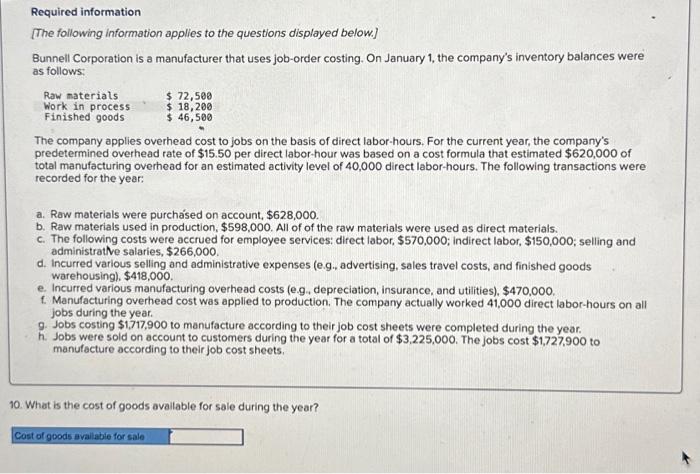

Required information [The following information applies to the questions displayed below] Bunnell Corporation is a manufacturer that uses job-order costing. On January 1 , the company's inventory balances were as follows: The company applies overhead cost to jobs on the basis of direct labor-hours. For the current year, the company's predetermined overhead rate of $15.50 per direct labor-hour was based on a cost formula that estimated $620,000 of total manufacturing overhead for an estimated activity level of 40,000 direct labor-hours. The following transactions were recorded for the year: a. Raw materials were purchsed on account, $628,000. b. Row materials used in production, $598,000. All of of the raw materials were used as direct materials. c. The following costs were accrued for employee services: direct labor, $570,000; indirect labor, $150,000; selling and administrative salaries, $266,000. d. Incurred various selling and administrative expenses (e. 9 , advertising, sales travel costs, and finished goods warehousing), $418,000. e. Incurred various manufacturing overhead costs (e.g, depreciation, insurance, and utilities), $470,000. 1. Manufacturing overhead cost was appled to production. The company actually worked 41,000 direct labor-hours on alt jobs during the year. 9. Jobs costing $1,717,900 to manufacture according to their job cost sheets were completed during the year. h. Jobs were sold on account to customers during the year for a total of $3,225,000. The jobs cost $1,727,900 to manufacture according to their job cost sheets. 4. What is the total amount of manufacturing overhead applied to production during the year? Required information [The following information applies to the questions displayed below] Bunnell Corporation is a manufacturer that uses job-order costing. On January 1, the company's inventory balances were as follows: The company applies overhead cost to jobs on the basis of direct labor-hours. For the current year, the company's predetermined overhead rate of $15.50 per direct labor-hour was based on a cost formula that estimated $620,000 of total manufacturing overhead for an estimated activity level of 40,000 direct labor-hours. The following transactions were recorded for the year: a. Raw materials were purchased on account, $628,000. b. Raw materials used in production, $598,000. All of of the raw materials were used as direct materials. c. The following costs were accrued for employee services: direct labor, $570,000; indirect labor, $150,000; selling and administratve salaries, $266,000. d. incurred various selling and administrative expenses (e.g., advertising, sales travel costs, and finished goods warehousing), $418,000. e. Incurred various manufacturing overhead costs (e.g, depreciation, insurance, and utilities), $470,000. f. Manufacturing overhead cost was applied to production. The company actually worked 41,000 direct labor-hours on all jobs during the year. 9 Jobs costing $1,717,900 to manufacture according to their job cost sheets were completed during the year. h Jobs were sold on account to customers during the year for a total of $3,225,000. The jobs cost $1,727,900 to manufacture according to their job cost sheets. 5. What is the total manufacturing cost added to Work in Process during the year? Required information [The following information applies to the questions displayed below] Bunnell Corporation is a manufacturer that uses job-order costing. On January 1 , the company's inventory balances were as follows: The company applies overhead cost to jobs on the basis of direct labor-hours. For the current year, the company's predetermined overhead rate of $15.50 per direct labor-hour was based on a cost formula that estimated $620,000 of total manufacturing overhead for an estimated activity level of 40,000 direct labor-hours. The following transactions were recorded for the year: a. Raw materials were purchsed on account, $628,000. b. Raw materials used in production, $598,000. All of of the raw materials were used as direct materials. c. The following costs were accrued for employee services: direct labor, $570,000; indirect labor, $150,000; selling and administrattve salaries, $266,000. d. Incurred various selling and administrative expenses (e.g, advertising. sales travel costs, and finished goods warehousing), $418,000. e. Incurred various manufacturing overhead costs (e.g, depreciation, insurance, and utilies), $470,000. 1. Manufacturing overhead cost was applied to production. The company actually worked 41,000 direct labor-hours on all jobs during the year. 9. Jobs costing $1,717,900 to manufacture according to their job cost sheets were completed during the year. h. Jobs were sold on account to customers during the year for a total of $3,225,000. The jobs cost $1,727,900 to manufacture according to their job cost sheets. 8. What is the total amount of actual manufacturing overhead cost incurred during the year? Required information [The following information applies to the questions displayed below] Bunnell Corporation is a manufacturer that uses job-order costing. On January 1, the company's inventory balances were as follows: The company applies overhead cost to jobs on the basis of direct labor-hours. For the current year, the company's predetermined overhead rate of $15.50 per direct labor-hour was based on a cost formula that estimated $620,000 of total manufacturing overhead for an estimated activity level of 40,000 direct labor-hours. The following transactions were recorded for the year: a. Raw materials were purchsed on account, $628,000. b. Raw materials used in production, $598,000. All of of the raw materials were used as direct materials. c. The following costs were accrued for employee services: direct labor, $570,000; indirect labor, $150,000; selling and administratVe salaries, $266,000. d. Incurred various selling and administrative expenses ( 0.9 , advertising, sales travel costs, and finished goods warehousing), $418,000. e. Incurred various manufacturing overhead costs (e.g. depreciation, insurance, and utilities), $470,000. f. Manufacturing overhead cost was applied to production. The company actually worked 41,000 direct labor-hours on all jobs during the year. 9. Jobs costing $1,717,900 to manufacture according to their job cost sheets were completed during the year. h. Jobs were sold on account to customers during the year for a total of $3,225,000. The jobs cost $1,727,900 to manufacture according to their job cost sheets. 9. is manufacturing overhead underapplied or overapplied for the year? By how much? Required information [The following information applies to the questions displayed below.] Bunnell Corporation is a manufacturer that uses job-order costing. On January 1 , the company's inventory balances were as follows: The company applies overhead cost to jobs on the basis of direct labor-hours. For the current year, the company's predetermined overhead rate of $15.50 per direct labor-hour was based on a cost formula that estimated $620,000 of total manufacturing overhead for an estimated activity level of 40,000 direct labor-hours. The following transactions were recorded for the year: a. Raw materials were purchsed on account, $628,000. b. Raw materials used in production, $598,000. All of of the raw materials were used as direct materials. c. The following costs were accrued for employee services: direct labor, $570,000; indirect labor, $150,000;; selling and administrathe salaries, $266,000. d. Incurred various selling and administrative expenses (e.g., advertising, sales travel costs, and finished goods warehousing), $418,000. e. Incurred various manufacturing overhead costs (e.g, depreciation, insurance, and utilities), $470,000. f. Manufacturing overhead cost was applied to production. The company actually worked 41,000 direct labor-hours on all jobs during the year. 9. Jobs costing $1,717,900 to manufacture according to their job cost sheets were completed during the year. h. Jobs were sold on account to customers during the year for a total of $3,225,000. The jobs cost $1,727,900 to manufacture according to their job cost sheets. 10. What is the cost of goods avallable for sale during the year