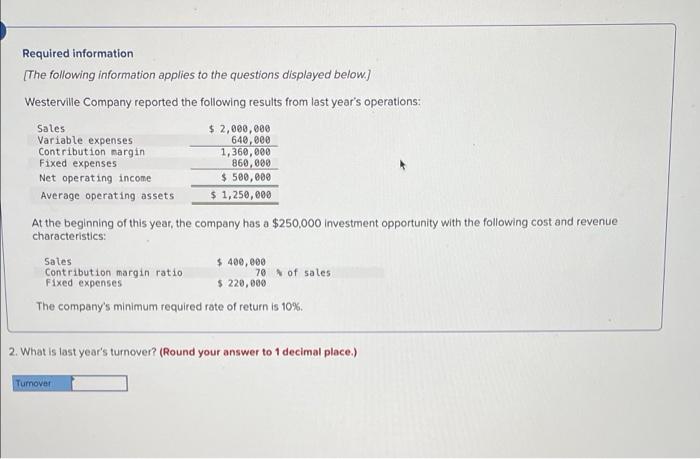

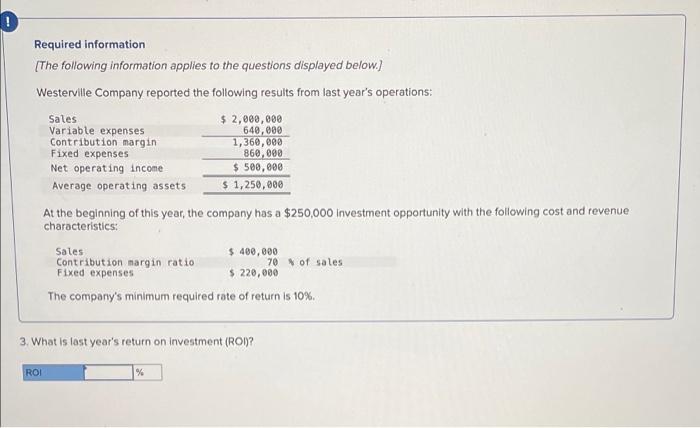

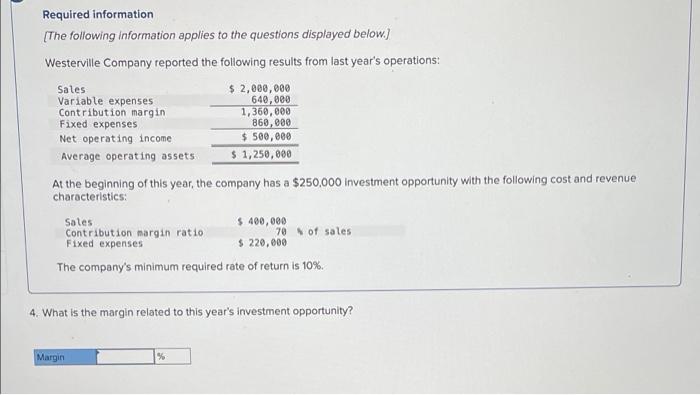

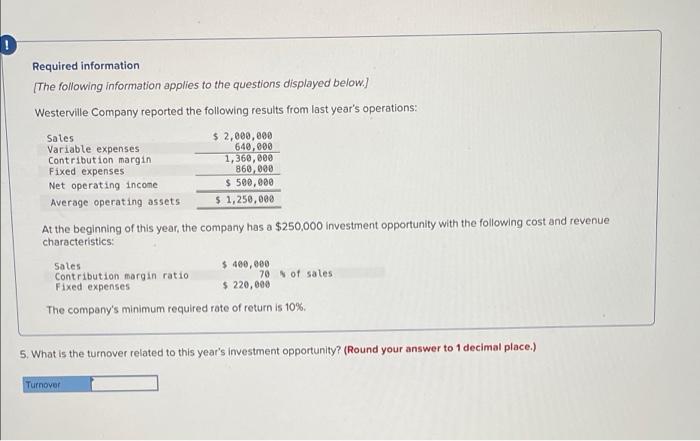

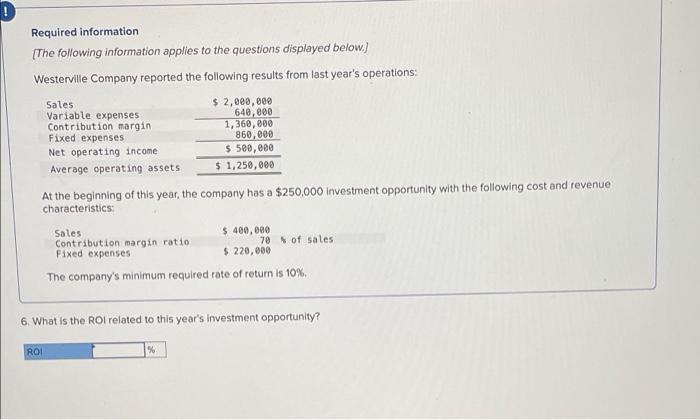

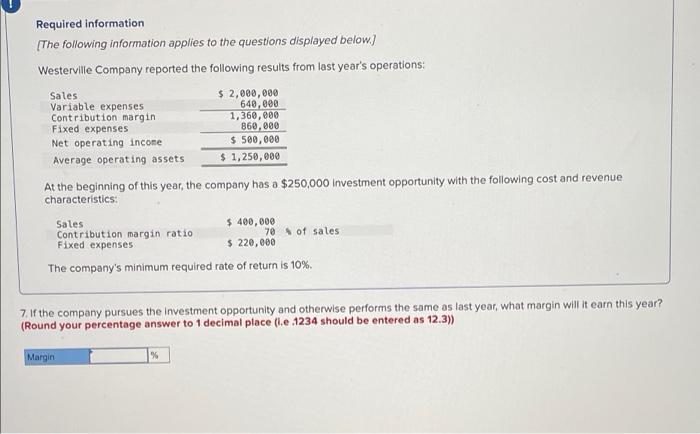

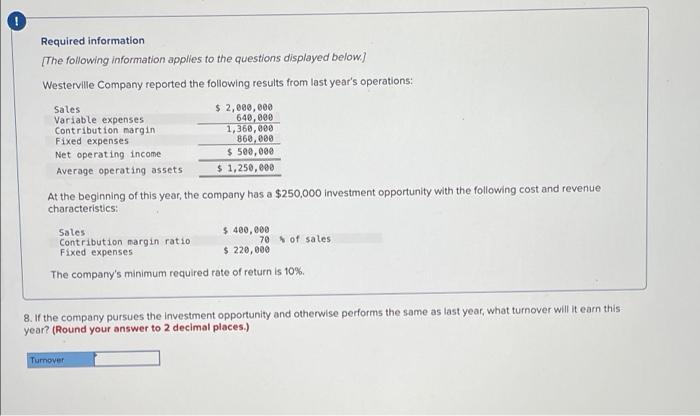

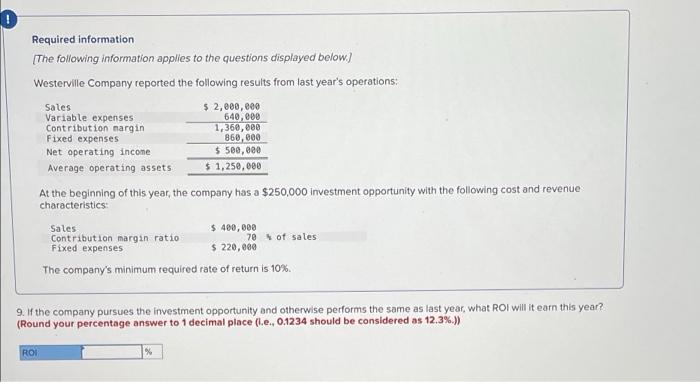

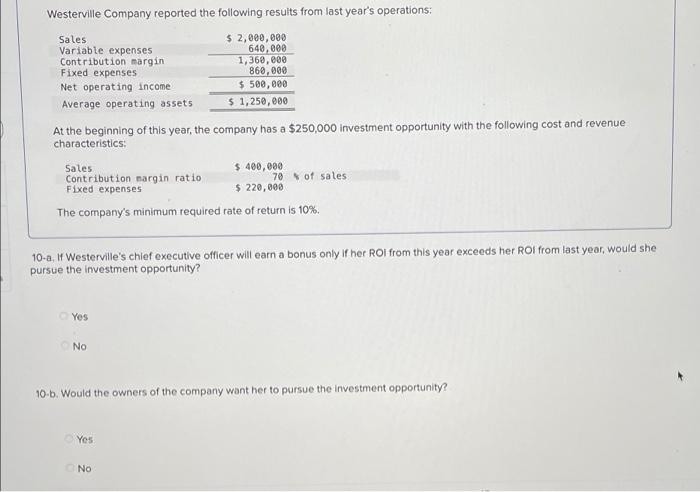

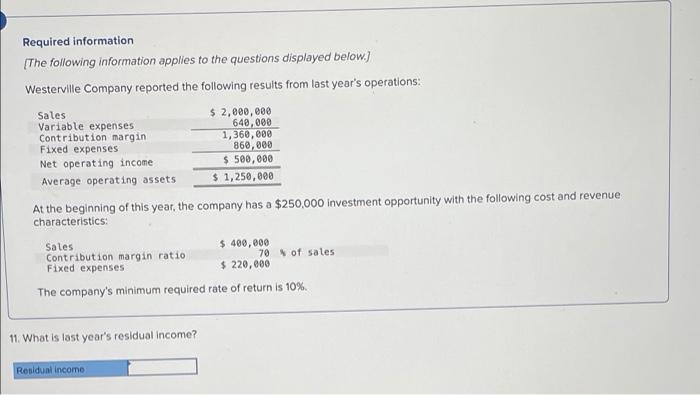

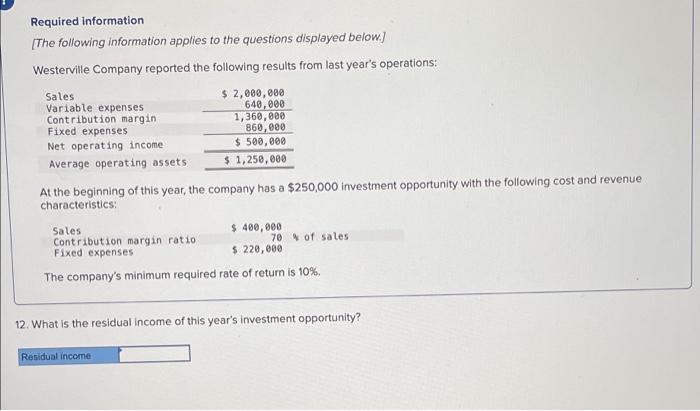

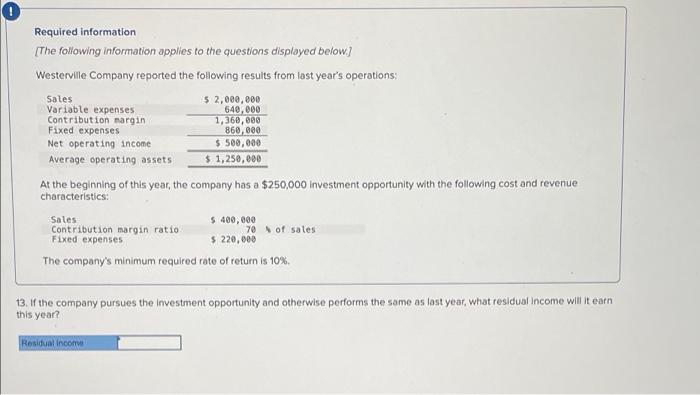

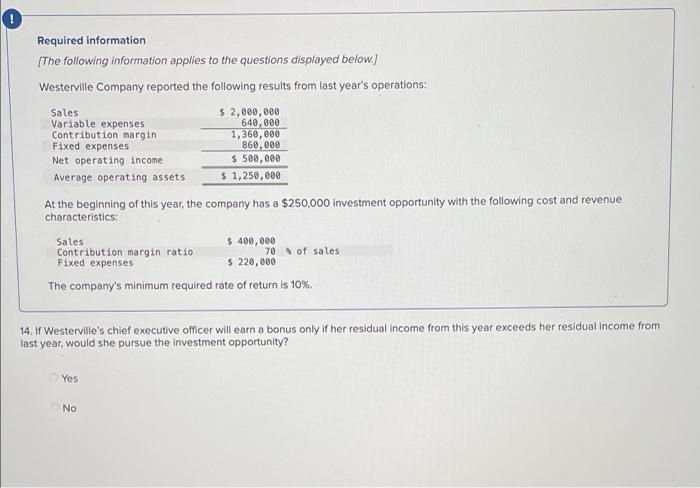

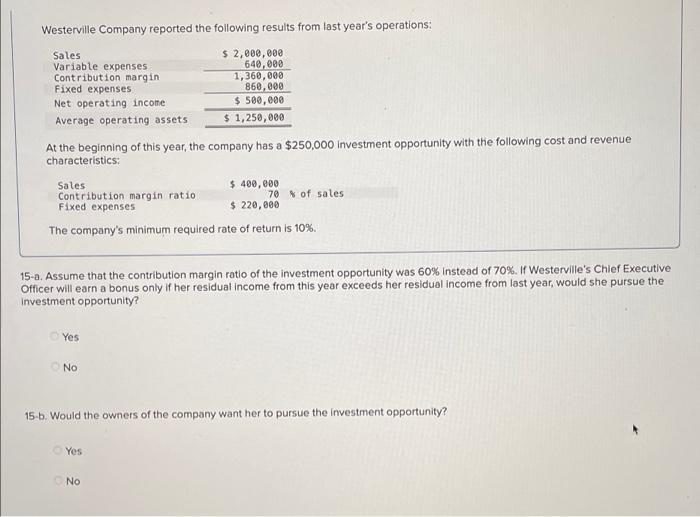

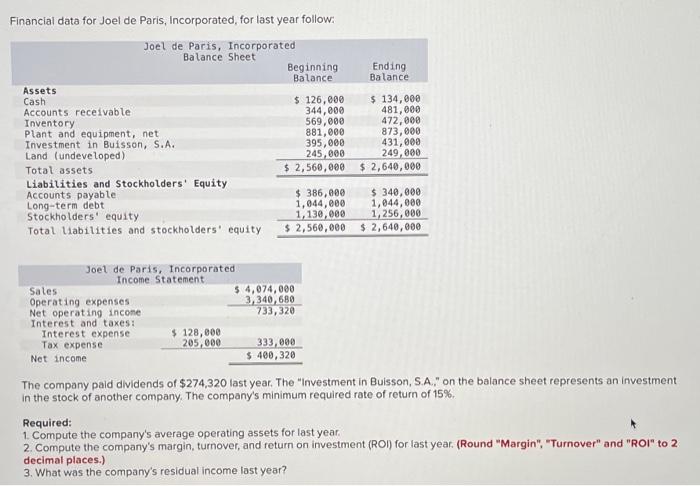

Required information [The following information applies to the questions displayed below.] Westerville Company reported the following results from last year's operations: Sales Variable expenses Contribution margin Fixed expenses $ 2,000,000 640,000 1,360,000 860,000 Net operating income $ 500,000 Average operating assets $1,250,000 At the beginning of this year, the company has a $250,000 investment opportunity with the following cost and revenue characteristics: Sales $ 400,000 Contribution margin ratio Fixed expenses 70 of sales $ 220,000 The company's minimum required rate of return is 10%. 2. What is last year's turnover? (Round your answer to 1 decimal place.) Turnover Required information [The following information applies to the questions displayed below.] Westerville Company reported the following results from last year's operations: Sales Variable expenses Contribution margin Fixed expenses $ 2,000,000 640,000 1,360,000 860,000 $ 500,000 Net operating income Average operating assets $ 1,250,000 At the beginning of this year, the company has a $250,000 investment opportunity with the following cost and revenue characteristics: Sales $ 400,000 70% of sales Contribution margin ratio Fixed expenses $ 220,000 The company's minimum required rate of return is 10%. 3. What is last year's return on investment (ROI)? ROI % Required information [The following information applies to the questions displayed below.] Westerville Company reported the following results from last year's operations: Sales Variable expenses Contribution margin. Fixed expenses $ 2,000,000 640,000 1,360,000 860,000 $ 500,000 Net operating income i Average operating assets $ 1,250,000 At the beginning of this year, the company has a $250,000 investment opportunity with the following cost and revenue characteristics: Sales $ 400,000 70% of sales Contribution margin ratio Fixed expenses $ 220,000 The company's minimum required rate of return is 10%. 4. What is the margin related to this year's investment opportunity? Margin Required information [The following information applies to the questions displayed below.] Westerville Company reported the following results from last year's operations: Sales Variable expenses Contribution margin Fixed expenses $ 2,000,000 640,000 1,360,000 860,000 Net operating income $ 500,000 Average operating assets $ 1,250,000 At the beginning of this year, the company has a $250,000 investment opportunity with the following cost and revenue characteristics: Sales $ 400,000 70% of sales Contribution margin ratio. Fixed expenses $ 220,000 The company's minimum required rate of return is 10%. 5. What is the turnover related to this year's investment opportunity? (Round your answer to 1 decimal place.) Turnover ! Required information [The following information applies to the questions displayed below.] Westerville Company reported the following results from last year's operations: Sales $ 2,000,000 Variable expenses. Contribution margin Fixed expenses 640,000 1,360,000 860,000 $ 500,000 Net operating income Average operating assets $ 1,250,000 At the beginning of this year, the company has a $250,000 investment opportunity with the following cost and revenue characteristics: Sales $ 400,000 Contribution margin ratio. Fixed expenses 70 of sales $ 220,000 The company's minimum required rate of return is 10%. 6. What is the ROI related to this year's investment opportunity? ROI % Required information [The following information applies to the questions displayed below.] Westerville Company reported the following results from last year's operations: Sales Variable expenses Contribution margin Fixed expenses $ 2,000,000 640,000 1,360,000 860,000 $ 500,000 Net operating income Average operating assets $1,250,000 At the beginning of this year, the company has a $250,000 investment opportunity with the following cost and revenue characteristics: Sales $ 400,000 Contribution margin ratio Fixed expenses 70 of sales $ 220,000 The company's minimum required rate of return is 10%. 7. If the company pursues the investment opportunity and otherwise performs the same as last year, what margin will it earn this year? (Round your percentage answer to 1 decimal place (i.e .1234 should be entered as 12.3)) Margin % Required information [The following information applies to the questions displayed below.] Westerville Company reported the following results from last year's operations: Sales Variable expenses Contribution margin Fixed expenses $ 2,000,000 640,000 1,360,000 860,000 $ 500,000 Net operating income. Average operating assets $1,250,000 At the beginning of this year, the company has a $250,000 investment opportunity with the following cost and revenue characteristics: Sales $ 400,000 Contribution margin ratio 70 of sales Fixed expenses $ 220,000 The company's minimum required rate of return is 10%. 8. If the company pursues the investment opportunity and otherwise performs the same as last year, what turnover will it earn this year? (Round your answer to 2 decimal places.) Turnover Required information [The following information applies to the questions displayed below.) Westerville Company reported the following results from last year's operations: Sales Variable expenses Contribution margin Fixed expenses $ 2,000,000 640,000 1,360,000 860,000 $ 500,000 Net operating income Average operating assets $1,250,000 At the beginning of this year, the company has a $250,000 investment opportunity with the following cost and revenue characteristics: Sales $ 400,000 70 of sales Contribution margin ratio Fixed expenses $ 220,000 The company's minimum required rate of return is 10%. 9. If the company pursues the investment opportunity and otherwise performs the same as last year, what ROI will it earn this year? (Round your percentage answer to 1 decimal place (l.e., 0.1234 should be considered as 12.3%.)) ROI % Westerville Company reported the following results from last year's operations: Sales: Variable expenses Contribution margin Fixed expenses $ 2,000,000 640,000 1,360,000 860,000 $ 500,000 Net operating income. Average operating assets $ 1,250,000 At the beginning of this year, the company has a $250,000 investment opportunity with the following cost and revenue characteristics: Sales. $ 400,000 Contribution margin ratio 70 of sales: Fixed expenses $ 220,000 The company's minimum required rate of return is 10%. 10-a. If Westerville's chief executive officer will earn a bonus only if her ROI from this year exceeds her ROI from last year, would she pursue the investment opportunity? Yes No 10-b. Would the owners of the company want her to pursue the investment opportunity? Yes No Required information [The following information applies to the questions displayed below.] Westerville Company reported the following results from last year's operations: Sales. Variable expenses Contribution margin Fixed expenses $ 2,000,000 640,000 1,360,000 860,000 $ 500,000 Net operating income Average operating assets $1,250,000 At the beginning of this year, the company has a $250,000 investment opportunity with the following cost and revenue characteristics: Sales $ 400,000 70% of sales Contribution margin ratio. Fixed expenses $ 220,000 The company's minimum required rate of return is 10%. 11. What is last year's residual income? Residual income Required information [The following information applies to the questions displayed below.] Westerville Company reported the following results from last year's operations: Sales. Variable expenses Contribution margin Fixed expenses $ 2,000,000 640,000 1,360,000 860,000 $ 500,000 Net operating income. Average operating assets $ 1,250,000 At the beginning of this year, the company has a $250,000 investment opportunity with the following cost and revenue characteristics: Sales $ 400,000 Contribution margin ratio 70% of sales Fixed expenses $ 220,000 The company's minimum required rate of return is 10%. 12. What is the residual income of this year's investment opportunity? Residual income 0 Required information [The following information applies to the questions displayed below.] Westerville Company reported the following results from last year's operations: Sales Variable expenses Contribution margin Fixed expenses $ 2,000,000 640,000 1,360,000 860,000 Net operating income $500,000 Average operating assets $1,250,000 At the beginning of this year, the company has a $250,000 investment opportunity with the following cost and revenue characteristics: Sales $ 400,000 Contribution margin ratio 70 of sales Fixed expenses $ 220,000 The company's minimum required rate of return is 10%. 13. If the company pursues the investment opportunity and otherwise performs the same as last year, what residual income will it earn this year? Residual income 0 Required information [The following information applies to the questions displayed below.] Westerville Company reported the following results from last year's operations: Sales $ 2,000,000 Variable expenses Contribution margin Fixed expenses 640,000 1,360,000 860,000 $ 500,000 Net operating income Average operating assets $ 1,250,000 At the beginning of this year, the company has a $250,000 investment opportunity with the following cost and revenue characteristics: Sales $ 400,000 70% of sales Contribution margin ratio Fixed expenses $ 220,000 The company's minimum required rate of return is 10%. 14. If Westerville's chief executive officer will earn a bonus only if her residual income from this year exceeds her residual income from. last year, would she pursue the investment opportunity? Yes No Westerville Company reported the following results from last year's operations: Sales. $ 2,000,000 Variable expenses Contribution margin Fixed expenses 640,000 1,360,000 860,000 $ 500,000 Net operating income Average operating assets. $ 1,250,000 At the beginning of this year, the company has a $250,000 investment opportunity with the following cost and revenue characteristics: Sales $ 400,000 70% of sales Contribution margin ratio Fixed expenses $ 220,000 The company's minimum required rate of return is 10%. 15-a. Assume that the contribution margin ratio of the investment opportunity was 60% Instead of 70%. If Westerville's Chief Executive Officer will earn a bonus only if her residual income from this year exceeds her residual income from last year, would she pursue the Investment opportunity? Yes No 15-b. Would the owners of the company want her to pursue the investment opportunity? Yes No Financial data for Joel de Paris, Incorporated, for last year follow: Joel de Paris, Incorporated Balance Sheet Beginning Balance Ending Balance. Assets Cash $ 134,000 $ 126,000 344,000 481,000 Accounts receivable Inventory 569,000 472,000 Plant and equipment, net 881,000 873,000 Investment in Buisson, S.A. 395,000 431,000 Land (undeveloped) 245,000 249,000 Total assets $ 2,560,000 $ 2,640,000 Liabilities and Stockholders' Equity Accounts payable Long-term debt $ 386,000 1,044,000 $ 340,000 1,044,000 1,256,000 Stockholders equity 1,130,000 Total liabilities and stockholders' equity $ 2,560,000 $ 2,640,000 Joel de Paris, Incorporated Income Statement Sales $ 4,074,000 Operating expenses Net operating income. Interest and taxes: Interest expense 3,340,680 733,320 $ 128,000 205,000 Tax expense Net income. 333,000 $ 400,320 The company paid dividends of $274,320 last year. The "Investment in Buisson, S.A.," on the balance sheet represents an investment in the stock of another company. The company's minimum required rate of return of 15%. Required: 1. Compute the company's average operating assets for last year. 2. Compute the company's margin, turnover, and return on investment (ROI) for last year. (Round "Margin", "Turnover" and "ROI" to 2 decimal places.) 3. What was the company's residual income last year? Hry W Test k 305,000 245.000 17,44,032,400,00 ALAM 10,000 Lassandra att Lattian ter Accele 296.000 Long stoly Total satilties sticbeliers et $2.500,0 $4,400.000 Was toerating t 3,340, T15,34 co terest and 112,9 vidends of $274,320 yearThe "sment in Bu company The company's minimum required (90) fe * ese Deterest expens Set The company neck of a Required Compute the coverage rating for your 2.Completo company's margt del 3. When was the company's esitul con ! 1 AKANG ALIN Q Statel A NO I 2 N W S # 3 X E 2 D SA $ 4 R C www. MET MERIT % nx FL 5 T eu.com the bance sheet presents an I ara MacBook P 6 Y & 7 and or Next stv U . 00 8 G H V B N J V