasts for 2022 using the results of a regression analysis. Evaluate the results of the regression analysis and make appropriate changes to improve the model. (Hint: For Regression Two, use a dummy variable to incorporate seasonality into the model.) Complete this question by entering your answers in the tabs below. Required 2 Required 3 Looking at the graph you prepared for requirement 1, select two representative data points and calculate the quarterly forecast for 2022 using the high-low method. (Do not round intermediate calculations. Round your final answers to two decimal places.) 2022 Quarter Return Expenses 1 2 3 4 Required 2 Required 3 Calculate the quarterly forecasts for 2022 using the results of a regression analysis. Evaluate the results of the regression analysis and make appropriate changes to improve the model. (Hint: For Regression Two, use a dummy variable to incorporate seasonality into the model.) (Do not round intermediate calculations. Round your final answers to two decimal places.) Show less Regression One Predicted 2022 Quarter Expenses 1 2 3 4 Regression Two Predicted 2022 Quarter Expenses 1 2 3 4