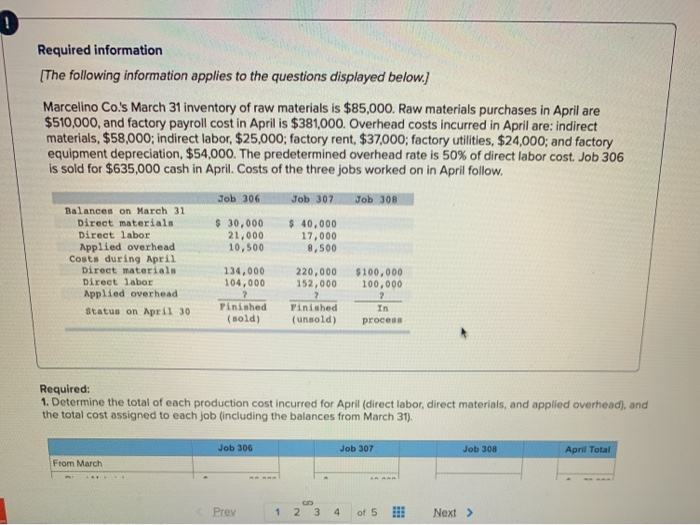

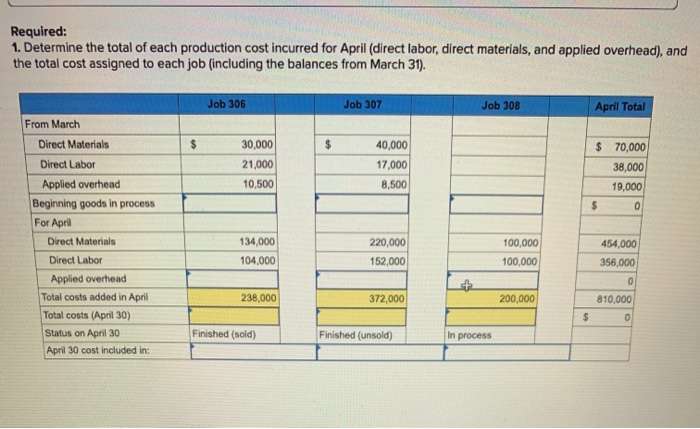

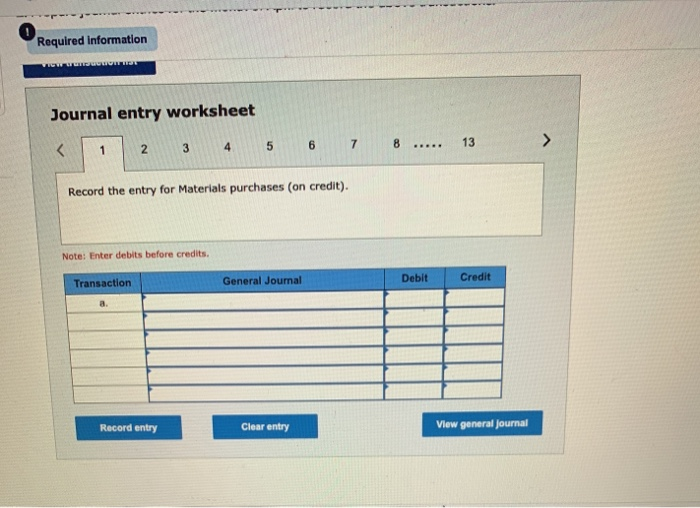

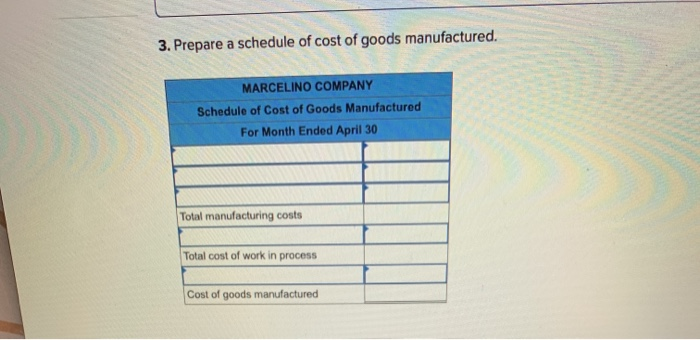

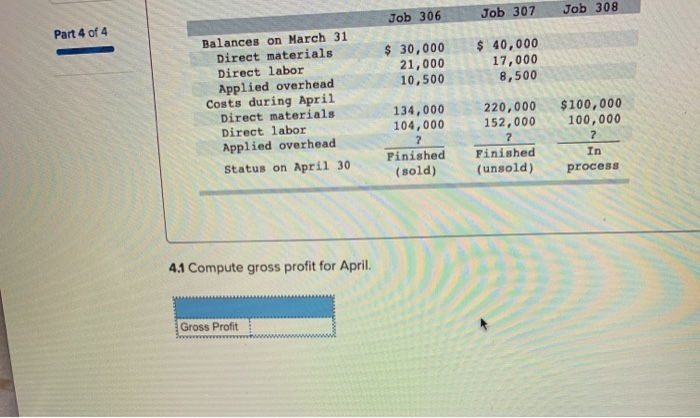

Required information [The following information applies to the questions displayed below. Marcelino Co's March 31 inventory of raw materials is $85,000. Raw materials purchases in April are $510,000, and factory payroll cost in April is $381,000. Overhead costs incurred in April are: indirect materials, $58,000; indirect labor, $25,000; factory rent, $37,000; factory utilities, $24,000; and factory equipment depreciation, $54,000. The predetermined overhead rate is 50% of direct labor cost. Job 306 is sold for $635,000 cash in April. Costs of the three jobs worked on in April follow. Job 306 Job 307 Job 308 Balances on March 31 Direct materials $ 30,000 $ 40,000 Direct labor 21,000 17,000 Applied overhead 10,500 8,500 Costs during April Direct materials 134,000 220,000 $100,000 Direct labor 104,000 152,000 100,000 Applied overhead 2 Pinished Pinished Status on April 30 (sold) (unsold) process In Required: 1. Determine the total of each production cost incurred for April (direct labor, direct materials, and applied overhead), and the total cost assigned to each job (including the balances from March 31). Job 306 Job 307 Job 308 April Total From March Prey N 3 4 of 5 !!! Next > Required: 1. Determine the total of each production cost incurred for April (direct labor, direct materials, and applied overhead), and the total cost assigned to each job (including the balances from March 31). Job 306 Job 307 Job 308 April Total $ $ $ 70,000 30,000 21,000 10,500 40,000 17,000 8,500 38,000 19,000 $ 0 From March Direct Materials Direct Labor Applied overhead Beginning goods in process For April Direct Materials Direct Labor Applied overhead Total costs added in April Total costs (April 30) Status on April 30 April 30 cost included in: 134,000 104,000 220,000 152,000 100,000 100,000 454,000 356,000 0 238,000 372,000 200,000 810,000 0 $ Finished (sold) Finished (unsold) In process Required information VIGW u Journal entry worksheet 6 7 3 4 8 1 2 Record the entry for Materials purchases (on credit). Note: Enter debits before credits. Debit General Journal Transaction Credit Record entry Clear entry View general Journal 3. Prepare a schedule of cost of goods manufactured. MARCELINO COMPANY Schedule of Cost of Goods Manufactured For Month Ended April 30 Total manufacturing costs Total cost of work in process Cost of goods manufactured Job 306 Job 307 Job 308 Part 4 of 4 $ 40,000 17,000 8,500 Balances on March 31 Direct materials Direct labor Applied overhead Costs during April Direct materials Direct labor Applied overhead Status on April 30 $ 30,000 21,000 10,500 134,000 104,000 2 Pinished (sold) 220,000 152,000 7 Finished (unsold) $100,000 100,000 7 In process 4.1 Compute gross profit for April. Gross Profit